Given the current market gyrations, we are going to examine the latest critical data each day, because a week is a long time in politics but a lifetime on the markets at the moment…

Category: Economic Data

US Cans European Flights

President Trump is suspending flights from Europe for the next 30 days because of the virus, a decision likely to ripple throughout the global economy. The president said such travel restrictions would apply to “trade and cargo,” but the White House later clarified that goods from Europe would still be able to enter the country. Via The Hill.

Trump said he will “soon be taking emergency action [to] provide financial relief … targeted for workers who are ill, quarantined, or caring for others due to coronavirus,” without specifying how he would do so.

The president also said he would instruct the Small Business Administration to extend low-interest loans to businesses in coronavirus hot spots to overcome steep declines in activity, and would ask Congress to approve a temporary payroll tax suspension that has fallen flat among lawmakers.

Trump also did not address a several issues that Democrats consider essential to any coronavirus aid plan, including provisions to expand unemployment insurance and ensure that low-income children don’t miss meals due to school closures. The House is set to vote on a bill with those measures and others, including federal paid sick leave, on Thursday in a bid to force the Senate to pass the legislation quickly.

More than 1,000 cases of coronavirus have now hit the U.S.

Earlier, President Trump insisted the U.S. is not suffering through a financial crisis in an Oval Office address to the country about the coronavirus outbreak on Wednesday.

“This is not a financial crisis. This is just a temporary moment of time that we will overcome together as a nation,” Trump said.

Dow Jones industrial average futures plunged after Trump’s address, projecting a loss of more than 800 points when markets open on Thursday.

UK Spends Big In Budget About Face

The budget released overnight reads more like a Labor than Conservative strategy, with big spending on infrastructure – including in the UK’s north, as well as a significant spend on combating the virus.

Rishi Sunak delivered his first budget with both the tactical and strategic in mind. He focused first on the public health challenges of coronavirus but went on to “levelling up” across the country.

His virus emergency package totaled £30bn, included welfare and business support, sick-pay changes and local assistance. This includes £7bn for businesses and families and £5bn for the NHS. Statutory sick pay will be available to individuals self-isolating and self-employed or gig workers will be able to access support from Government more easily. The requirement to physically attend a job centre will be removed – everything can be done on the phone and online.

The chancellor announced £1bn of lending via a government-backed loan scheme, with government backing 80% of losses on bank lending and £2bn of sick-pay rebates for up to 2m small businesses with fewer than 250 employees.

He will also abolish business rates altogether for this year for retailers, in a tax cut worth more than £1bn. Any company eligible for small business rates relief will be allowed a £3,000 cash grant – a £2bn injection for 700,000 small businesses.

Beyond the virus, Sunak said the government is tripling its investment in transport and infrastructure spending to the highest levels since 1955. The government will provide additional funding worth £640m for Scotland, £360m for Wales and £210m for Northern Ireland.

The government will spend £27bn on more than 4,000 miles of roads. £5bn of funding will be invested in gigabit-capable broadband. An additional £1.5bn will be made available for further education funding.

Sunak said almost £1.1bn of allocations from the housing infrastructure fund will be made to build almost 70,000 homes in high-demand areas.

The chancellor announced a Grenfell building safety fund worth £1bn. The funds will help to remove cladding from tall residential buildings.

He said almost £650m of funding will be made available to help rough sleepers into accommodation.

Sunak said the government will increase NHS funding by £6bn during this parliament. Reiterating campaign pledges, he said the package will help to hire 50,000 nurses and build 40 hospitals. The chancellor announced the NHS surcharge for people from overseas will increase to £624.

As a result, the chancellor forecasted growth before the coronavirus hit of 1.1% in 2020, then 1.8%, 1.5%, then 1.3% and 1.4% in the following years. Already lower than expected in earlier forecasts. So growth has been downgraded BEFORE the virus impact.

UK Government borrowing as a percentage of GDP will be 2.1% this year then will rise to 2.4% in 2020-2021, 2.8% in 2021-22, then falls to 2.5%, 2.4% and 2.2% in the following years. Debt as a share of GDP is forecast to fall from 79.5% this year to 75.2% in 2024-25. UK Austerity is over.

More Data Triangulation Points

We look at the latest economic data to test our view of the economy. What does it tell us about the market’s trajectory?

Coronavirus to slug APAC with $319bn loss: S&P

The coronavirus outbreak could result in a $319 billion loss for economies in the Asia Pacific, S&P Global Ratings has estimated, with Australia left vulnerable. Via InvestorDaily.

A report from S&P has forecast growth in the APAC will slow to 4 per cent in 2020, the lowest since the global financial crisis, as a result of the virus.

The multinational believes a U-shaped recovery will start later in the year, but by then, economic damage in the region will reach US$211 billion ($319 billion).

Shaun Roache, Asia-Pacific chief economist at S&P Global Ratings has said the loss will be distributed across the household, non-financial corporate, financial and sovereign sectors, with the burden to be on governments to soften the blow with public resources.

“Some economic activities will be lost forever, especially for the service sector,” Mr Roache said.

The hardest hit economies have been Hong Kong, Singapore and Thailand, where people flows and supply chain channels are large.

Australia is also exposed, with S&P forecasting its growth for the year to touch 1.2 per cent, more than half of what it was in 2019 at 2.7 per cent.

“Australia’s most disrupted sectors employ a large share of workers which will weaken both the labour market and consumer confidence,” Mr Roache said.

Services in Australia account for a large slice of employment, the reported noted, with accommodation and catering being sensitive to tourism and discretionary consumer spending.

Along with other economic experts, AMP Capital senior economist Diana Mousina signalled she expects Australian GPD growth to be negative in the March quarter, dragged by the bushfires and the virus.

Last week’s rate cut to 0.5 per cent will assist households with mortgages and businesses with debt, she wrote, but more stimulus is needed. AMP Capital, as well as UBS have called the RBA will enact another cut in April.

Ms Mousina anticipates fiscal stimulus from government, starting with support for businesses hit by COVID-19, followed by a broader boost to help investment and consumer spending.

“However if government stimulus does not prove to be enough (or come early enough) to support the economy then the RBA is expected to start an asset purchase program to further reduce the cost of borrowing,” she said.

As at Friday morning, there were 59 confirmed cases of COVID-19 in Australia, with two deaths.

APRA monitoring hits to financial system

The prudential regulator has indicated it is assessing how the coronavirus outbreak will affect the operation of financial institutions, with chairman Wayne Byres saying the system is positioned to handle volatility, but it will need considerable vigilance.

Speaking to the standing committee of economics last week, Mr Byres said the regulator has also been examining broader economic impacts from the virus.

The financial system has already copped hits from the extreme weather events over the summer. Current estimates for total insured losses as a result of the bushfires, storms, hail and floods across Australia are projected to be in the order of $5 billion. The Australian cyclone system is still yet to end.

APRA has reported the financial position of the insurance sector means it is well placed to cover the claims, however, Mr Byres stated: “The summer’s events will undoubtedly have an impact on the price and in some cases, availability of insurance in the future.”

Negative Interest Rates Are Coming – Watch Your Cash!

We look at the latest trends on Australian Bonds, Credit Markets and the recent IMF paper on negative interest rates – which they link to the need to restrict cash. This will not end well.

https://www.imf.org/external/pubs/ft/fandd/2020/03/what-are-negative-interest-rates-basics.htm

Australia May Spend Up to $10 Billion to Offset Virus Impact

Australia’s fiscal stimulus package to protect the economy against the impact of the coronavirus may run as high A$10 billion. Via Bloomberg.

The Sunday Telegraph newspaper reported that the package was likely to be $5 billion while broadcaster Sky News said the stimulus could be up to twice this amount. Australia is expected to reveal details of its plans on Tuesday, when Prime Minister Scott Morrison and his Cabinet meet.

Governments around the world have already pledged more than US$54 billion in budget support to counter the virus’s impact. Morrison has yet to put a figure on his plan, which he has said will be “targeted, measured and scalable,” with an emphasis on protecting business cash flow and jobs.

Initial estimates of the coronavirus’s impact from the nation’s Treasury and central bank suggest the economy is likely to suffer a quarterly contraction for the first time in nine years. For Australia, the blow is coming hot on the heels of a summer of devastating wildfires that were already expected to crimp growth.

While the country had only reported 74 confirmed cases of the virus as of Sunday, including three deaths, its economy is particularly exposed to China, the center of the outbreak. China is Australia’s key market for commodity exports and a vital source of tourists and students for the services sector.

The Australian Financial Review reported the package may feature tax breaks to spur emergency investment by big businesses while the Australian newspaper said stimulus could include cash payments to households.

The Sunday Telegraph report said the government was looking at wage subsidies and payments for small businesses. It also said the government may encourage pensioners to spend more by lowering the amount they are allowed to earn from financial assets before receiving government assistance

IMF Bells The Cat On Negative Interest Rates And A Need To Ban Cash

Hot off the press – How Can Interest Rates Be Negative? – we get the latest missive from the IMF which confirms precisely what we have been saying.

But the concern remains about the limits to negative interest rate policies so long as cash exists as an alternative.

Here is the article. Read, and weep….

Money has been around for a long time. And we have always paid for using someone else’s money or savings. The charge for doing this is known by many different words, from prayog in ancient Sanskrit to interest in modern English. The oldest known example of an institutionalized, legal interest rate is found in the Laws of Eshnunna, an ancient Babylonian text dating back to about 2000 BC.

For most of history, nominal interest rates—stated rates that borrowers pay on a loan—have been positive, that is, greater than zero. However, consider what happens when the rate of inflation exceeds the return on savings or loans. When inflation is 3 percent, and the interest rate on a loan is 2 percent, the lender’s return after inflation is less than zero. In such a situation, we say the real interest rate—the nominal rate minus the rate of inflation—is negative.

In modern times, central banks have charged a positive nominal interest rate when lending out short-term funds to regulate the business cycle. However, in recent years, an increasing number of central banks have resorted to low-rate policies. Several, including the European Central Bank and the central banks of Denmark, Japan, Sweden, and Switzerland, have started experimenting with negative interest rates —essentially making banks pay to park their excess cash at the central bank. The aim is to encourage banks to lend out those funds instead, thereby countering the weak growth that persisted after the 2008 global financial crisis. For many, the world was turned upside down: Savers would now earn a negative return, while borrowers get paid to borrow money? It is not that simple.

Simply put, interest is the cost of credit or the cost of money. It is the amount a borrower agrees to pay to compensate a lender for using her money and to account for the associated risks. Economic theories underpinning interest rates vary, some pointing to interactions between the supply of savings and the demand for investment and others to the balance between money supply and demand. According to these theories, interest rates must be positive to motivate saving, and investors demand progressively higher interest rates the longer money is borrowed to compensate for the heightened risk involved in tying up their money longer. Hence, under normal circumstances, interest rates would be positive, and the longer the term, the higher the interest rate would have to be. Moreover, to know what an investment effectively yields or what a loan costs, it important to account for inflation, the rate at which money loses value. Expectations of inflation are therefore a key driver of longer-term interest rates.

While there are many different interest rates in financial markets, the policy interest rate set by a country’s central bank provides the key benchmark for borrowing costs in the country’s economy. Central banks vary the policy rate in response to changes in the economic cycle and to steer the country’s economy by influencing many different (mainly short-term) interest rates. Higher policy rates provide incentives for saving, while lower rates motivate consumption and reduce the cost of business investment. A guidepost for central bankers in setting the policy rate is the concept of the neutral rate of interest : the long-term interest rate that is consistent with stable inflation. The neutral interest rate neither stimulates nor restrains economic growth. When interest rates are lower than the neutral rate, monetary policy is expansionary, and when they are higher, it is contractionary.

Today, there is broad agreement that, in many countries, this neutral interest rate has been on a clear downward trend for decades and is probably lower than previously assumed. But the drivers of this decline are not well understood. Some have emphasized the role of factors like long-term demographic trends (especially the aging societies in advanced economies), weak productivity growth, and the shortage of safe assets. Separately, persistently low inflation in advanced economies, often significantly below their targets or long-term averages, appears to have lowered markets’ long-term inflation expectations. The combination of these factors likely explains the striking situation in today’s bond markets: not only have long-term interest rates fallen, but in many countries, they are now negative.

Returning to monetary policy, following the global financial crisis, central banks cut nominal interest rates aggressively, in many cases to zero or close to zero. We call this the zero lower bound, a point below which some believed that interest rates could not go. But monetary policy affects an economy through similar mechanics both above and below zero. Indeed, negative interest rates also give consumers and businesses an incentive to spend or invest money rather than leave it in their bank accounts, where the value would be eroded by inflation. Overall, these aggressively low interest rates have probably helped somewhat, where implemented, in stimulating economic activity, though there remain uncertainties about side effects and risks.

A first concern with negative rates is their potential impact on bank profitability. Banks perform a key function by matching savings to useful projects that generate a high rate of return. In turn, they earn a spread, the difference between what they pay savers (depositors) and what they charge on the loans they make. When central banks lower their policy rates, the general tendency is for this spread to be reduced, as overall lending and longer-term interest rates tend to fall. When rates go below zero, banks may be reluctant to pass on the negative interest rates to their depositors by charging fees on their savings for fear that they will withdraw their deposits. If banks refrain from negative rates on deposits, this could in principle turn the lending spread negative, because the return on a loan would not cover the cost of holding deposits. This could in turn lower bank profitability and undermine financial system stability.

A second concern with negative interest rates on bank deposits is that they would give savers an incentive to switch out of deposits into holding cash. After all, it is not possible to reduce cash’s face value (though some have proposed getting rid of cash altogether to make deeply negative rates feasible when needed). Hence there has been a concern that negative rates could reach a tipping point beyond which savers would flood out of banks and park their money in cash outside the banking system. We don’t know for sure where such an effective lower bound on interest rates is. In some scenarios, going below this lower bound could undermine financial system liquidity and stability.

In practice, banks can charge other fees to recoup costs, and rates have not gotten negative enough for banks to try to pass on negative rates to small depositors (larger depositors have accepted some negative rates for the convenience of holding money in banks). But the concern remains about the limits to negative interest rate policies so long as cash exists as an alternative.

Overall, a low neutral rate implies that short-term interest rates could more frequently hit the zero lower bound and remain there for extended periods of time. As this occurs, central banks may increasingly need to resort to what were previously thought of as unconventional policies, including negative policy interest rates.

No, central banks are taking us down a blind alley!

The State Of The Economy In ~ 10 Slides…

This is an edited and updated version of my conversation with Nuggets News today.

I look at the latest economic data and try to figure what is going on

Retail turnover falls 0.3 per cent in January

Australian retail turnover fell 0.3 per cent in January 2020, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a fall of 0.7 per cent in December 2019.

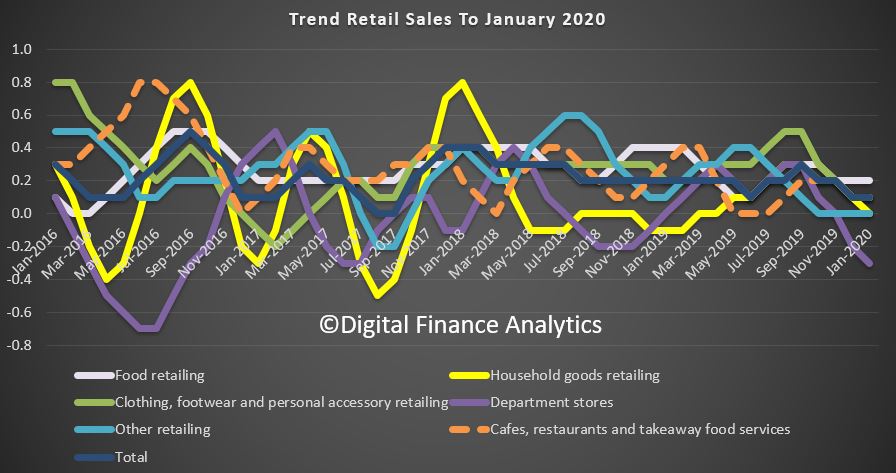

The trend estimate rose 0.1% in January 2020. This follows a rise of 0.1% in December 2019, and a rise of 0.2% in November 2019.

The seasonally adjusted estimate fell 0.3% in January 2020. This follows a fall of 0.7% in December 2019, and a rise of 1.0% in November 2019.

In trend terms, Australian turnover rose 2.3% in January 2020 compared with January 2019.

Compared to January 2019, the trend estimate rose 2.3 per cent.

The following industries rose in trend terms in January 2020: Food retailing (0.2%), Cafes, restaurants and takeaway food services (0.1%), and Clothing, footwear and personal accessory retailing (0.1%). Household goods retailing (0.0%), and Other retailing (0.0%) were relatively unchanged. Department stores (-0.3%) fell in trend terms in January 2020.

The following states and territories rose in trend terms in January 2020: Queensland (0.3%), Victoria (0.2%), Tasmania (0.7%), and the Northern Territory (0.1%). South Australia (0.0%), and Western Australia (0.0%) were relatively unchanged. New South Wales (-0.1%), and the Australian Capital Territory (-0.2%) fell in trend terms in January 2020.

“Bushfires in January negatively impacted a range of retail businesses across a variety of industries” said Ben James, Director of Quarterly Economy Wide Surveys. “Retailers reported a range of impacts that reduced customer numbers, including interruptions to trading hours and tourism.”

There were falls for household goods retailing (-1.1 per cent), department stores (-2.2 per cent), clothing, footwear and personal accessory retailing (-1.1 per cent), cafes, restaurants and takeaway food services (-0.3 per cent), and other retailing (-0.1 per cent). These falls were partially offset by a rise in food retailing (0.4 per cent).

In seasonally adjusted terms, there were falls in Western Australia (-1.1 per cent), Victoria (-0.2 per cent), the Australian Capital Territory (-2.3 per cent), New South Wales (-0.1 per cent), Queensland (-0.1 per cent), Tasmania (-0.5 per cent), and the Northern Territory (-0.5 per cent). South Australia (0.1 per cent) rose in seasonally adjusted terms in January 2020.

Online retail turnover contributed 6.3 per cent to total retail turnover in original terms in January 2020. In January 2019, online retail turnover contributed 5.6 per cent to total retail.