Bank of Queensland has announced it will be increasing interest rates across its variable home loans and Lines of Credit for owner occupiers and investors.

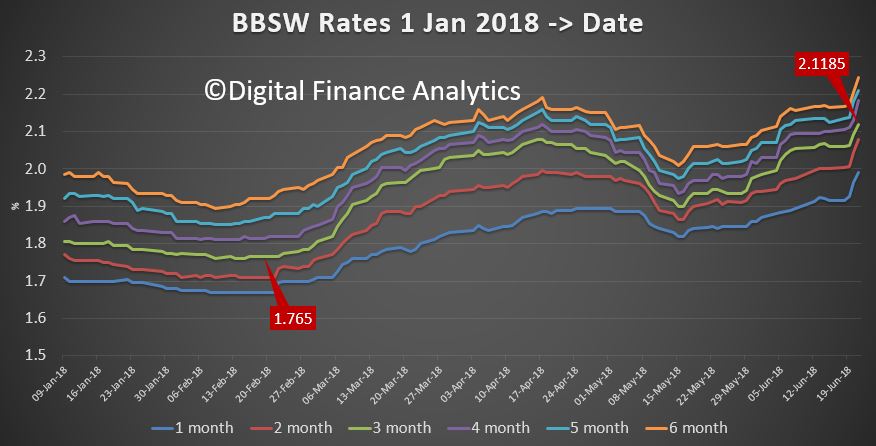

This should come as no surprise, given the rise in the BBSW, as we discussed yesterday.

This should come as no surprise, given the rise in the BBSW, as we discussed yesterday.

We expect other banks to follow, as they are all sitting on the same funding cost volcano.

We expect other banks to follow, as they are all sitting on the same funding cost volcano.

BOQ said that the variable home loan rate for owner occupiers (principal and interest repayments) will increase by 0.09 per cent, per annum; variable home loan rate for owner occupiers (interest only repayments) will increase by 0.15 per cent, per annum; variable home loan rate for investors (principal and interest and interest only repayments) will increase by 0.15 per cent, per annum; and Owner occupier and investor Lines of Credit will increase by 0.10 per cent, per annum.

Anthony Rose, Acting Group Executive, Retail Banking said today’s announcement is largely due to the increased cost of funding.

“Funding costs have significantly risen since February this year and have primarily been driven by an increase in 30 and 90 day BBSW rates, along with elevated competition for term deposits.

“While the bank has absorbed these costs for some time, the changes announced today will help to offset the ongoing impact of the increased funding costs.

“These decisions are always difficult and BOQ balances the needs of our borrowers and depositors when making changes,” Mr Rose said.

The interest rate changes are effective Monday, 2 July 2018.