Robbie Barwick from the Citizens Party and I discuss the need to create a National Bank to support the economic reconstruction which with country needs.

Category: Banking Culture

CBA Provides Advice To Customers

A large scale communication campaign has been launched by CBA to clearly address customers’ most common questions and concerns. It is one of the clearest I have seen yet, and provides some really helpful advice. Kudos to them on their Financial Guide for Customers.

In what is a concerning and confusing time for many Australians, Commonwealth Bank is launching a mass coronavirus communication campaign from today, across all mainstream and social media channels, to help customers access the support and information they need.

CBA’s financial assistance contact centres are currently receiving up to eight times the usual call volumes with a significant number of customers wanting information on how to access support from CBA as well as the recently announced Government assistance measures as they face job loss and business closures.

This new campaign, centred on a detailed Financial Guide for Customers, aims to provide clear, concise, consistent and reliable information to help customers navigate the large volume of recent announcements, as they try to comprehend what support they are eligible for and how to access it quickly.

Customers are also looking for reassurance as well as the tools that will help them regain control of their financial wellbeing.

With the Federal Government designating banking as an essential service, Commonwealth Bank intends to keep as many of its branches open as possible while also encouraging customers to use digital banking for all banking needs other than those for which a visit to a branch is unavoidable. Branches have a range of safe distancing, health and hygiene measures in place.

At such an important time for customers in need, CBA will do whatever it can to help keep as many businesses afloat, as many people in jobs, and as many people in their homes, as possible.

The new Financial Guide will be regularly updated in its easy-to-read format and is available at www.commbank.com.au/coronavirus.

RBNZ to Implement $30bn Asset Purchase of NZ Govt Bonds

The New Zealand Monetary Policy Committee (MPC) has decided to implement a Large Scale Asset Purchase programme (LSAP) of New Zealand government bonds.

The negative economic implications of the coronavirus outbreak have continued to intensify. The Committee agreed that further monetary stimulus is needed to meet its inflation and employment objectives.

Globally, the number of people infected with the virus has increased rapidly and measures to contain the outbreak have become more restrictive. Global trade and travel, and business and consumer spending have been curtailed significantly.

The severity of the impacts on the New Zealand economy has increased. Weaker global activity is affecting the economy through a range of channels, not just reduced trade. Domestic measures to contain the outbreak of the virus are also reducing economic activity. Employment and inflation are expected to fall relative to their targets in the near term.

In addition, financial conditions have tightened unnecessarily over the past week, reducing the impact of the low OCR on achieving the MPC’s mandate. Heightened risk aversion has caused a rise in interest rates on long-term New Zealand government bonds and the cost of bank funding.

The Committee has decided to implement a LSAP programme of New Zealand government bonds. The programme will purchase up to $30 billion of New Zealand government bonds, across a range of maturities, in the secondary market over the next 12 months. The programme aims to provide further support to the economy, build confidence, and keep interest rates on government bonds low.

The Committee will monitor the effectiveness of the programme and make adjustments and additions if needed. The low OCR, lower long-term interest rates, and the fiscal stimulus recently announced together provide considerable support to the economy through this challenging period.

Record of meeting: Monetary Policy Committee (MPC)

20-22 March 2020

On Friday 20 March the Chair of the MPC spoke with the external members of the MPC by phone to update them on the Bank’s financial stability activities and the interaction with monetary policy. These activities were public. The external MPC members were made aware of what the other members of the Committee were involved in with regard to the Bank’s ongoing support to financial market functioning and stability.

The Chair and the external members also discussed the fact that any further monetary stimulus provided by the Bank would likely be through the purchase of government bonds in a Large Scale Asset Programme (LSAP). All MPC members were also made aware that monetary policy recommendations were being sent to them for a decision soon, and that there would likely be an ongoing series of Bank monetary and financial stability actions as the economic impacts of COVID-19 unfolded.

MPC members received papers on Friday evening containing staff advice about the ongoing deterioration in the economic situation relating to COVID-19.

The initial view of staff was that an MPC decision on their recommendations would be preferable by Sunday 22 March 2020. On Saturday 21 March, following advice from the Reserve Bank’s financial markets team as to their operational and legal readiness to implement a LSAP, the MPC Chair called for an MPC decision to be made by email. An in-person meeting was seen as unnecessarily risky given current official guidance about social distancing.

There was agreement amongst members to proceed in this manner and by Sunday morning there was a consensus MPC agreement to:

- Provide further monetary policy stimulus through a Large Scale Asset Purchase (LSAP) programme of New Zealand government bonds in the secondary market.

- The initial scale of the LSAP programme is up to $30 billion of government bonds, across a range of maturities, to be purchased over the next 12 months.

- Communicate the decision on the morning of 23 March.

This decision was made in response to staffs’ briefing material to the committee indicating the increasing severity of the economic situation and deterioration in financial market conditions.

It was noted that the Government’s fiscal package announced on March 17 has delivered significant spending stimulus in addition to the monetary stimulus announced on March 16. However, the health and safety measures announced by governments over prior days – related to the reduction in travel and large gatherings globally – would add to inflation and employment falling below target in the near term.

Returning inflation and employment to target over the medium term will require support from monetary policy. How much stimulus will depend on how the COVID-19 pandemic progresses and the actions to abate the virus.

The committee considered a range of scenarios, and it was apparent that in light of the evolving situation more stimulus was needed.

Committee members’ attention was drawn to the tightening in financial conditions over the past week. Interest rates on long-term New Zealand government bonds had risen significantly, affecting the cost of wholesale funding for any banks accessing the market at this time. Such increases mean that the reduction in the OCR announced on March 16 was not effectively passing through into interest rates faced by borrowers. The depreciation in the exchange rate had helped ease conditions at the margin but not sufficiently.

The staff briefing material also included updates on global economic developments and other countries’ economic policy responses to the pandemic.

Committee members were advised that the recommendation of a $30 billion LSAP program reflected a current assessment of the maximum effective stimulus achievable while maintaining a well-functioning government bond market. Staff noted the importance for liquidity to remain in the bond market and for multiple market makers.

Staff recommended that purchases up to $30 billion should be spread over at least 12 months and across a range of maturities, in order to leave enough liquidity for the New Zealand government bond market to function effectively. And that the Bank’s communications should emphasise that the LSAP programme would provide confidence and support for the government bond market, and monetary stimulus through keeping longer-term interest rates low.

Members noted that the exact amount of stimulus needed is difficult to quantify, and that the range of economic scenarios they had seen were consistent with a need to deliver significant stimulus.

Briefing material also included information about the implications of an LSAP program to the Reserve Bank’s balance sheet, and about the governance arrangements in place between the Reserve Bank and the Minister of Finance. It was noted that MPC agreement would be sought if further stimulus was needed to be provided, either by increasing the size of the LSAP programme, or through the use of other instruments.

The Committee reached a consensus to:

- Approve a programme of Large Scale Asset Purchases to a total volume of $30 billion of NZ Government bonds over 12 months

- Delegate to staff the implementation decisions of the LSAP programme

- Communicate the program in terms of the total volume to be purchased

Debt And Power – With Michael Hudson

In this post we discuss debt in the current context, and consider where the very high levels of debt will take us. And as importantly, who wins and who loses. Transcript is available for download.

Michael Hudson is an American economist, Professor of Economics, Author of Killing the Host and “and forgive them their debts,” among many earlier books.

Many articles and interviews are available on http://michael-hudson.com/

Debt and Power. Transcript, recorded 20th March 2020

Martin: Today Debt and Power. I’m Martin North from Digital Finance Analytics. Welcome to our latest post covering finance and property news with a distinctively Australian flavour.

Today it is my pleasure to introduce Michael Hudson, American Economist, Professor of Economics and author of “Killing the Host” and “and Forgive Them Their Debts”. In the current environment I think those are great titles. Michael welcome.

You have been following the economy and the question of debt for quite some time and I’d like to start the discussion with a simple question: How much debt is too much debt?

Michael: Too much debt is when it’s beyond the ability to be paid. At a certain point every debt grows beyond the ability to be paid because of the magic of compound interest. At 5 percent interest, a debt doubles every 15 years. If you can imagine since the whole debt take-off in 1945, the first 15 years gets you to 1960. Then, the debt doubles again by 1975, and doubles again by 1990, then again by 2005, and then today – 64 times the relatively small debt owed back in 1945, some 75 years ago. And the creation of yet new credit (peoples’ debt to the banks and to wealthy savers) has grown at a similar rate even without new lending taking place, so the debt overhead actually has grown much, much more than that 5% a year. It’s grown more like 15% per year. That is much faster than national income or GDP. This disparity in expansion paths means that more and more income and GDP needs to be paid each year, So, to answer your question, too much debt is when it can’t be paid – that is, can’t be paid without transferring property to creditors, reducing consumer spending and home ownership rates, and plunging the economy into austerity in which only the wealthy financial class is affluent.

What happens when a debt can’t be paid? Well, either you default and lose your property as creditors foreclose on your home or drive you into bankruptcy, or – if you’re a corporation – they drive you under and a corporate raider takes you over. Or else, you write down the debt.

Interest-bearing debt was first invented in the third millennium BC, maybe 2800 2700 in the ancient Near East. The first records are about 2500 BC. Interest rates were about 20%. Rulers were obliged to think about your question: how to maintain economic balance and avoid too much debt. The answer they found was that when each new ruler would take the throne, they would proclaim a Clean Slate. Its terms were basically those of the Judaic Jubilee Year, whose word deror was a cognate to Babylonian andurarum. This Babylonian practice was put in the middle of Mosaic law, in Leviticus 25. It returned land to debtors who had forfeited them to foreclosing creditors, and it freed debtors who had fallen into debt bondage. This periodically avoided too much debt, by regularly wiping out personal debts – mainly agrarian debts denominated in grains. However, business debts were left in place, to be settled among the well-to-do who could afford it.

Western civilization became Western by making a radical break from what went before. Classical Greece and Rome didn’t have any debt cancellations, because they didn’t have any palatial authority to do so. They had chieftains, but they didn’t have an independent palace with authority to overrule the ambitious families that became the oligarchy. So from the time that the Roman oligarchy overthrew the last king in 509 BC down to the time when Julius Caesar was killed in 44 BC, you had five centuries of debt revolts. The plebeians in Rome, like many Greeks, demanded the debts be cancelled.

That demand was what prompted the call for democracy in Greece and in Rome. They needed political democracy with everybody able to vote and serve in the government in order to have a government that could cancel the debts and redistribute the land.

But the oligarchy resisted this policy, seeking to hold onto its creditor claims that kept the population at large in dependency and outright bondage. In the 7th and 6th centuries BC, most Greek cities were overthrown by leaders called tyrants. They were basically reformers who overthrew the closed local aristocracies, cancelled the debts and redistributed land to the people. Solon abolished debt bondage in Athens in 594 BC (but did not redistribute land) via his “shedding of burdens,” his seisachtheia, referring to the debt burden. A similar radical restructuring occurred in Sparta.

But Greece ultimately was conquered, sacked and looted by Roman generals, first in 147 BC then in 88 BC under Sulla. Rome took over, and its oligarchy was intransigent. They accused popular leaders wanting to cancel the debts of “seeking kingship,” and usually killed them. They killed the Gracchi, they ended up killing Caesar, they killed Catiline when (having failed to become consul) organized an army to fight for debt cancellation.

Finally, the Emperor’s Emperor Hadrian and Marcus Aurelius cancelled debts in AD 118 and 178 respectively. By that time these debts were mainly tax arrears. After that, there were no debt cancellations. That makes Western civilization very different from the Near East. The legacy of Roman law is that you can’t cancel the debts, you can’t write them down. That means that again and again and again, debts are going to grow too big to be paid without forfeiting your land or forfeiting your liberty and falling into debt peonage, losing your means of support and going bankrupt.

That’s what we’re facing today. Is society going to say that all debts have to be paid, without regard for the economic and social consequences? Almost 90 percent of American debts are owed to the richest 10 percent of the population. I’m sure the situation is similar in Australia, and the 10 percent of course includes the London and the New York banks. So the question is whether you are going to let the economy’s wealth, income and property be sucked upward as a massive debt foreclosure? Or, are you going to restore equilibrium by wiping out this enormous overgrowth of debt.

You really should think of these debts as bad loans. A bad debt that can’t be paid means that there’s a bad loan. But modern economic orthodoxy agrees with the Roman oligarchy: All debts have to be paid, even if that destroys society and ends up in feudalism. We’re going along that route because that’s our individualist morality – even anti-social morality at this point. There is a reluctance, a cognitive dissonance, to recognize that debts are too big to be paid without imposing austerity that makes economies look like recent Greece or Argentina.

Martin: It’s a scary thought isn’t it. And is there a difference between public debt and private debt? In other words, does it behave in the same way?

Michael: As I think Steve Keen explained on your show before, the public debtors can’t go bankrupt domestically, because governments can simply print the money to monetize it, or just refuse to pay the debt. Private debt is created by what Steve calls endogenous banking. In other words, banks simply create credit (their customers’ debt) on a computer. A debt IOU is created as the bank’s asset, along with a credit for the borrower. So the balance sheet remains in balance, as assets (of the bank) and debts (of borrowers) reman constant. The word “savings” obscures the fact that creditor loans are simply created out of nothing but electric current to write a new balance sheet. And then, of course, interest has to be paid to the creditors.

Private debt is created for different reasons than public debt. Public banks would not lend for corporate takeover loans. They would not lend to corporate raiders, or for stock buybacks. They would not create junk mortgages way beyond the ability of borrowers to pay. Government debt would be extended presumably for spending for the public purpose – to increase economic growth and increase prosperity. Private debt these days has become largely dysfunctional. Its effect has often been to shift prosperity from 90% of the population to the 10% of the population that controls the banks and the creditors. So private debt has become corrosive and parasitic, while public debt is supposed to be handled well – except to the extent that the oligarchy has taken over the government.

In the United States since 2008, the Federal Reserve has created $4.5 trillion of credit to the stock and bond market and mortgage market to support prices for real estate. The aim has been to make housing more expensive, enabling the banks to collect on their mortgages and not go under. This credit keeps the debt overhead in place, thereby keeping the keep the financial system afloat instead of facing the reality that debt needs to be written down. Because if it is not written down, the “real” economy will be hollowed out. In that sense the financial overgrowth is largely fictitious wealth.

The Fed’s supply of $4.5 trillion isn’t called public debt, because it’s technically a swap, so it doesn’t appear as an increase in the money supply. The increase in the money supply will be what President Trump proclaimed today, March 19: $50 billion dollars to the airlines, and Boeing. Yet Boeing has spent $45 billion in the last ten years on stock buybacks. So Trump said, in effect, that if companies has spent 92 and 95 percent of all of their income just to buy shares and pay out dividends instead of investing it, the government will create money and give it to them all over again, because his priority -is how well the stock market is doing. In other words, how much does the “real” economy have to shrink in order to keep sucking up an exponentially growing volume of interest and stock-price gains to cover all this corporate debt, business debt and personal debt?

Martin: And so the obvious question then is who are Central Banks working for?

Michael: Central banks work for their clients the commercial banks. Until 1913 in the United States the Treasury did almost everything that the Federal Reserve is doing today. It moved money around the country. It had 12 districts. It intervened in markets. It did what a central bank did. But then JP Morgan and the bankers essentially anticipated Margaret Thatcher and Ronald Reagan, and pressed for a privatized central bank run out of Wall Street, Boston and Philadelphia, not Washington. They excluded Washington from the Fed’s board so as not to let the Treasury have a voice on it.

Their logic was that banking should only be regulated by the private sector, because only in that way could they turn the government from a democracy into an oligarchy. So that they created a central bank that acted on behalf of bankers, not the economy as a Treasury is supposed to do. So basically, the development of central banks for the Western countries has been a disaster to the extent that they represent financial interests instead of representing the economy as a whole. Protecting financial interests means sustaining growth in their product, debt overhead, instead of protecting the economy from finance and its bad loans that create a burdensome overhead for families and business.

Martin: Right. I suppose that explains why they are focused on financial stability rather than the prosperity of real people.

Michael: “Financial stability” is a deceptive term. It means increasing austerity for the economy you cannot have financial stability and economic stability at the same time. If the growth of debt and finance is exponential and the economy is growing in an S curve, then the economy has to shrink at a deepening rate in order to maintain stable compound-interest growth and even higher stock-market prices.

The relevant mathematics was developed already in Hammurabi’s day by 1800 BC. We have the cuneiform textbooks from which scribal students in Babylonia were taught. They were asked to calculate how fast a debt grows at an annual 20 percent (their normal commercial rate). How long does it take a debt to double at going 20 percent rate of interest? The answer is five years. How long does it take the quadruple? Ten years. How long to multiply 8 times? 15 years. How many 16 times? Well, that’s 20 years. And within a 30-year generation you have a debt multiplying 64 times.

We also have the scribal texts calculating how fast a herd of cattle grows. It grows in an S-curve. So you know that the gap between the rise of debt and the growth of a herd is increasingly wide.

Most of the loans that were not cancelled were in foreign trade, among merchants (and their debts to the palace, which advanced many textiles and other inventories to traders). These commercial debts were denominated in silver, while most domestic debts were denominated in grain. So unless Sumer could keep on trading abroad and making profits, debts were going to be too large to be paid. That’s when rulers would raise the sacred torch, like the Statue of Liberty, signalling a debt cancellation and they’d cancel the debts. If the crops failed they’d cancel the debts because if they didn’t cancel the debts then the small farmers would end up becoming bond-servants to their creditors, who often were tax collectors in the palace bureaucracy. They then would owe their labor to the creditors, and so couldn’t perform corvée labor building palaces, walls and other public building or even serve in the army. So it would have been civic suicide for a community not to cancel such debts.

Mesopotamian and other Near Eastern rulers were not idealistic utopians. They were simply being practical in realizing that debts grow faster than ability to be paid. All of their mathematics shown that. So their models 4000 years ago were more sophisticated than the models that are used today, which just assume that debts will remain a stable proportion of income and output.

Martin: So, I guess we’ve got this pile of debt and it’s growing as the recent central bank interventions are just adding more debt into the system. How do we get out of this mess?

Michael: The only way you can escape and maintain stable economic relations is to write down the debts. That means you have to let many banks and their loans go under. That almost happened in 2008. Sheila Bair, the Federal Deposit Insurance Corporation head, wanted to foreclose on one bank that she wrote was more incompetent and crooked than the others. That was the largest bank: Citibank. The problem is that its sponsors were President Obama, Robert Rubin and basically Wall Street. Rubin was Secretary of the Treasury under Bill Clinton, and had become head of Citibank. His protege Tim Geithner became the bagman for Citibank, and was made Secretary of the Treasury. Geithner blocked the Obama administration and Sheila Bair from taking over Citibank.

Here would have been a wonderful chance. You take over one of the worst bank in the United States – the bank that made the bad bets and so many junk mortgage loans that it was called a serial criminal by former S&L prosecutor Bill Black, now at the University of Missouri at Kansas City. Imagine if Citibank would have been taken into the public domain and made a public bank. It wouldn’t have made more crooked loans. It would have made loans for what people and business actually needed. But Obama invited the bankers to the White House, and promised to protect them from the “mob with pitchforks.” The mob with pitchforks were his own voters, his supporters, the people whom Hillary called deplorables – mainly indebted wage-earners. Obama said that he would protect the banks from loss and not to worry about Congressional reprisals.

Posing as a black civil rights icon, Obama bailed out the banks – his major campaign sponsors and donors – so generously that not only did they not go under, but they are now gigantic as a result of the bailouts and designation as Too Big to Fail (TBTF) driving out the small smaller banks. Obama didn’t write down the mortgages as he had promised voters. I think he was the worst U.S. president in a century, because the economy stood at what could have been a turning point with real hope and change. He’d promised to write down the mortgage debts to the realistic value of the buildings instead of the inflated value that Citibank, Bank of America and Wells Fargo and other crooked banks had put on them. Instead he let them go ahead foreclose on 10 million American homes.

That became a great wealth-producing activity as large Wall Street companies like Blackstone came in and bought up homes that were foreclosed on, for pennies on the dollar, and turned them into rental properties. That raised rents on Americans very rapidly. So the rentier sector got rich by squeezing the working-class, leaving them with little to spend on goods and services without going deeper into debt. So Obama’s policy basically imposed what is now more than a decade of austerity on the economy.

Since 2008, the GDP per 95 percent of the American population is actually shrunk. All the growth in America’s GDP has occurred only to the wealthiest 5% of the population. That’s Obamanomics, and it’s the Democratic Party policy – which is the main reason why President Trump was elected. He made a left run around Hillary and the Democratic Party. He’s doing it again today. That’s why most people expect that despite Trump’s mishandling of the virus crisis, he will move to the left of Joe Biden or Hillary or whomever the Democrats decide to run against him.

Martin: You’ve made an interesting connection between the political forces in the economy and the financial forces. Essentially, it’s those two against the people, isn’t it?

Michael: That’s what you call an oligarchy. It has the trappings of democracy because you can vote now for either Joe Biden or Donald Trump. They call that a democracy, but both of them work for Wall street and both of them represent the oligarchy. So it’s what the 19th century called a sham democracy.

Martin: Right, and so the appearance of what’s going on and the reality of what’s going on are actually quite different?

Michael: I think the appearance is actually what it is. They’re not getting away with it. The appearance is becoming clear: a corrupt takeover by the oligarchy deliberately impoverishing the rest of the population. You have the right-wing Fox News and Rush Limbaugh saying that the outbreak is a godsend to America. Look at look at how its stabilizing the economy: Number one, it wipes out mainly older people. They get sick the most rapidly. That means we can cut Social Security spending the elderly die off. It will help solve the pension shortfall. That’s looked at as positive. The disease will also end up reducing unemployment, I think of reporters who said that the world’s overpopulated.

But most of all, the crisis gave Trump an excuse to give enormous bailouts to Boeing and the airline companies that already were near insolvency as a result of their own debt problem. They hope to use the crisis not to revive the economy, but to just pound it into debt deflation, leaving the debts in place while bailing out the banks and the landlord class. While people are losing their jobs, especially part-time workers or those who work in retail stores, bars and restaurants. They are laid off and can’t pay their rent. Their employers often are small businesses who also can’t pay their rents. Already there are for rent signs all up and down the big streets here in New York. The threat is that the landlords will not be able to pay the banks, because they won’t have tenants. So there’s a rising wave of arrears for all kinds of debts.

The rate of arrears and missed payments is one way you tell when debts are too large to be paid. They are mounting and are up to 30 or 40 percent for student debts. They’re rising for automobile loans, and many mortgage debts are also in arrears. So basically the virus crisis has become a vehicle to bail out the both the landlord class and keep the banks afloat while sacrificing the wage-earning population.

Martin: So if you run history ahead over the next 3 to 5 years, let’s assume that they actually find a way to get the health issue under control. What you’re saying is at the end of it, most ordinary people will be hollowed out further, and power and authority will be ever more concentrated in the rich elite who own the banking system and also own the political system

Michael: That’s the trend. In the 1830s when Malthus’s successor at the East India Company’s Haileybury college, William Nassau Senior was asked about the million Irishman who were dying in the potato famine, he said, “It is not enough,” meaning that it wasn’t enough to balance the economy as it was then set up. His idea of equilibrium needed many more people to die. Even without having a Social Security “problem.”

When there’s poverty, suicide rates go up, and emigration accelerates. You can look at Greece in the last five years to see what happens when an economy becomes debt strapped. Lifespans shorten, people get sick, suicides rates rise. Greeks emigrate abroad. But Americans can’t emigrate, because they don’t speak a foreign language, and English-speaking countries have gone neoliberal.

It looks pretty bad, and there’s no economic doctrine that deals clearly enough with what’s happening to explain that if you have to pay this exponential growth in debt, you’re going to have less and less to buy goods and services. More and more stores are going to close and labor will be laid off. Nobody can afford to go to work. That’s what happens in a depression, and that is the game plan that’s called “financial stability,” as if it is the price that you have to pay to keep the bad-debt-based financial sector afloat.

Martin: Does that mean that unless we can find a completely different formula around democracy – and I assume that means focusing much more on public infrastructure public investments and all of those things – there’s no alternative? Who’s talking about that?

Michael: A few people you have had on your show seem to be talking about it. But we’re a small group of maybe 15 people who have a common discussion with each other.

Martin: So it is still a minority sport. Yet it seems to me to be probably the most critical debate we should be having, because we have the bulk of the population effectively being crushed by the way that the system is currently working. Yet everyone is told to look over there and watch Netflix rather than think about these more fundamental issues.

Michael: One of the problems is that since the late 1970s the University of Chicago and neoliberals have taken over the editorship of almost all the leading academic journals in this country, England and elsewhere. They’re run by doctrinaire advocates of privatization and deregulation to broadcast an oligarchic patter talk. I was teaching at the University of Missouri at Kansas City, the center of Modern Monetary Theory, but our graduates had difficulty getting hired at prestigious on universities, because in order to get hired by a prestigious university you have to publish in one of the journals run by the Chicago Consensus.

The key of free-market economics is that you can’t impose a free market unless you can exclude everybody who disagrees with you and shows how a free market will polarize the economy and lead to austerity. To impose a free market in Chile, for instance, they gave General Pinochet’s police permission to kill labor leaders, advocates of land reform, and to close every economics department in Chile except for the Catholic University that taught the Friedmanite Chicago dogma. So libertarianism is totalitarian. Libertarianism means a small government, and if government is small, then who’s going to do the planning? Every economy is planned, and if governments don’t do the regulating and planning, there’s only one alternative: Wall Street does the planning, or the City of London, including the planning for Australia, from what I understand.

Martin: Right. The consequence there is that freedom – which everybody sort of exposes as being the character of modern society – is probably less strong than many people think.

Michael: The Romans described Liberty as the ability to do whatever you want. They said that this meant that only the wealthy people could have Liberty to do whatever they want, including to foreclose and deprive debtors and other people of their Liberty.

Martin: Michael I found this a fascinating and interesting conversation and so critical

for people to understand. I really thank you for your time today. The good news is that there are many more articles interviews on your website michael-hudson.com, whom I understand is curated in Australia by a webmaster here, so that’s an interesting connection.

.

NAB Support For Businesses And Homeowners

NAB has today announced a sweeping support package for business and personal customers at a time when they need it most.

Business customers experiencing financial difficulty can defer their payments on a range of floating and variable rate business loans for up to six months. Home loan customers experiencing financial challenges will also be able to pause their repayments for up to six months.

NAB, which is Australia’s largest bank for businesses, will cut 200bps from the rate on new loans and all overdrafts on its flagship digital business product QuickBiz, effective March 30.

It will reduce variable rates on small business loans by 100bps, effective March 30 – on top of the 25bps reduction announced on March 13.

NAB also announced reductions of up to 60bps to fixed rate home loans to give customers the option of added certainty.

There are no changes to home loan variable rates. For depositors, NAB has introduced a 10-month term deposit rate of 1.75% p.a. in recognition that this low interest rate environment is hurting savers.

This package could provide a potential injection of more than $10 billion into the economy over six months, or $380 million a week, depending on customer needs and take-up.

NAB CEO Ross McEwan said: “Our focus is clear – to support our business and personal customers with their financial needs when they need it most.

“These measures will provide significant relief to businesses and homebuyers over the next six months as we all deal with this unprecedented situation.

“Businesses in particular need help and they need it now, so we have come through with a range of measures. This support will provide cash flow relief so they can stay open, and keep people in jobs. One third of Australia’s small to medium businesses bank with NAB and we are going to be there for them.

“The changes also offer our home loan customers the option to fix their rate at our lowest rate ever, or pause payments to help ease financial pressures.”

The support package announced by NAB is in addition to industry-wide measures announced earlier today by the Australian Banking Association.

“We support the measures announced by the ABA today and welcome recent actions taken by the Federal Government, Reserve Bank of Australia and APRA. We will continue to work with the Government and regulators on further initiatives,” Mr McEwan said.

“This is an extremely difficult time but we will get through this together. For more than 160 years, NAB has supported Australians through challenges. We are well-capitalised and stand ready to play our critical role.

“NAB is open for business. We continued lending throughout the Global Financial Crisis and we’ll continue to lend through this.”

Mr McEwan encouraged customers to call NAB to discuss how they may be able to access the relief package. “If any customer has questions or concerns contact your banker now – please don’t wait,” he said.

The full list of measures announced by NAB is:

NAB Business customers will be able to:

- Defer principal and interest for up to six months on a range of business loans, including floating and variable rates, and equipment finance loans;

- Receive a 200-basis point rate cut on new loans and all overdrafts on QuickBiz, effective March 30;

- Receive an additional 100-basis point reduction on variable rates for small business loans, effective March 30. This is on top of a 25-bps reduction earlier this month;

- Access up to $65 billion of additional secured limits to pre-assessed customers, with $7 billion currently available for fast assessment process;

- Access up to $9 billion in additional limits for unsecured lending for existing customers via QuickBiz; and

- Defer business credit card repayments.

NAB Personal customers will be able to:

- Pause home loan repayments for up to six months, including a three-month checkpoint. For a customer with a typical home loan of $400,000, this will mean access to an additional $11,006 over six months, or $1,834 per month.

- Access a 10-month term deposit rate of 1.75% p.a. for 10 months, effective March 24. This is for personal customers only, with deposits of $5,000 to $2 million.

- Access fixed home loan rates of 2.39% p.a. for 1-year, 2.29% p.a. for 2- and 3-year, and 2.79% p.a. for 5-year (owner-occupier P&I), effective March 25. First home buyers will have access to a rate of 2.19% p.a., fixed for two years. This delivers reductions of between 10 and 60bps (table below).

- Access over $20bn in redraw and more than $30bn in offset. Note: Around 1 in 2 accounts are at least 6 months ahead based on redraw & offset balance; and 4 in 10 are 12 months ahead.

- Reduce repayments on variable rate loans. Over the past 12 months, reductions of 84bps to our owner-occupier variable rates have provide a potential benefit of $3,360 per year to customers with a $400,000 loan. Most customers have not yet taken the option to reduce their payments.

NAB’s advertised package home loan fixed rates change as follows, from 25 March 2020:

Banks Announce Small Business Relief Package

Australian banks will defer loan repayments for six months for small businesses who need assistance because of the impacts of COVID-19.

Australian Banking Association CEO Anna Bligh today announced a small business relief package from Australia’s banks.

“This Assistance Package will apply to more than $100bn of existing small business loans and depending on customer take up, could put as much as $8 billion back into the pockets of small businesses as they battle through these difficult times,” Ms Bligh said.

“This is a multi billion dollar lifeline for small businesses when they need it most, to help keep the doors open and keep people in jobs,” Ms Bligh said.

“Banks are putting in place a fast track approval process to ensure customers receive support as soon as possible.

“Australia’s banks have supported the country through difficult times in the past and continue to do so.

“While this is first and foremost a health crisis, this pandemic has begun to have serious impacts across the economy, with small businesses beginning to feel the devastating effects.

“Over the last few days banks have worked closely with the Treasurer and the Government to identify measures to support the economy through this crisis.

“Small businesses are the most vulnerable part of the economy and have the most urgent need for assistance.

“Small businesses employ 5 million Australians and this package is designed to help them keep doing just that.

“Small businesses can rest assured that if they need help, they will get it. Banks are already reaching out to their customers to offer assistance and packages will start rolling out in full on Monday,” she said.

Any small business who has not already been contacted should contact their bank to apply.

Banks have developed this Small Business Relief Package following discussions with APRA and ASIC to provide the appropriate regulatory treatment. The package is subject to authorisation by the ACCC.

Westpac hit with another class action

Westpac confirmed it has been hit with another class action relating to the AUSTRAC scandal. Via Financial Standard.

The class action, brought by Johnson Winter & Slattery, has been filed on behalf of certain shareholders who acquired interest in Westpac securities or equity swap confirmations between 2013 and 2019.

“The claim relates to market disclosure issues connected to Westpac’s monitoring of financial crime over the relevant period and matter which are the subject of the AUSTRAC proceedings,” Westpac told the ASX.

“The claim does not identify the amount of any damages sought.”

Westpac said it will be defending the claim, as it has said for the other class actions filed against it.

Prior to this proceeding being filed, Westpac said it expects around $80 million in additional expenses in FY20 as part of its response plan to the AUSTRAC scandal.

The bank is facing 23 million alleged breaches of anti-money laundering and counter-terrorism laws brought on by AUSTRAC.

The regulator alleges, amongst other things, Westpac failed to appropriately assess the online money laundering and terrorism financing risks associated with the movement of money into and out of Australia through correspondent banking relationships.

The bank is also facing class actions from US-based law firm Rosen Law on behalf of purchasers of Westpac shares between November 2015 and November 2019, as well as another Australia-based class action lodged by Phi Finney McDonald.

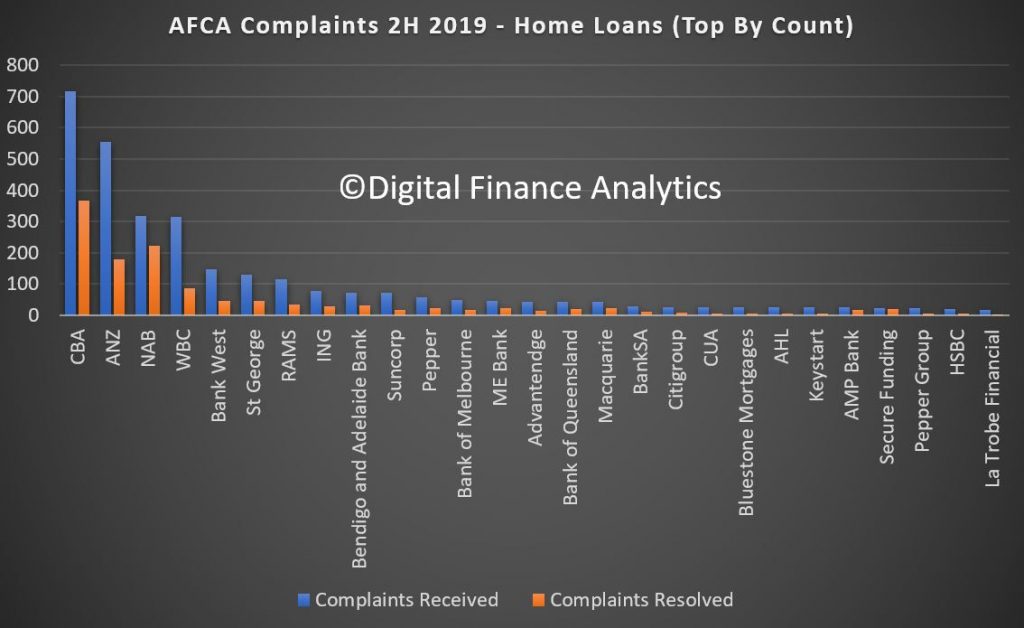

Home Loan Complaints Rocket By 20%

New data released today by the Australian Financial Complaints Authority (AFCA) has shown that complaints about home loans have increased by 20 per cent in the last six months of 2019.

The data shows that CBA and Westpac have the largest proportion of complaints, with the CBA Group at 890 and Westpac Group 639 of the complaints made.

This increase has been driven by financial firms failing to respond to requests for assistance, the conversion of loans from interest only to principal and interest and issues with responsible lending.

Credit card complaints were 2,750 in the same period.

The data, which has been made freely available to the public through AFCA’s Datacube shows that between July and December last year, the financial services ombudsman received 2,201 complaints about home loans, that’s 367 per month, on average.

AFCA Chief Operating Officer Justin Untersteiner said that it was disappointing to see the increase but making the data available to the public was an important step in increasing transparency.

“Every six months, AFCA releases data which allows Australians to see how many complaints their insurer, bank, financial adviser, superannuation fund or other financial firm has received and how they have responded to those complaints,” Mr Untersteiner said.

“Rebuilding trust in the Australian financial services will be a long journey and one that requires effort across the entire sector.

“Transparency is key in this transformation and we have made significant changes in the way we report our data and decisions to make them more accessible to the public.

“The data also shows that we are getting very few complaints about financial advice, just 30 per month, and complaints against debt buyers or collectors rose by just five per cent. “Our hope by releasing this data is that we see improvements and the industry takes action to reduce the number of complaints that end up at AFCA.”

CBA launches venture building entity X15

Commonwealth Bank has today launched X15 Ventures, an Australian technology venture building entity, designed to deliver new digital solutions to benefit Australian consumers and businesses.

X15 will leverage CBA’s franchise strength, security standards and balance sheet to build stand-alone digital businesses which benefit from and create value for CBA’s core business. CBA customers will benefit from a broader range of solutions which complement the bank’s core product proposition.

The bank will partner with Microsoft and KPMG High Growth Ventures to deliver X15 Ventures. Microsoft will bring its platform and engineering capability to the initiative, while KPMG will provide advisory services.

CBA Chief Executive Officer Matt Comyn said: “We remain focused on bringing together brilliant service with the best technology to deliver exceptional customer outcomes in the core of our business. X15 will enable us to innovate more quickly, and continue to offer the best digital experience for our customers.”

X15 will be a wholly-owned subsidiary of CBA, with funding provided from CBA’s $1 billion annual technology investment envelope, its own delivery model, and a dedicated management team. X15 will be headed by Toby Norton-Smith who has been appointed Managing Director of X15 Ventures.

Mr Norton-Smith said: “X15 allows us to open the door and partner more easily with entrepreneurs than ever before. Under its umbrella, we will create an environment for new businesses to flourish, we’ll empower Australia’s innovators and bring new solutions to market designed to empower customers as never before.

“X15 businesses will be nurtured and developed as start-ups but will have the scale and reach of CBA behind them to achieve rapid growth. We are pleased today to be unveiling our first two new ventures, Home-In, a digital home buying concierge, and Vonto, a business insights aggregation tool. We intend to launch at least 25 ventures over the next five years.”

Microsoft Australia Managing Director Steven Worrall said: “Commonwealth Bank has always excelled in terms of its technology vision and we have partnered with the bank for more than 20 years. Today’s announcement takes that innovation and transformation effort to the next level with the launch of X15 Ventures. I believe that the next wave of major technology breakthroughs will come from partnerships such as this, bringing together our deep technical capabilities and absolute clarity about the business challenges that need to be addressed.”

Amanda Price Head of High Growth Ventures KPMG said: “A performance mindset can be the difference between success and failure for start-ups. We look forward to working with CBA and X15 Ventures to build the ecosystem of support these new ventures need. From founder programs designed to unlock sustained high performance, to business and strategy solutions for high-growth ventures, there will be a wealth of smart tools at their disposal to help them overcome the challenge of scaling at speed.”

Further information:

More information on X15 Ventures, please visit: www.x15ventures.com.au.

Home-in, which is live for select customers today, is a virtual home buying concierge that will simplify the complex process of buying a home. Smart app technology helps buyers navigate the purchase process more easily from end-to-end, leverage a platform of accredited service providers like conveyancers and utility companies, access tailored checklists and a dedicated home buying assistant who will respond to queries with the touch of a button. More information is available at www.home-in.com.au.

Vonto, launched today, is a free app available to all small business owners, not matter who you bank with. It draws data from Xero, Google Analytics, Shopify and other online business tools and presents the data and analytics in one location, allowing users to obtain a quick, holistic and rich view of their business for ease and increased control. For more information on Vonto, please visit: www.vonto.com.au.

Black Swans And Green Swans – The Property Imperative Weekly 25 Jan 2020

A number of unanticipated events are haunting the markets, the swans are circling…

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents:

- 00:20 Introduction

- 02:00 Virus alert

- 03:25 US Markets

- 06:20 Fed and Repo

- 07:55 UK and RBS

- 10:00 Euro-zone and PMI’s

- 13:13 Australian Segment

- 13:13 Consumer Sentiment

- 14:30 Bushfire impacts

- 14:40 Retail recession

- 15:20 PMI

- 16:20 Home Prices

- 20:00 Mortgages

- 20:30 Migration

- 21:54 Australian Markets