The Commonwealth narrowly pipped Westpac as Australia’s top bank due to the usability of its mobile and digital services, but Westpac was deemed to be the bank with the highest score in mobile banking functionality, according to a newly published study. However, apart from CommBank and Westpac, the other Australian banks still have a way to go when it comes to money movement, service features, cross-channel guidance, and marketing and sales.

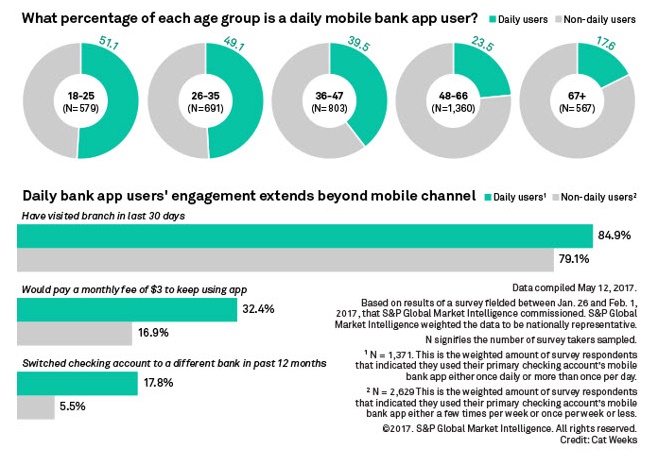

The study of Australia’s large retail banks by global research firm Forrester found that digital banking teams have improved transactional features like mobile bill payment and point-of-sale payments – but few banks help customers manage their money better, make relevant product offers, or provide much help through mobile banking.

Forrester surveyed five large retail banks in Australia. As well as the Commonwealth and Westpac, it surveyed ANZ Bank, Macquarie Bank and National Australia Bank (NAB).

But, in naming CommBank the best of the big banks, Forrester said it emerged on top with “impressive usability”.

“CommBank ranks as one of the top banks globally in usability in our benchmark. The bank stood out with impressive usability, specifically in making search and navigation clearly visible and easy to understand at all stages of the key tasks that the persona is looking to achieve,” said Forrester’s report author Zhi Ying Ng.

“The bank also offers strong mobile functionality, provides the widest range of touchpoints for customers, and makes login convenient.”

Forrester also found that CommBank earned the highest score in money movement.

“It not only lets customers make basic internal and external money transfers, but also supports more sophisticated features, such as letting customers use their phone’s camera to pay someone or pay bills,” Forrester notes.

Forrester says Westpac excels at functionality.

“Westpac received the highest overall functionality score and emerged second overall in our review, delivering services that are both useful and usable,” Ng said.

“The bank earned full marks for login, letting customers view balances conveniently and offering useful product research and financial tools prior to login. Westpac stood out in marketing and sales; the bank offers relevant products and services to customers based on their immediate needs and information that the bank knows about them.

“It’s also the only bank in Australia that gives customers product comparison tools within mobile banking.”

And, according to Forrester, many Australian banks provide strong login features, giving customers the ability to see the balances without logging in and to use fingerprint biometrics or a quick PIN to log in.

But on a negative note, Forrester also says many banks are weak on service and sales.

“Few banks help customers manage their money better, make relevant product offers, or provide much help through mobile banking,” Forrester says.

It says it also reviewed the mobile services of other leading retail banks worldwide and is publishing these results in separate reports.

Forrester conducted the 2017 Australian Mobile Banking Benchmark between 21 February and 13 March and says the Australian banks it reviewed achieved an average functionality score of 64 out of 100, an average usability score of +6 (on a scale from –30 to +30) – and the individual category scores reveal the differences between the banks’ mobile banking services.

Forrester says some banks are stronger in functionality or usability, while others excel in both areas.

“The other Australian banks have work to do to match the leaders,” Forrester says.

“Most large Australian banks offer a sturdy foundation for mobile banking that meets customers’ basic mobile needs and expectations.

“But apart from CommBank and Westpac, the other Australian banks still have a way to go when it comes to money movement, service features, cross-channel guidance, and marketing and sales.

“Australian banks should give customers the flexibility to schedule future-dated or recurring transfers and to view and search for transactions easily. They should also provide value-added contextualised products and services that help to improve customers’ financial well-being.”

And, according to Forrester, many banks can improve service features and money management.

“None of the Australian banks we reviewed let customers contact the bank via secure messaging or chat to request help. Few banks send customers mobile alerts to warn them of potential security issues.

“Some Australian banks offer basic digital money management, such as setting up a simple savings goal, but the majority does not offer personalised financial guidance or planning tools to help customers achieve their financial goals.”

Forrester says that the most successful banks share a common, iterative approach to mobile.

“Digital teams at leading banks have built strong relationships between their digital business strategy and technology management teams, which work together on a joint business technology agenda.

“They have adopted an iterative test-and-learn process. Cross-functional teams and an agile approach of experimentation, measurement, and quick adjustment have helped drive success at leading banks.

“Westpac uses an Agile framework where digital banking execs, CX pros, product managers, designers, and solution architects work in sprints to develop and test mobile banking products and services.

“Our research is intended to provide a benchmark for the current state of retail mobile banking in Australia and uncover good practices from the banks we assessed. We found best-in-class examples from many of the firms we reviewed. These range from relatively simple features like money transfer options to more advanced capabilities, such as personalised financial guidance and planning tools.”

Forrester says most banks let customers bank through a wide range of mobile touchpoints and, to serve customers in their “mobile moments”, banks have to develop services and design experiences for many different touchpoints, operating systems, and device types, “not to mention mobile browsers and third-party messaging apps”.

“This fractured landscape has driven many firms to adopt approaches like responsive design. CommBank and Westpac support customers on the widest range of devices,” Forrester concludes