We had the latest national accounts to end of December 2019 this week. The ABS advised that:

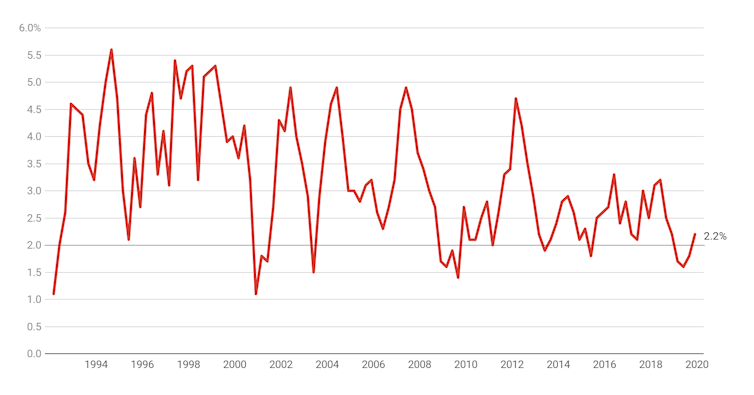

The Australian economy grew 0.5 per cent in seasonally adjusted chain volume terms in the December quarter 2019 and 2.2 per cent through the year, according to figures released by the Australian Bureau of Statistics (ABS).

Chief Economist for the ABS, Bruce Hockman, said: “The economy has continued to grow and picked up through the year, however the rate of growth remains below the long run average.”

Domestic demand remained subdued with 0.1 per cent growth in the December quarter. A pick up in household discretionary spending and continued increases in the provision of government services was dampened by falls in dwelling and private business investment.

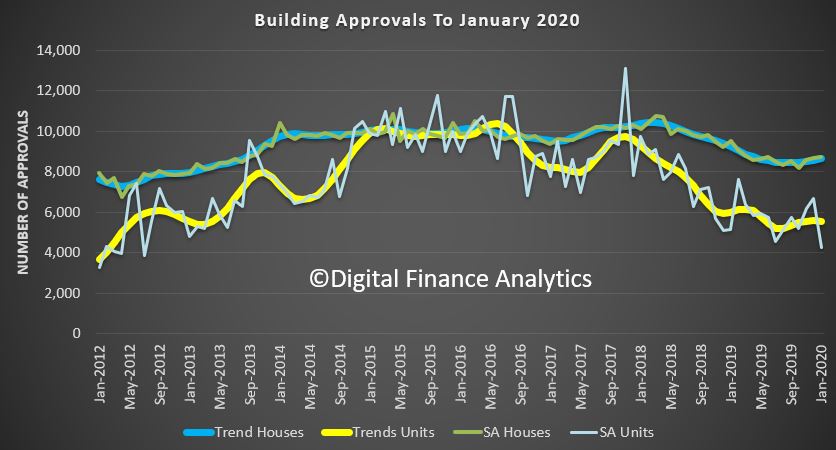

Falls in dwelling investment continued, declining 3.4 per cent during the quarter, the sixth consecutive fall. This fall was consistent with the decline in construction industry value added, falling 2.3 per cent. The housing market recovery is evident in the increase in ownership transfer costs, rising 12.3 per cent during the quarter to be up 6.5 per cent through the year.

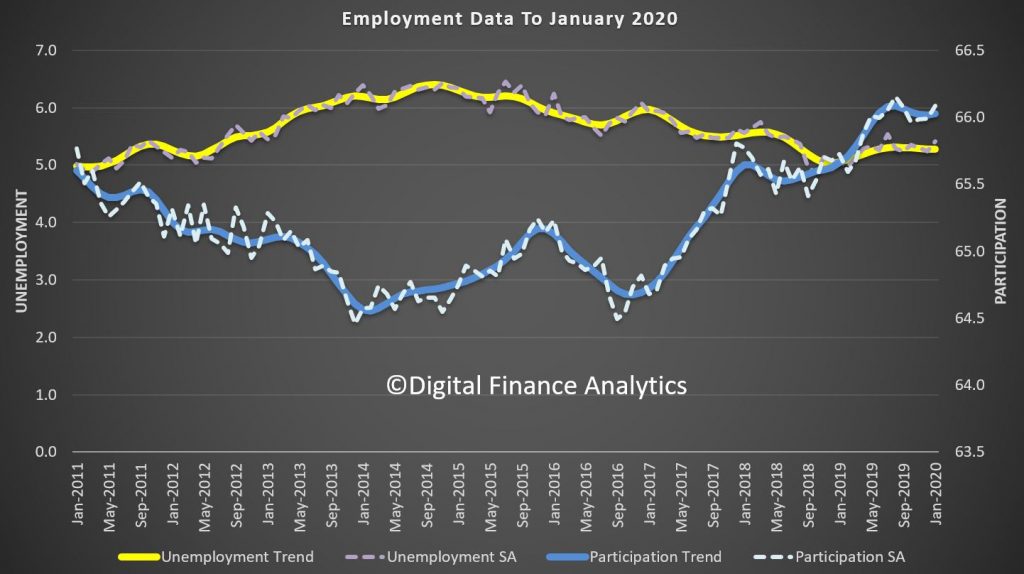

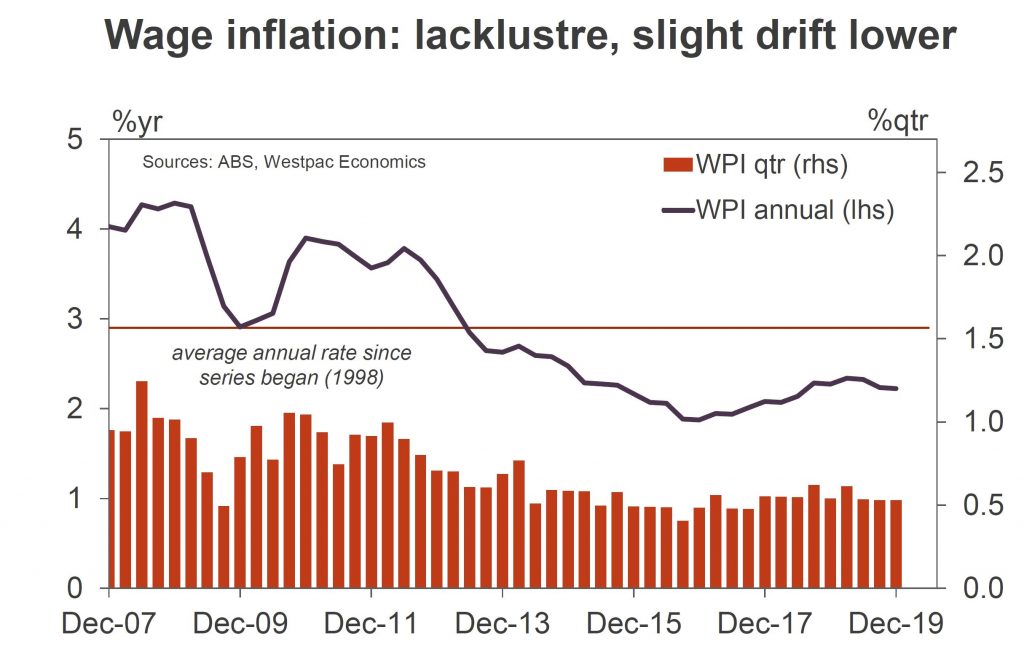

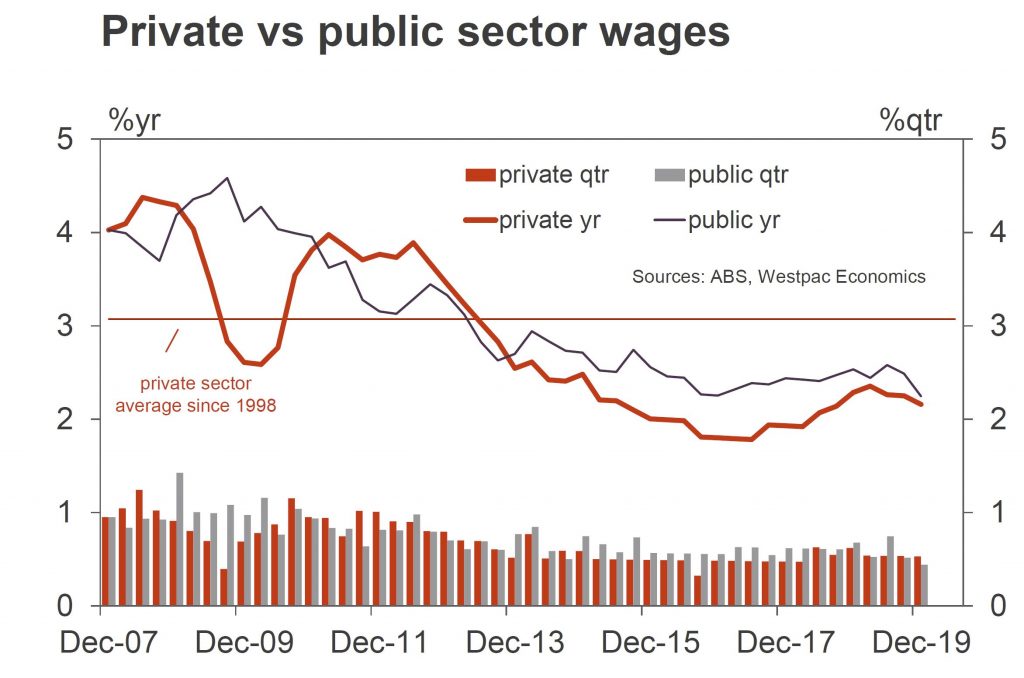

Household income remained steady with compensation of employees recording its twelfth consecutive rise, increasing 1.0 per cent during the quarter. This reflects a rise in the number of wage and salary earners as well as a steady increase in the wage rate. Non-life insurance claims contributed to household income reflecting increased claims attributed to natural disaster occurrences in the quarter. The household saving to income ratio was 3.6 per cent, driven by the subdued consumption coupled with steady increases in wages and a boost in insurance claims.

The Mining industry provided additional strength to the economy, with growth in production volumes of 1.6 per cent, strengthening through the year to 7.3 per cent. This was reflected in the growth in mining exports and inventories.

Falling prices for key export commodities impacted the terms of trade in the December quarter, which fell 5.3 per cent. This reduced nominal GDP, which fell 0.3 per cent, as lower coal, iron ore and gas prices contributed to more subdued company profits. Mining profits declined 2.6 per cent for the quarter.

Real net national disposable income declined 0.9 per cent. “Fluctuations in commodity prices have significant effects on the Australian economy in terms of export revenues and real income,” added Mr Hockman.

But the real question is, does the GDP really tell us anything useful? I discuss the GDP question with American in OZ Salvatore Babones, Associate Professor, University of Sydney.