On 4 June, Canada’s Office of the Superintendent of Financial Institutions (OSFI) made its semi-annual domestic stability buffer announcement, implementing a 25-basis-point increase in the minimum amount of capital it requires domestic systemically important banks (D-SIBs) to hold. Canadian D-SIBs will have a minimum Common Equity Tier 1 (CET1) capital requirement of 10.00% as of 31 October 2019. Via Moody’s.

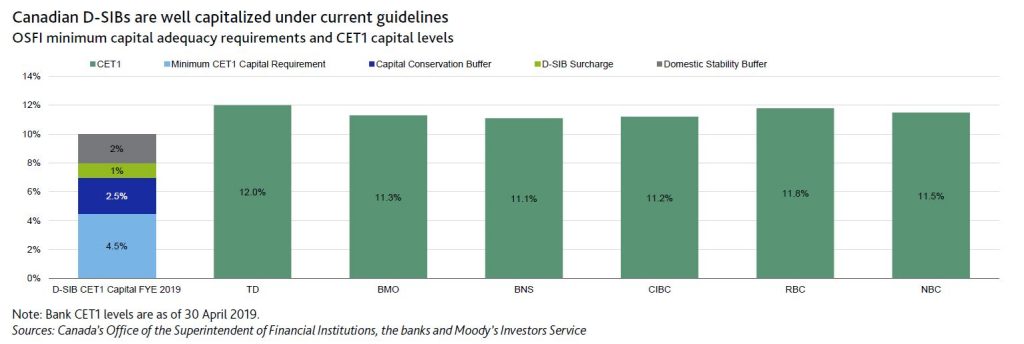

The capital increase is credit positive for Canadian D-SIBs because it will require them to maintain higher capital stocks, increasing protection for bondholders against unexpected losses. Although all Canadian D-SIBs have CET1 levels above this new minimum requirement resulting from the stability buffer increase, we believe the banks’ capital ratios will trend upwards over time, as we expect them maintain their current management buffers.

The stability capital buffer supplements other CET1 requirements such as the capital conservation buffer, the D-SIB surcharge and counter-cyclical buffer. Taken together, these CET1 classifications help creditors better understand risks to the banks the regulator is signaling. With this increase, for example, OSFI specifically highlighted its concerns about high Canadian consumer indebtedness, asset imbalances in the Canadian market; and Canadian institutional indebtedness.

The affected D-SIBs are Bank of Montreal, Bank of Nova Scotia, Canadian

Imperial Bank of Commerce, Royal Bank of Canada, The Toronto-Dominion Bank and National Bank of Canada.

The stability capital buffer will be set to 2.00% as of 31 October 2019, up from the current 1.75% of total risk weighted assets. The buffer is a macro-prudential tool designed to mitigate a range of primarily domestic system risks based on OSFI’s judgment and assessment of a number of system vulnerabilities.

OSFI raises the stability buffer when it determines that these risks have increased and banks should hold more capital, and it decreases the buffer if the risks subside. Increases to the buffer will be phased in over time, while decreases will take immediate effect. The buffer is the same for all D-SIBs, but OSFI may require individual banks to hold additional capital to cover greater idiosyncratic risks.

Canadian D-SIBs exceeded the minimum publicly disclosed capital requirements by 110–200 basis points as of 30 April 2019. As the exhibit below shows, Canadian D-SIBs’ current capital levels are adequate given their high asset quality and ability to generate capital.

Should a bank breach the buffer, a remediation plan would need to be submitted to OSFI, while in more serious cases, supervisory intervention would take place. We expect the banks’ current prudent capital management practices to continue.