Join me tonight as we dissect the latest RBA statement and examine the real-life financial footprint of Australian households. You can ask a question live, and I will have the post code data base on line, as well as our geo-mapping series.

Category: Household Survey

Why Household Financial Stress Remains High

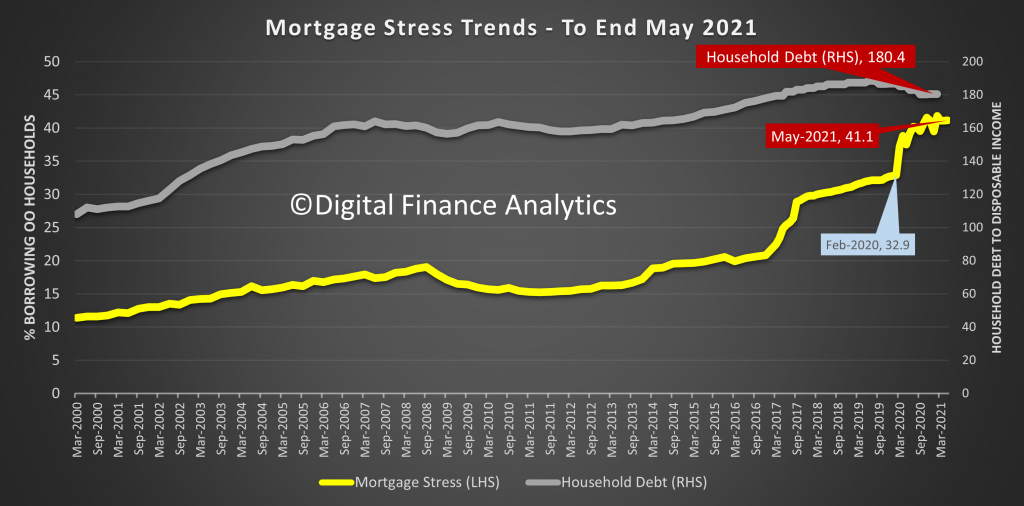

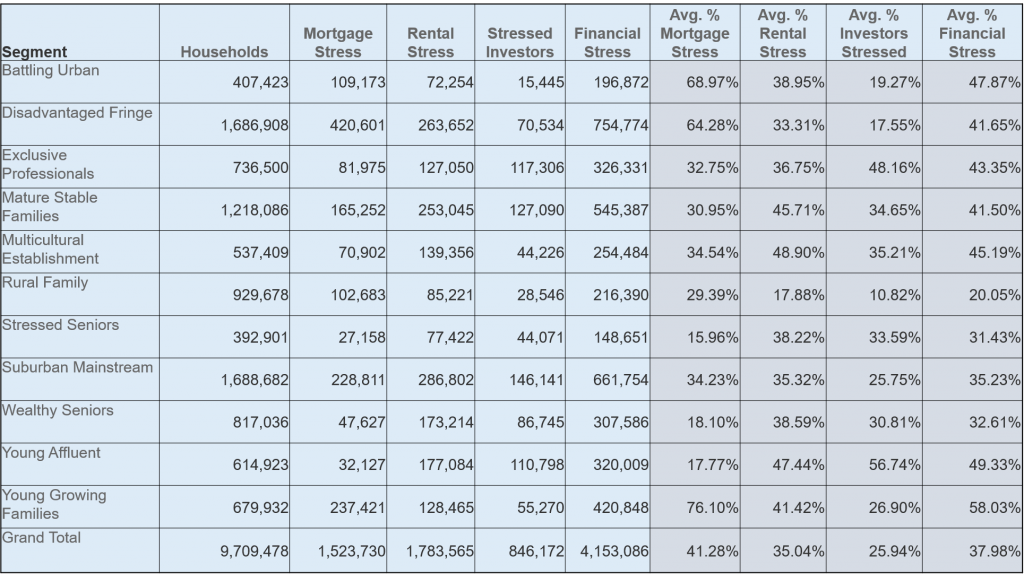

The latest data from our household surveys for May revealed little change in mortgage stress among households – still at around 41%, but there was a shocking rise in rental stress as the JobSeeker and JobKeeper supports were withdrawn, and the random lock-downs continue.

Even Property “experts” accept that affordability has deteriorated recently, as house prices rocket higher in many suburbs, although of course real interest rates are very low, for now, if rising ahead.

Our approach to measuring stress is unique in that we examine household cash flow – money in and money out. Given that many households saved hard last year though the heights of COVID, it is not surprising to see many now draining down those savings, by spending more. This means that their cash flow will in net terms be negative for now, and so will register as stressed. That said, if spending continues unabated financial difficulties will eventuate.

In addition we continue to see more households reaching for credit (from Buy Now Pay Later, to Pay Day loans) as well as equity release from property. In fact the latest hikes in perceived values has led to a run of refinancing, to try and pay down debt, or to provide funds to offspring for property purchase via the Bank of Mum and Dad. Again these one-off moves can adversely impact household stress measures in our methodology.

And we also note that many prefer not to accept the truth that some households are not home and clear in terms of their finances, given the uncertain part-time work, multiple jobs and zero hours contracts which many are on. But we continue to analyze households in net cash flow terms. If more funds drain away, compared with income, they are classified as stressed.

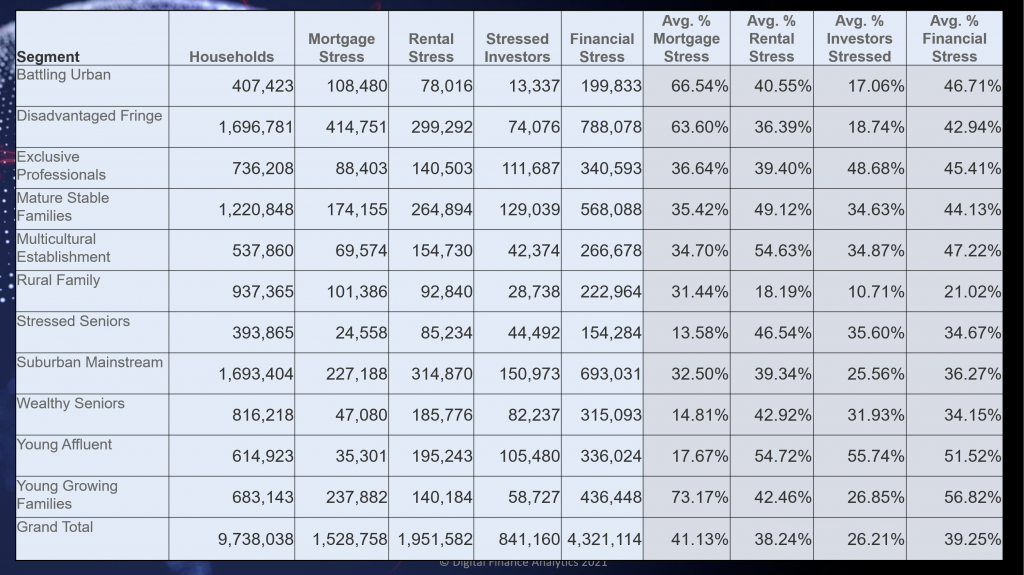

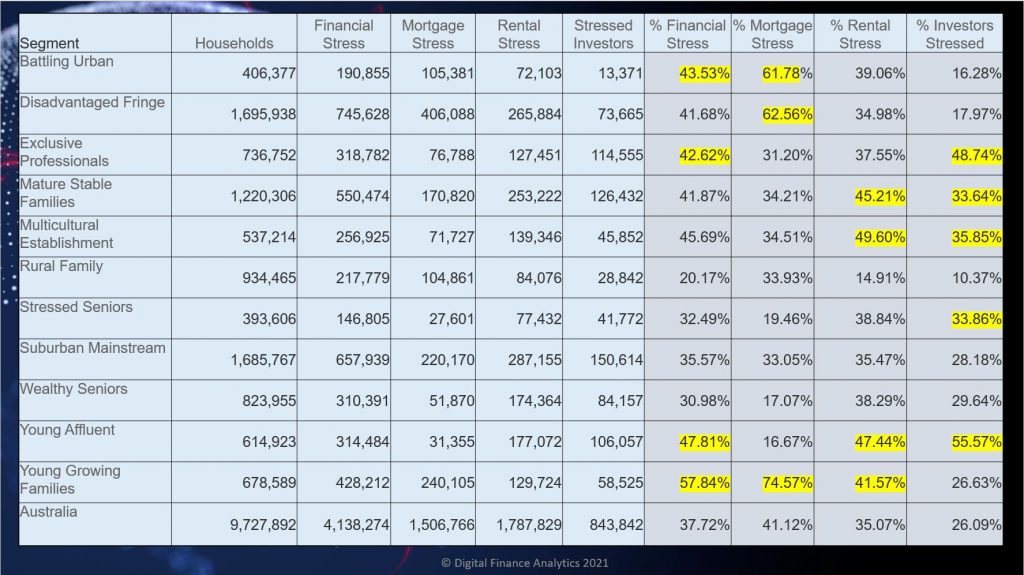

Across our segments we continue to see quite different dynamics emerging, with many younger households (often first time buyers) impacted, alongside the high growth corridors containing many first generation Australians, as well as some more affluent groups. Financial Stress takes no prisoners.

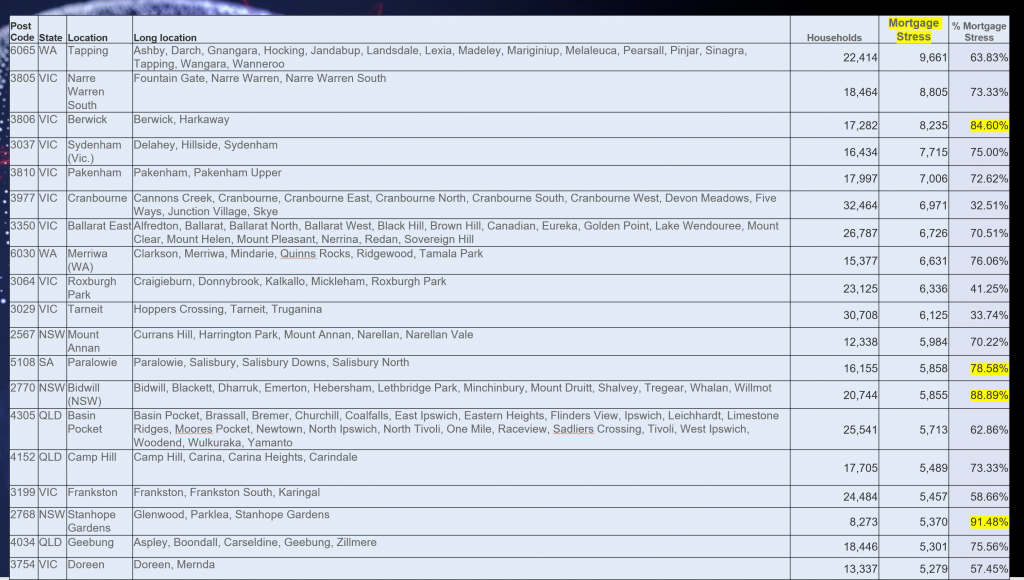

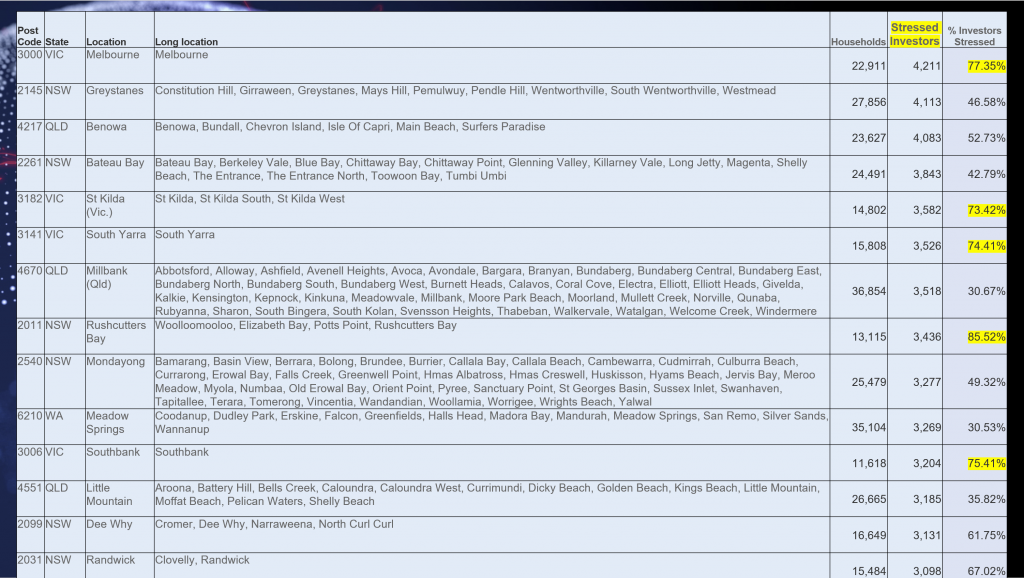

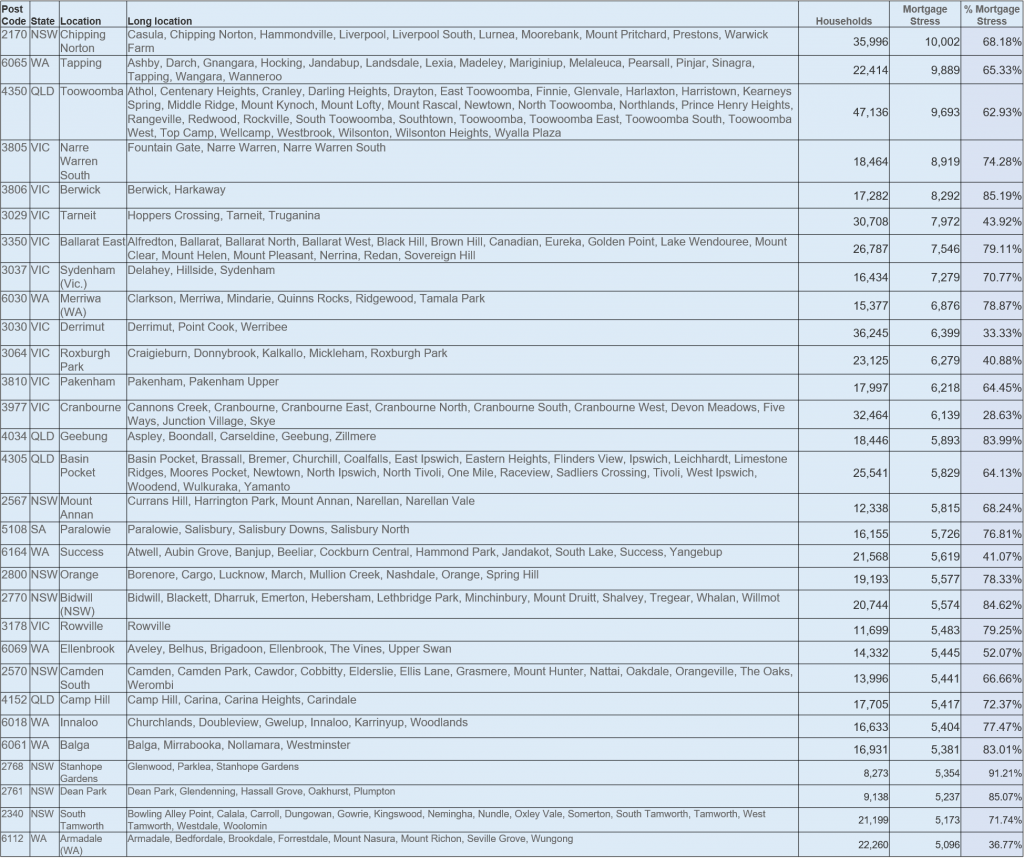

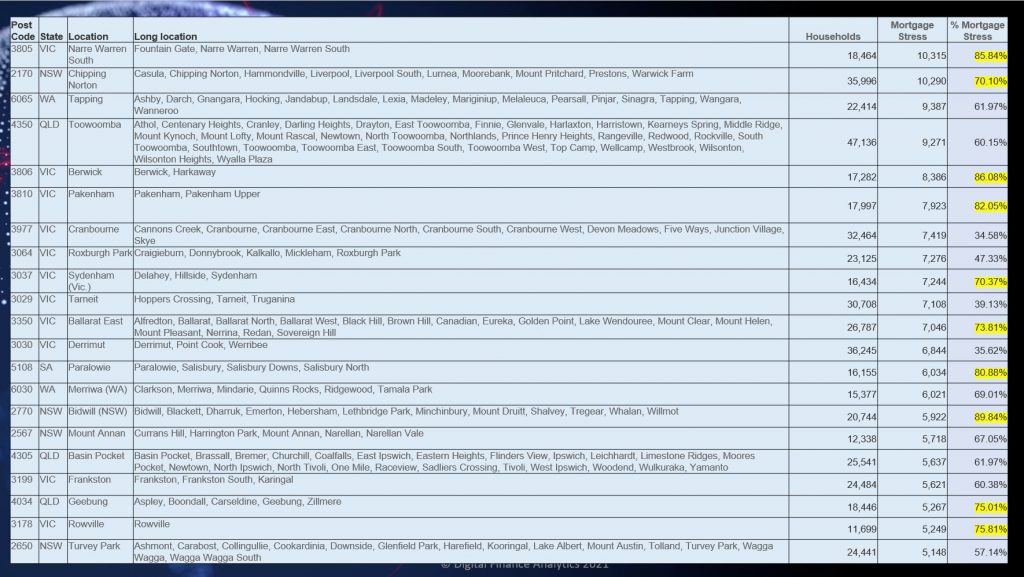

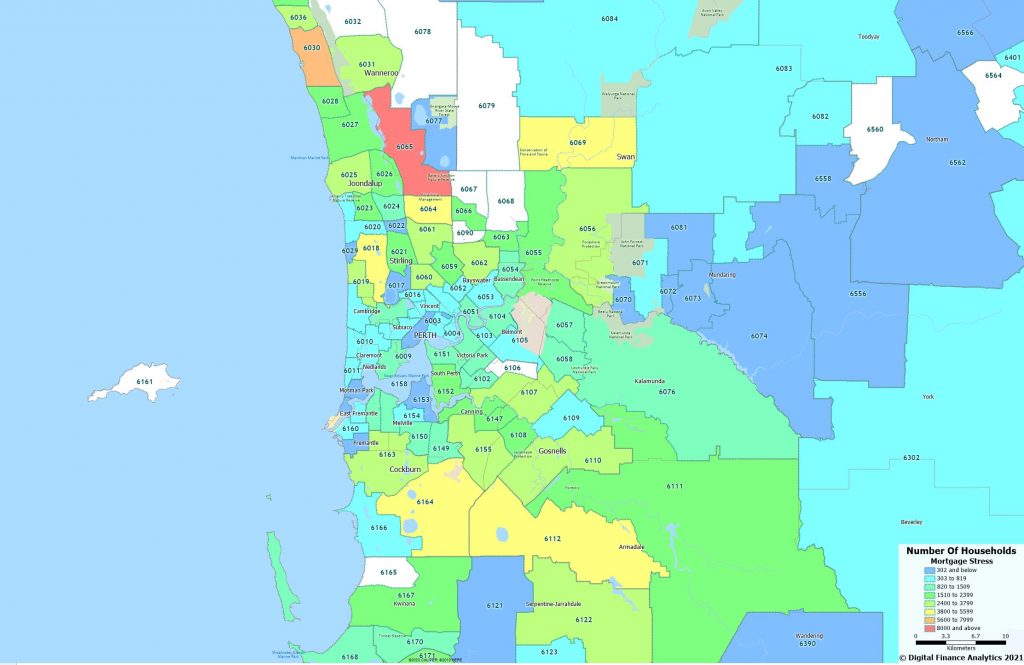

The mortgage stress counts are highest in high growth corridors in WA and VIC – where in some cases more than 80% of households in the area have cash flow issues.

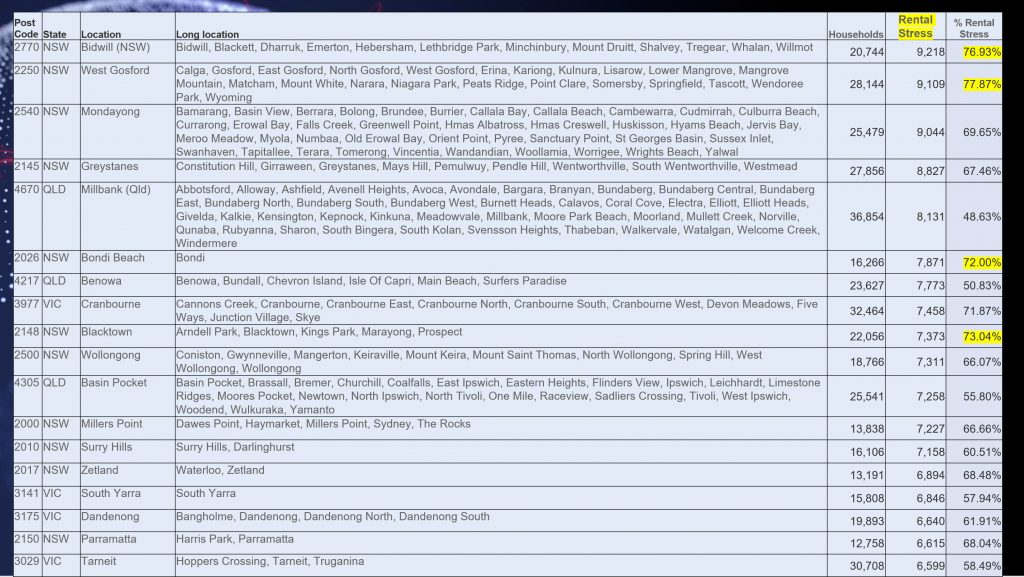

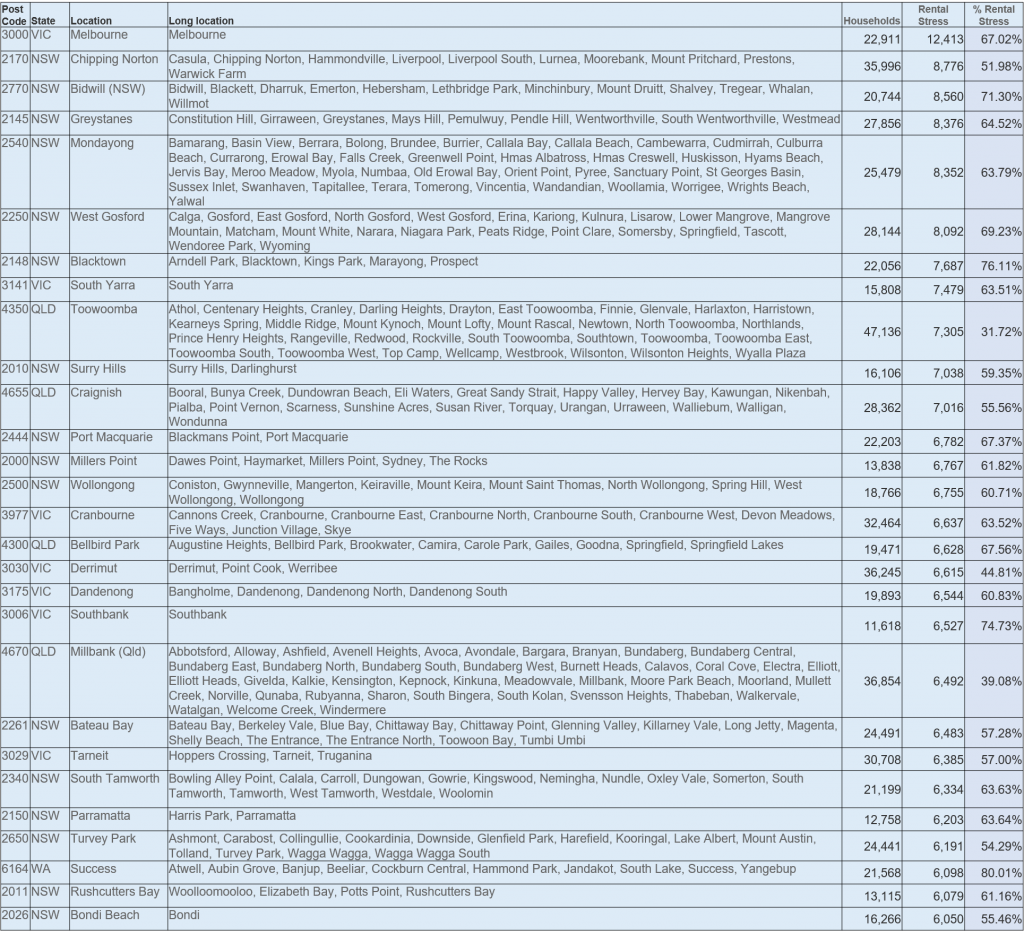

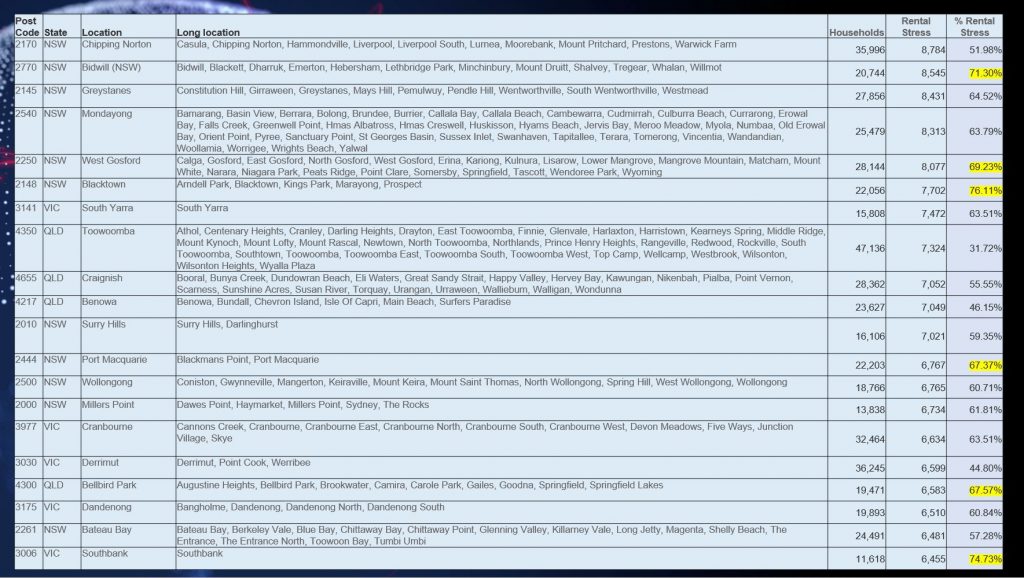

Rental stress is more strongly registered in NSW and QLD, with Western Sydney and the Central Coast and Bundaberg in the top 10.

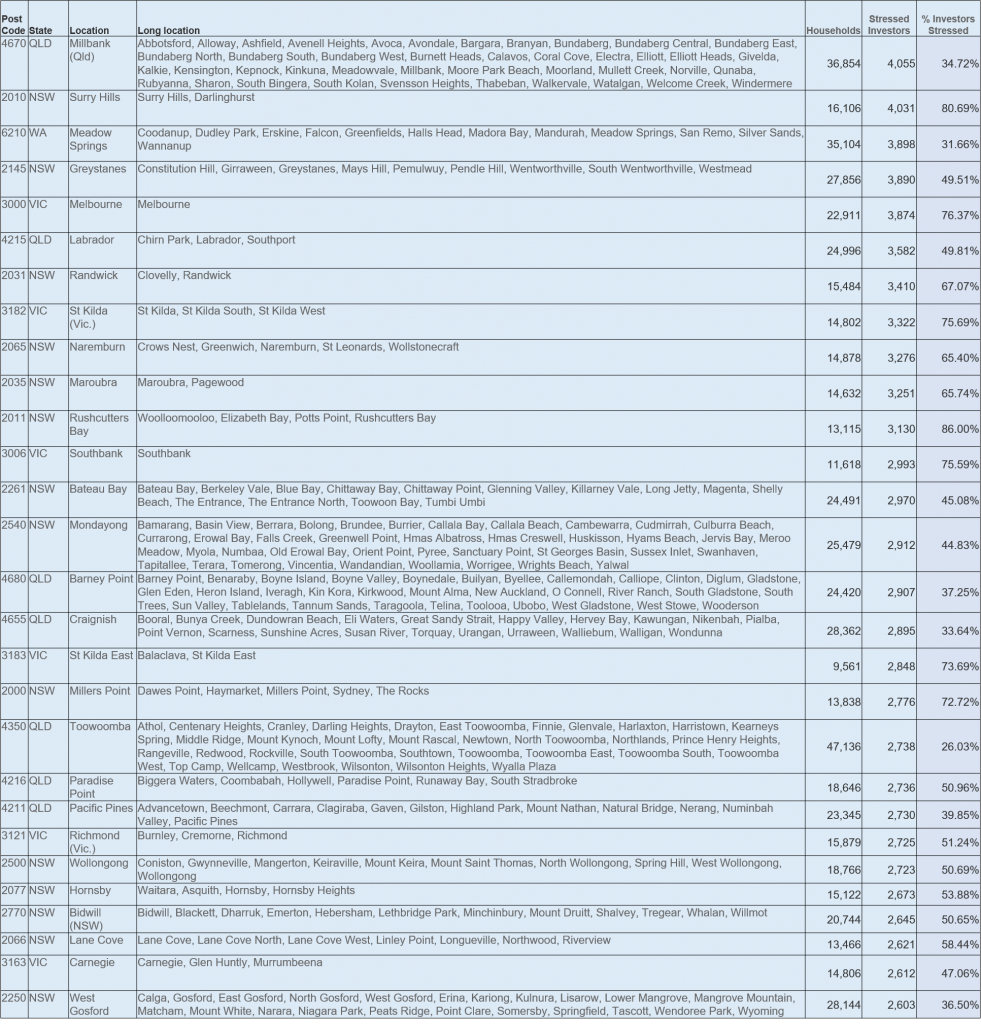

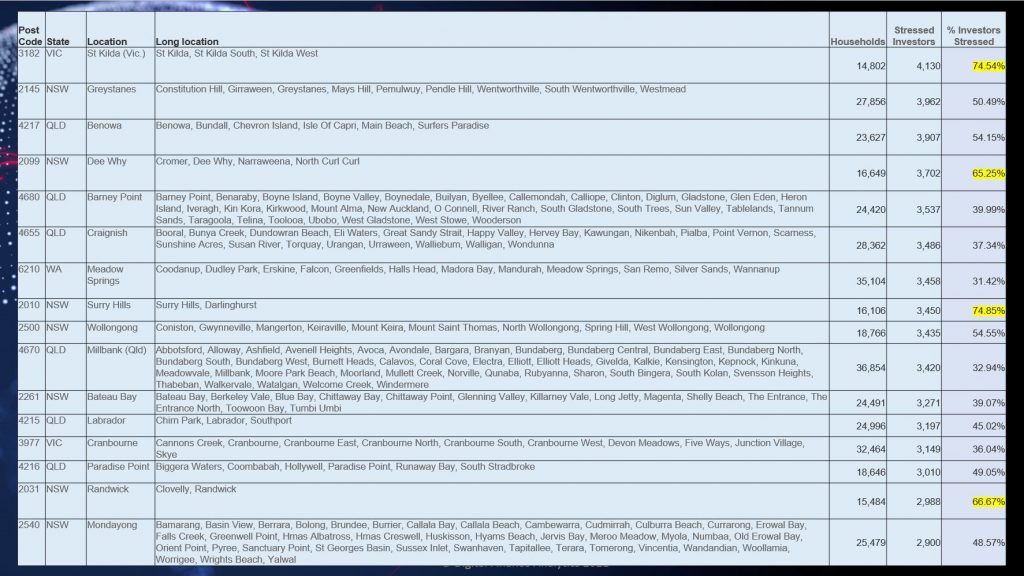

Property investors are having difficulty in Melbourne 3000, thanks to the lack of students and ongoing lock-downs. A number of VIC suburbs are impacted thanks to high vacancy rates, negative net yields and falling apartment values.

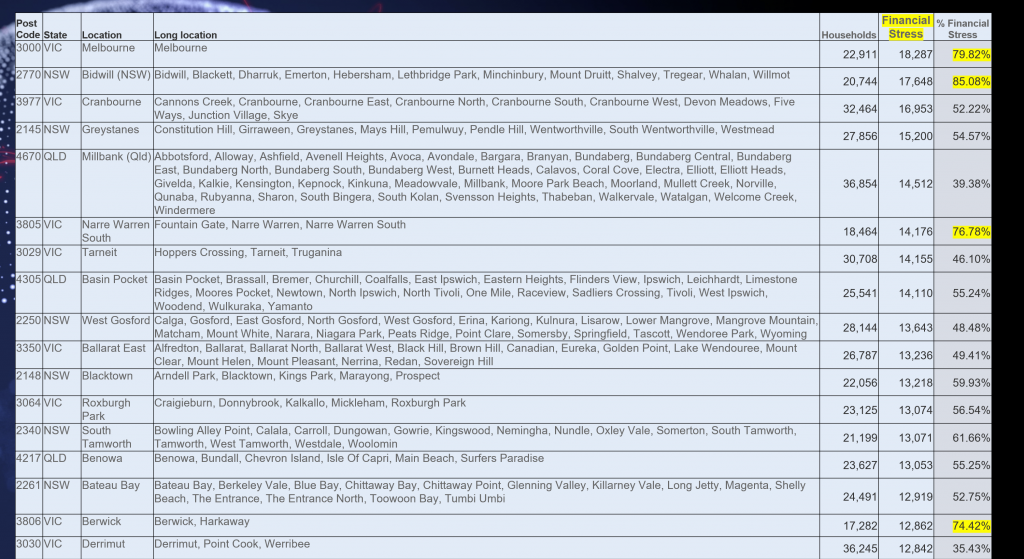

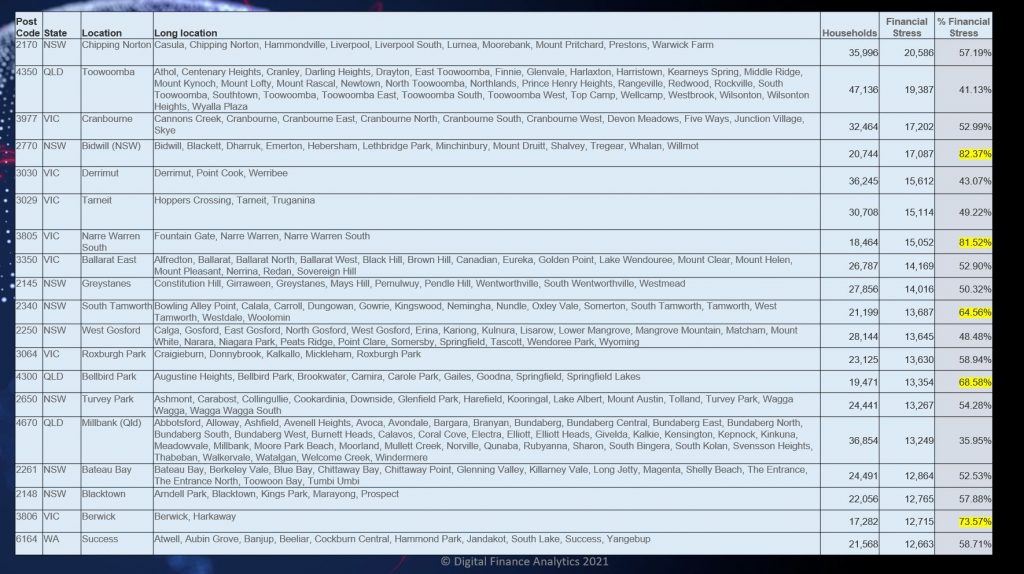

Overall financial stress, our aggregate measure reveals that Melbourne 3000 has the highest stress levels. That is followed by a number of the high growth corridors.

The continued pressure on households from low income growth, and rising living costs will persist, while the risks of interest rate rises grow with the competition of the Term Funding Facility at the end of June.

Households continue to wait for a magic bullet to solve their financial flow issues, and while some can draw on savings and equity, or reach for more credit, unless spending patterns are understood (half have no budgets), we think these trends will continue to bubble away.

Of course, financial stress is not the same a mortgage default, but those with cash flow issues are more likely later to end up having to sell their home, unless remedial action is taken.

Households in financial stress should certainly speak to their lender, prioritise spending, and be cautious about further loan commitments. There is no income growth “get out of jail card” for now.

FINAL REMINDER: DFA Live 8pm Sydney – Latest Household Survey Results And Scenarios

Join us for a live Q&A as I discuss the latest from our surveys. You can ask a question live. https://walktheworld.com.au/

Is There Mortgage Trouble Ahead?

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

April Household Financial Stress Rises

The latest data from our rolling household surveys reveals that the pressure on many households continues to build, despite the headline news of a booming recovery and jobs growth. Of course the missing element remains underemployment, where we still see many households struggling to get the income they need to cover their ongoing commitments. This is how we define stress – when incoming cash flow is not sufficient to cover ongoing costs.

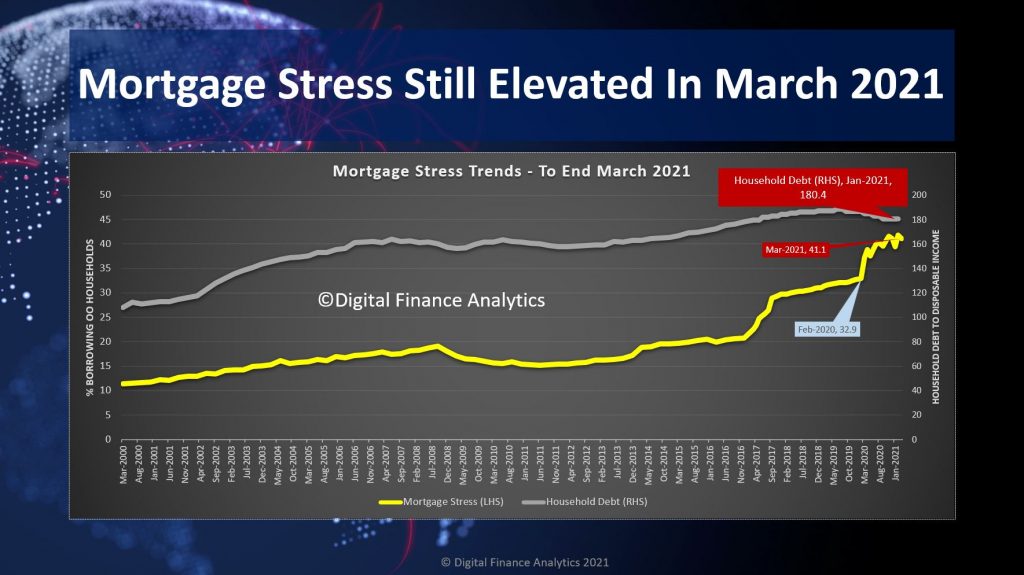

Mortgage stress rose to 41.1% of borrowing households which translates to 1.52 million households, with the end of JobSeeker and JobKeeper in March.

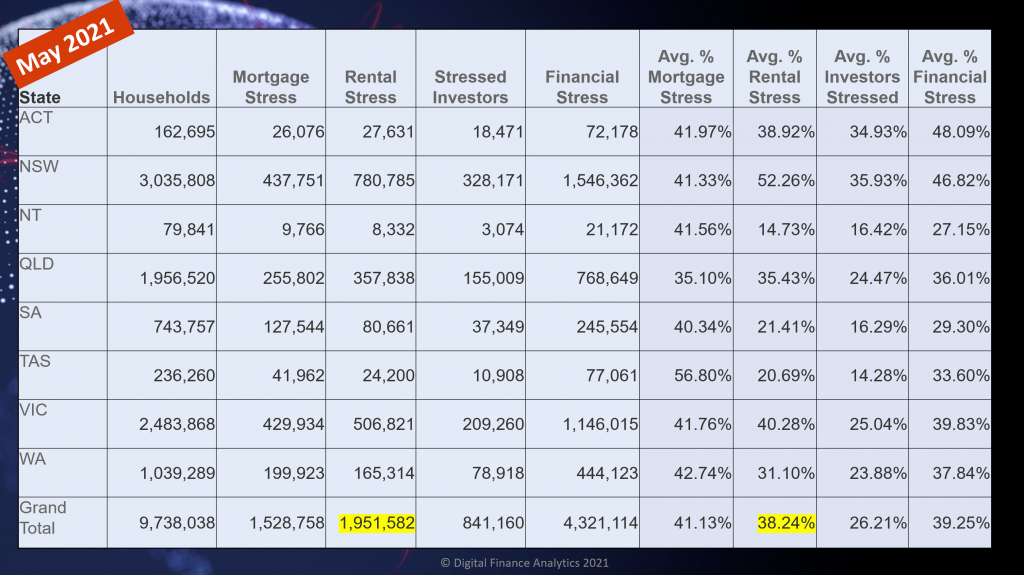

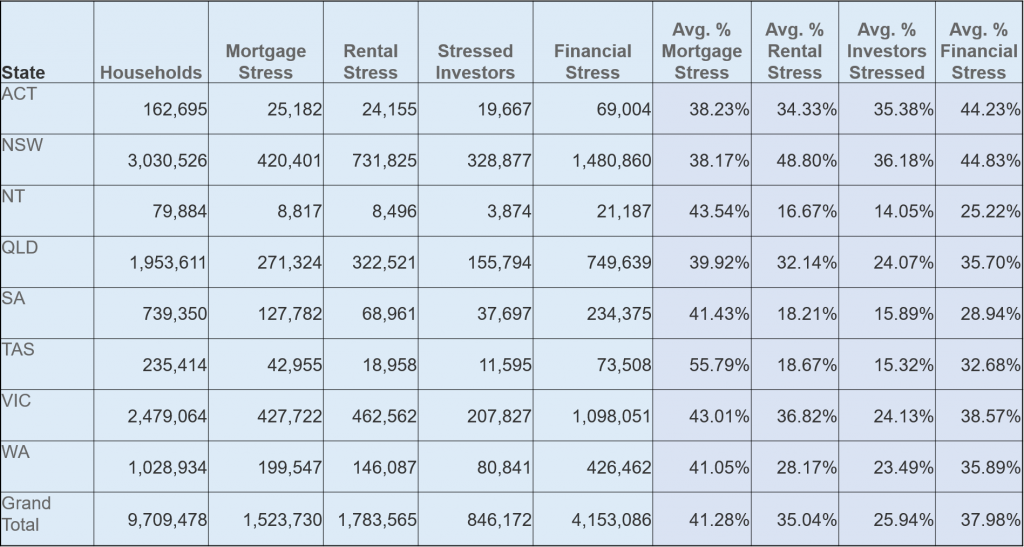

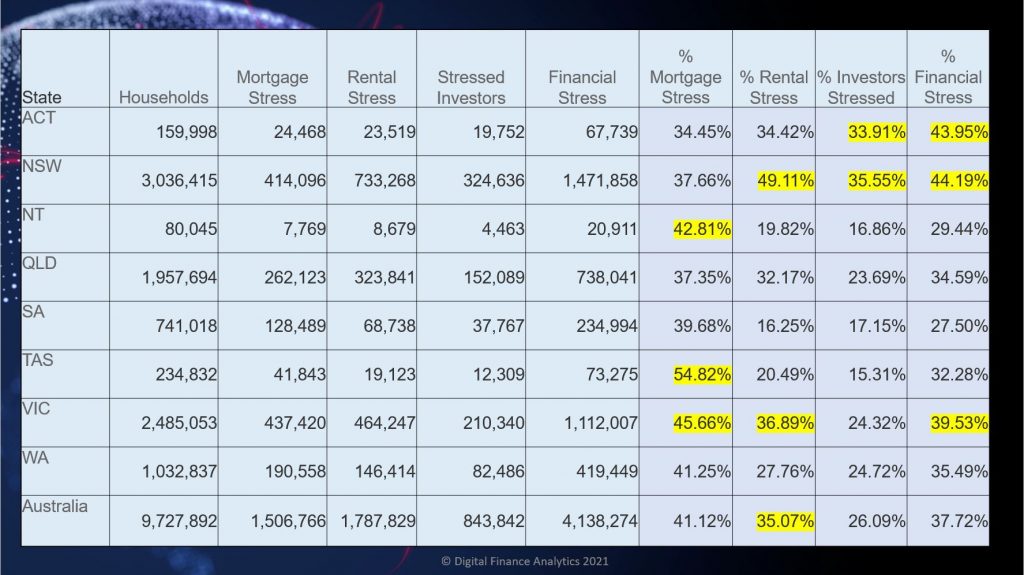

Within the series both mortgage stress and rental stress were higher, although there was a small improvement in Victoria. Mortgage stress remains highest in Tasmania, at 55.8%, while rental stress is highest in NSW. Property investor stress is highest in NSW and ACT, and overall financial stress (which is a weighted average of all stressed households, against all households) was highest in NSW and ACT.

Across the DFA household segments, many Young Growing Families (which includes significant representation of First Time Buyers) are exposed, as are households living in the high growth high construction corridors around our major centres. But we also continue to see more affluent households who are often highly leveraged, with multiple properties also being caught. It is also worth highlighting that many first generation migrants are being caught too.

The postcodes with the highest levels of mortgage stress (measured by count of households) includes Chipping Norton 2170, Tapping, Wanneroo 6065, Toowoomba 4350 and Narre Warren 3805. So the pressures are wide spread, with the highest counts in those high growth corridors.

Turning to rental stress, the footprint is rather different, with Melbourne 3000 at the top of the list (thanks to many students and young workers in the area) followed by 2770, Liverpool and surrounds, 2145 which includes Westmead and Wentworthville, 2540 Jervis Bay and surrounds, and 2250, the area around Gosford. So rental stress appears in a range of settings.

Investor stress is led off by Queensland post code 4670 which includes Bundaberg, 2010 which includes Surry Hills and Darlinghurst, Meadow Springs and Mandurah 6210, 2145 Westmead and 3000 Melbourne.

Overall financial stress (our aggregate measure) was highest in 2170, Toowoomba 4350, 27770, 3000 and 3029, which includes Hoppers Crossing. Again this shows the wide distribution of those under financial pressure.

We discussed this in our recent show on DFA, together with some heat maps

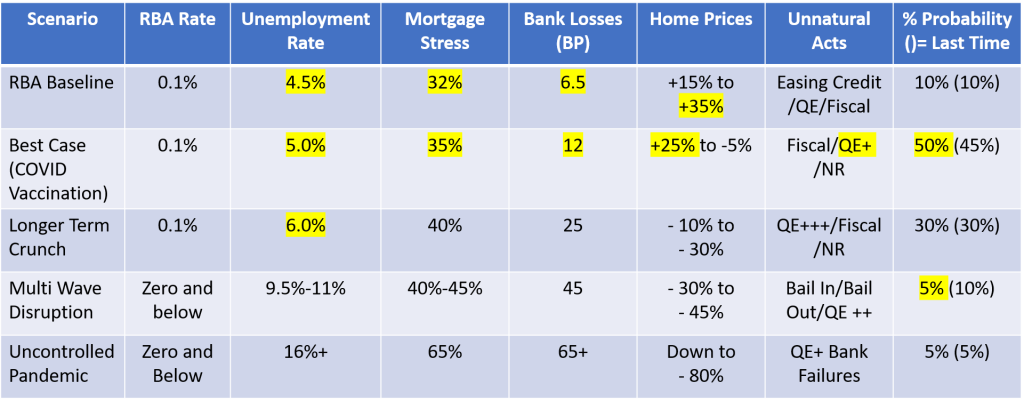

We updated our core market model to take account of these changes, with our main scenario seeking an ongoing rise in property values ahead, but determined by the trajectory of the virus, vaccine rollout and border controls.

In conclusion, while many households are experiencing a rebound, there are many who are still caught in significant and growing financial pressures. Given that costs of many services are rising, while income is not, plus the larger mortgages being written at the moment, we expect stress to remain elevated for some time. And given the long cycle between stress, and ultimate property sale or mortgage default, it is likely we will see a continued build up in those financially exposed ahead.

Do People Think Home Prices Are Going To Go Up, Or Down?

My latest discussion with Steve Mickenbecker from Canstar.

Steve Mickenbecker is in Canstar’s Group Executive Team, bringing more than 30 years of experience in the Australian financial services industry. As a financial commentator for Canstar, Steve enjoys sharing his expertise across topics such as home loans, superannuation, insurance, mortgages, banking, credit cards, investment, budgeting, money management and more.

https://www.canstar.com.au/team-members/steve-mickenbecker/

Go to the Walk The World Universe at https://walktheworld.com.au/

FINAL REMINDER: DFA Live 8pm Sydney – Household Stress And Scenario Update

Join us for our live show tonight via YouTube. You can ask a question live via the chat.

Welcome To The DFA Member Zone!

We explore our new Member Zone. You can sign up via Patreon Tier 4 https://www.patreon.com/DigitalFinanceAnalytics

Go to the Walk The World Universe at https://walktheworld.com.au/

Household Financial Stress Higher Than Before COVID

The latest results from our household surveys confirms that there are more households in financial stress than before the pandemic hit. As the various Government support mechanisms are ratcheted back, we will see the true impact on the community. Household debt is also turning higher again.

We have 41.1% of mortgaged households (1.5 million) in financial flow stress, despite the lower interest rate environment. While many have paid down debt, other have borrowed more. For example, the average new first time buyer loan is 15-18% larger than a year back- so much for the maintenance of lending standards!

We discussed this in detail in our live show, last night.

Across the states, the patterns are familiar, with Tasmania still reporting the highest proportion of households in mortgage stress thanks to low wages, and rising home prices. Victoria continues to be impacted by the longer lock-downs. Rental stress is being exacerbated by the end of tenant protections, so expect to see more evictions, and rent rises in the weeks ahead. Property investors in NSW are still having rental flow issues (due to high vacancies and lower rents). Overall financial stress – the aggregated measure across all households is highest in NSW, ACT and VIC.

Across our household segments young growing families, and those on the urban fringe in high growth corridors are being impacted, although across our segments and stress categories, it remains a real patchwork.

The top post codes for mortgage stress include Narre Warren and Fountain Gate, 3805 in Victoria, and Liverpool 2170 in NSW.

The top rental stress post codes include Liverpool 2170, NSW, Mount Druitt and Lethbridge Park 2770, NSW and Westmead 2145 NSW.

Investor stress is highest is St Kilda 3182, Westmead 2145 and Surfers Paradise 4217 in QLD.

Cumulative financial stress is highest in Liverpool 2170, Mount Druitt 2145, and Westmead 2145.

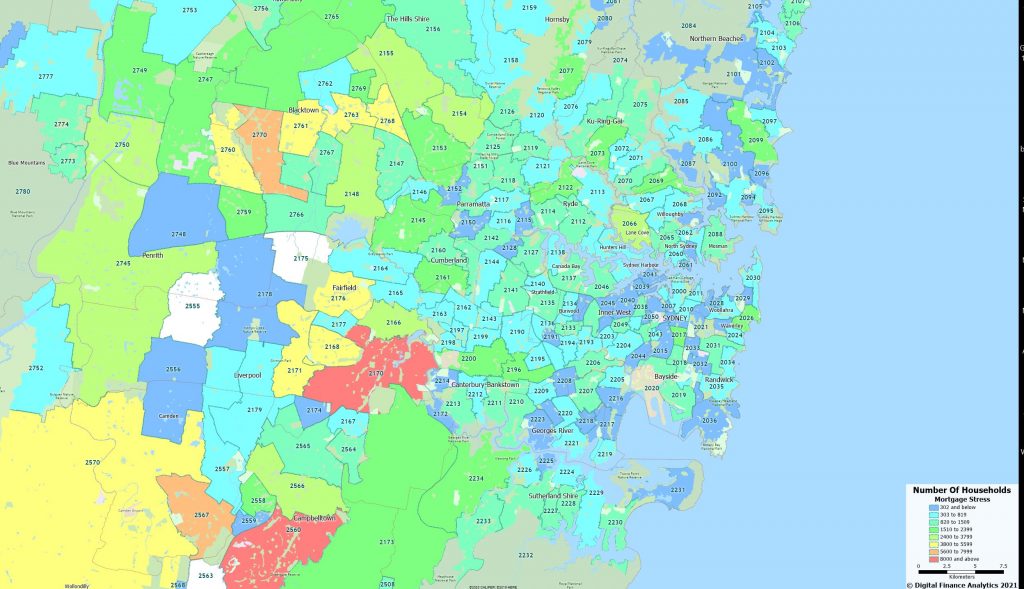

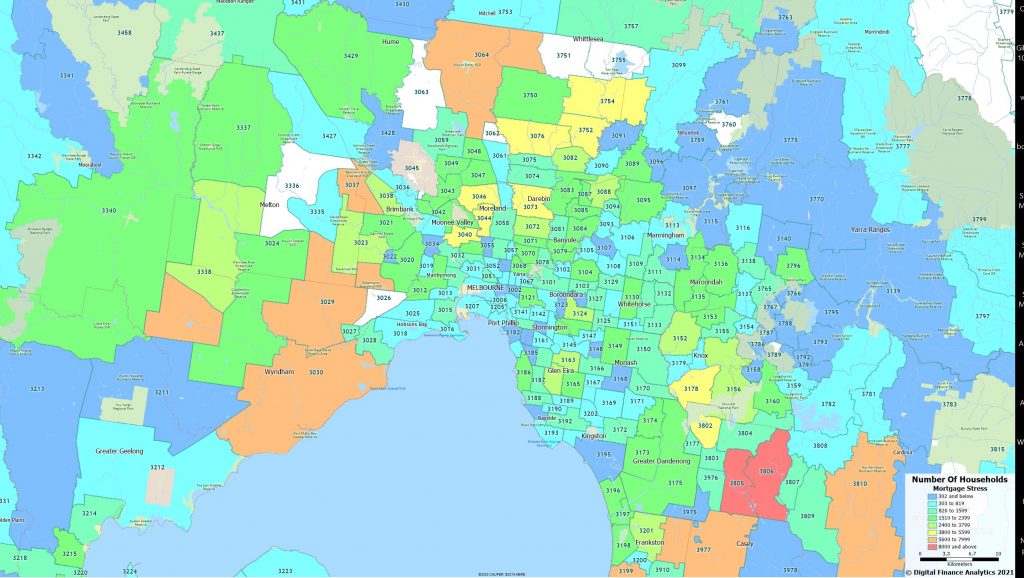

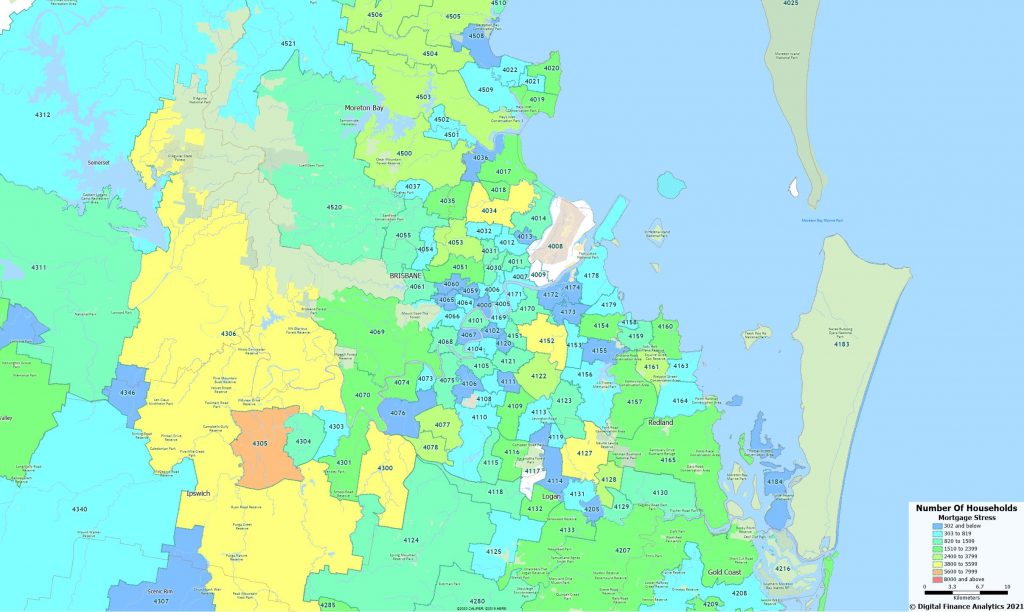

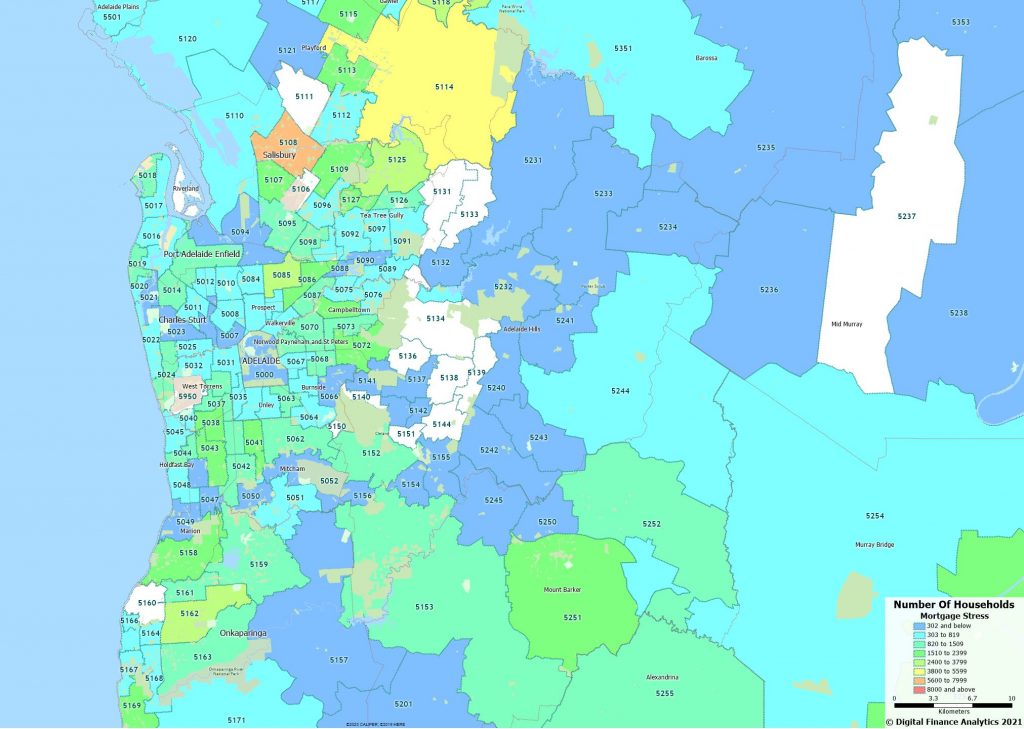

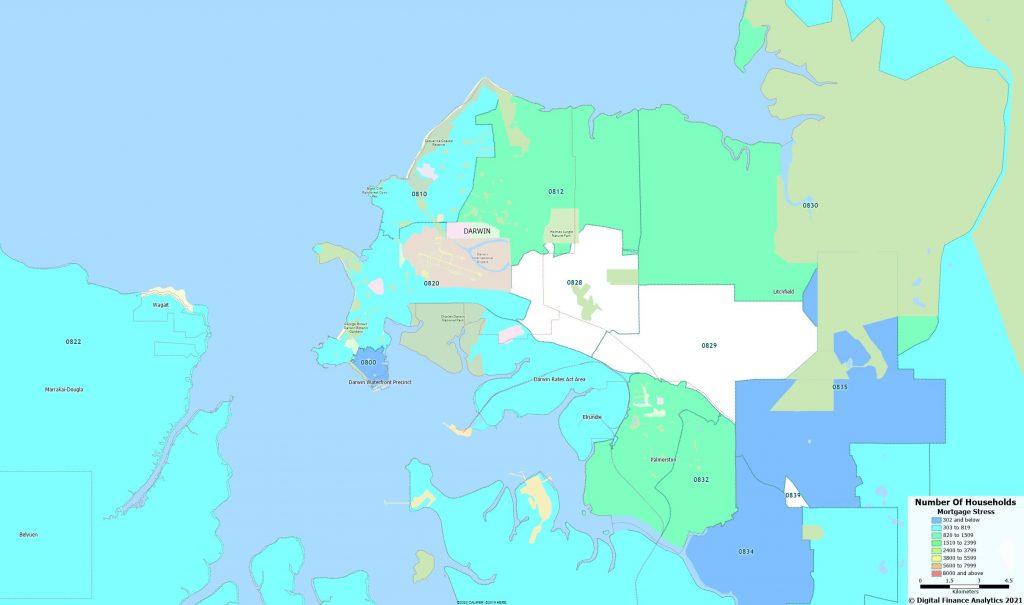

The mapping of mortgage stress to post codes reveals the potential hot spots, which include many of the high growth corridors, where vast estates continue to be built and sold to people who extend themselves to buy them. Many are first time buyers. Given flat wages, and higher unemployment post JobKeeper, this is one to watch.

Sydney

Melbourne

Brisbane

Adelaide

Perth

Hobart

ACT

Darwin

Whilst property prices are rising in many areas, the financial pressures on households are building, and we expect to see more casualties ahead. Financial stress can ultimately lead to significant social and behaviourial issues. Mortgage default rates (which are also rising) do not tell the full story.

Inequality Rules – Or How The Other Half Lives…

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/