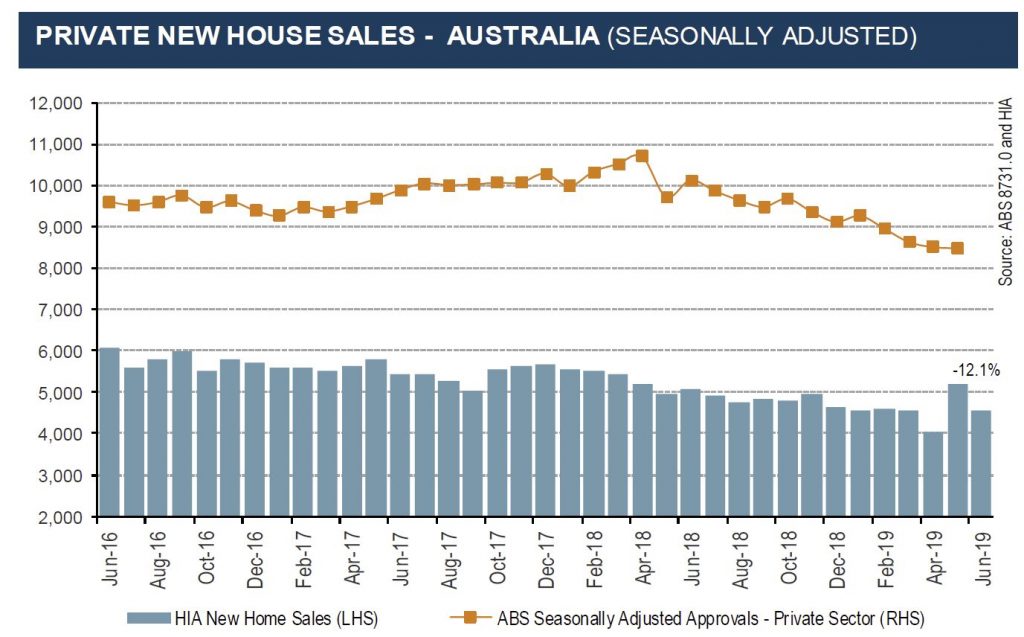

Over the year to June 2019 new home sales fell 12.4 per cent compared with the previous financial year with every state recording a sharp contraction in sales says The HIA New Home Sales report – a monthly survey of the largest volume home builders in the five largest states.

Around the states, new home sales rose for the June quarter compared to the previous quarter in Victoria (+5.1 per cent), Western Australia (+2.9 per cent) and South Australia (+2.6 per cent). The quarterly declines in sales in New South Wales (-1.7 per cent) and Queensland (-8.9 per cent) still represented a moderation of earlier declines.

However, the small improvement in sales in the June quarter, up by just 0.8 per cent on the preceding quarter, suggests that the decline in new home sales that has been underway for more than a year, has started to ease said the HIA.

The upside of the current building industry downturn is that activity levels have synchronised across the east and west coasts – and within each state – making it easier for policy makers to coordinate policy settings.

Two interest rates cuts, a tax cut and repeal of regulatory restrictions will encourage increased activity in the home building market.

These measures, combined with ongoing stable population and employment growth should see new home sales improve toward the end of the year