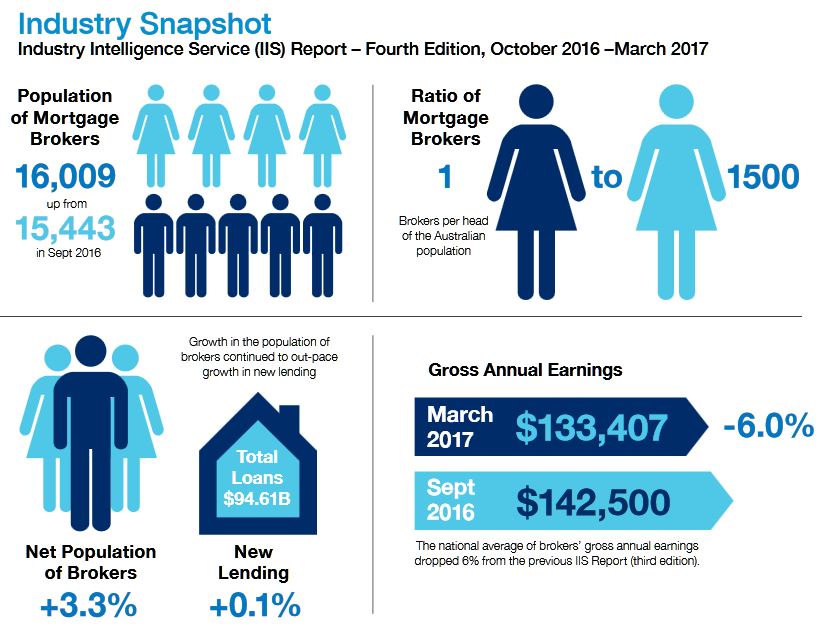

According to the MFAA, the boom in brokers may be unsustainable, given lower mortgage growth. The snapshot, up to March 2017, shows that the number of brokers is estimated to be 16,009, representing 1 broker for every 1,500 in the population. Overall brokers rose 3.3% but net lending only 0.1%. As a result the average broker saw a fall in their gross annual income. On these numbers, brokers cost the industry more than $2 billion each year!

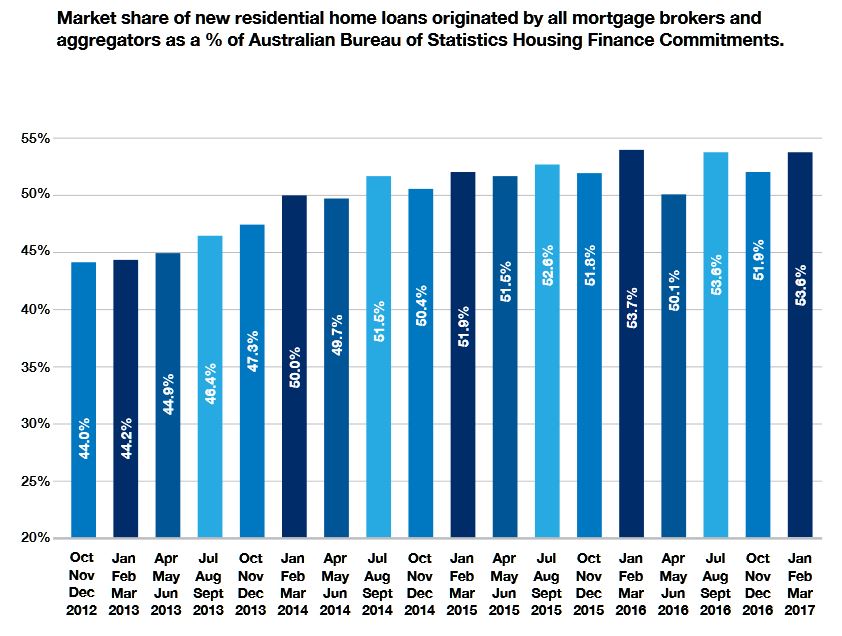

Around 53% of new loans come via brokers, they claim.

Around 53% of new loans come via brokers, they claim.

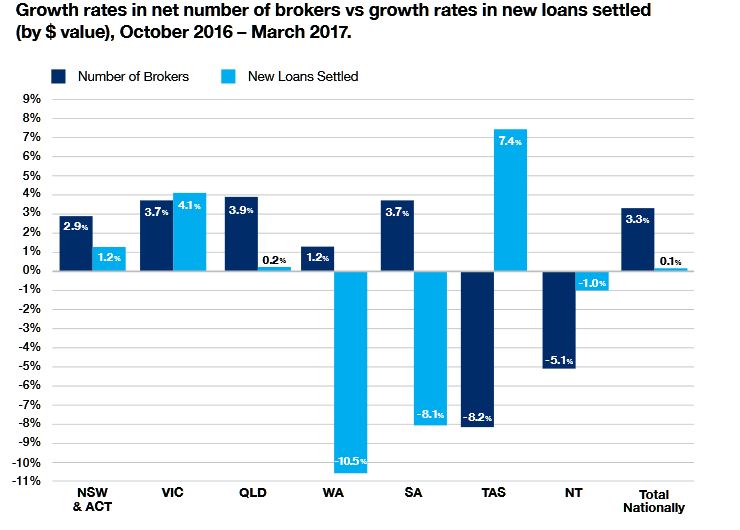

They call out a mismatch between the number of brokers and new loans settled, and other than in VIC, volumes are down relative to brokers.

They call out a mismatch between the number of brokers and new loans settled, and other than in VIC, volumes are down relative to brokers.

The latest Industry Intelligence Service (IIS) Report has revealed that finance brokers continue to facilitate more than one in two (53.6%) of all mortgages written in Australia.

“This is a strong performance in the context of investor and interest only prudential measures imposed by regulators during the period, however, there are some warning signs that we need to be taking note of,” said Mortgage & Finance Association of Australia (MFAA) CEO Mike Felton.

The IIS Report has revealed the number of finance brokers in Australia has grown by 3.3% to just over 16,000 (in the six-month period October 2016 to March 2017), with more than 500 new brokers joining the industry in the reporting period.

This exceeded the growth in the value of new home loan settlements by brokers nationally (up 0.1% at $94.61 billion) and the number of broker-originated new loan applications which fell 4.5% to 303,300.

“Whilst the improved broker coverage is positive for consumers, these statistics should be seen as grounds for caution and need to be closely monitored. It is not a sustainable trend to have broker numbers continually rising faster than the value of new business written and could be part of the reason why the report shows the average income for brokers is down 6% nationally. When the pie stays the same size and there’s more mouths to feed, the slices inevitably get smaller. The report reveals that, on average, the sum of a broker’s up-front and trail remuneration is $133,500 per annum, before costs, which is down from $142,500 in the previous report,” he said.

“The data shows that on a state level, only Victoria appears to have a clear alignment, or a reasonable equilibrium between the growth in broker numbers and growth in new lending,” he said.

The report also reveals that Australia’s finance brokers are gradually utilising the services of a more diverse range of lenders and diversifying the types of loans they are writing as well.

“This report is showing a shift in the broker use of loan products from majors and regionals aligned to majors to specialist lenders, international lenders and broker white label products,” Mr Felton said.

“Greater diversity is good news in that it strengthens the broker proposition and competition within the mortgage market,” Mr Felton said.

The MFAA’s Industry Intelligence Service (IIS) Report provides reliable, accurate and timely market intelligence for the mortgage broking sector. It is designed, produced and delivered by Comparator, a CoreLogic business and a recognised provider of performance benchmarking, market diagnostics and ad-hoc investigative services to the retail financial services sector in Australia and New Zealand.