An important legal judgement underscores the real risks of death from Asbestos dust which lurks in many homes across the country (and in other places too…).

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

An important legal judgement underscores the real risks of death from Asbestos dust which lurks in many homes across the country (and in other places too…).

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest edition of our finance and property news digest with a distinctively Australian flavour.

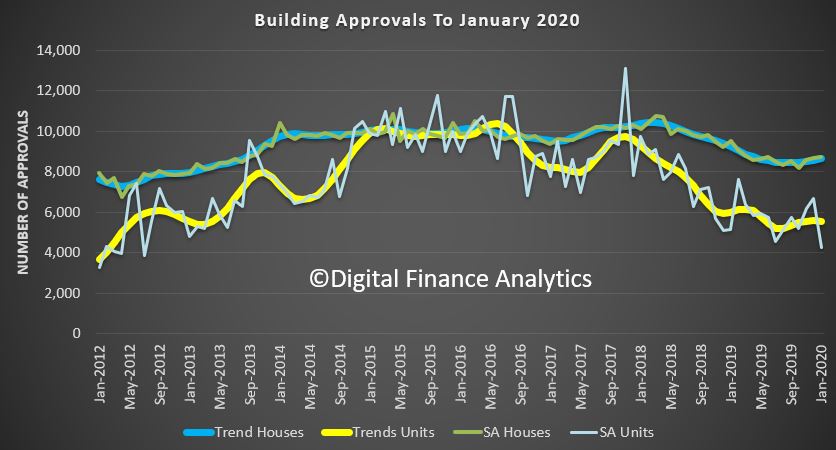

The number of dwellings approved rose 0.5 per cent in January, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today.

The data is weaker than many was expecting, but we suspect that’s a direct impact of slowing of high-rise approvals, especially in Victoria, and perhaps the bushfires. The one-offs we saw at the end of last year, were exactly that.

ABS Director of Construction Statistics, Daniel Rossi, said: “The rise was driven by private sector houses, which rose 0.8 per cent, in trend terms.

“Meanwhile, private sector dwellings excluding houses fell 0.1 per cent. A significant fall in the number of apartments approved in January has offset the strength recorded in late 2019.”

Across the states and territories, dwelling approvals rose in Australian Capital Territory (7.3 per cent), Victoria (2.8 per cent) and Northern Territory (2.7 per cent). Falls were recorded in Tasmania (3.7 per cent), South Australia (3.4 per cent), Western Australia (2.0 per cent), New South Wales (0.8 per cent) and Queensland (0.7 per cent), in trend terms.

Approvals for private sector houses increased in Victoria (2.6 per cent), Western Australia (2.0 per cent), Queensland (0.6 per cent) and South Australia (0.4 per cent). Private house approvals in New South Wales fell 2.1 per cent, in trend terms.

The seasonally adjusted estimate for total dwellings approved fell 15.3 per cent in January, driven by a 35.5 per cent decrease in private dwellings excluding houses. This was largely due to weakness in approvals for apartments (which is volatile from month-to-month), especially in Victoria.

The value of total building approved rose 0.3 per cent in January, in trend terms, after falling for six months. The value of residential building rose 0.1 per cent, while non-residential building increased 0.4 per cent.

The NSW Government proposes to use Ratings Agencies to solve the poor quality of building construction – what are they thinking?

https://www.smh.com.au/national/nsw/unit-buyers-to-pay-for-ratings-check-on-dodgy-apartments-under-reforms-20200121-p53t7t.html

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

CONTENTS:

January Live Show: https://youtu.be/Z03jkJEmvOI

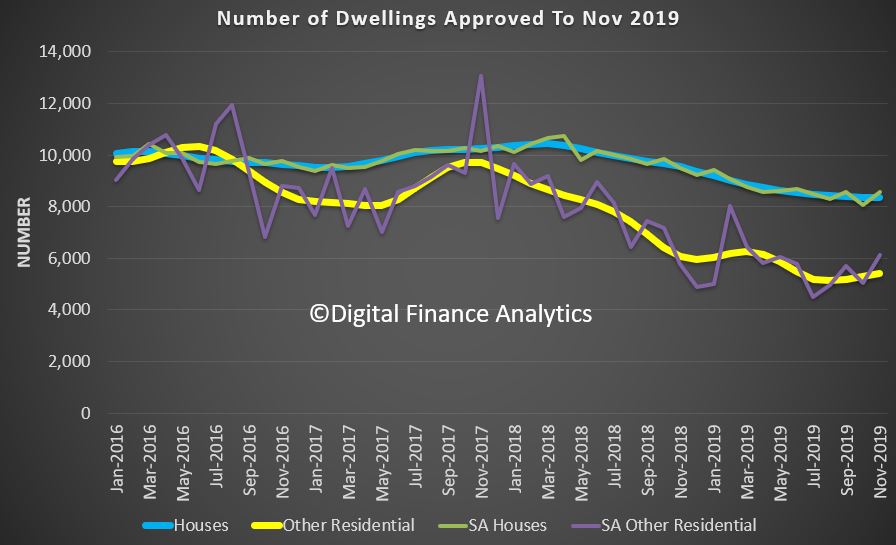

The dwelling approvals data is quite noisy, but the release from the ABS today reported a stronger rise in approvals than might have been expected in November 2019. We continue to report the trend series, as the seasonally adjusted is more volatile.

The trend estimate for total dwellings approved rose 0.8% in November. Within that, the trend estimate for private sector houses approved fell 0.3% while private sector dwellings excluding houses rose 2.9%.

However, the trend estimate of the value of total building approved fell 2.6% in November and has fallen for five months. The value of residential building fell 0.7% and has fallen for nine months. The value of non-residential building fell 5.0% and has fallen for four months.

The trend estimate for the value of non-residential building approved fell 5.0% in November and has fallen for four months.

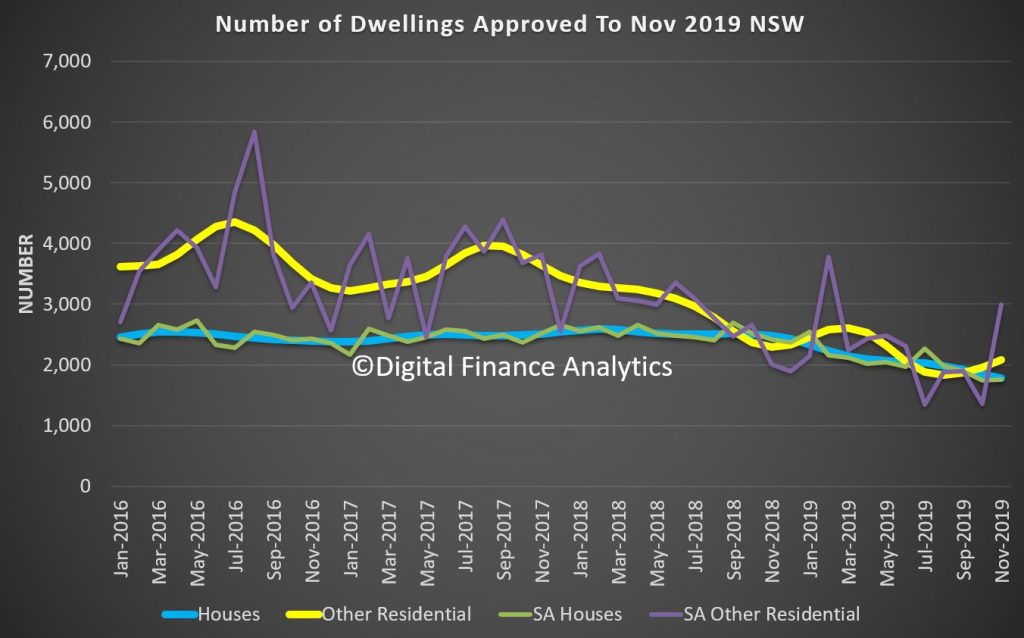

Across the states, trend estimate for total number of dwelling units approved in New South Wales rose 1.6% in November. The trend estimate for the number of private sector houses fell 3.4% in November. In Victoria, the trend estimate for total number of dwelling units approved rose 0.7% in November. The trend estimate for the number of private sector houses rose 0.2% in November. The trend estimate for total number of dwelling units approved in Queensland fell 0.4% in November. The trend estimate for the number of private sector houses rose 1.1% in November. The trend estimate for total number of dwelling units approved in South Australia rose 4.2% in November. The trend estimate for the number of private sector houses rose 0.9% in November. The trend estimate for total number of dwelling units approved in Western Australia fell 1.9% in November. The trend estimate for the number of private sector houses rose 1.5% in November.

So much of the change can be traced to a rise in unit development in NSW.

Australia is in the midst of a bushfire crisis that will affect local communities for years, if not permanently, due to a national crisis of underinsurance. Via The Conversation.

Already more than 1,500 homes have been destroyed – with months still to go in the bushfire season. Compare this to 2009, when Victoria’s “Black Saturday” fires claimed more than 2,000 homes in February, or 1983, when the “Ash Wednesday” fires destroyed about 2,400 homes in Victoria and South Australia, also in February.

The 2020 fire season could end up surpassing these tragedies, despite the lessons learned and improvements in preparedness.

One lesson not really learned, though, is that home insurance is rarely sufficient to enable recovery. The evidence is many people losing their homes will find themselves unable to rebuild, due to lack of insurance.

We know this from interviews with those affected by the October 2013 Blue Mountains bushfires (in which almost 200 homes were destroyed). Despite past disasters, more than 65% of households affected were underinsured.

Research published by the Victorian government in 2017, meanwhile, estimated just 46% Victorian households have enough insurance to recover from a disaster, with 28% underinsured and 26% having no insurance.

The consequences aren’t just personal. They potentially harm local communities permanently, as those unable to rebuild move away. Communities lose the vital knowledge and social networks that make them resilient to disaster.

All too often the disaster of having your home and possessions razed by fire is followed by the disaster of realising by how much you are underinsured.

As researchers into the impact of fires, we are interested why people find themselves underinsured. Our research, which includes interviewing those who have have lost their homes, shows it is complicated, and not necessarily due to negligence.

For example, a woman who lost her home in Kinglake, northeast of Melbourne, in the 2009 fires, told us how her insurance calculations turned out to bear no resemblance to the actual cost of rebuilding.

“You think okay, this is what I paid for the property,” she said. “I think we had about $550,000 on the house, and the contents was maybe $120,000.” It was on these estimates that she and her partner took out insurance. She told us:

You think sure, yeah, I can rebuild my life with that much money. But nowhere near. Not even close. We wound up with a $700,000 mortgage at the end of rebuilding.

A common issue is that people insure based on their home’s market value. But rebuilding is often more expensive.

For one thing there’s the need to comply with new building codes, which have been improved to ensure buildings take into account their potential exposure to bushfire. This is likely to increase costs by 20% or more, but is rarely made clear to insurance customers.

Construction costs also often spike following disasters, due to extra demand for building services and materials.

A further contributing factor is that banks can claim insurance payments to pay off mortgages, meaning the only way to rebuild is by taking out another mortgage.

“People who owned houses, any money that was owing, everything was taken back to the bank before they could do anything else,” said a former shop owner from Whittlesea, (about 30km west of Kinglake and also severely hit by the 2009 fires).

This meant, once banks were paid, people had nothing left to restart.

She told us:

People came into the shop and cried on my shoulder, and I cried with them. I helped them all I could there. That’s probably why we lost the business, because how can you ask people to pay when they’ve got nothing?

In rural areas there is often a shortage of rental properties. Insurance companies generally only cover rent for 12 months, which is not enough time to rebuild. For families forced to relocate, moving back can feel disruptive to their recovery.

Underinsurance significantly increases the chances those who lose their homes will move away and never return – hampering social recovery and resilience. Residents that cannot afford to rebuild will sell their property, with “tree changers” the most likely buyers.

Communities not only lose residents with local knowledge and important skills but also social cohesion. Research in both Australia and the United States suggested this can leave those communities less prepared for future disasters.

This is because a sense of community is vital to individuals’ willingness and ability to prepare for and act in a threat situation. A confidence that others will weigh in to help in turn increases people’s confidence and ability to prepare and act.

In Whittlesea, for example, residents reported a change in their sense of community cohesion after the Black Saturday fires. “The newer people coming in,” one interviewee told us, “aren’t invested like the older people are in the community.”

Australia is one of the few wealthy countries that heavily relies on insurance markets for recovery from disasters. But the evidence suggests this is an increasingly fraught strategy, particularly when rural communities also have to cope with the reality of more intense and frequent extreme weather events.

If communities are to recover from bushfires, the nation cannot put its trust in individual insurance policies. What’s required is national policy reform to ensure effective disaster preparedness and recovery for all.

Authors: Chloe Lucas, Postdoctoral Research Fellow, Geography and Spatial Sciences, University of Tasmania; Christine Eriksen, Senior Lecturer in Geography and Sustainable Communities, University of Wollongong; David Bowman, Professor of Pyrogeography and Fire Science, University of Tasmania

The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents 00:20 Introduction 00:48 US Markets 01:50 Labor Stats 05:20 Oil 06:00 Gold 06:45 Euro 07:00 China 08:00 UK 08:12 New Zealand 08:40 Bitcoin 11:55 Australian Section 11:55 Economic Data 13:00 Property – Opal Tower 14:00 Timber-PVC Cladding 15:40 PCI Index 16:20 Auctions 17:10 Prices 17:45 Council of Financial Regulators 20:00 Local Markets

Data from the ABS today shows that the number of dwellings approved fell 0.8 per cent in October 2019, in trend terms, and has fallen for 23 months. Private dwellings excluding houses also fell, by 0.5 per cent.

The seasonally adjusted estimate for total dwellings approved fell 8.1 per cent in October, driven by a 11.3 per cent decrease in private dwellings excluding houses. Private sector houses fell 7.0 per cent.

The value of total building approved fell 0.7 per cent in October, in trend terms, and has fallen for two months. The value of residential building fell 1.2 per cent, while non-residential building fell 0.2 per cent.

Number of total dwelling units

The trend estimate for Australia fell 0.8% in October.

Number of private sector houses

The trend estimate for private sector houses approved fell 0.9% in October.

Number of private sector dwellings excluding houses

The trend estimate for private sector dwelling units excluding houses fell 0.5% in October.

Value of new residential building

The trend estimate for the value of new residential building approved fell 1.3% in October and has fallen for eight months.

Value of alterations and additions to residential building

The trend estimate for the value of alterations and additions to residential building fell 0.1% in October and has fallen for seven months.

Value of non-residential building

The trend estimate for the value of non-residential building approved fell 0.2% in October after rising for 14 months.

Across the states and territories, dwelling approvals fell in the Northern Territory (11.1 per cent), New South Wales (4.6 per cent), Queensland (1.4 per cent), and Western Australia (1.0 per cent). Tasmania (4.5 per cent), South Australia (3.1 per cent), Australian Capital Territory (3.1 per cent), and Victoria (1.3 per cent) recorded increases, in trend terms.

Approvals for private sector houses fell in New South Wales (2.3 per cent), Victoria (1.7 per cent), Western Australia (0.2 per cent), and Queensland (0.1 per cent). South Australia rose 2.0 per cent, in trend terms.

New South Wales

The trend estimate for total number of dwelling units approved in New South Wales fell 4.6% in October. The trend estimate for the number of private sector houses fell 2.3% in October.

Victoria

The trend estimate for total number of dwelling units approved in Victoria rose 1.3% in October. The trend estimate for the number of private sector houses fell 1.7% in October.

Queensland

The trend estimate for total number of dwelling units approved in Queensland fell 1.4% in October. The trend estimate for the number of private sector houses fell 0.1% in October.

South Australia

The trend estimate for total number of dwelling units approved in South Australia rose 3.1% in October. The trend estimate for the number of private sector houses rose 2.0% in October.

Western Australia

The trend estimate for total number of dwelling units approved in Western Australia fell 1.0% in October. The trend estimate for the number of private sector houses fell 0.2% in October.

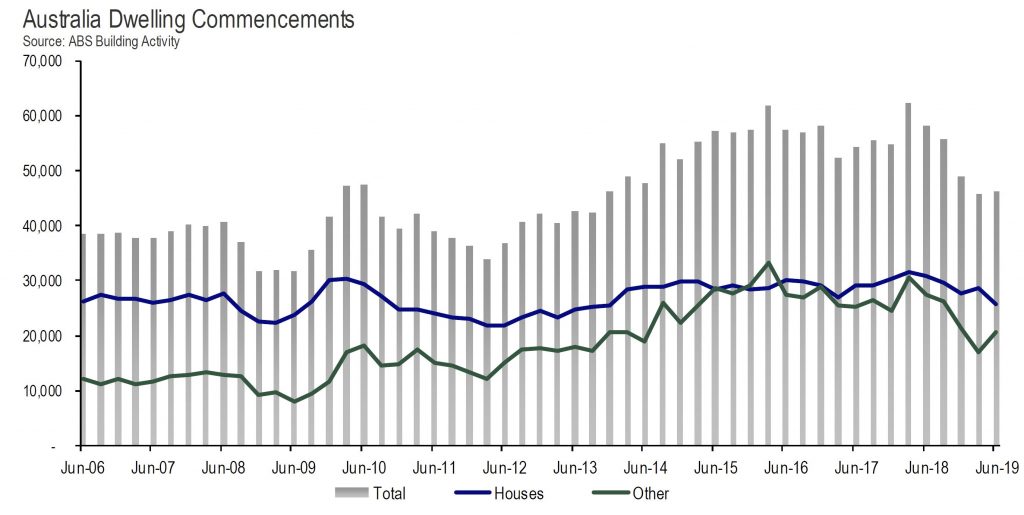

The ABS today released building activity data for the June quarter of 2019 and for August 2019.

The trend estimate for total dwellings approved fell 3.9% in August.

The seasonally adjusted estimate for total dwellings approved fell 1.1% in August.

The value of residential building fell 2.9% and has fallen for six months.

The trend estimate of the value of new residential building work done fell 2.5% in the June quarter. The value of work done on new houses fell 1.7%, while new other residential building fell 3.5%.

The seasonally adjusted estimate of the value of new residential building work done fell 4.7% to $16,097.2m. Work done on new houses fell 4.7% to $8,682.9m, while new other residential building fell 4.7% to $7,414.3m.

Despite a small improvement in new home starts in the June quarter, they remain 20 per cent lower than against the same period a year ago.

Annual housing starts during the 2018/19 financial year fell in all states and territories, with the exception of the Australian Capital Territory (+17.8 per cent) and Tasmania (+5.3 per cent).

The largest annual fall was recorded in the Northern Territory (-28.4 per cent), followed by South Australia (-22.6 per cent), Victoria (-17.8 per cent), Western Australia (-14.3 per cent), Queensland (-13.9 per cent), and New South Wales (-13.1 per cent).

“The number of new homes commencing construction in the June quarter increased by 1.1 per cent, the first increase since December 2017,” said Tim Reardon, HIA Chief Economist.

Commenting on the results, Tim Reardon, HIA Chief Economist said “The number of new homes commencing construction in the June quarter increased by 1.1 per cent, the first increase since December 2017.

“The increase in total starts was due to a 21 per cent lift in multi-unit starts, mainly in NSW and WA. Detached housing starts have slowed to their lowest level since December 2013.”

“More recent data informs us that the downturn in detached home starts has slowed. The impact of three cuts to interest rates and small fiscal stimulus has slowed the decline in work entering the pipeline.

“The slowdown in building activity over the past 18 months has adversely affected the national economy and has been one of the main drags on GDP growth.

“A return to normal lending conditions would provide a boost to home building and the wider economy.

“Indications are that the downturn in new projects entering the pipeline are starting to improve following cuts to interest rate but the market is not yet at the bottom of this cycle.