We finish our household survey update by looking at holders, up-traders and down-traders. Importantly, there are more households seeking to trade down compared with those trading up. You can read the full analysis in the Property Imperative 7, released today.

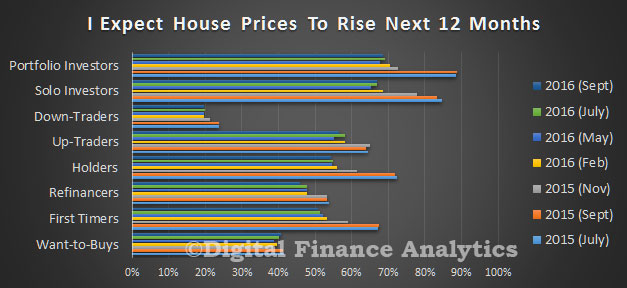

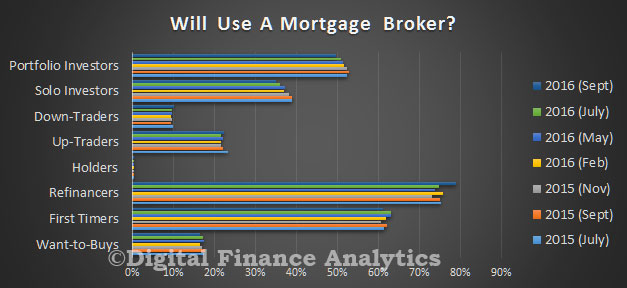

Holders – More than 780,000 households are holding property, with 81% owner occupied and 21% investment. 418,000 of these properties are owned outright and are mortgage free. Of these households 54% expect house prices to rise in the next year, but under 1% would consider using a mortgage broker because they are by definition not intending to transact in the next year (99%).

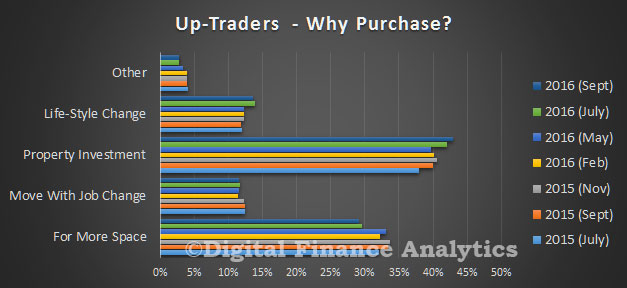

Up Traders – Our survey identified about 1,045,000 households who are considering buying a larger property. Most (92%) are owner occupied. Of these households 12% are expecting to transact within the next 12 months, whilst 56% of households expect house prices to rise in this period.

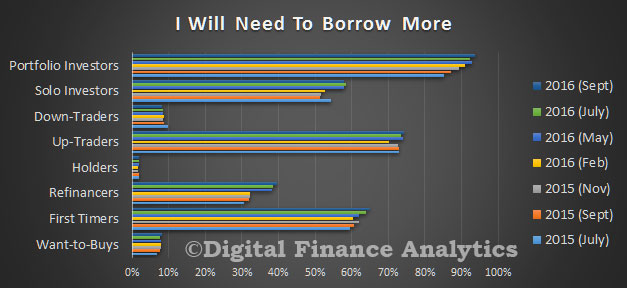

The main reasons for these households to transact are as a property investment (42% – up from 40% last year), to obtain more space (29% – down from 33% last year), because of a job move (12%) and for a life-style change (13%). Many of these households will require further finance (74% – up from 70% last year) and a quarter will consider using a mortgage broker (22%), whilst 35% of these households are actively saving to facilitate a transaction. We note that prospective future capital gains rated most strongly, the view of property as an investment continues to drive behaviour. The trend is getting stronger.

The main reasons for these households to transact are as a property investment (42% – up from 40% last year), to obtain more space (29% – down from 33% last year), because of a job move (12%) and for a life-style change (13%). Many of these households will require further finance (74% – up from 70% last year) and a quarter will consider using a mortgage broker (22%), whilst 35% of these households are actively saving to facilitate a transaction. We note that prospective future capital gains rated most strongly, the view of property as an investment continues to drive behaviour. The trend is getting stronger.

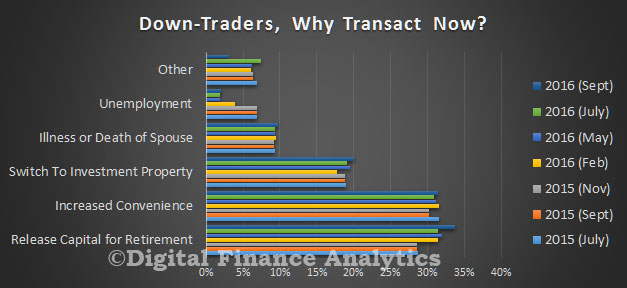

Down Traders – More than 1.2 million households are considering selling and buying a smaller property, up by 100,000 from last year. Of these 71% are considering an owner occupied property, and 29% an investment property. Of these 680,000 currently have no mortgage and own the property outright. Around 20% of these households expect house prices to rise over the next year, a consistently low figure compared with other segments, whilst 38% expect to transact within 12 months, 10% will consider using a mortgage broker and 8% will need to borrow more. Households will transact to facilitate increased convenience (31%), to release capital for retirement (33%), because of unemployment (2%) or because of illness or death of a spouse (10%).

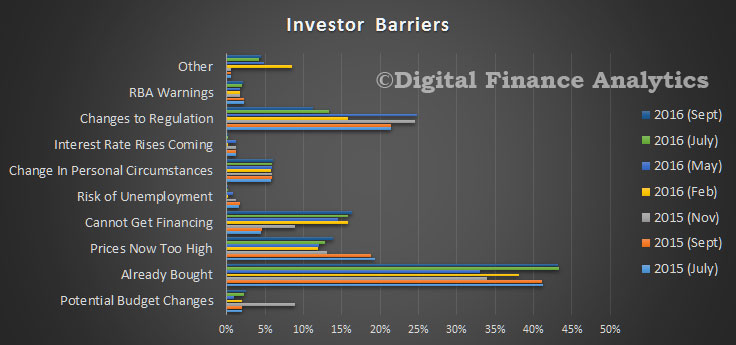

We see a continued sense among down traders that an investment property is likely to be a factor in their ongoing wealth management strategy, especially given the saving crunch underway at the moment, with deposit rates falling, and the inherent quest for yield.

We see a continued sense among down traders that an investment property is likely to be a factor in their ongoing wealth management strategy, especially given the saving crunch underway at the moment, with deposit rates falling, and the inherent quest for yield.