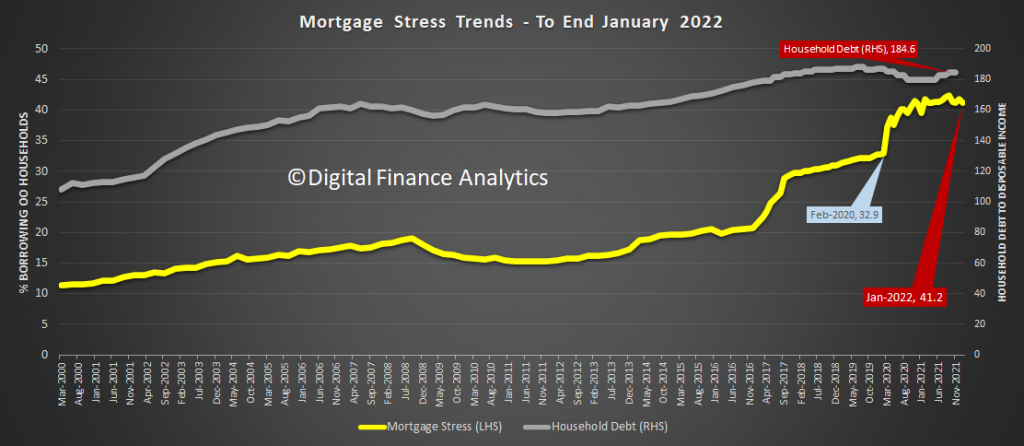

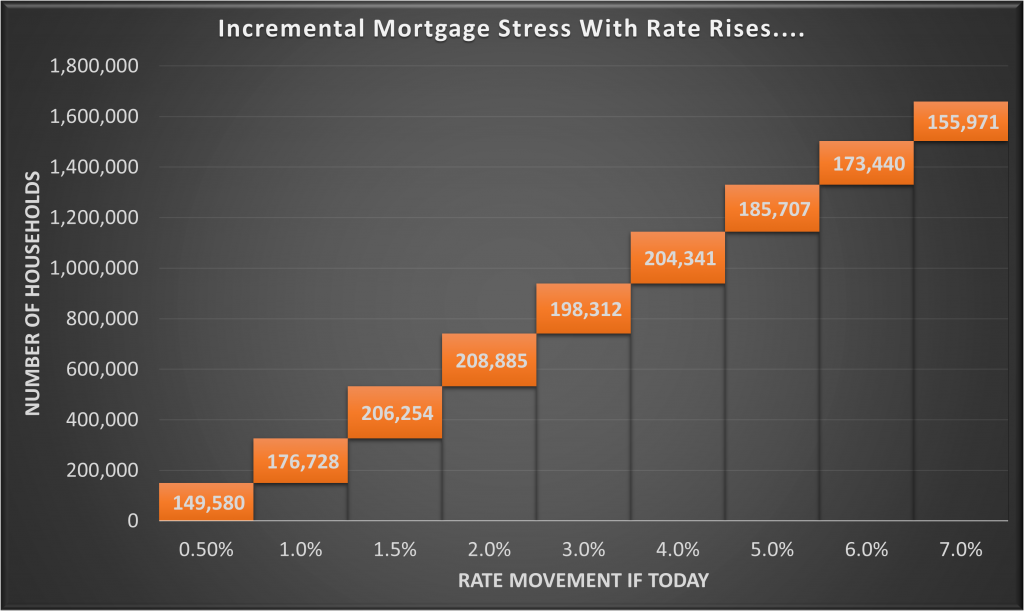

A deep dive of our mortgage stress analysis to end of January 2022, plus some rate sensitivity analysis and mapping. Where are the hot spots? How many households are under pressure?

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

This is material drawn from several recent shows on this and other channels, explaining mortgage and household stress and what is happening in the current environment – with data to December 2021 and beyond.

Go to the Walk The World Universe at https://walktheworld.com.au/

Join us for a live discussion as I explore the data from our models to end December 2021, including post code level analysis of mortgage stress. We will have the post code engine on line, and you can ask as a question live.

This is a succinct summary of our latest mortgage stress analysis, based on our surveys. We also add some additional comments about how to address stress at a household level.

Go to the Walk The World Universe at https://walktheworld.com.au/ The original live stream is here:

A deep dive on household financial stress, based on my recent live show https://youtu.be/0RyvpENjl4E plus additional comments.

Go to the Walk The World Universe at https://walktheworld.com.au/

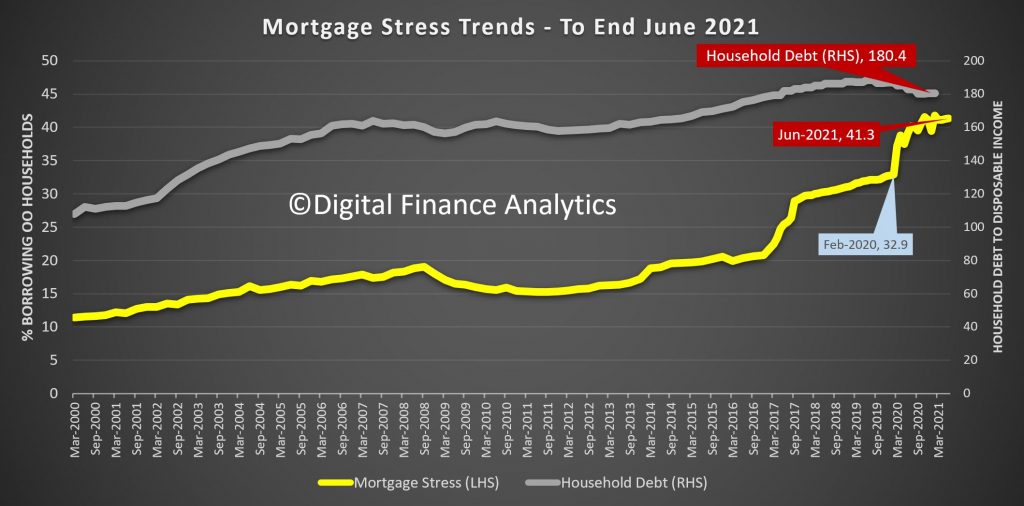

We discuss the September 2021 DFA Household survey results. Many households remain in a difficult position, as cash-flows remain negative thanks to crushed incomes, rising costs and bigger mortgages (despite the lower available interest rates). We examine data at a state, segment and post code level, as well as geo-mapping which highlights the patchwork nature of the problem. Stress lurks in strange places, including some more “affluent” places!

Go to the Walk The World Universe at https://walktheworld.com.au/

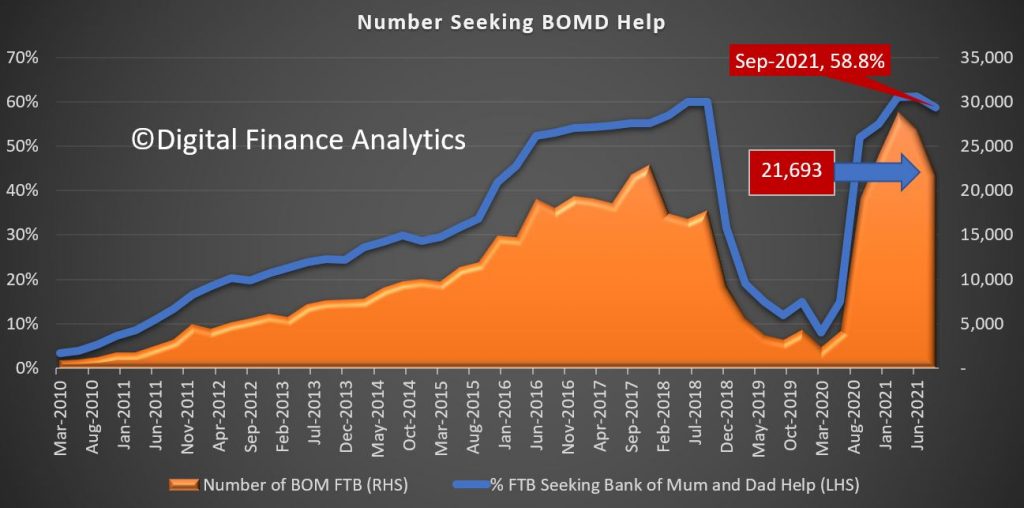

We look at the latest DFA survey data relating to how parents are helping their kids to enter the Australian property market. The totals are growing fast, despite the risks. But there are a number of questions to be asked, and trade-offs to be considered.

Not least the relationship between BOMD and Lenders Mortgage Insurance. https://digitalfinanceanalytics.com/blog/what-you-should-know-about-lmi/

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.

Join us for a live Q&A as I discuss the latest results from our surveys and modelling. You can ask a question live. https://walktheworld.com.au/ .

I caught up with Steve Mickenbecker from Canstar to review some concerning recent research about household finances. We discussed strategies which may be considered to assist with cash-flow management, especially during these uncertain times.

Steve Mickenbecker is in Canstar’s Group Executive Team, bringing more than 30 years of experience in the Australian financial services industry. As a financial commentator for Canstar, Steve enjoys sharing his expertise across topics such as home loans, superannuation, insurance, mortgages, banking, credit cards, investment, budgeting, money management and more.

Go to the Walk The World Universe at https://walktheworld.com.au/

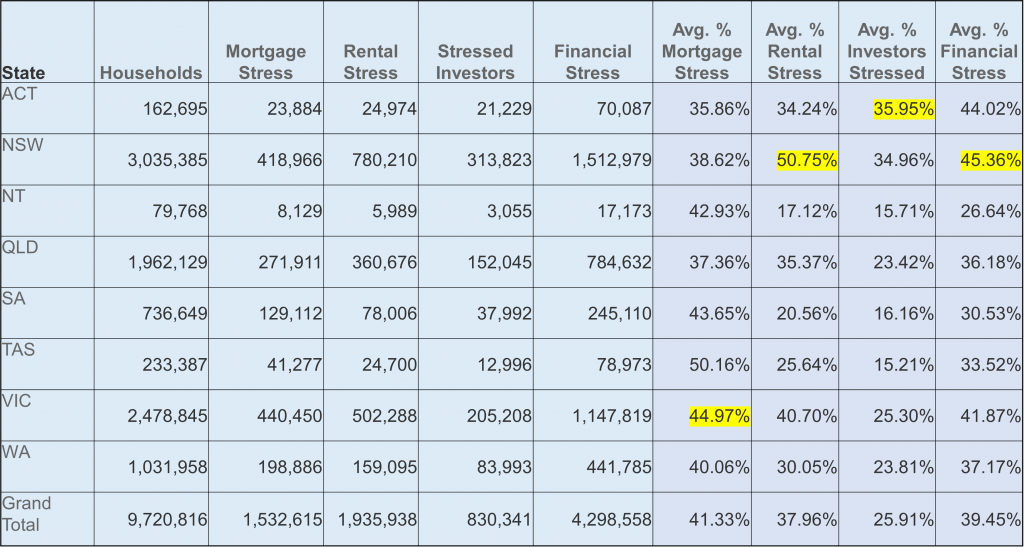

The latest data from our running household surveys reveal that overall levels of household financial stress – measured in available cash flow, continues to trouble many households. Mortgage stress stands at 41.33% of households or 1.53 million households.

Overall financial stress (an aggregate of our stress metrics, weighted to all households) was highest at 45.4% in NSW, with 1.51 million households under pressure.

We continue to see many younger households who are highly leveraged into either buying their first home, or into property investment. Rental stress at 56.09% is highest among first generation Australians. Financial stress overall is highest among Young Growing Families.

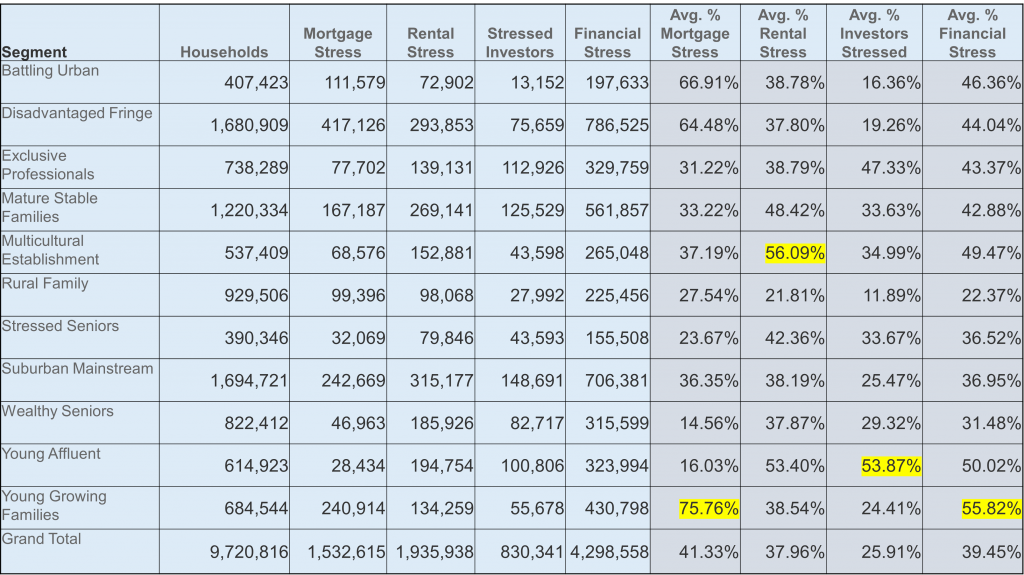

Top mortgage stressed post codes (by number of households stressed) are concentrated in the high growth corridors of Melbourne, as well as regional centres such as Ballarat.

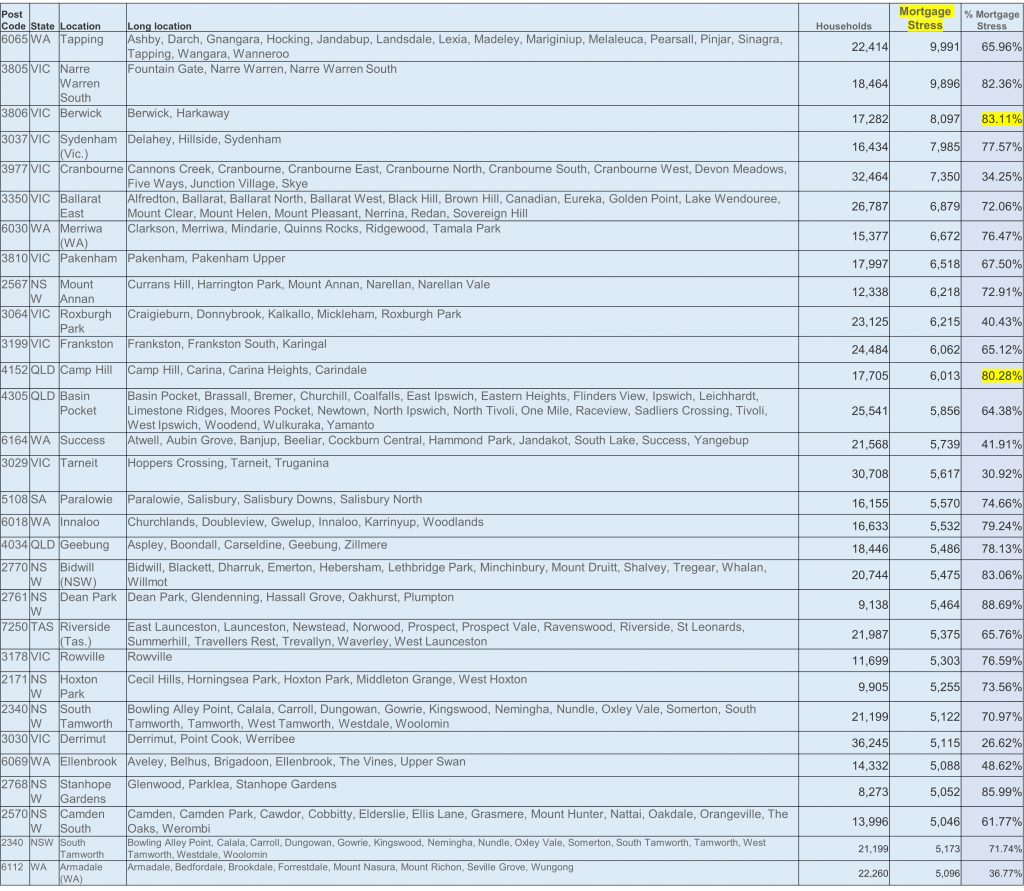

Rental stress is centred on areas of New South Wales, including in regional areas, including the South Coast and Central coast as well as high growth corridors, and some more central areas such as Bondi (2026) Central Sydney (2000) and Central Melbourne. Family formation is varied in different areas, from singles, through to larger family blocks.

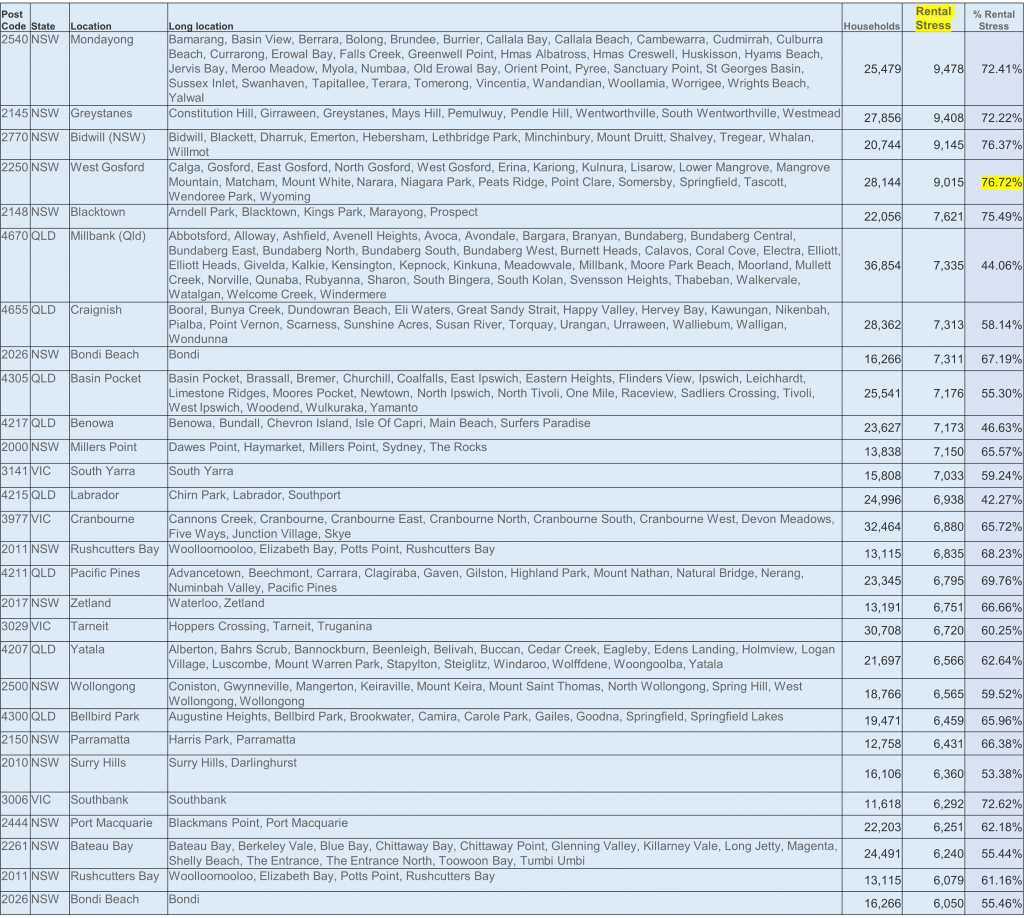

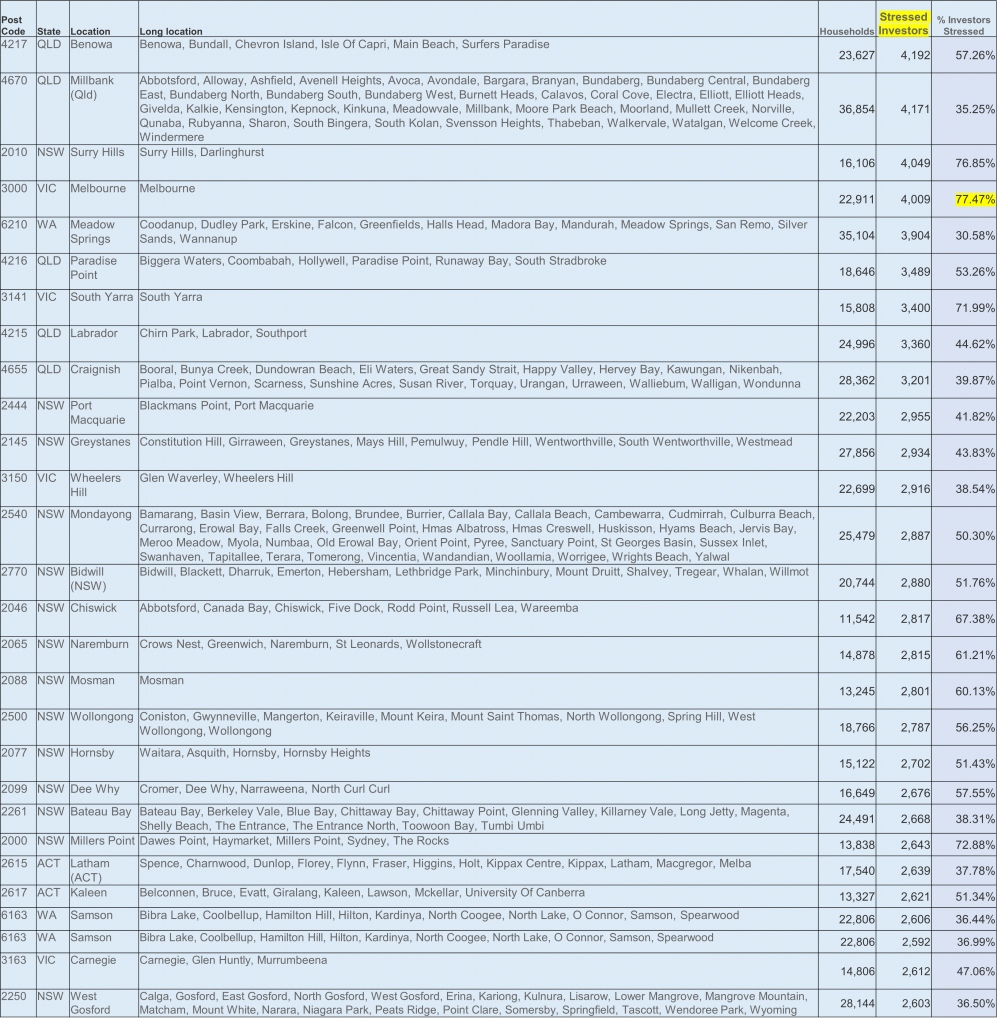

Investor stress (defined as property investors who are under water from a cash-flow perspective, or who cannot let their property, or who are trying to sell) ranges from areas in Queensland around Surfers Paradise (4217) and Bunderberg (4670). Surry Hills in Sydney and Central Melbourne are also pressure points – with many vacant units, either unlet, or deeply discounted.

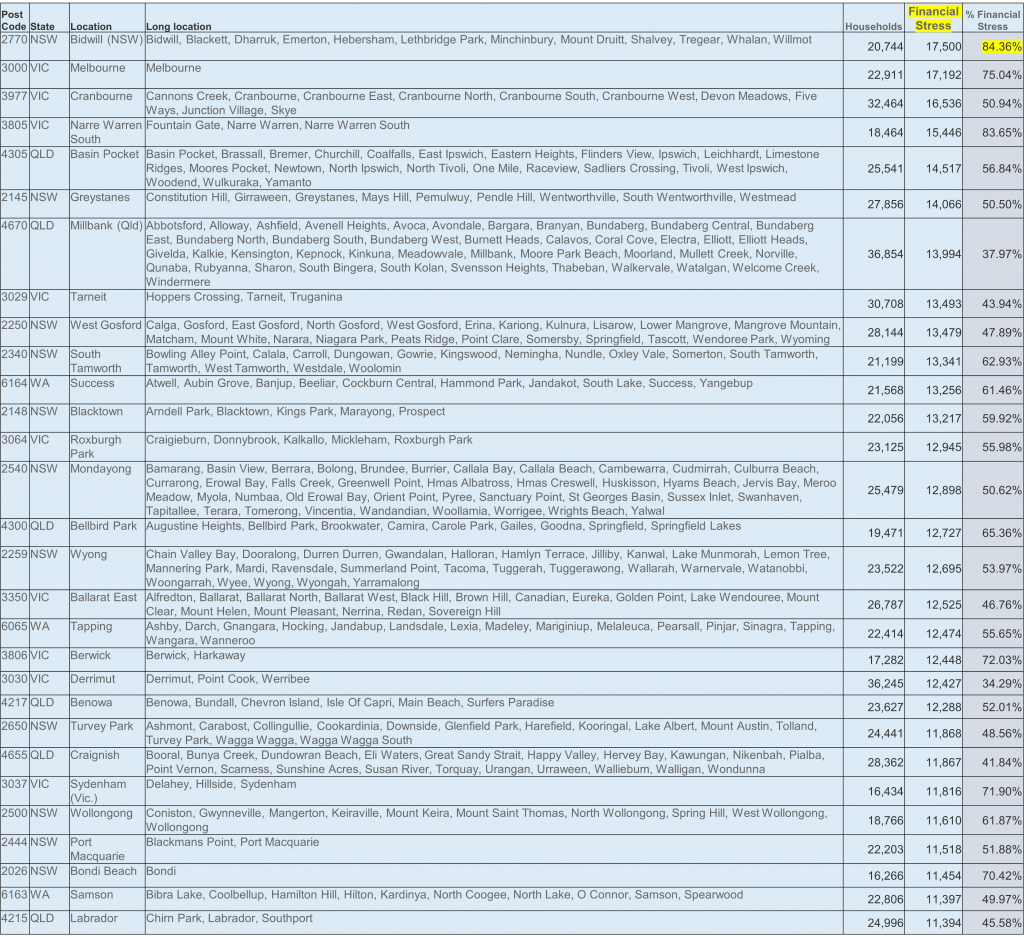

Overall financial stress registered most strongly in areas such as Mount Druitt (2770), central Melbourne (3000) and high growth suburbs including Cranbourne (3977) and Narre Warren (3805). But the stress patchwork is widespread across the country.

We discussed this data in our recent live show, including geo-mapping several areas to illustrate the findings.

The overall conclusion remains that the financial settings in Australia, with raging home prices, and high debt, against an uncertain economic outlook and made worse by recent lock-downs – is putting pressure on many households. This belies the “official narrative” the the recovery is booming.

We continue to see many households trying to get by using more credit (including Buy Now Pay Later) and draining savings for every day expenses. Many still do not maintain cash flow records, so are not clear about their real exposures.

Importantly, those with mortgage commitments who continue to struggle would do well to speak to their bank. Given continued flat income, the virus conditions in some suburbs, and other factors, we do not expect this to change ahead. Many are hoping for a magic bullet but in the current environment this is unlikely.