We look at what the economists are saying about the potential impact. Tourism and exports are likely to be hit – and these are significant to the Australian economy. More broadly, will global growth be hit?

Category: Economic Data

Coronavirus will hurt spending in China, with spillover to global companies

On 29 January, the World Health Organization said that China’s coronavirus has infected nearly 6,000 people domestically so far, with an additional 68 confirmed cases in 15 other countries. The primary impact is on human health. However, the risk of contagion is affecting economic activity and financial markets. The immediate and most significant economic impact is in China but will reverberate globally, given the importance of China in global growth as well as in global company revenue. By sector, the coronavirus will likely have the largest negative impact on goods and services sectors within and outside of China that rely on Chinese consumers

and intermediary products. Via Moody’s.

China’s annual GDP growth forecast unchanged so far, but composition could shift

In our baseline, we expect the outbreak to have a temporary impact on China’s economy and for annual GDP growth in China to remain in line with our forecast of 5.8% in 2020. However, the composition of growth will likely shift because of a dampening of consumption in the first quarter, potentially offset by stimulus measures. Nonetheless, there is still a high level of uncertainty around the length and intensity of the outbreak, and we will review our forecasts as conditions evolve.

Following the outbreak of Severe Acute Respiratory Syndrome (SARS) in 2003, growth and financial markets in China weakened significantly, but for only a short period. An offsetting rebound limited the overall negative effects on annual growth. But the SARS episode is not a perfect comparison, since the composition of the Chinese economy has changed appreciably since 2003.

Over the past 16 years, the contribution of consumption to China’s economic growth has risen significantly. Therefore, the impact of the coronavirus through the consumption channel may well be higher now. If there is indeed a sharp slowdown in consumption, we would expect macroeconomic policy to be eased in response. This could lead to a shift in the drivers of growth in 2020.

The virus will likely have an effect on the revenue of China’s discretionary travel, transportation, lodging, restaurants, retail and services sectors. However, the impact on offline retail sales could be smaller compared with the weakness following the SARS outbreak because of the rapid shift to online sales in China over the past decade. Non-discretionary consumer demand related to the healthcare sector and medical equipment will likely surge.

Chinese authorities have been proactive in taking quarantine measures to contain the infection, including closing public transportation in some cities and conducting screening in major transportation centers. These measures help contain the spread of infection and promote early treatment, although they add costs and constrain economic activity.

Among the challenges of containing the coronavirus include that it can be contagious during the incubation period, and many of those infected or potentially infected traveled ahead of the Lunar New Year. The next few weeks will be vital for determining the extent of infection and the effectiveness of the quarantine measures.

Loss of productivity will likely weigh on domestic supply as a result of sickness, furloughs, and potential delays in manufacturing production given the government’s decision to extend the Lunar New Year holiday. This situation will likely also reduce private investment, but this effect will be secondary to the effect on consumer spending, and will also depend on the macroeconomic policy response.

Hubei province will bear the brunt of economic impact

The outbreak began in Wuhan, the capital of Hubei province and the key transportation and industrial hub in central China. The economic effects on the local area will be significant. Hubei province had expected to record a regional economic growth rate of up to 7.8% in 2020 according to the local authorities, 200 basis points higher than our forecast for China’s total economy. As China’s ninth-most populous and seventh-highest province by GDP, a slowdown in economic activity will pose significant repercussions for the country as a whole.

Hubei’s role in linking China’s eastern coastal area with the central and western regions will extend the ripple effect on neighboring cities and provinces with a higher reliance on service sectors and with higher population densities.

China’s size and interconnectedness amplifies global impact

The fear of contagion risk is already evident in global financial markets. In addition, the negative spillover will also affect countries, sectors and companies that either derive revenue from or produce in China. China has an even higher share in world growth and is even more closely connected with the rest of the world than during the SARS episode. If the outbreak spreads significantly outside China, the burden on healthcare sectors in other affected countries will potentially increase. The revenue of companies and sectors that rely on Chinese demand will be affected as that demand dampens.

The outbreak will also potentially have a disruptive effect on global supply chains. Global companies operating in the affected area may face output losses as a result of the evacuation of workers. Companies operating outside China that have a strong dependence on the upstream output produced from the affected area will also be under pressure because of possible supply chain disruptions resulting from temporary production delays.

Other Asian-Pacific economies are vulnerable to a decline in tourism from China

The outbreak will take a toll on tourism sectors elsewhere in the region, and places outside the region that receive tourists from China. The initial outbreak occurred a few weeks before the Lunar New Year, which has increasingly become a popular time to travel. China has imposed travel bans on outbound group tours to contain the spread of the virus. The fear of contagion could dampen consumer demand and affect tourism, travel, trade, and services in Hong Kong, Macao, Thailand, Japan, Vietnam and Singapore, which have been the top destinations of Chinese tourists in recent years.

China’s National Immigration Administration recorded outbound travel grew about 12% year-on-year to 6.3 million trips during the 2019 Lunar New Year. Following the SARS outbreak, tourism fell sharply in most of these economies, particularly in Singapore and Hong Kong, which were also subject to a relatively high number of infections. We expect the risk of potential negative spillovers to domestic tourism in neighboring countries to be higher than during SARS because Chinese nationals now make up the largest share of visitors to other Asia-Pacific economies. The timing is particularly bad for Japan as it seeks to rebound from the dip in consumption, and presumably real GDP growth, in the last quarter of 2019 following a sales tax hike.

John Adams Hits A Home Run In The Senate Cash Inquiry

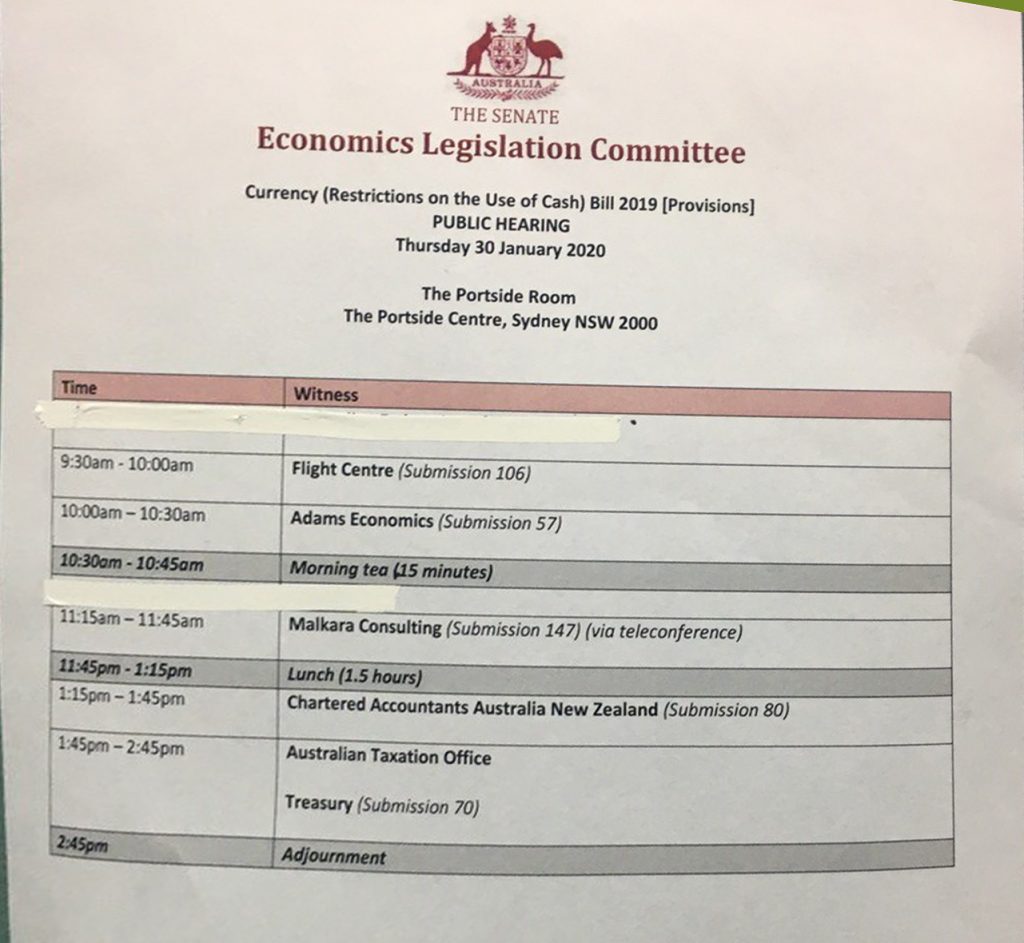

The Senate held a hearing in Sydney today relating to the Cash Restrictions Bill.

There were a good number of Australians in the audience.

Economist John Adams made a powerful presentation, linking the proposed cash ban with civil liberties, monetary policy and negative interest rates.

CPI Is Still In The Gutter!

We look at the latest from the ABS. The drought and lower dollar is not helping.

What will the RBA do?

Will Coronavirus create a Market Hangover? | Nucleus Investment Insights

Nucleus Wealth’s Head of Investment Damien Klassen, Chief Strategist David Llewellyn Smith and Tim Fuller, discuss “Will Coronavirus create a Market Hangover?”

Topics include the pandemic spreading as the Chinese new year fast approaches, if the data can be trusted, Australian and macro implications if Chinese growth slows, how similar this is to the Chinese SARS outbreak in 2003, and as always we wrap up with our investment outlook

To listen as a podcast click here http://bit.ly/NucleusPod

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.

Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

The Ultimate Fight For Freedom Will Occur In 6 Days

The Senate will hold a hearing in Sydney on 30th January 2020.

John Adams will be appearing to give evidence.

The hearing will be in public at the Portside Centre which is located at 207 Kent Street, Sydney NSW 2000.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

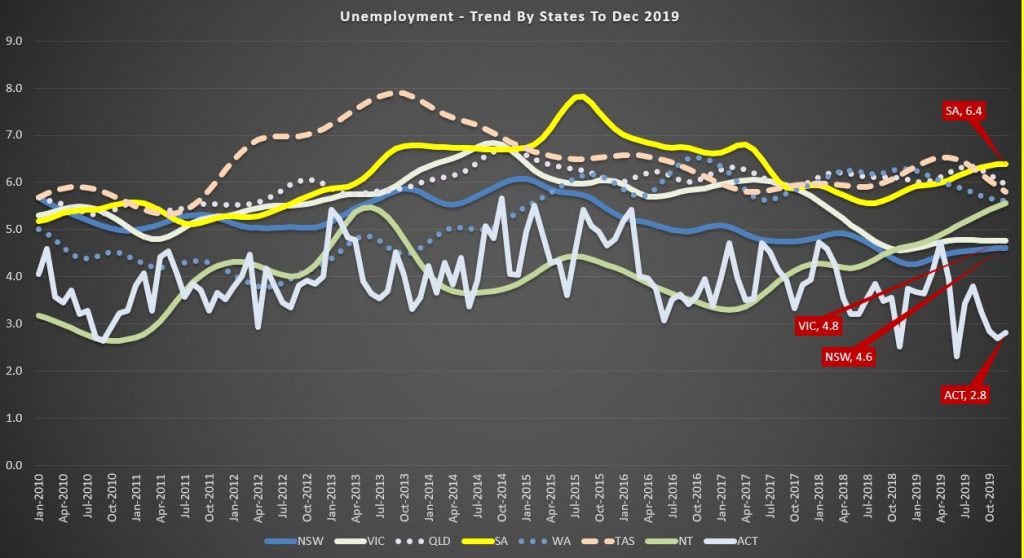

Trend Unemployment Rate Ends 2019 At 5.1%

Australia’s trend unemployment rate decreased to 5.1 per cent in December 2019, according to the latest information released by the Australian Bureau of Statistics (ABS) today.

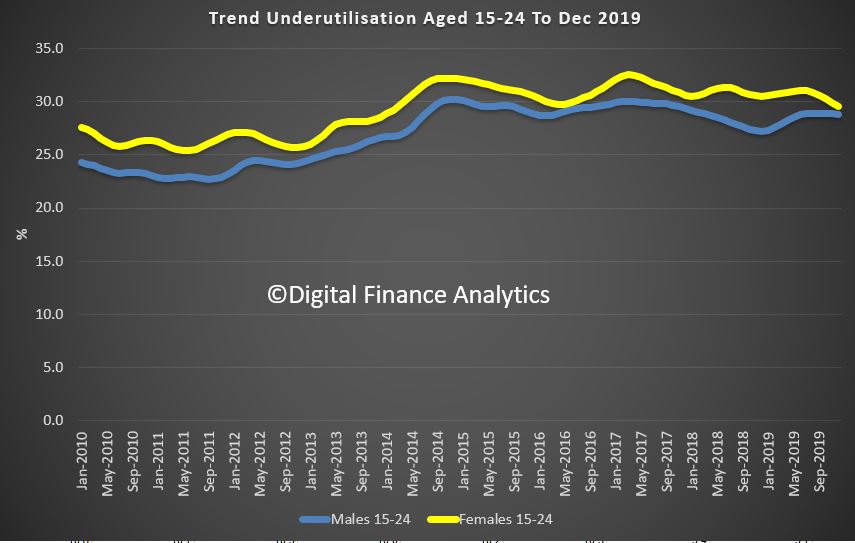

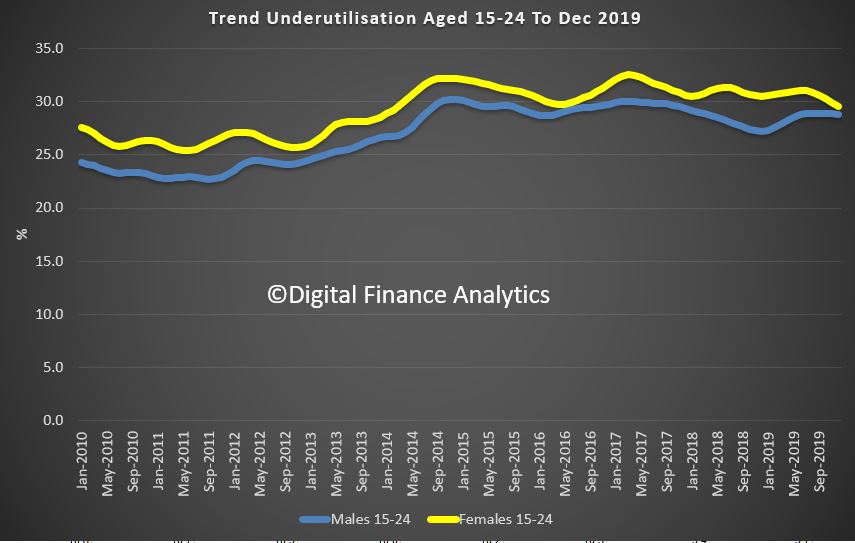

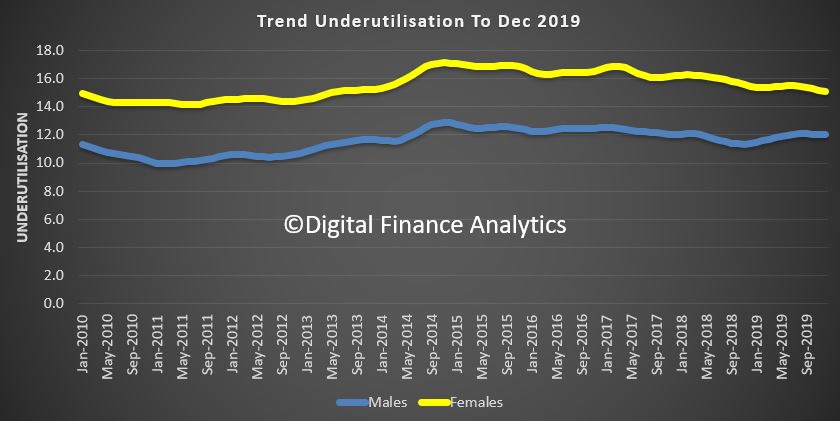

This may be enough to stay the RBA’s hand in February, as the headline rate fell, and the jobs hours worked rose, though there was a disproportionate shift towards part-time work, and the underutilisation rate is also higher. In fact, the fall can be best linked to a falling participation rate as more chose not to work over the summer. So nothing here to really support signs of a stronger economy. Underutilisation among the 15-25’s is above 25%.

Employment and hours

In December 2019, trend monthly employment increased by around 18,000 people. Both full-time and part-time employment increased by around 9,000 people.

Over the past year, trend employment increased by around 261,000 people (2.1 per cent), which continued to be above the average annual growth over the past 20 years (2.0 per cent).

Full-time employment growth (1.5 per cent) was below the average annual growth over the past 20 years (1.6 per cent) and part-time employment growth (3.2 per cent) was above the average annual growth over the past 20 years (3.0 per cent).

“While there has been stronger growth in part-time employment over the past year, the underemployment rate is still where it was last December, at 8.3 per cent,” said Mr Hockman.

The trend monthly hours worked increased by 0.2 per cent in December 2019 and by 1.7 per cent over the past year. This was in line with the 20 year average annual growth of 1.7 per cent.

Underemployment and underutilisation

The trend monthly underemployment rate remained steady at 8.3 per cent in December 2019, unchanged over the past year. The trend monthly underutilisation rate also remained steady at 13.5 per cent in December 2019, an increase of 0.2 percentage points over the past year.

States and territories trend unemployment rate

The monthly trend unemployment rate increased in the Northern Territory, and decreased in Queensland and Tasmania in December 2019. The unemployment rate remained steady in all other states and the Australian Capital Territory.

Over the year, unemployment rates fell in Queensland, Western Australia, Tasmania and the Australian Capital Territory. Unemployment rates increased in all other states and the Northern Territory.

Seasonally adjusted data

The seasonally adjusted unemployment rate decreased by 0.1 percentage points to 5.1 per cent in December 2019, while the underemployment rate remained steady at 8.3 per cent. The seasonally adjusted participation rate remained steady at 66.0 per cent, and the number of people employed increased by around 29,000.

The net movement of employed in both trend and seasonally adjusted terms is underpinned by around 300,000 people entering and leaving employment in the month.

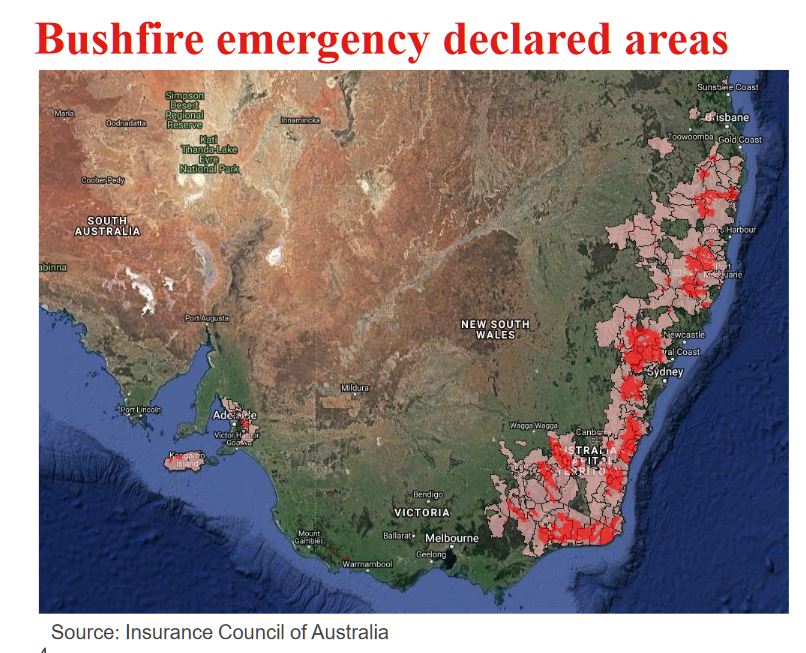

How Bushfires May Impact Tourism

We look at the tourism data to assess the impact on GDP, regional visits and the education sector. How much of the $60 billion contribution to GDP (fourth largest) could be impacted, and will a marketing campaign make any difference?

This week, the Australian Tourism Export Council told the Australian Financial Review that cancellations by tourists from large markets such as the US, UK and China was hurting the industry and could cost the country at least $4.5 billion by the end of the year. There have been mass cancellations, and bookings in some areas are down by half. And this may not be just a short-term blip, with pictures of the smoke last week in Melbourne, Canberra and Sydney all adding to the concerns potential tourists may have.

The hazardous ratings were worse than in many industrial cities around the world. And whilst Australia is a large country (it takes 5 hours or so to fly from Sydney to Perth) the bushfire impact is bigger than just the areas where bushfires are still burning. And the lasting damage to Australia as an environmentally sensitive country and worth a visit might be shot. In addition, it is estimated more than 1 million wild animals and birds may have perished and in some area’s species – like Koalas and Platypus are threatened with extinction.

The Government announced that they would spend $76 million dollars on marketing campaigns to underscore to international and interstate visitors that Australia is open for tourists to visit. The bulk of the money to be spent on overseas advertising. Prime Minister Scott Morrison said Australian tourism is facing “its biggest challenge in living memory”. And described the funding — drawn from the Government’s national bushfire recovery fund — as an “urgent injection” of funds for businesses impacted by the bushfire crisis.

The Government’s package includes $20 million for marketing to domestic travellers and $25 million for a global tourism campaign to advise international visitors that Australia is “safe and open for business”, as well as $10 million towards creating new attractions in bushfire affected regions of the country.

So today I wanted to look at the tourist data for Australia to see how important it is and to examine where the tourist dollar comes from, and where it goes to. And we need to look at both international visitors, and separately local visitors, including those from other states. Some of the reporting in the mainstream media have only told part of the story. Then I will try to estimate the potential impact.

According to data from Austrade, total tourism generated $149.6 billion dollars to the year to 30th September 2019. Within that, domestic overnight travel had 115.7 million visitors spending a record $79.1 billion, while foreign visitors generated $45.2 billion in income to the economy, up 4.7% on the previous year. This was generated from 8.7 million international visitors, up 2.5%, with an average spend per trip of $5,219.

Data published by TOURISM RESEARCH AUSTRALIA using ABS data shows that in 2018-19, total tourist consumption was $152.0 billion, which resulted in $60.8 billion in GDP to the economy which is 3.1% of the national total and employed 666,000 persons or 5.2% of the Australian workforce. Note though that this is a derived estimate, according to the ABS as we do not measure tourism directly.

In fact tourism is our largest service export, contributing $39.1 billion to Australia’s economy in 2018–19. This represents 8.2% of all goods and services exports – and places the industry fourth overall behind iron ore, coal and natural gas. But we actually have a tourist trade deficit, with visitors coming here – Exports of $39.1 billion from international visitors to Australia while Australian travelling overseas – Imports were $58.3 billion.

The tourist GDP contribution has been growing by between 5% and 6% for some years, and is up from around $38 billion in 2010-11 to $60 billion last year. This has seen tourism grow from a 2.9% share of national GDP to a 3.1% share.

So now let’s look in more detail at the tourist sector, and at international trade first.

Within the $45.7 billion, $17.1 million came from holidays, $13.2 billion from education, $7.5 billion from visiting family and relatives, $4.1 billion on business, $2.2 billion on business and $1.2 billion for other reasons.

Visitors from China accounted for $12.3 billion of spend, of which $3.2 billion was holidays and $7.1 billion on education. This came from 1.3 million visitors, with an average spend per trip of $9,235.

The United States was second, with $4.0 billion spent, of which $2.0 billion was for holidays and $300 million on education. This came from 771,000 visitors with an average spend per trip of $5,200.

Next was the United Kingdom with $3.3 billion spent, with $1.4 billion on holidays. And $1.3 billion on visiting family and friends, and just $68 million on education. We had 669,000 visitors from the UK and their average spend was $4,959.

New Zealand accounted for $2.6 billion in spend, of which $1.1 billion was holidays, 0.7 billion on families and friends and just $76 million on education. Interestingly they accounted for $1.3 million visits and their average spend was $2,032. That may tell you something about our Kiwi cousins!

Across the states and territories, NSW received $11.5 billion, of which $3.6 billion was for holidays, $4.7 billion for education and $1.4 billion for visiting relatives. The average spend per trip was $2,610. Of this around $1 billion was from regional NSW, mainly holidays at $381 million and education $362 million.

Victoria accounted to $8.8 billion, of which $2.3 billion was holidays, $4.0 billion education and $1.5 billion was visiting relatives and friends. The average trip was worth $2,810. Regional Victoria earned $594 million from international tourism, of which $249 million was holiday related from international visitors.

In Queensland, international tourism was worth $6 billion, including $2.8 billion for holidays, $1.7 billion for education and $830 million for visiting families and friends.

Within that Gold Coast generated $1.3 billion, including holidays at $755 million and education at $335 million, Brisbane was $2.8 billion comprising holidays $644 million and education $1.3 billion, and regional QLD generated $1.8 billion, of which holidays was $1.4 billion.

Turning to local tourism, that generated $79.1 billion, with an average spend of $684 a trip, and over an average 4-night stay. Of that $35.2 billion was holidays, $13.9 billion visiting relatives and friends, $17.8 billion business related and $12 billion other reasons.

Across the states, $23.2 billion was spent in NSW, with regional NSW collecting $13.9 billion, $16.5 billion in VIC, with regional VIC earning $7.1 billion, $19 billion in QLD with the Gold Coast generating $3.7 billion and Regional QLD $10.2 billion, $5 billion in SA, $8.5 billion in WA, $2.3 billion in NT, $2 billion in the ACT and $2.7 billion in Tasmania.

So a couple of observations, international revenue from education is more significant than from overseas people visiting, so it will be important to reassure potential students that Australia is safe and open for education services – to that end, the pictures of smoke in Sydney and Melbourne are extremely damaging when it comes to selecting a country in which to study, and as degrees in particular can take three of four years, this could create a long term hole in GDP.

Local travel by Australians can generate significant income, so focus on reassuming locals it is safe to travel to fire effected areas will be important, but many will likely stay away until the fires are out. As at today there are still more than 80 burning in NSW alone.

In fact, my read of Morrison’s announcement is its more to do with public perceptions of how he is handling that bushfires (after earlier bloomers), than really making a difference. For that we need to have the fires extinguished, and we need strategies to mitigate future risks. So, to me, $76 million is a pimple on the elephant and will make very little difference indeed.

But we can estimate the potential loss, bearing in mind more than half of tourists come over the summer period. So, apply this to the proportion of areas directly impacted overall, I get around $4 billion dollars in income lost. If you add in a broader swathe of cancellations to Melbourne, Canberra, Adelaide and Sydney, and assume a 5% reduction in education spend, I get an additional $8 billion in this financial year. Thus, if I put all the known data together, that $60 billion GDP could easily drop by $12 billion over the next year, and the impacts could run over 2021 and beyond. But to reemphasise the point there are indeed many areas of Australia still open for business and it’s a big country, but its going to be a hard message to communicate while the fires are still running.

https://www.tra.gov.au/domestic/domestic-tourism-results

https://www.austrade.gov.au/Australian/Tourism/News-Research-and-Publications/research

https://www.abs.gov.au/ausstats/abs@.nsf/mf/5249.0

https://www.adnews.com.au/news/where-the-76-million-tourism-marketing-bushfire-recovery-package-will-be-spent

Australia, You Were Warned Says Scientists!

Those who say “I told you so” are rarely welcomed, yet I am going to say it here. Australian scientists warned the country could face a climate change-driven bushfire crisis by 2020. It arrived on schedule. Via The Conversation.

For several decades, the world’s scientific community has periodically assessed climate science, including the risks of a rapidly changing climate. Australian scientists have made, and continue to make, significant contributions to this global effort.

I am an Earth System scientist, and for 30 years have studied how humans are changing the way our planet functions.

Scientists have, clearly and respectfully, warned about the risks to Australia of a rapidly heating climate – more extreme heat, changes to rainfall patterns, rising seas, increased coastal flooding and more dangerous bushfire conditions. We have also warned about the consequences of these changes for our health and well-being, our society and economy, our natural ecosystems and our unique wildlife.

Today, I will join Dr Tom Beer and Professor David Bowman to warn that Australia’s bushfire conditions will become more severe. We call on Australians, particularly our leaders, to heed the science.

The more we learn, the worse it gets

Many of our scientific warnings over the decades have, regrettably, become reality. About half of the corals on the Great Barrier Reef have been killed by underwater heatwaves. Townsville was last year decimated by massive floods. The southeast agricultural zone has been crippled by intense drought. The residents of western Sydney have sweltered through record-breaking heat. The list could go on.

All these impacts have occurred under a rise of about 1℃ in global average temperature. Yet the world is on a pathway towards 3℃ of heating, bringing a future that is almost unimaginable.

How serious might future risks actually be? Two critical developments are emerging from the most recent science.

First, we have previously underestimated the immediacy and seriousness of many risks. The most recent assessments of the Intergovernmental Panel on Climate Change show that as science progresses, more damaging impacts are projected to occur at lower increases in temperature. That is, the more we learn about climate change, the riskier it looks.

For Australia, a 3℃ world would likely lead to much harsher fire weather than today, more severe droughts and more intense rainfall events, more prolonged and intense heatwaves, accelerating sea-level rise and coastal flooding, the destruction of the Great Barrier Reef and a large increase in species extinctions and ecosystem degradation. This would be a tough continent to survive on, let alone thrive on.

The city I live in, Canberra, experienced an average seven days per year over 35℃ through the 1981-2010 period. Climate models projected that this extreme heat would more than double to 15 days per year by 2030. Yet in 2019 Canberra experienced 33 days of temperatures over 35℃.

Second, we are learning more about ‘tipping points’, features of the climate system that appear stable but could fundamentally change, often irreversibly, with just a little further human pressure. Think of a kayak: tip it a little bit and it is still stable and remains upright. But tip it just a little more, past a threshold, and you end up underwater.

Features of the climate system likely to have tipping points include Arctic sea ice, the Greenland ice sheet, coral reefs, the Amazon rainforest, Siberian permafrost and Atlantic Ocean circulation.

Heading towards ‘Hothouse Earth’?

These tipping points do not act independently of one another. Like a row of dominoes, tipping one could help trigger another, and so on to form a tipping cascade. The ultimate risk is that such a cascade could take the climate system out of human control. The system could move to a “Hothouse Earth” state, irrespective of human actions to stop it.

Hothouse Earth temperatures would be much higher than in the pre-industrial era – perhaps 5–6℃ higher. A Hothouse Earth climate is likely to be uncontrollable and very dangerous, posing severe risks to human health, economies and political stability, especially for the most vulnerable countries. Indeed, Hothouse Earth could threaten the habitability of much of the planet for humans.

Tipping cascades have happened in Earth’s history. And the risk that we could trigger a new cascade is increasing: a recent assessment showed many tipping elements, including the ones listed above, are now moving towards their thresholds.

It’s time to listen

Now is the perfect time to reflect on what science-based risk assessments and warnings such as these really mean.

Two or three decades ago, the spectre of massive, violent bushfires burning uncontrollably along thousands of kilometres of eastern Australia seemed like the stuff of science fiction.

Now we are faced with more than 10 million hectares of bush burnt (and still burning), 29 people killed, more than 2,000 properties and several villages destroyed, and more than one billion animals sent to a screaming, painful death.

Scientists are warning that the world could face far worse conditions in the coming decades and beyond, if greenhouse gas emissions don’t start a sharp downward trend now.

Perhaps, Australia, it’s time to listen.

Author: Will Steffen, Emeritus Professor, Australian National University

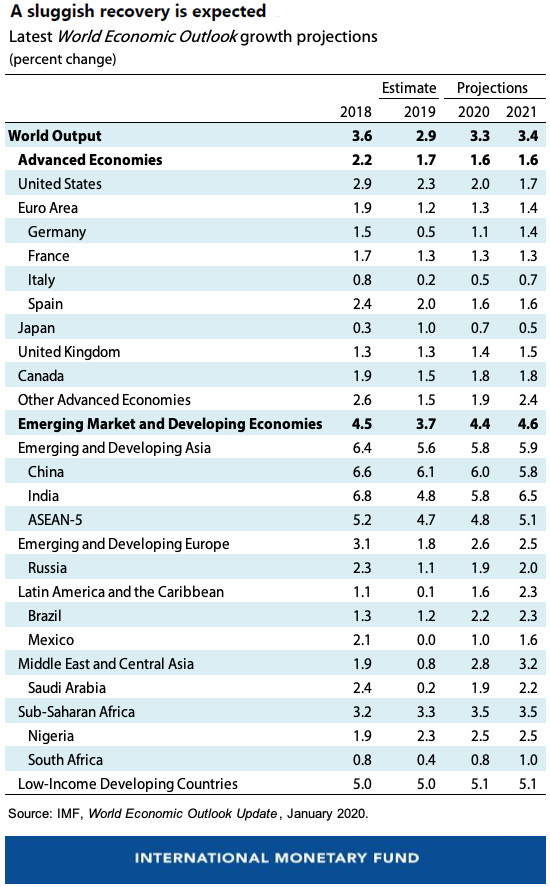

Risks To Growth Abound: WEF

The latest WEF reports make salutatory reading. While there are some tentative signs of growth, the risks, from trade through to weather related, abound.

Trade policy uncertainty, geopolitical tensions, and idiosyncratic stress in key emerging market economies continued to weigh on global economic activity—especially manufacturing and trade—in the second half of 2019. Intensifying social unrest in several countries posed new challenges, as did weather-related disasters—from hurricanes in the Caribbean, to drought and bushfires in Australia, floods in eastern Africa, and drought in southern Africa.

In this update to the World Economic Outlook, we project global growth to increase modestly from 2.9 percent in 2019 to 3.3 percent in 2020 and 3.4 percent in 2021. The slight downward revision of 0.1 percent for 2019 and 2020, and 0.2 percent for 2021, is owed largely to downward revisions for India. The projected recovery for global growth remains uncertain. It continues to rely on recoveries in stressed and underperforming emerging market economies, as growth in advanced economies stabilizes at close to current levels.

There are preliminary signs that the decline in manufacturing and trade may be bottoming out. This is partly from an improvement in the auto sector as disruptions from new emission standards start to fade. A US-China Phase I deal, if durable, is expected to reduce the cumulative negative impact of trade tensions on global GDP by end 2020—from 0.8 percent to 0.5 percent.

The projected recovery for global growth remains uncertain.

The service sector remains in expansionary territory, with resilient consumer spending supported by sustained wage growth. The almost synchronized monetary easing across major economies has supported demand and contributed an estimated 0.5 percentage point to global growth in both 2019 and 2020.

In advanced economies, growth is projected to slow slightly from 1.7 percent in 2019 to 1.6 percent in 2020 and 2021. Export dependent economies like Germany should benefit from improvements in external demand, while US growth is forecast to slow as fiscal stimulus fades.

For emerging market and developing economies, we forecast a pickup in growth from 3.7 percent in 2019 to 4.4 percent in 2020 and 4.6 percent in 2021, a downward revision of 0.2 percent for all years. The biggest contributor to the revision is India, where growth slowed sharply owing to stress in the nonbank financial sector and weak rural income growth. China’s growth has been revised upward by 0.2 percent to 6 percent for 2020, reflecting the trade deal with the United States.

The pickup in global growth for 2020 remains highly uncertain as it relies on improved growth outcomes for stressed economies like Argentina, Iran, and Turkey and for underperforming emerging and developing economies such as Brazil, India, and Mexico.

Risks retreating but still prominent

Overall, the risks to the global economy remain on the downside, despite positive news on trade and diminishing concerns of a no-deal Brexit. New trade tensions could emerge between the United States and the European Union, and US-China trade tensions could return. Such events alongside rising geopolitical risks and intensifying social unrest could reverse easy financing conditions, expose financial vulnerabilities, and severely disrupt growth.

Importantly, even if downside risks appear to be somewhat less salient than in 2019, policy space to respond to them is also more limited. It is therefore essential that policymakers do no harm and further reduce policy uncertainty, both domestic and international. This will help to revive investment, which remains weak.

Policy priorities

Monetary policy should remain accommodative where inflation is still muted. With interest rates expected to stay low for long, macroprudential tools should be proactively used to prevent the build-up of financial risks.

Given historically low interest rates alongside weak productivity growth, countries with fiscal space should invest in human capital and climate-friendly infrastructure to raise potential output. Economies with unsustainable debt levels will need to consolidate, including through effective revenue mobilization. To ensure a timely fiscal response if growth were to slow sharply, countries should prepare contingent measures in advance and enhance automatic stabilizers. A coordinated fiscal response may be needed to improve the effectiveness of individual measures. Across all economies, a key imperative is to undertake structural reforms, enhance inclusiveness, and ensure that safety nets protect the vulnerable.

Countries need to cooperate on multiple fronts to lift growth and spread prosperity. They need to reverse protectionist trade barriers and resolve the impasse over the World Trade Organization’s appellate court. They must adopt strategies to limit the rise in global temperatures and the severe consequences of weather-related natural disasters. A new international taxation regime is needed to adapt to the growing digital economy and to curtail tax avoidance and evasion, while ensuring that all countries receive their fair share of tax revenues.

To conclude, while there are signs of stabilization, the global outlook remains sluggish and there are no clear signs of a turning point. There is simply no room for complacency, and the world needs stronger multilateral cooperation and national-level policies to support a sustained recovery that benefits all.