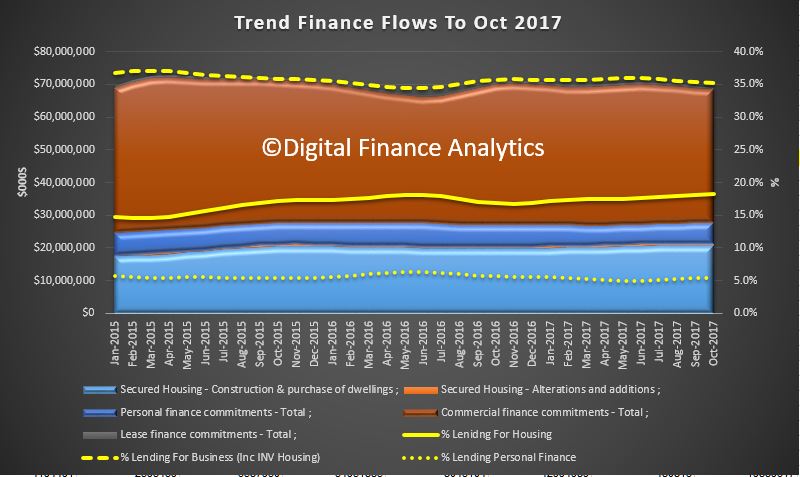

The final piece of the October 2017 lending finance data came from the ABS today. It is not pretty. As usual we will focus on the trend series which irons out some of the statistical bumps.

Owner occupied housing lending excluding alterations and additions fell 0.1% in trend terms. Personal finance commitments rose 1.3%. Fixed lending commitments rose 2.2%, while revolving credit commitments fell 0.1%.

Total commercial finance commitments fell 1.1%. Fixed lending commitments fell 2.5% (which includes mortgage lending for investment purposes), while revolving credit commitments rose 3.7%.

The trend series for the value of total lease finance commitments fell 0.7%.

Here is the summary with the relative percentage for owner occupied housing and personal finance rising (so putting more pressure on household debt ratios in a flat income, rising cost market). Overall lending to business, relative to all lending fell again.

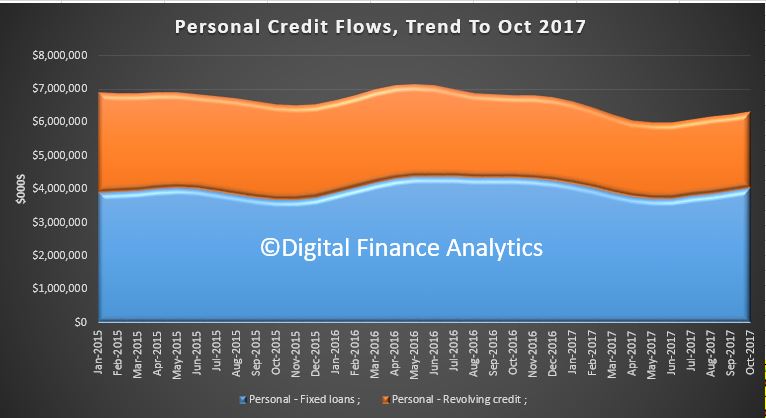

Personal credit is rising, now, as households find their cash flow is under pressure, many are now seeking fixed loans to help bridge the gap left by falling savings. In prior years there was a fall at this time of year, before the Christmas binge, but that is different this year. This does not bode well for Christmas spending, and we see signs of the New Year sales already underway!

Personal credit is rising, now, as households find their cash flow is under pressure, many are now seeking fixed loans to help bridge the gap left by falling savings. In prior years there was a fall at this time of year, before the Christmas binge, but that is different this year. This does not bode well for Christmas spending, and we see signs of the New Year sales already underway!

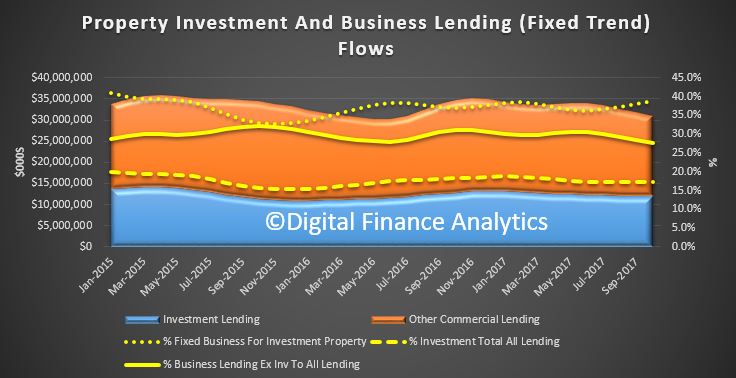

Then finally, if we look at the fixed business lending, and split it into lending for property investment and other business lending, the horrible truth is that even with all the investment lending tightening, relatively the proportion for this purpose grew, while fixed business lending as a proportion of all lending fell.

Then finally, if we look at the fixed business lending, and split it into lending for property investment and other business lending, the horrible truth is that even with all the investment lending tightening, relatively the proportion for this purpose grew, while fixed business lending as a proportion of all lending fell.

These a clear signs of a sick economy (in the sense of unwell!), with business investment still sluggish, still too much lending on property investment, and as we showed above, too much additional debt pressure on households.

These a clear signs of a sick economy (in the sense of unwell!), with business investment still sluggish, still too much lending on property investment, and as we showed above, too much additional debt pressure on households.

I will repeat. Lending growth for housing which is running at three times income and cpi is simply not sustainable. Households will continue to drift deeper into debt, at these ultra low interest rates. This makes the RBA’s job of normalising rates even harder.

The mid-year economic forecast, later in the week will likely simply underscore the fact the economic settings are not appropriate. And, by the way, tax cuts, even if they could be paid for, will not help.