The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Category: Economics and Banking

Legal Opinion: Deposit Bail-In In Australia Is Possible

Deposit Bail-In is something which we have been discussing in recent times, not least because of the overt example now active in New Zealand under the Open Banking Resolution, the mandate from the G20 and the Financial Stability board and the implementation in several other countries in response to this.

In Australia, the situation has been unclear, since the 2018 bill was passed on the voice.

Treasury and politicians keep denying there is any intent to bail-in deposits to rescue a failing bank, but then divert to a discussion of the $250k deposit insurance scheme which first would need to be activated by the Government, and second only once a bank has failed. It is irrelevant to bail-in.

Bail-in is where certain instruments could be converted to shares in a bank to buttress its capital in times of pressure to attempt to stop a bank failing, and so would reduce the risk of a Government bail-out using tax payer funds. They will use private funds (potentially including deposits, which are unsecured loans to a bank), instead.

So, today we release an opinion from Robert H. Butler, Solicitor. This was addressed to the Citizens Electoral Council of Australia, and is published with their permission. The key finding is simply that:

Whilst not beyond doubt, it is my opinion that the provisions of the Act do provide for a power of bail-in of bank deposits which did not exist prior to the passing of the Act.

This means that unless the law is changed to specifically exclude deposits (any side of politics going to volunteer to drive this?), bank deposits are not unquestionably free from the risk of bail-in. And we have the view that the vagueness is quite deliberate, and shameful.

Time to pressure our members of Parliament, and raise this issue during the expected election ahead.

Here is the full opinion:

I have been asked to provide an opinion as to whether the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 (“the Act”) creates a power of bail-in by Australia’s banks of customers’ deposits.

At a minimum, the Act empowers APRA to bail in so-called Hybrid Securities – special high-interest bonds evidenced by instruments which by their terms can be written off or converted into potentially worthless shares in a crisis.

However, the Act also includes write-off and conversion powers in respect of “any other instrument”. The Government has contended that these words do not extend to deposits, on the basis that the power only applies to instruments that have conversion or write-off provisions in their terms, which deposit accounts do not. However, the reference to “any other instrument” would be unnecessary if the power only applied to instruments with conversion or write-off provisions; moreover, banks are able to change the terms and conditions of deposit accounts at any time and for any reason, including on directions from APRA to insert conversion or write-off provisions, which would thereby bring them within the specific terms of the write-off or conversion provisions of the Act.

The issue could now be simply resolved by Government passing a simple amendment to the Act to explicitly exclude deposits from being bailed in.

Bail-in is one of the 3 alternative actions which can be taken in respect of a distressed bank.

The alternatives are:-

- Bankruptcy and liquidation of the bank;

- Bail-out, which is the injection into the bank of the necessary capital to meet the bank’s liabilities. This is the action which was undertaken after the 2008 GFC by governments through their Treasuries and Central Banks bailing out the banks with taxpayers’ funds;

- Bail-in, which is the injection into the bank of the necessary capital to meet the bank’s liabilities either by the bank writing off its liabilities to creditors or depositors or converting creditors’ loans or deposits into shares whereby creditors and depositors take a loss on their holdings. A bail-in is the opposite of a bail-out which involves the rescue of a financial institution by external parties, typically governments that use taxpayers’ money.

Liability limited by a scheme, approved under Professional Standards Legislation

The provisions of the Act as they affect bail-in require a consideration of the issue in 3 different sets of circumstances, and the provisions of the Act need to be considered separately in relation to each such set of circumstances.

Those 3 sets of circumstances are:-

- Hybrid Securities issued by banks;

- Customer deposit accounts with banks;

- Bank documentation implementing deposit accounts.

(i) Hybrid securities

The ASX describes Hybrid Securities as “a generic term used to describe a security that combines elements of debt securities and equity securities.” Whilst there are a variety of such securities, in short they are securities issued by banks which permit the amounts secured by the security to be converted into shares or written off at the option of the bank in certain circumstances.

The Act provides specifically for Hybrid Securities. Section 31 adds “Subdivision B-Conversion and write off provisions” to the Banking Act 1959 and inserts a definition Section 11CAA which provides that “conversion and write off provisions means the provisions of the prudential standards that relate to the conversion or writing off of:

- Additional Tier 1 and Tier 2 capital; or

- any other instrument.”

The Act also inserts Section 11CAB which provides:

“(1) This section applies in relation to an instrument that contains terms that are for the purposes of the conversion and write off provisions and that is issued by, or to which any of the following is a party:

(a) an ADI;

……

- The

instrument may be converted in accordance with the terms of the instrument despite:

- any Australian law or any law of a foreign country or a part of a foreign country, other than a specified law; and

…..

- The

instrument may be written off in accordance with the terms of the instrument

despite:

- any Australian law or any law of a foreign country or a part of a foreign country;

…..

Under the Basel Accord, a bank’s capital consists of Tier 1 capital and Tier 2 capital which includes Hybrid Securities.

The Section 11CAB provisions mean that any law which would otherwise prevent the conversion or write-off of Hybrid Securities does not apply unless a particular legislative provision specifically provides that it does apply. One of the principle types of legislation that this provision would be directed towards is consumer legislation, particularly those provisions which allow a Court to set aside or vary agreements if a party has been guilty of false or misleading conduct – this is precisely the sort of argument which could be raised in the circumstances referred to by outgoing Australian Securities and Investments Commission (ASIC) Chairman Greg Medcraft in an exchange with Senator Peter Whish-Wilson in the hearings of the Senate Economics Legislation Committee on 26 October 2017: Mr Medcraft said: “There are two reasons we believe a lot of the retail investors buy these securities. One is they don’t understand the risks that are in over 100-page prospectuses and, secondly – and this is probably for a lot of investors – they do not believe that the government would allow APRA to exercise the option to wipe them out in the event that APRA did choose to wipe them out.“

When Senator Whish-Wilson raised the spectre of “bail-in”, Mr Medcraft confirmed: “Yes, they’ll be bailed in. The big issue with these securities is the idiosyncratic risk. Basically, they can be wiped out – there’s no default; just through the stroke of a pen they can be written off. For retail investors in the tier 1 securities – they’re principally retail investors, some investing as little as $50,000 – these are very worrying. They are banned in the United Kingdom for sale to retail. I am very concerned that people don’t understand, when you get paid 400 basis points over the benchmark [4 per cent more than normal rates], that is extremely high risk. And I think that, because they are issued by banks, people feel that they are as safe as banks. Well, you are not paid 400 basis points for not taking risks…” He emphasised: “I do think this is, frankly, a ticking time bomb.“

The over-riding intention behind Sections 11CAB(2) and 11CAB(3) is to deal with issues arising from the examples in the comments of Graeme Thompson of APRA in an address on 10 May 1999 when he said: “… APRA will have powers under proposed Commonwealth legislation to mandate a transfer of assets and liabilities from a weak institution to a healthier one. This is a prudential supervision tool that the State supervisory authorities have had in the past, and it has proved very useful for resolving difficult situations quickly. We expect the law will require APRA to take into account relevant provisions of the Trade Practices Act before exercising this power, and to consult with the ACCC whenever it might have an interest in the implications of a transfer of business.” The new Sections 11CAB(2) & (3) mean that APRA does not need to consider those issues (or any other) in relation to conversion and write-off of Hybrid Securities.

(ii) Deposits

Whether or not bail-in of other than Hybrid Securities is implemented by the Act has been the subject of debate and concern since the Bill which led to the Act became public. The principal area of concern is whether or not the bail-in regime was extended by the Act to deposits made by customers with banks.

The central issue is the wording of the definition in Section 11CAA quoted above and what “any other instrument” means. “Instrument” is not defined in the Act but a “financial instrument” is defined by Australian Accounting Standard AASB132 as “any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.” As confirmed by the Reserve Bank, a deposit with an ADI bank comes under such a definition – it is a contract with terms and conditions as to the deposit being set by a bank, accepted by a depositor on making a deposit and creating a financial asset (a right of repayment) and a financial liability in the bank (the obligation to repay).

Deposits are created by “instruments” and are governed by the terms and conditions of those instruments.

The intent of the reference to “any other instrument” in Section 11CAAAA is assisted by the Explanatory memorandum which accompanied the Exposure Draft and which states:

“5.14 Presently, the provisions in the prudential standards that set these requirements are referred to as the ‘loss absorption requirements’ and requirements for ‘loss absorption at the point of non-viability’. The concept of ‘conversion and write-off provisions’ is intended to refer to these, while also leaving room for future changes to APRA’s prudential standards, including changes that might refer to instruments that are not currently considered capital under the prudential standards.”

Section 11AF of the Banking Act provides that APRA can determine Prudential Standards which are binding on all ADIs. These standards are in effect regulations which have the force of legislation by virtue of the authorisation in the Banking Act. That Section provides, inter alia:

“(1) APRA may, in writing, determine standards in relation to prudential matters to be complied with by: (a) all ADIs; …..”

Banks are ADIs.

The various Prudential Standards issued by APRA are accordingly headed with the phrase: “This Prudential Standard is made under section 11AF of the Banking Act 1959 (the Banking Act).”

That power then leads into the issue of APRA using this authority to expand the meaning of “capital” the subject of conversion or write-off, to encompass deposits if deposits are not already covered by the reference to “any other instrument”.

That these provisions as to conversion and write-off are not limited to Hybrid Securities is confirmed in Section 11CAA itself as quoted above. The provisions extend to “any other instrument” by sub-section (b) of that Section and must relate to instruments other than those referred to in sub-section (a), i.e. other than “Additional Tier 1 and Tier 2 capital” (being instruments which themselves contain an explicit provision for conversion or write-off). All instruments that the Act refers to as to being able to be converted or written off “in accordance with the terms of the instruments” come under the definition of “Additional Tier 1 and Tier 2 capital” – “any other instruments” is not only an entirely unnecessary addition if the Act is intended to apply only to instruments with conversion or write-off terms, its very broad language must be intended to encompass some other instruments (“which are not currently considered capital” as stated in the Explanatory memorandum) and that could extend to instruments relating to deposits.

If Section 11CAA thus extends to instruments relating to deposits then APRA can as the Prudential Regulator issue a Prudential Requirement Regulation or a Prudential Standard for the writing-off or conversion of deposits.

APRA already has a power to prohibit the repayment of deposits by ADIs, a power which already verges on the writing off of those deposits. The Banking Act Section 11CA provides:

“(1) … APRA may give a body corporate that is an ADI … a direction of a kind specified in subsection (2) if APRA has reason to believe that:

…..

- the body corporate has contravened a prudential requirement regulation or a prudential standard; or

- the body corporate is likely to contravene this Act, a prudential requirement regulation, a prudential standard or the Financial Sector (Collection of Data) Act 2001, and such a contravention is likely to give rise to a prudential risk; or

- the body corporate has contravened a condition or direction under this Act or the Financial Sector (Collection of Data) Act 2001 ; or

….

(h) there has been, or there might be, a material deterioration in the body corporate’s financial condition; or

….

(k) the body corporate is conducting its affairs in a way that may cause or promote instability in the Australian financial system.

…..

(2) The kinds of direction that the body corporate may be given are directions to do, or to cause a body corporate that is its subsidiary to do, any one or more of the following:

….

- not to repay any money on deposit or advance;

- not to pay or transfer any amount or asset to any person, or create an obligation (contingent or otherwise) to do so;

…..”

This provision was inserted into the Banking Act in 2003 by the Financial Sector Legislation Amendment Act (No 1).

It is not known whether this power has been exercised by APRA. Relevantly Graeme Thompson in the address referred to above said: ” … Particularly in the case of banks and other deposit-takers that are vulnerable to a loss of public confidence, APRA may prefer to work behind the scenes with the institution to resolve its difficulties. (Such action can include arranging a merger with a stronger party, otherwise securing an injection of capital or limiting its activities for a time.)“

It is a relatively small step to then convert or write-off what the ADI has been prohibited from repaying or paying out.

It might be argued that APRA’s powers in existing Sections of the Act are not absolute and are subject to various qualifications and limitations arising out of their context within the Act or the balance of the Section or Sections of the Act in which they appear. To avoid such an interpretation, Section 38 of the Act inserts 2 new sub-sections to Section 11CA in the Banking Act:

“(2AAA) The kinds of direction that may be given as mentioned in subsection (2) are not limited by any other provision in this Part (apart from subsection (2AA)).

(2AAB) The kinds of direction that may be given as mentioned in a particular paragraph of subsection (2) are not limited by any other paragraph of that subsection.”

APRA has already adopted the need for certain capital to be capable of conversion or write-off, regardless of laws, constitutions or contracts which may affect such decisions, the Explanatory Statement for Banking (Prudential Standard) Determination No. 1 of 2014 stating:

“The Basel Committee on Banking Supervision (BCBS) has developed a series of frameworks for measuring the capital adequacy of internationally active banks. Following the financial crisis of 2007-2009, the BCBS amended its capital framework so that banks hold more and higher quality capital (Basel III). For this purpose, the BCBS established in Basel III more detailed criteria for the forms of eligible capital, Common Equity Tier 1 (CET1), Additional Tier 1(AT1) and Tier 2 (T2), which banks would need to hold in order to meet required minimum capital holdings.

Basel III provides that AT1 and T2 capital instruments must be written-off or converted to ordinary shares if relevant loss absorption or non-viability provisions are triggered.

Banking (prudential standard) determination No. 4 of 2012 incorporated the Basel III developments into APS 111 with effect from 1 January 2013. …”

(iii) Bank documentation implementing deposit accounts

Even if the words “any other instrument” in Section 11CAA do not encompass deposits, there is a further issue in relation to the implementation of bail-in of deposits revolving around the issue of the documents/instruments issued by banks in opening accounts and accepting deposits from customers.

The documentation issued by each Australian bank when opening such an account, has a provision which enables the Bank to change the terms and conditions from time to time without the consent of the customer. The specifics of the power vary from bank to bank but each fundamentally contain such a power. Some examples of various clauses are set out in Appendix 1.

If APRA as the Prudential Regulator issued a Prudential Requirement Regulation or a Prudential Standard requiring a bank to insert a provision into its documentation/instruments relating to deposit-taking accounts providing for the bail-in of those deposits – their write-off or conversion – then those provisions would then clearly come within the specific provisions of conversion or write-off within the Act and the deposit the subject of the account could be bailed-in immediately.

Such a directive could be issued by APRA in accordance with the secrecy provisions in the Australian Prudential Regulation Authority Act1998 and be implemented with little or no notice to the account holder.

Whilst not directly relevant to an interpretation of the provisions of the Act, there are a number of unusual and concerning aspects to its introduction, passing and intentions.

As noted above, the issue could now be simply resolved by Government passing a simple amendment to the Act to explicitly exclude deposits from being bailed in i.e. written off or converted into shares.

Whilst not beyond doubt, it is my opinion that the provisions of the Act do provide for a power of bail-in of bank deposits which did not exist prior to the passing of the Act.

Yours faithfully,

Debt, Divorce and Death!

In a falling property market, who still has to sell? Property expert Joe Wilkes and I discuss. We also note how the banks are targetting some of these cohorts.

ASIC welcomes approval of new laws to protect financial service consumers

ASIC has welcomed the passage of key financial services reforms contained in the Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) legislation introducing:

- a design and distribution obligations regime for financial services firms; and

- a product intervention power for ASIC

The design and distribution obligations will bring accountability for issuers and distributors to design, market and distribute financial and credit products that meet consumer needs. Phased in over two years, this will require issuers to identify in advance the consumers for whom their products are appropriate, and direct distribution to that target market.

The product intervention power will strengthen ASIC’s consumer protection toolkit by equipping it with the power to intervene where there is a risk of significant consumer detriment. To take effect immediately, this will better enable ASIC to prevent or mitigate significant harms to consumers.

These reforms were recommended by the Financial System Inquiry in 2014 and represent a fundamental shift away from relying predominantly on disclosure to drive good consumer outcomes.

ASIC Chair James Shipton said the reforms were a critical factor in the development of a financial services industry in which consumers could feel confident placing their trust.

‘These new powers will enable ASIC to take broader, more proactive action to improve standards and achieve fairer consumer outcomes in the financial services sector. This will be a significant boost for ASIC in achieving its vision of a fair, strong and efficient financial system for all Australians,’ he said.

‘This will also provide invaluable assistance to ASIC as we all seek to rebuild the community’s trust in our banking and broader wealth management industries. And we note the overwhelming level of support this attracted from across the Parliament.’

Mr Shipton also welcomed the amendments to the original legislation, which extended the reach of these reforms, providing a comprehensive framework of protection for most consumer financial products. It will also empower ASIC to intervene in relation to a wider range of products where ASIC identifies a risk of significant detriment to consumers.

How Complex Is Banking Change Really?

In the final part of my discussion with Ex-ANZ Director John Dahlsen, ahead of the closing date for submissions into the Senate Inquiry into Banking Structural Separation, we discussed the core questions, and what barriers really need to be overcome.

To make a submission, check out this link:

http://cecaust.com.au/Pass-Glass-Steagall/

There you will find a guide to make a submission, and some pointers to help develop your input.

See our earlier discussions

“Structure is a dirty word“, “Beyond The Royal Commission” and

“More on Bank Separation“.

US regulatory proposal would limit effects of large bank failures

Moody’s says on 2 April, the US Federal Reserve Board, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency proposed a rule that would require US global systemically important bank (GSIB) holding companies and advanced-approaches banking organizations1 to hold additional capital against investments in total loss absorbing capacity (TLAC) debt. The additional capital required for investments in TLAC debt would reduce interconnectedness between large banking organizations and the systemic effect of a GSIB’s failure, a credit positive for the US banking system.

The credit-positive proposal would require companies to deduct from their regulatory capital any investment in their own regulatory capital instrument which includes TLAC debt, any investment in another financial institution’s regulatory capital instrument, and investments in unconsolidated financial institutions’ capital instruments that would qualify as regulatory capital if issued by the banking organization itself (subject to a certain threshold). The deductions intend to discourage banks from investing in the regulatory capital instruments of another bank and improve the largest banks’ resiliency to stress and ensure a more efficient bank resolution process.

The proposal also includes additional required disclosures about TLAC debt in bank holding companies’ public regulatory filings, which would increase transparency.

The TLAC rules were first proposed in 2015 and finalized in December of 2016. However, in 2016 when the TLAC rules were finalized, regulators needed more time to determine the rule’s regulatory capital treatment for investments in certain debt instruments such as TLAC issued by bank holding companies.

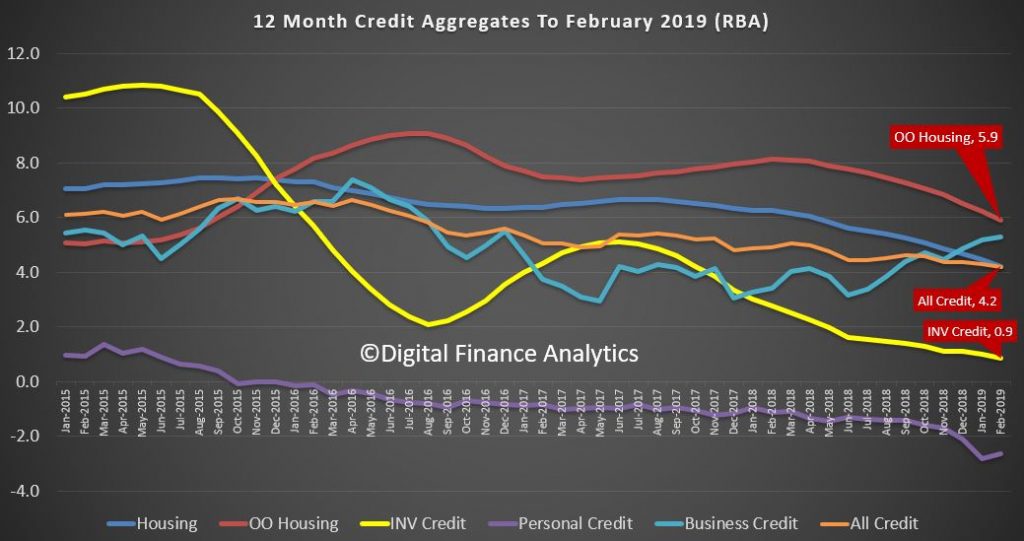

Mortgage Stress Builds Again as Debt Grows

Digital Finance Analytics (DFA) has released the March 2019 mortgage stress and default analysis update. It’s the continuing story of pressure on households as ongoing wages growth is not offsetting costs of living, and mortgage repayments and total debt continues to rise.

Note: Later in the month we will release mapping showing the percentage of households in stress across postcodes (as opposed to the number estimated to be in stress). We generally avoid this data view because a raw percentage calculation can easily be distorted by postcodes with low counts of borrowing household, but then we have had several requests for this alternative view.

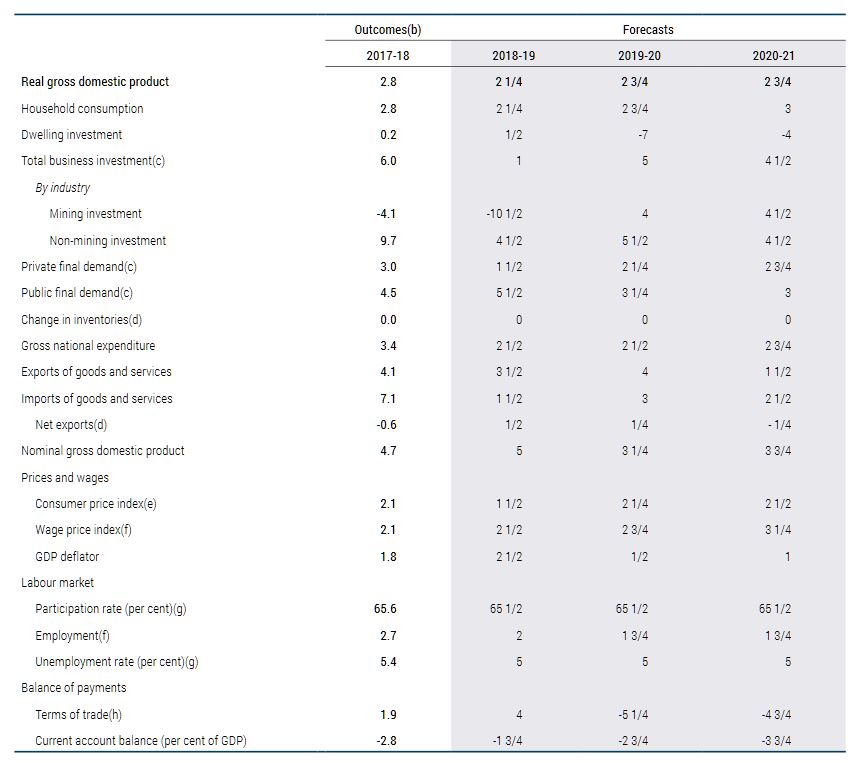

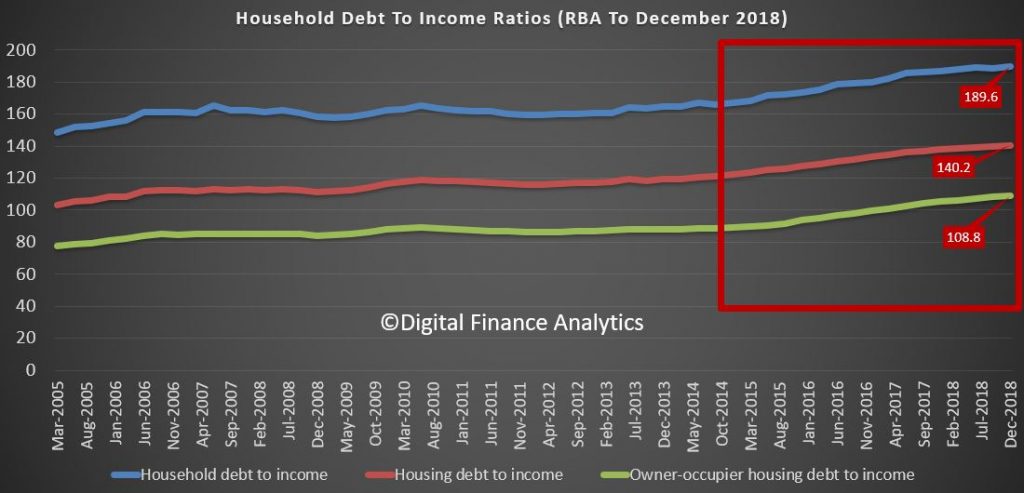

The latest RBA data on household debt to income to December rose to 189.6[1], and remains highly elevated. Plus, the housing debt ratio continues to climb to a new record of 140.2, according to the RBA. This shows that household debt to income is still increasing.

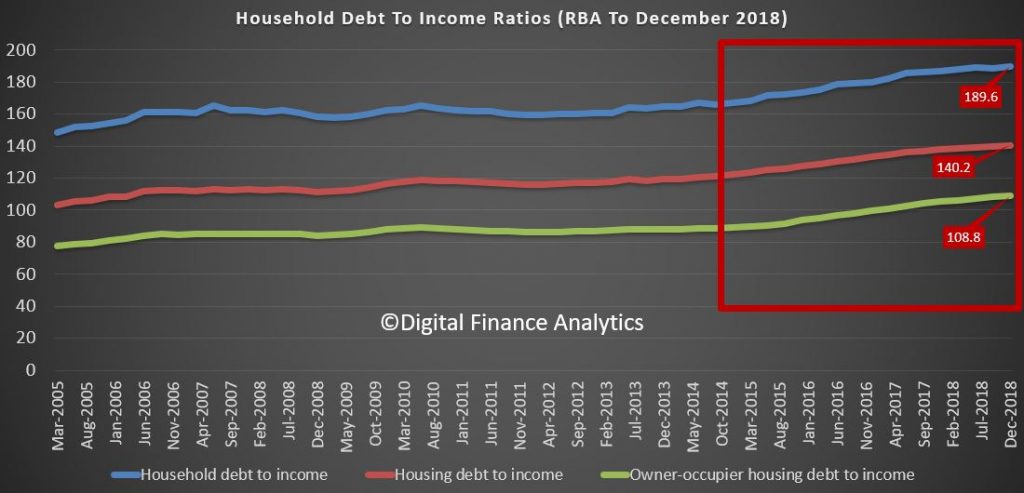

This is confirmed by the latest financial aggregates recently released by the RBA, with owner occupied lending still growing significantly faster than inflation at 5.9%.

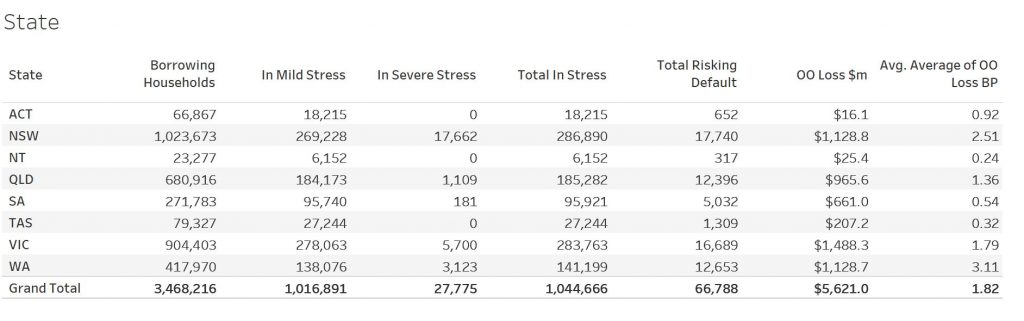

This high debt level, in the context of broader financial pressure, helps to explain the fact that mortgage stress continues to rise. Across Australia, more than 1,044,666 households are estimated to be now in mortgage stress (last month 1,036,214), another new record. This equates to more than 31.6% of owner-occupied borrowing households. In addition, more than 27,775 of these are in severe stress. We estimate that more than 66,700 households’ risk 30-day default in the next 12 months, up 800 from last month. This is as the impact of flat wages growth, rising living costs and higher real mortgage rates hit home. Bank losses are likely to rise a little ahead.

Our analysis uses the DFA core market model which combines information from our 52,000 household surveys, public data from the RBA, ABS and APRA; and private data from lenders and aggregators. The data is current to the end of March 2019. We analyse household cash flow based on real incomes, outgoings and mortgage repayments, rather than using an arbitrary 30% of income.

Households are defined as “stressed” when net income (or cash flow) does not cover ongoing costs. They may or may not have access to other available assets, and some have paid ahead, but households in mild stress have little leeway in their cash flows, whereas those in severe stress are unable to meet repayments from current income. In both cases, households manage this deficit by cutting back on spending, putting more on credit cards and seeking to refinance, restructure or sell their home. Those in severe stress are more likely to be seeking hardship assistance and are often forced to sell.

The forces continue to build, despite reassurances that household finances are fine. This is because we continue to see an accumulation of larger mortgages compared to income whilst costs are rising, and incomes remain static. Housing credit growth is running significantly faster than incomes and inflation and continued rises in living costs – notably child care, school fees and electricity prices are causing significant pain. Many households are depleting their savings to support their finances.

Probability of default extends our mortgage stress analysis by overlaying economic indicators such as employment, future wage growth and cpi changes. Our Core Market Model also examines the potential of portfolio risk of loss in basis point and value terms. Losses are likely to be higher among more affluent households, contrary to the popular belief that affluent households are well protected. This is shown in the segment analysis below:

Stress by the numbers.

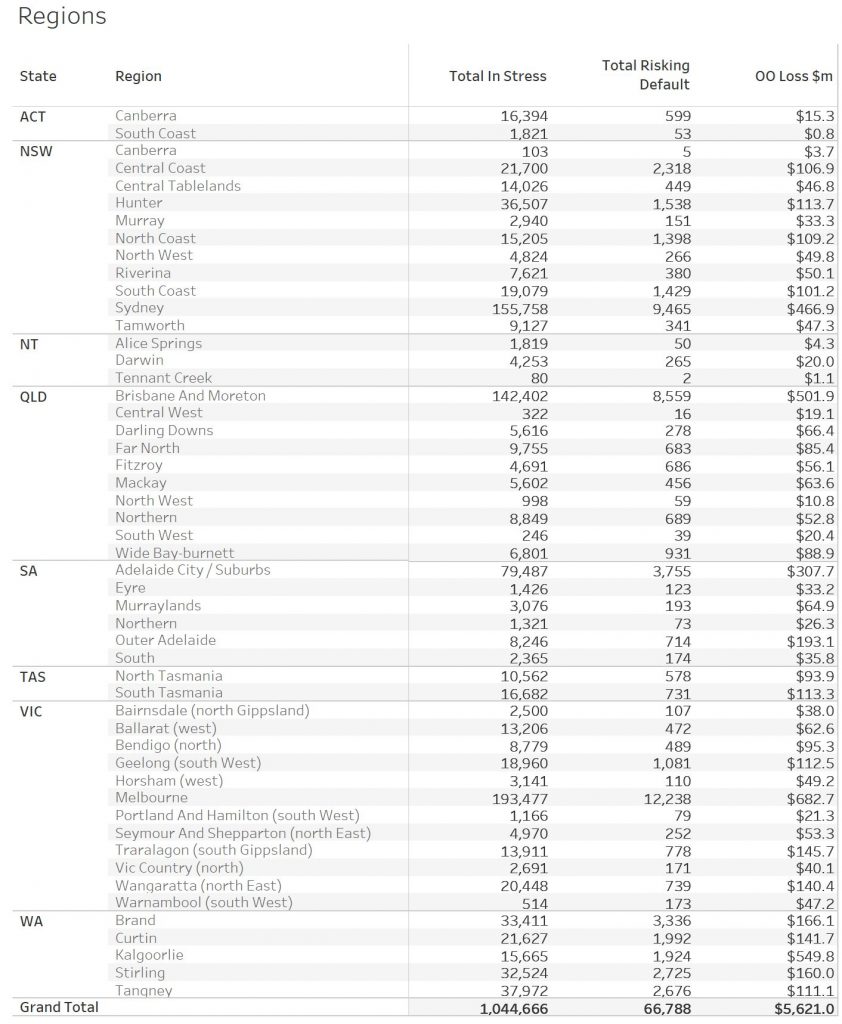

Regional analysis shows that NSW has 286,890 households in stress (286,469 last month), VIC 283,753 (278,091 last month), QLD 185,282 (185,424 last month) and WA has 141,199 (139,142 last month). The probability of default over the next 12 months rose, with around 12,600 in WA, around 12,400 in QLD, 16,700 in VIC and 17,700 in NSW.

The largest financial losses relating to bank write-offs reside in NSW ($1.1 billion) from Owner Occupied borrowers) and VIC ($1.49 billion) from Owner Occupied Borrowers, though losses are likely to be highest in WA at 3.1 basis points, which equates to $1,045 million from Owner Occupied borrowers.

A fuller regional breakdown is set out below.

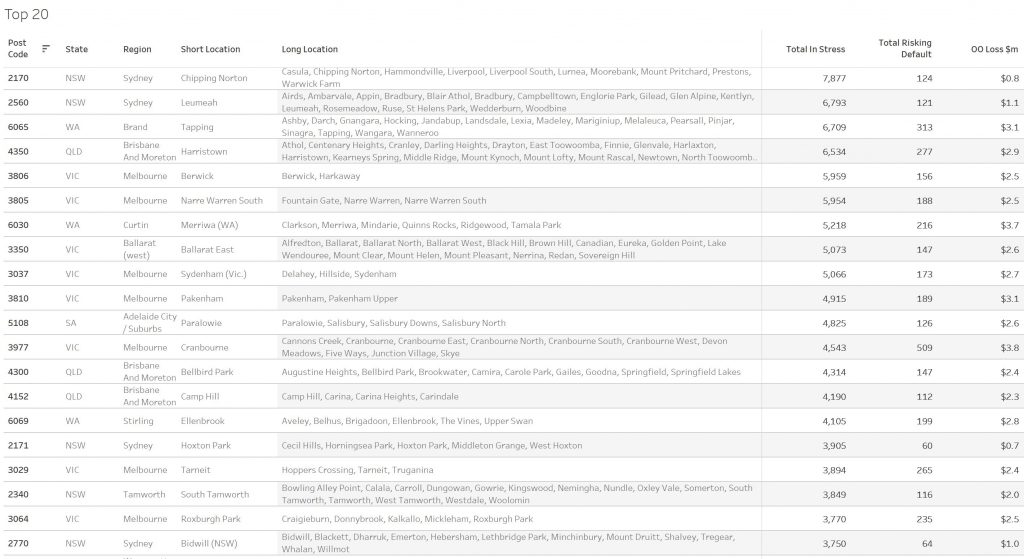

Here are

the top postcodes sorted by number of households in mortgage stress.

Handling Mortgage Stress

Households who are in financial difficulty should not ignore the signs. Though many do. And trying to refinance to solve the problem often ends up just postponing the inevitable.

We think there are some simple steps households can take:

Step one is to draw up a budget, so you can see where the money is coming and going. From our research, only half of households have any budget. This means you can then make decisions about what is most important, and what can be foregone. Select and prioritise.

Step two is to talk with your lender, as they have a legal obligation to assist is case of hardship. Yet many households avoid having that conversation, hoping the problem will cure itself. I have to say, in the current low-income growth, high cost environment, that is unlikely. And remember rates are likely to rise at some point.

Step three. Work out what would happen if mortgage rates rose

by say half or one percent. Pass that across your budget and examine the

impact. Then you will really know where you stand. Then plan accordingly.

[1] RBA E2 Household Finances – Selected Ratios December 2018

You can request our media release. Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The March 2019 Stress Release’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The March 2019 Media Release’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=”Comment If You Like” type=”textarea”/][/contact-form]

Note that the detailed results from our surveys and analysis are made available to our paying clients.

The Never-ending Rivers Of Debt

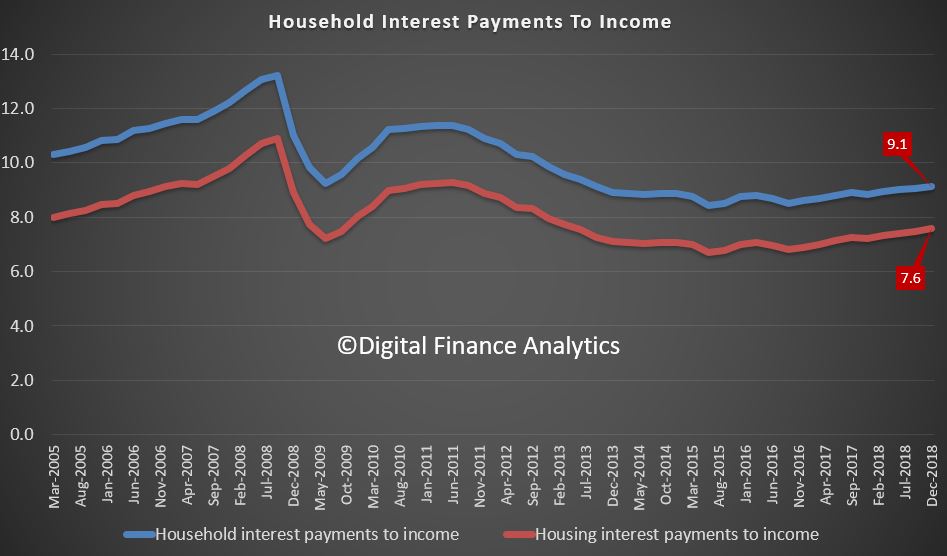

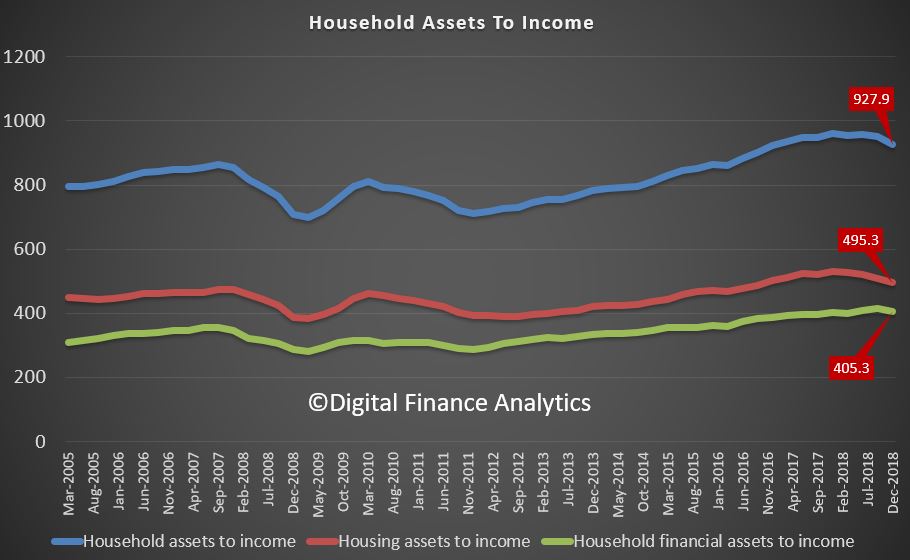

In the latest RBA data series (E2) we get an update on household debt to income and debt to asset ratios, and they are ALL moving in the wrong direction. This is to December 2018.

The household debt to income moved higher to a new record of 189.6, and housing debt to income to a new record of 140.2.

The change in trajectory from 2014/5 is significant, as lending standards were weakened, and interest rates cut (forcing home prices higher).

The interest payments to income also rose, thanks to bigger mortgages, slightly higher interest rates, and little income growth.

But in contrast, the asset values are falling, so the asset to income ratios are falling. Housing assets in particular are dropping.

All pointing to a higher burden of debt on households. And remember only one third, or there about, have a mortgage, so in fact the TRUE ratios are much much worst. But the trends do not lie in relative terms, and by the way these are extended ratios compared with most western economies. We are drowning in rivers of debt!

Federal Budget: And Finance

The federal government has announced a $600 million fighting fund to support the recommendations of the financial services royal commission, via InvestorDaily.

Buried on page 167 of the hefty 2019 Federal Budget are the Hayne-related expenses to be incurred by Treasury over the next five years.

The government will provide $606.7 million over five years from 2018-19 to facilitate its response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

The package comprises a suite of measures that fulfil the government’s commitment to take action on all 76 of the recommendations of the Royal Commission’s Final Report, including:

• Designing and implementing an industry funded compensation scheme of last resort for consumers and small business ($2.6 million over two years from 2019-20);

• Providing the Australian Financial Complaints Authority with additional funding to help establish a historical redress scheme to consider eligible financial complaints dating back to 1 January 2008 ($2.8 million in 2018-19);

• Paying compensation owed to consumers and small businesses from legacy unpaid external dispute resolution determinations ($30.7 million in 2019-20);

• Resourcing the Australian Securities and Investments Commission (ASIC) to implement its new enforcement strategy and expand its capabilities and roles in accordance with the recommendations of the Royal Commission ($404.8 million over four years from 2019-20).

• Resourcing the Australian Prudential Regulation Authority (APRA) to strengthen its supervisory and enforcement activities which will support its response to key areas of concern raised by the Royal Commission, including with respect to governance, culture and remuneration ($145.0 million over four years from 2019-20);

• Establishing an independent financial regulator oversight authority, to assess and report on the effectiveness of ASIC and APRA in discharging their functions and meeting their statutory objectives ($7.7 million over three years from 2020-21);

• Undertaking a capability review of APRA, which will examine its effectiveness and efficiency in delivering its statutory mandate, as well as its capability to respond to the Royal Commission ($1.0 million in 2018-19);

• Establishing a Financial Services Reform Implementation Taskforce within the Treasury to implement the Government’s response to the royal commission, and co-ordinate reform efforts with APRA, ASIC and other agencies through an implementation steering committee ($11.2 million in 2019-20); and

• Providing the Office of Parliamentary Counsel with additional funding for the volume of legislative drafting that will be required to implement the Government’s response to the Royal Commission ($0.9 million in 2019-20).

The cost of this measure will be partially offset by revenue received through ASIC’s industry funding model and increases in the APRA Financial Institutions Supervisory Levies and from funding already provisioned in the Budget.

Lower taxes

Handing down the Federal Budget 2019-2020 in parliament last night, Mr Frydenberg said that the budget would restore the nation’s finances without raising taxes.

“The budget is back in the black and Australia is back on track,” the treasurer said, announcing that the coalition delivered a $7.1 billion surplus.

“Over the last year the interest bill on national debt was $18 billion,” he said. “We are reducing the debt and this interest bill, not by higher taxes, but by good financial management and growing the economy.”

The government has announced immediate tax relief for low- and middle‑income earners of up to $1,080 for singles or up to $2,160 for dual income families to ease the cost of living.

The coalition will also be lowering the 32.5 per cent rate to 30 per cent in 2024-25, increasing the reward for effort by ensuring a projected 94 per cent of taxpayers will face a marginal tax rate of no more than 30 per cent.

“The Australian Government is lowering taxes for working Australians and backing small and medium‑sized business, while ensuring all taxpayers, including big business and multinationals, pay their fair share,” the treasurer said.

Superannuation

The Government will allow voluntary superannuation contributions (both concessional and non-concessional) to be made by those aged 65 and 66 without meeting the work test from 1 July 2020. People aged 65 and 66 will also be able to make up to three years of non-concessional contributions under the bring-forward rule.

Those up to and including age 74 will be able to receive spouse contributions, with those 65 and 66 no longer needing to meet a work test.

“This measure is estimated to reduce revenue by $75.0 million over the forward estimates period,” the treasurer said.

“Currently, people aged 65 to 74 can only make voluntary superannuation contributions if they self-report as working a minimum of 40 hours over a 30 day period in the relevant financial year. Those aged 65 and over cannot access bring-forward arrangements and those aged 70 and over cannot receive spouse contributions.”

The government will make permanent the current tax relief for merging superannuation funds that is due to expire on 1 July 2020.

“This measure is estimated to have an unquantifiable reduction in revenue over the forward estimates period,” Mr Frydenberg said.

Since December 2008, tax relief has been available for superannuation funds to transfer revenue and capital losses to a new merged fund, and to defer taxation consequences on gains and losses from revenue and capital assets.

The tax relief will be made permanent from 1 July 2020, ensuring superannuation fund member balances are not affected by tax when funds merge. It will remove tax as an impediment to mergers and facilitate industry consolidation, consistent with the recommendation of the Productivity Commission’s final report into the superannuation industry.

The treasurer said consolidation would help address inefficiencies by reducing costs, managing risks and increasing scale, leading to improved retirement outcomes for members.

The government will also reduce costs and simplify reporting for superannuation funds by streamlining some administrative requirements for the calculation of exempt current pension income (ECPI).

The Government will allow superannuation fund trustees with interests in both the accumulation and retirement phases during an income year to choose their preferred method of calculating ECPI.

The Government will also remove a redundant requirement for superannuation funds to obtain an actuarial certificate when calculating ECPI using the proportionate method, where all members of the fund are fully in the retirement phase for all of the income year.

This measure will start on 1 July 2020 and is estimated to have no revenue impact over the forward estimates period.

FSC has mixed feelings

The Financial Services Council (FSC) welcomed the government’s superannuation changes to reduce red tape and improve access to voluntary contributions.

“The expansion of the work test exemption, spouse contributions and bring-forward arrangements will provide workers nearing retirement greater flexibility to make additional super contributions if they are able. The electronic requests for release of super and simplification of exempt current pension income calculations are sensible and welcome,” FSC chief executive Sally Loane said.

“The FSC also supports the tax relief for merging super funds, as this will help the superannuation industry consolidate to reduce costs and improve member outcomes.”

However, the FSC is disappointed this is not part of a comprehensive product rationalisation scheme, despite this being a longstanding government commitment.

“A lack of reform in this area means consumers are locked into older, more expensive products,” Ms Loane said.

The FSC is pleased to note the Budget has largely kept the superannuation settings unchanged. However, Ms Loane said the council is disappointed the government has failed to reform non-resident withholding tax for managed funds in the Asia Region Funds Passport.

“This means Australia will remain uncompetitive in our region, and Australia will not be competing with Asian funds on a level playing field.

“The withholding tax on managed funds raises little money, but harms our competitiveness within Asia, putting Australia’s fund managers at a major competitive disadvantage in the region.”

The Budget Smoke And Mirrors

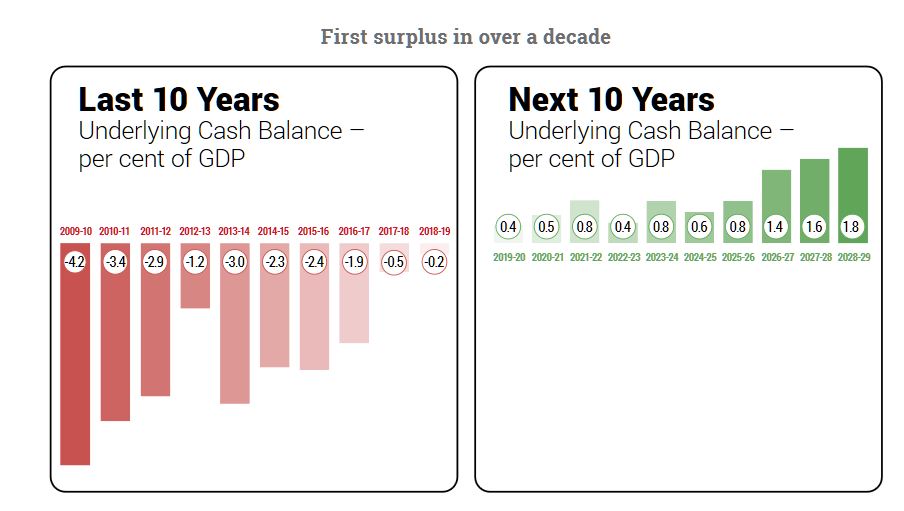

The Treasurer Josh Frydenberg has given his budget speech tonight, and he said that for the first time in 12 years the federal budget has returned to surplus.

His first budget includes billions of dollars for tax cuts, major road upgrades and health care. But actually, it is due to return to surplus in the NEXT financial year, and project small surpluses in subsequent years.

He is also spending big ahead of the election, so yes this is political (and in some regards intimating Labor’s policies in places) . This is a “boots and all” approach to try and gain election ground. Reminds me of Howard and Costello!

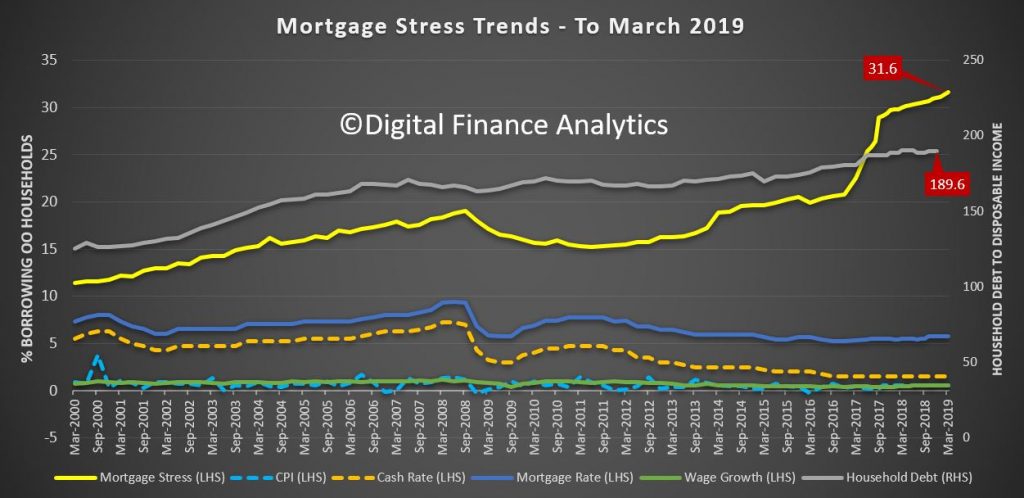

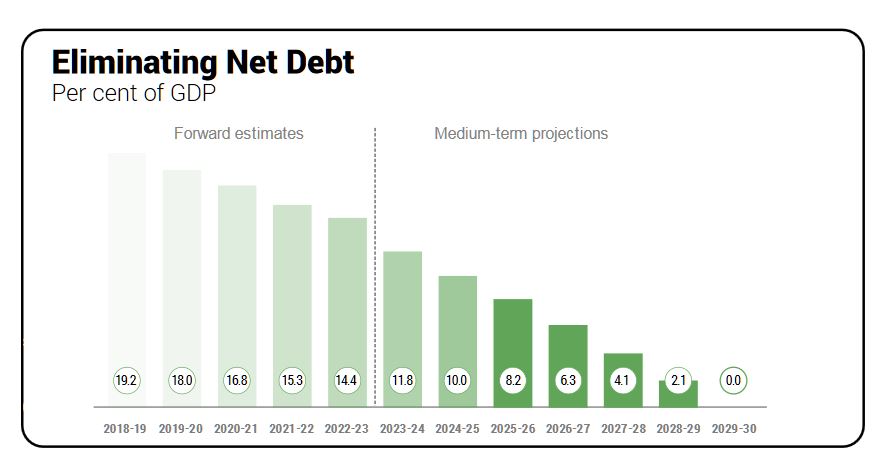

Net debt is forecast to be $360 billion next financial year, but the Coalition is promising to eliminate it by 2030 if it retains government (if the aggressive assumptions and no slow-down occurs in that time).

But it forecasts lower wages growth, then a jump back to higher rates (why?) and the same is true of economic growth at 2.75% next year, then higher later. Plus a promise for another 1.25 million jobs in the next 5 years (what type of jobs?).

“The budget is back in the black and Australia is back on track,” the treasurer said, announcing that the coalition delivered a $7.1 billion surplus

The Budget forecasts surpluses in each year over the forward estimates, reaching as high as $17.8 billion in 2012-22.

But the budget recognizes a number of risks locally and internationally and is under-funding the NDIS by $3 billion in the next two years.

“The residential housing market has cooled, credit growth has eased and we are yet to see the full impact of flood and drought on the economy.”

The mantra though the speech was that the budget would restore the nation’s finances without raising taxes.

“We are reducing the debt and this interest bill, not by higher taxes, but by good financial management and growing the economy.”

The truth is the budget may go into surplus next year thanks to very high iron ore export prices to China. This was lucky, and is explained by supply disruption from other sources lifting prices.

He makes the point that Australia has a significant national debt which is currently costing $18 billion, and this with interest rates ultra low!

Last year the coalition had announced plans to reduce income taxes for Australians by $144 billion. Now the Treasurer said the government would deliver more than $150 billion in income tax cuts.

From 1 July 2024 taxes will be reduced from 32.5 per cent to 30 per cent for those earning between $45,000 and $200,000.

“Taxes will always be lower under the coalition,” Mr Frydenberg said, adding that small businesses will also get tax relief from the 2019 budget.

“Small business taxes have been reduced to 25 per cent and the instant asset write-off will be increased from $25,000 to $30,000 and can be used every time and asset under that amount is purchased.

“The instant asset write-off will also be expanded to businesses with a maximum turnover of $50 million.”

The coalition will also boost infrastructure spending to $100 billion over the next ten years.

Finally, the Government has matched Labor’s commitment to end a freeze on the Medicare rebate for GP visits from the first of July, as part of a $1.1 billion primary healthcare plan.