Prof. Joachim Wuermeling Member of the Executive Board of the Deutsche Bundesbank spoke about AI. Consumers may be rated by AI when applying for a mortgage. Pooling data points from internal transactions, social networks and other sources provides a more meaningful picture of banks’ borrowers. But if too much trust is put in “intelligent” systems, the stability of financial markets may be at stake.

1. Don’t miss out on the opportunities of AI in finance …

AI in finance could impact on the functioning of our financial system in a profound way. Some suggest that AI is enhancing the power of the human brain in the same way that electricity enhanced the power of the body 150 years ago. Hence, it could become a big thing in finance.

Artificial intelligence and big data are currently the strongest and most vivid innovation factors in the financial sector. Using AI in finance may trigger dramatic improvements in many businesses. AI elevates the role of data as a key commodity. Used wisely, big data make outcomes more reliable and may improve financial mediation. Process chains can be organised in new ways. “The scope and nature of banks’ risks and activities are rapidly changing,” as a recent Basel Committee analysis puts it.

This evolution towards increased use of non-human intelligence is not something that has just occurred in the last few years. The first invention of neural networks, a central pillar of most AI systems, dates back to the year 1943.

Until a few years ago, the main users of big data and AI in the area of finance were certain hedge funds and high-frequency trading firms. In recent times, the application of AI in finance has begun to spread widely, via “normal” banks, FinTechs and other financial service providers, to the general public.

Since 2011, HFT has accounted for about 45–50 % of all trading in US equities. The figures for the main European indices are in the same region (with about 40 % for German DAX futures). Taken together with all other “normal” algorithmic trading activities, we currently estimate the amount of algorithmic trading to be in the realm of 80–90 % of the entire trading volume for equities (and somewhat less but still very high in other market segments).

A single normal trading day generates about 3–6 million data points about prices, order deletions and modifications in DAX futures alone. No human can analyse these amounts of data simply by looking at them in an Excel spreadsheet. More sophisticated and sometimes also AI-driven techniques are necessary to do the job.

AI profoundly changes the functioning of our financial system in at least three areas: products, processes and analysis. This is true for both front office functions (eg customer business, trading) and back office functions (eg executing trades, risk management, market research). Special-purpose AI can solve specific problems, eg in customer engagement, financial management or cybersecurity.

Applications focused on market operations cover various core areas eg trading, portfolio composition, backtesting and validation of models, market impact analysis, modelling trading of large positions and stress testing. Dynamic portfolio adjustment, depending on the macro environment, may be strengthened by AI.

With the help of AI, various human shortcomings in dealing with finance can be mitigated. As behavioural finance has taught us, biases, inertia and ignorance lead to the malfunctioning of markets. AI allows humans to reach out beyond their intellectual limits or simply avoid mistakes.

2 … but beware of the risks

But opportunities are always accompanied by risks. As regards the financial system, if too much trust is put in “intelligent” systems, the stability of financial markets may be at stake. The workings of AI can be a mystery; it can trigger loss of control, make fatal errors, and have a procyclical effect due to its mechanistic functions. Pattern recognition has its limits. This can be dangerous particularly in crisis scenarios. An autopilot would never have been able to land a jet on the Hudson River. Nor can algorithms stabilise in periods of financial stress.

Looking at the recent turbulence in equities and the market for VIX-related financial products, it can be concluded that the events of 5 February share many similarities with a “flash crash”. Unfortunately, as with the original flash crash of May 2010, we have only limited knowledge about the direct drivers that triggered the event. It can be assumed that algorithmic market participants were quite active during the relevant period. But as to which strategies were applied and to what effect, we have no knowledge so far. The rise in volatility in the S&P 500 then nearly instantly affected the VIX industry, making it not the cause but more the first victim of this market event, with losses up to 95 % on assets. We do not expect this phenomenon to disappear in the future. On the contrary, more of these flash events are to come.

AI is still in its infancy. Continuous processes for the entire AI lifecycle still have to be defined and scaled for business needs. That means that AI must be embedded in the process of acquiring and organising data, modelling, analysis and delivering analytics. The skills gap, particularly with regard to data science and machine learning expertise, is the foremost challenge. At this stage, non-human intelligence is far from replacing the human brain in any respect. Computers are like school pupils dividing numbers mechanically without having understood what they were doing.

3. Consumers should take care: they remain the risk-takers

What makes this development so significant is the fact that it is not just occurring at the level of systemic institutions, markets and stock exchanges. With robo advisers, for example, AI can directly influence and control the daily financial decisions of customers and ultimately their personal wellbeing. Society has barely begun to understand the economic, ethical and social implications of AI.

While client interaction is made more convenient by mobile banking, chatbots or virtual customer assistants, banks can find out more about customer habits and provide them with tailor-made financing.

Consumers may be rated by AI when applying for a mortgage. Pooling data points from internal transactions, social networks and other sources provides a more meaningful picture of banks’ borrowers. But denials may be hard to understand. It may become even harder to challenge a decision made by algorithms.

The proper functioning of the applications is not a given. Simple flaws, cyberattacks and criminal behaviour render the systems extremely vulnerable. Consumers should be cautious. They need to be protected. Laws may have to be modified to cover new threats. Responsibility and liability in the case of malfunctioning machines have to be clarified.

4. FinTechs should not ignore the legitimate concerns of society and supervisors

Agile tech companies are driven by an admirable energy and inspiration. By nature, they take risks. They create an idea, build a prototype and try it out immediately in the real world. Regulation, supervision, obligations and requirements must make them extremely nervous.

But the wellbeing of society depends on rules. The public demands cybersecurity, data privacy, consumer protection and financial stability. FinTechs should not brush aside the concerns of their stakeholders. Business can only flourish if it is broadly accepted by citizens.

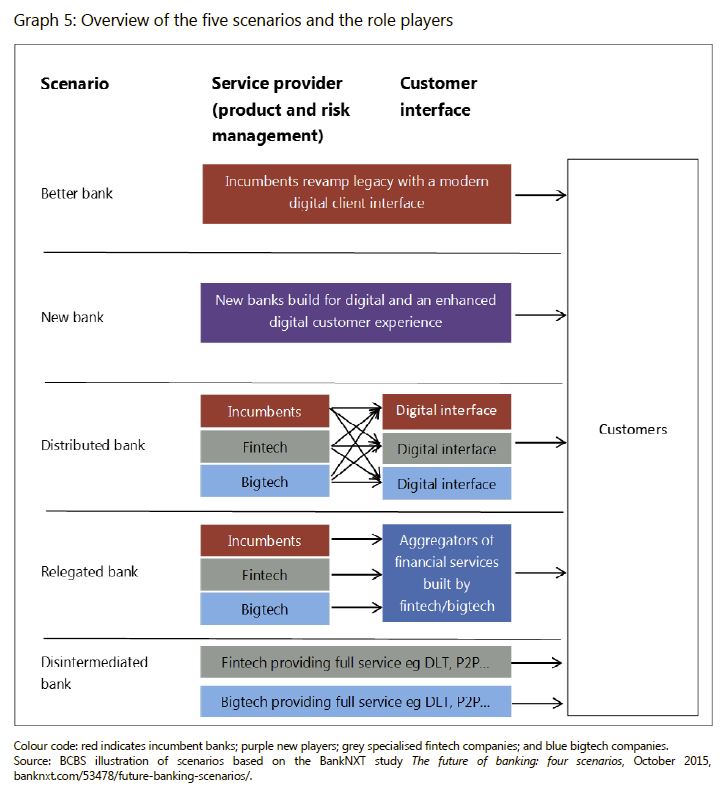

FinTechs usually pick up specific elements of the work chain of finance or create new features. Using technology, they modularise and customise products as a third party or standalone provider.

FinTechs are part of the finance sector but are not necessarily supervised. As long as they carry out tasks for supervised entities, these institutions are responsible for the behaviour of the FinTech.

5. AI needs new forms of supervision

“Artificial intelligence” may sound glamorous from a technological perspective, but in banking supervision, the well-established principle of “same business, same risk, same rules” has so far proved to be a sound standard for innovations. Whether they employ AI themselves or outsource it to FinTechs, from the supervisors’ point of view responsibility remains entirely with the bank.

For German supervisors, IT governance and information security nowadays are equally as important as capital and liquidity requirements.

All financial institutions should address the risks posed by new technologies. Banks have to implement effective control environments needed to properly support key innovations. This includes the requirement to have appropriate processes for due diligence, risk assessment and ongoing monitoring of any operations outsourced to a third party.

The European MiFID II includes the requirement that firms applying algorithmic models based on AI and machine learning should have a robust development process in place. Firms need to ensure that potential risks are considered at every stage of the process.

Regulators increasingly have to apply AI-supported analytical methods themselves to recognise vulnerability patterns, scan lengthy reports or analyse incoming data.

In any case, we must strike a balance between financial stability and avoiding barriers for potential new entrants, products and business models. Alongside technological progress, regulators have to constantly reassess the current legal framework, supervisory models and resources.

6. Central banks should embrace AI

Central banks have access to huge amounts of very valuable data stemming from market operations, supervision, payments and statistics. They are well positioned to tap the benefits of AI so they can enhance their ability to fulfil their mandate for price stability and the stability of the financial system.

Machine learning is already being used at the Bundesbank in different narrow segments. The experiences of all users have been good without exception. While monitoring the technical progress, we are currently discovering further use cases and defining our AI foundation, strategy, organisation and processes.

Here is a list of examples, which is by no means exhaustive:

In risk management, neural networks assess and evaluate the financial soundness of the markets. Market research is supported by adopting web mining techniques and machine learning in content analysis, topic modelling and clustering of relevant articles. In statistics, machine learning enables new methods for data quality management, eg in the context of securities holdings or the classification of company data. Furthermore, the informational content of seasonality tests is assessed by a random forest machine learning technique. For our IT user help desk, the handling of routine requests via automated chatbot responses could be a useful support measure. We use social media data to detect trends, turning points or sentiments. Machine learning methods can be applied for variable selection purposes in econometric models.

ANNEX: Use case – monitoring of real estate markets

An interesting data source is internet platforms. For example, some rental and housing platforms have the potential to improve the analysis and monitoring of real estate markets via the provision of information such as list prices and structural and locational characteristics of the property market at a disaggregated level.

This is mainly based on the assumption that these data contain information on the expectations and interests of economic agents with respect to future decisions. In such contexts, a wide range of topics or “search strings” are often potentially relevant. This can result in many different, highly correlated time series.

Furthermore, the “textual analysis” method is increasingly applied in research, as large amounts of “unstructured” information on businesses and the economy are available electronically on the internet. In order to operationalise textual data for econometric analysis, machine learning algorithms can be helpful. Learning methods can be applied to classify textual documents into different categories which can then be used to draw statistical inferences.