According to the Australian today, Lazard Asset Management fund managers are concerned about the banks’ skyhigh valuations and the risks of a housing market correction.

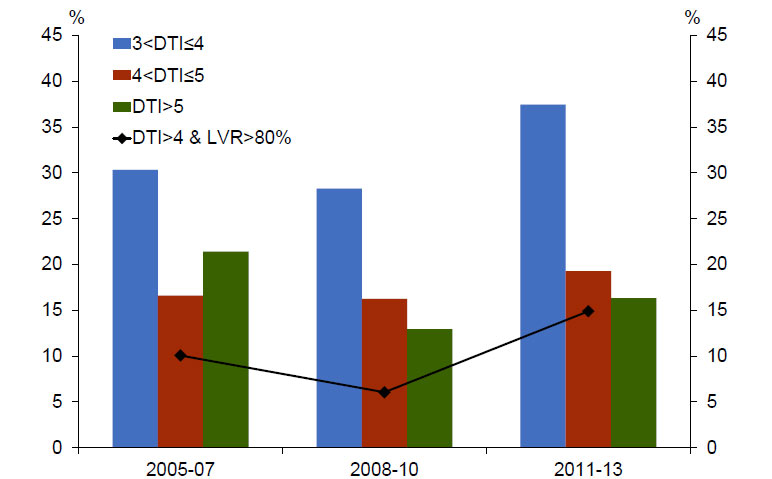

“…it’s record high household debt in a hot property market — a more worrying scenario for it tends to cause deeper economic pain.

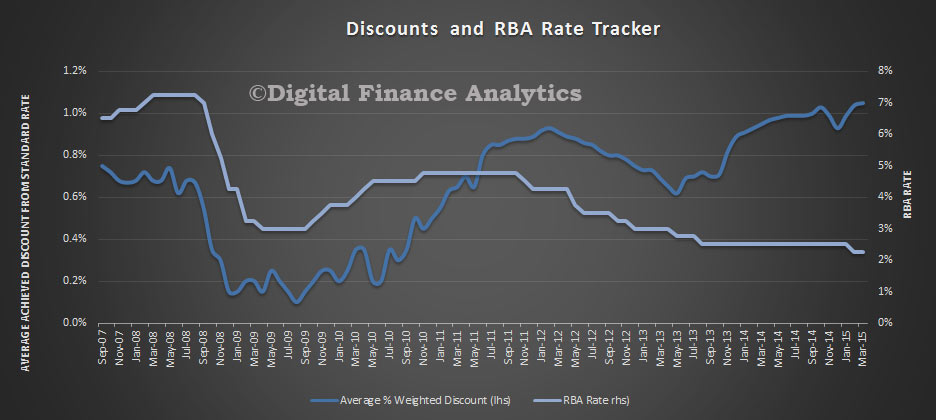

“Property prices, bank valuations — we’re still in the pre-2007 paradigm: as soon as we get a rate cut, we go out and buy another property,” Mr Hofflin said, citing higher median prices in Wagga Wagga than Chicago.

“What happened in the US in terms of the wealth effect when property fell could be worse here because property dominates Australians’ balance sheet … and because prices are so high in the first place.

“If you have an asset that is expensive but there’s no debt against it, we think it’s much less dangerous to the economy … in this case there is a lot of debt against it.”

While there is a view that Australia’s circumstances such as tight land supply and tax incentives protected the nation from a property collapse, regulators are growing increasingly concerned, particularly in Sydney.

As chief banking regulator Wayne Byres noted last week, the nation’s good housing fortune over the years “doesn’t mean that will always be the case”.

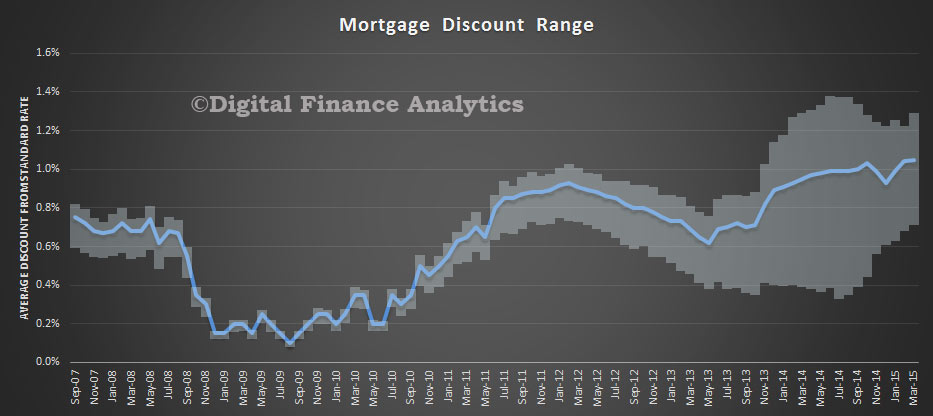

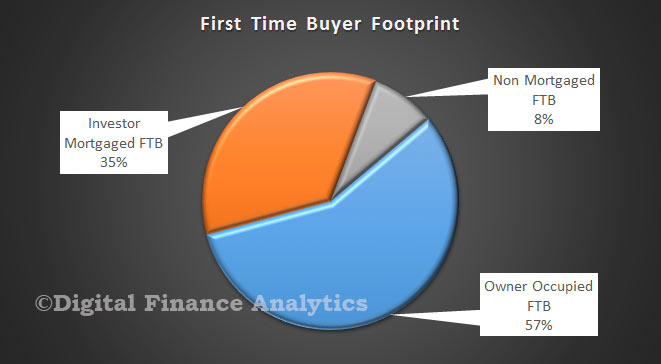

Mr Hofflin, fresh from speaking at the national “Big Day Out” events for financial advisers, shares regulators’ concerns about the state of lending, where almost half of new loans are to investors and 45 per cent on interest-only terms. He added that if you use gross rental yields, costs and taxes to generate, residential property is trading on a massive 60 times earnings — four times the value investors ascribe to the stockmarket.

The housing credit boom and insatiable appetite for yield stocks has pushed bank market capitalisations to about 35 per cent of the stockmarket, a level Mr Hofflin said he’d never seen before”.