Home loan conversion rates are plummeting as borrowers attempt to secure a mortgage by making multiple applications across different channels, new research has found.

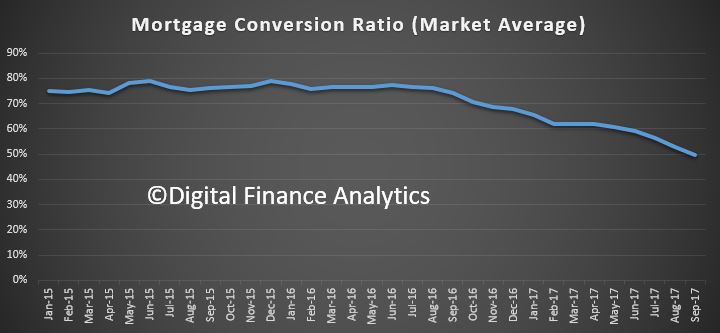

Data from Digital Finance Analytics (DFA) shows that in recent months, the number of mortgage applications which are made, but which do not lead to a funded loan, is on the rise.

Back in 2015, the ratio was around 80 per cent. Now it has dropped to around 50 per cent.

DFA principal Martin North said that the data, which is based on 52,000 Australian households, shows that more multiple applications are being made to a portfolio of lenders in an attempt to get a single approved loan.

“Essentially, they are backing both horses,” Mr North explained. “They are talking to brokers and potentially putting applications in via brokers but also putting applications in themselves.

“It is creating a lot of noise in the system. That means there is a much lower probability of an application a broker is handling translating into a funded loan.”

The analyst believes that a number of factors are contributing to the rise in multiple mortgage applications being made by the same client across different channels. The ease of applying for a mortgage online, driven by comparison websites and digital platforms that enable a DIY approach, is believed to be a major factor.

In addition, Mr North points out that consumers understand that credit has become tighter following the introduction of macro-prudential measures.

“They understand that the hurdles are higher now,” the principal said. “They don’t necessarily trust one channel over another, but they will try this portfolio approach and see what turns up. The fact that the processes are far simpler now than they used to be is making it easier.”

The DFA data shows that younger borrowers under the age of 40 are making multiple applications more than any other age groups. Mr North said that this is not surprising, given their digital literacy.

He believes that the findings shift the conversation about mortgage channels and pose significant challenges for banks and brokers.

“I bet nobody asks whether the borrower currently has a mortgage application in the system,” Mr North said. “Perhaps, that’s a questions banks and brokers need to start asking.”

One thought on “Brokers burned by customer-driven channel conflict”