A bunch of new data came out this week, so we discuss the findings and explore what it means for households and their budgets.

Welcome to the Property Imperative weekly to 9th September 2017, the latest edition of our finance and property news digest.

Welcome to the Property Imperative weekly to 9th September 2017, the latest edition of our finance and property news digest.

We released the August edition of our Mortgage Stress research which showed that across the nation, more than 860,000 households are estimated to be now in mortgage stress (last month 820,000) with more than 20,000 of these in severe stress. This equates to 26.4% of households, up from 25.8% last month.

The main drivers of stress are rising mortgage rates and living costs whilst real incomes continue to fall and underemployment is on the rise. This is a deadly combination and is touching households across the country, not just in the mortgage belts. In August higher power prices, council rates and childcare costs hit home. You can watch our video where we walk through the post codes most at risk.

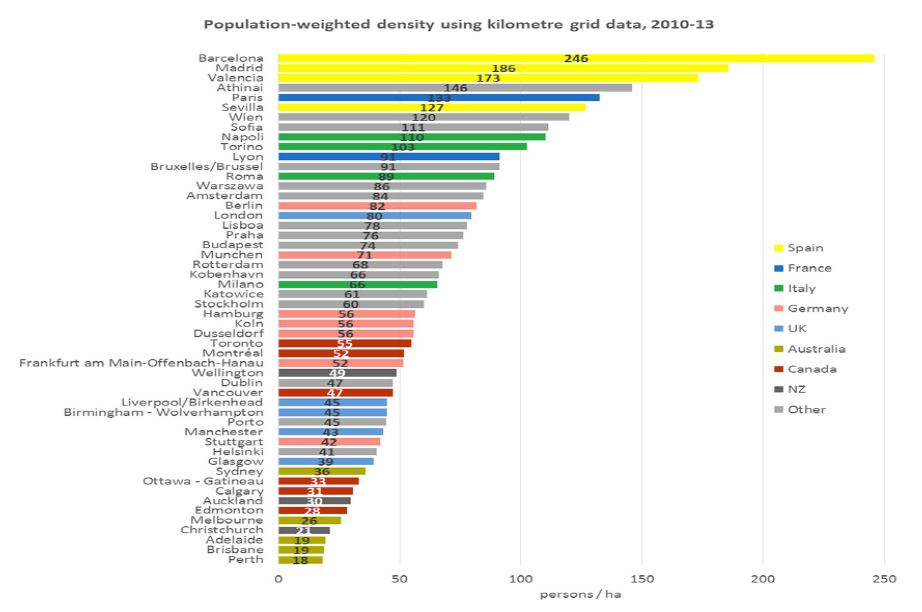

The latest Adelaide Bank/REIA Housing Affordability Report showed that buying a house became even less affordable during the June quarter with the proportion of median family income required to meet average home loan repayments increasing by 0.2 percentage points to 31.4 per cent.

Research from Mozo.com.au showed that one third of first time buyers were reliant on help from the Bank of Mum and Dad, and the average value of that assistance in NSW was $88,250. This is pretty similar to our own findings on the rise and rise of the Bank of Mum and Dad.

Data from Roy Morgan highlighted the fact that more Australians are now under-employed than at this time last year. 1.24 million (9.5%) Australians are under-employed (which means looking for work or looking for more work), up a significant 324,000 (2.4%) in a year. They also called the “real” unemployment rate at 10.2%, as opposed to the official ABS data of 5.6%.

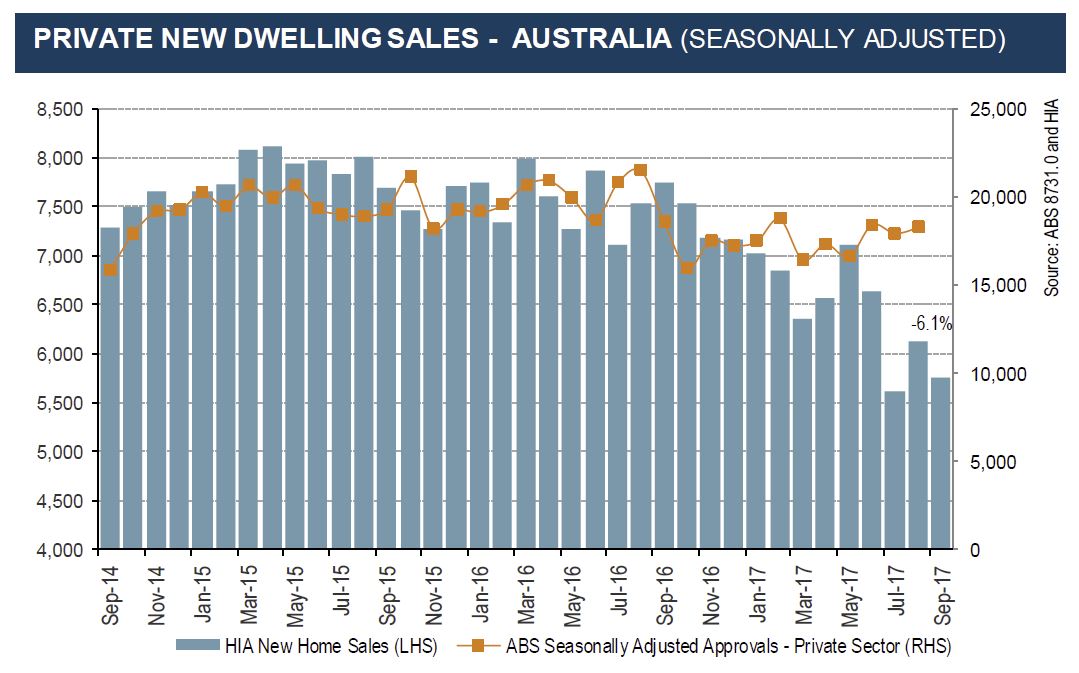

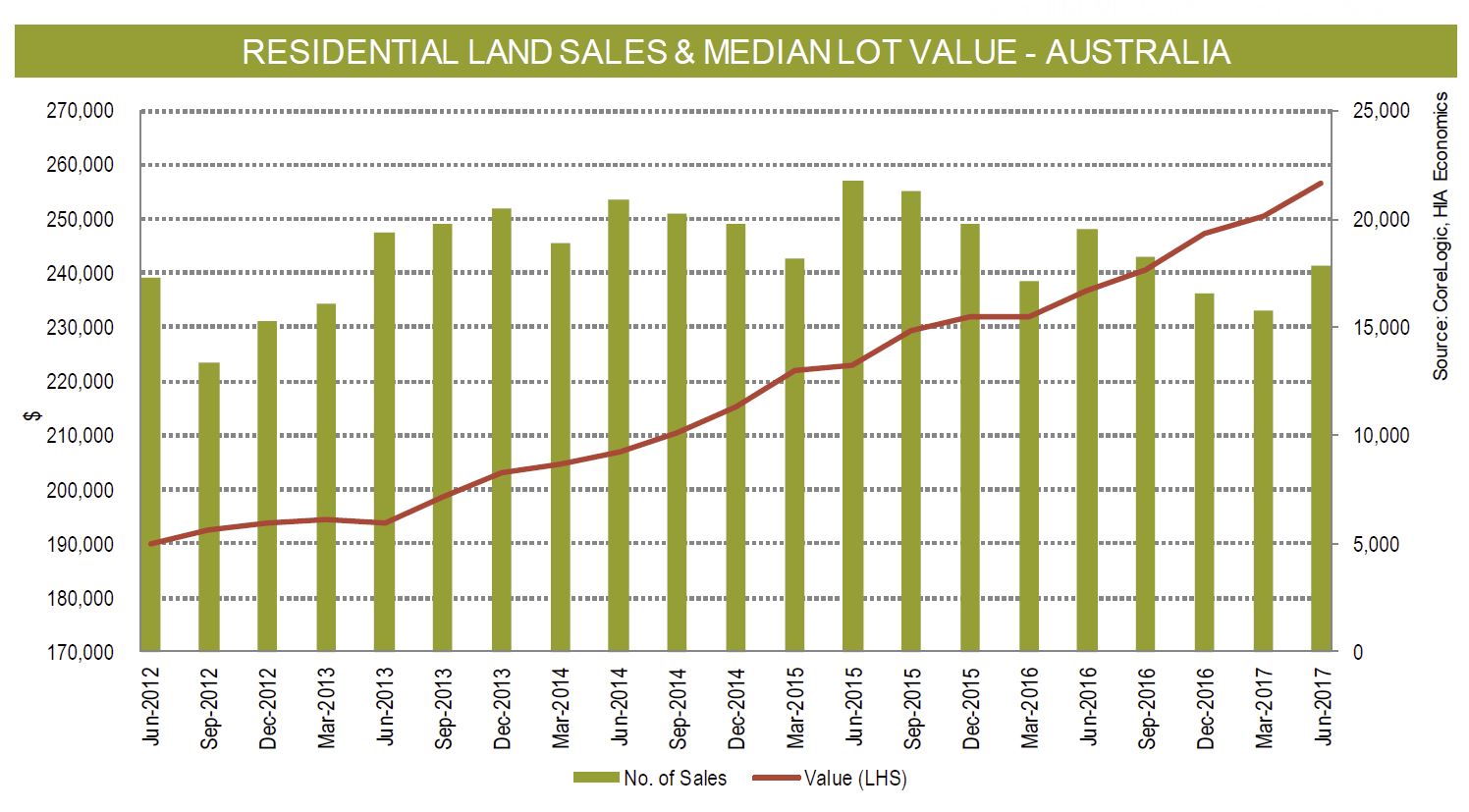

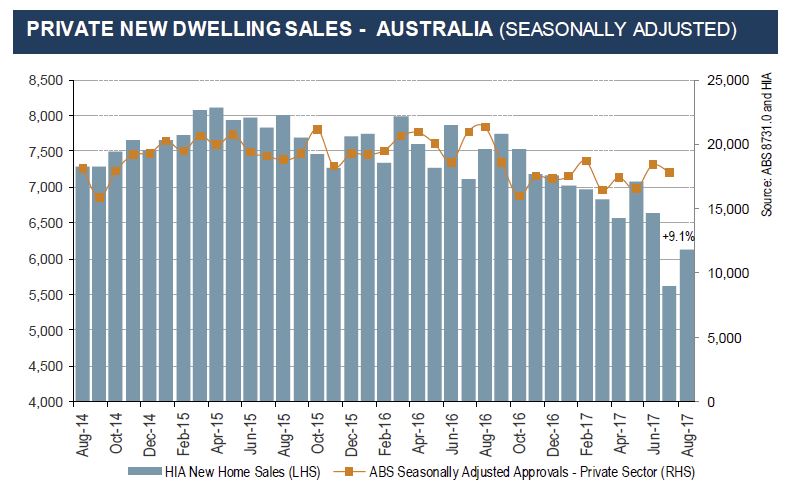

CoreLogic said that while auction clearance rates were pretty firm, the volume of sales continued to fall. But there is no stopping the housing train. Demand for property is still strong, but the mix of purchasers is changing as shown by the housing finance from the ABS which came out on Friday.

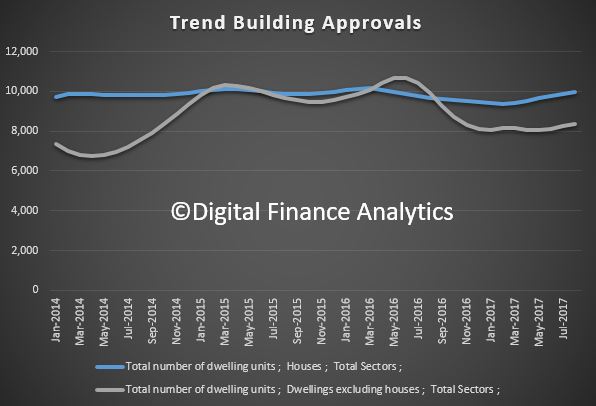

Owner occupied purchases are steaming ahead, while investment lending is stagnating. A clear reflection of the tightening in investor lending regulation, and the availability of new incentives and grants for first time buyers, alongside the attractor loan rates for new borrowers. We saw first time buyers more active in NSW and VIC, two states where new concessions started in July. The proportion of first home buyer commitments rose to 16.6% in July from 14.9% in June. Just remember back in 2009 they comprised more than 30% of total transactions, so all the hype about the return of first time buyers is over done in our view.

But in July, trend lending flows were $33 billion, up 0.1% overall, with owner occupied lending up $20.8 billion or 0.7%, and Investment lending down 1% to $12.1 billion. The number of owner occupied transactions rose 0.6%, construction of dwellings rose 2%, new dwellings 2% and the purchase of established dwellings 0.3%. As a result, total bank home lending stock rose again to $1.61 trillion, another record.

There are some amazing attractor mortgage loan offers in the market right now, as lenders fight for market share. We see significant falls in some investment property loan offer rates, as well as discounts for new owner occupied borrowers, with rates down to as low as 3.65%. These rates of course are not available for existing borrowers, the oldest trick in the book, so this may explain a rise in refinanced transactions.

ASIC launched a series of videos to help consumers make “MoneySmart” decisions when buying a home. Some would say, better late than never! The recommendations on budgeting are especially pertinent. However, a weakness of the MoneySmart calculators are they are static, we think they need a calculator to show the impact of changing interest rates for example. That said, their TrackMySpend App is a really useful tool to get to grips with what is being spent.

The point is that our research shows households are exposed to potential future interest rate rises, and whilst lenders are required to factor in expense and interest rate buffers, they are probably not sufficient to protect borrowers in a rising rate environment, and in any case, the majority of borrowers do not understand the financial impact of such rises, nor are they planning for them. We think lenders should have an obligation to display the recalculated monthly repayment at an average long term rate, which would be at least 3% above current levels. Households would be shocked to see the impact, and it may reduce the overreach which many are locked into at the moment. It all depends on when rates rise.

Treasurer Scott Morrison said that interest rates are “obviously” going to rise in the future but that many home owners would be able to avoid mortgage stress thanks to “mortgage buffers”.

It’s worth noting that ASIC is alleging Westpac used an expenditure benchmark that was based on “conservative” estimates of what a household would spend and “represents only an estimate of what Australian families consume”.

APRA said this week it is important that lenders accurately assess borrower income and living expenses. Living expenses, in particular, are difficult to measure, and so banks often utilise benchmarks as a proxy where borrower estimates appear too low. In fact, APRA’s recent work showed the lion’s share of loans by the larger lenders are assessed using expense benchmarks, rather than the borrower’s own estimates. There is nothing wrong in principle with using benchmarks, provided they aren’t seen as a substitute for proper inquiries of the borrower about their expenses.

Actually, in some cases, across the market, loans were being made where the borrower had only the slimmest of spare income.

The RBA Governor also warned that rates will rise at some point and discussed why lenders may trade off risks in their book against market share. To stress the point about rate rises, Canada lifted their cash rate this week, and already there are signs of home price corrections following there. The RBA held the cash rate again this week, and they highlighted the fact that the growth in housing debt has been outpacing the slow growth in household incomes, as well as poor wage growth. They still hold their view on positive future growth.

Some of the economic news this week was quite positive, with ANZ job ads higher rising 2.0% m/m in August, the sixth straight rise. Job advertisements currently sit 13.3% higher than a year ago.

The current account data from the ABS showed a deficient increase to $9.6 billion, partly due to lower export commodity prices. Exports grew faster than imports though.

Overall the economy grew 0.8% in the June quarter. This was below expectations and was helped by significant government investment. Household consumption figure were pretty solid, but at the expense of the household savings ratio which dipped to 4.6%, (5.3% in March). As a result, the current savings ratio is the lowest since 2008, thanks to very weak wage growth. The point though is this cannot continue indefinitely, because household savings are not infinite, and they are also skewed in distribution terms towards those with more assets and net worth. Stress resides among households with lower net worth and little or no savings.

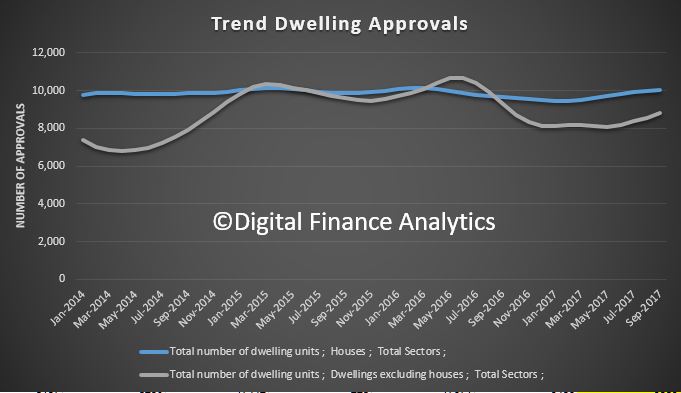

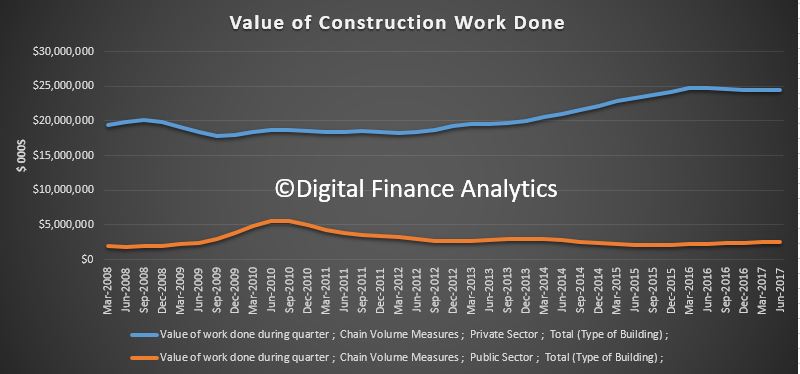

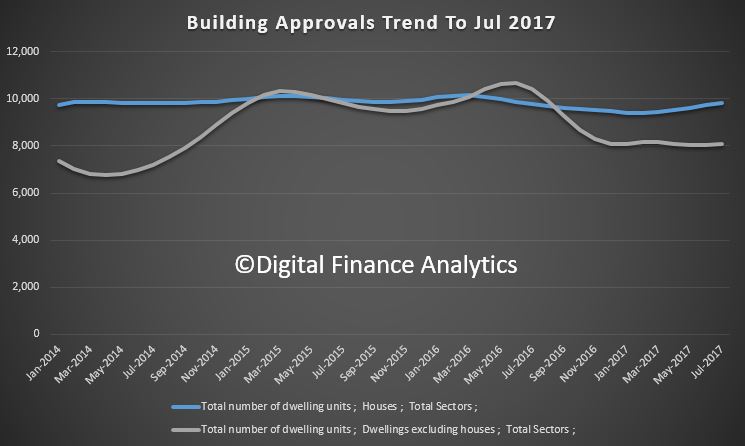

Dwelling construction grew a moderate 0.2 per cent with growth being observed in New South Wales and Queensland. On an annual basis GDP growth is 1.9%, and to meet the RBA’s expectations will need to lift over the next year or so. We are not sure where such growth will come from. We need new ways to lift productivity.

Finally, Retail turnover was flat in July, further evidence of the pressure on household budgets after stronger growth earlier in the year.

So to conclude, we still see home lending growing faster than inflation or wage growth, lifting household debt higher. This is at a time when interest rates are clearly going to rise higher, later.

Lenders are still trading off risk against market share, because at the end of the day, households will pick up the tab in a crash. But households should not simply rely on an assurance from the bank they can afford a loan, they should do their own work, to calculate the real effect on their budgets of a 3% rate rise. In fact, borrowing less is the best insurance against future stress.

And that’s the Property Imperative weekly to 9th September 2017. If you found this useful do subscribe to get our updates, and check back next week.