Welcome to the Property Imperative weekly to 29th September 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Another mega week, with the Royal Commission interim report out, the FED lifting rates, APRA releasing their banking stress tests, more class actions launched and Banks lifting their provisions to cover the costs of remediation, so let’s get stuck in…

Another mega week, with the Royal Commission interim report out, the FED lifting rates, APRA releasing their banking stress tests, more class actions launched and Banks lifting their provisions to cover the costs of remediation, so let’s get stuck in…

Watch the video or read the transcript.

And by the way you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content..

The Royal Commission Interim Report came out on Friday and turned the spotlight on the Greed driving Financial Services to sell at all costs, take fees from dead people, and reward anti-customer behaviour. The report also called into question the role of the regulators, saying they were weak, and did not do their job. In fact, it’s not the lack of appropriate law, but it is noncompliance, without consequence which is the issue. They also raised the question of the STRUCTURE of industry. We discussed this in an ABC Radio National Programme, alongside Journalist Adele Ferguson and Ex. ACCC boss Graeme Samuel, and also in our show “Inside The Royal Commission Interim Report”.

The Royal Commission has touched on the critical issues which need to be considered. But now we have to take the thinking further. In terms of structure, we should be thinking about how to break up the financial services sector into smaller more manageable entities that are not too big to fail. We should separate insurance from wealth management from core banking, and separate advice from product selling and manufacturing. There is a clear opportunity to implement Glass Steagall, which separates risky speculative activity from core meat and potatoes banking services we need. There is a big job to be done in terms of cultural change, within the organisations, as they shift to customer centricity – building their businesses around their customers. This requires different thinking from the top. Also Regulators have clearly not been effective because they were too close and too captured. This must be addressed. The industry has played them, being prepared to pay small penalties if they get caught as just a cost of doing business. No real consequences.

Poor culture is rife across the industry and regulators. For example, LF Economics Lyndsay David tried under a FOI request to get APRA to release details of its targeted reviews into the mortgage sector from 2016. Specifically whether Treasury were aware of the results. They were not.

The review was never intended to made public but was revealed during the Hayne Royal Commission. It found that at Westpac only one in 10 of banks’ lending controls were operating effectively. In fact, APRA had ordered these “targeted review” in October 2016 and were conducted by PWC for WBC and CBA. On 12 October 2016, APRA issued a letter to the Bank and 4 other large banks requesting that they undertake a Review into the risks of potential misrepresentation of mortgage borrower financial information used in loan serviceability assessments. In its letter, APRA referenced assertions made by commentators that “fraud and manipulation of ADI residential mortgage origination practices are relatively commonplace”. Frankly the fact that these were buried, and the APRA still refuses to release they tells us more about APRA than anything else. After all we know mortgage fraud was widespread.

In this light, the APRA stress tests results, is on the same theme, high level, and vague, compared with the bank by bank data the FED releases, it’s VERY high level! In APRA’s view, the results of the 2017 exercise provide a degree of reassurance: ADIs remained above regulatory minimum levels in what was a very severe stress scenario. John Adams and I discussed this recently in our post “The Great Airbrush Scandal” APRA is not convincing.

ASIC revealed this week that it has identified serious, unacceptable delays in the time taken to identify, report and correct significant breaches of the law among Australia’s most important financial institutions. It can they say take over 4.5 years to identify that a breach incident has occurred! ASIC chair said “Many of the delays in breach reporting and compensating consumers were due to the financial institutions’ inadequate systems, procedures and governance processes, as well as a lack of a consumer orientated culture of escalation”.

So now there is a growing sense of panic as according to the Australian, for example, from APRA who says a horde of Australia’s biggest financial institutions and superannuation funds have been forced by the prudential regulator to ram through an in-depth review of their culture and governance before the royal commission ends next year. After copping heavy criticism over the course of Kenneth Hayne’s royal commission over a lack of enforcement in the financial sector, the Australian Prudential Regulation Authority has demanded Westpac, ANZ and National Australia Bank mimic the landmark cultural investigation of Commonwealth Bank the regulator launched late last year. Along with the major banks, some of the nation’s biggest union and employer-backed super funds — such as the $40 billion Hostplus, $35bn fund Cbus and $50bn REST super fund — have also been asked by APRA to review their culture.

And from the industry, for example the AFR reported that Westpac hauled each of its 40,000 bankers into urgent briefings by chief executive Brian Hartzer this week, before the Royal Commission Report came out, who warned them to bring forward customer problems.

Westpac also announced that Cash earnings in Full Year 2018 will be reduced by an estimated $235 million following continued work on addressing customer issues and from provisions related to recent litigation. This included increased provisions for customer refunds associated with certain advice fees charged by the Group’s salaried financial planners due to more detailed analysis going back to 2008. These include where advice services were not provided, as well as where we have not been able to sufficiently verify that advice services were provided; Increased provisions for refunds to customers who may have received inadequate financial advice from Westpac planners; Additional provisions to resolve legacy issues as part of the Group’s detailed product reviews; Provisions for costs of implementing the three remediation processes above; and Estimated provisions for recent litigation, including costs and penalties associated with the already disclosed responsible lending and BBSW cases. Costs associated with responding to the Royal Commission are not included in these amounts.

Across the industry more than $1 billion has been put aside, so far and more to come. And guess who will ultimately pick up the tab for these expenses – yes we the customers will pay!

Another class action was announced this week as Law firm Slater and Gordon said it had filed class action proceedings in the Federal Court against National Australia Bank and MLC on behalf of customers sold worthless credit card insurance. Most were existing NAB customers and the bank should have known the insurance was likely to be of little or no benefit to them. Despite knowing this, NAB have continued to push the insurance widely, reaping millions in premiums while doing so. most people were sold the insurance over the phone and were not given a reasonable opportunity to understand the terms and conditions of the policy.

We continued to debate the trajectory of home price falls, as Media Watch discussed the 60 Minutes segment we were featured in. Once again somewhat myopic views were expressed by host Paul Barry, as we discussed on our recent post. You can also watch the 60 Minutes segment on YouTube which covers my views more comprehensively. Prices are set to fall further. Period.

Realestate.com.au says that according to a survey of property experts and economists further falls in housing prices across Australia’s cities are expected. They suggest an 8.2% fall in house prices in Sydney, a 8.1% fall in Melbourne and a 7% fall in Brisbane. In fact all centres are expected to see a fall. Finder.com.au insights manager Graham Cooke was quoted as saying that the cooling market conditions made it harder for existing homeowners to build up equity. But they could be good news for first-home buyers with a deposit in hand. “If you’re thinking of getting into the market over the next few years, hold out until prices have dropped further and use this time to save for your upfront costs,” he said. “Right now, there’s no need to jump on the first suitable property you see. Waiting a few years could potentially save you thousands of dollars.”

Damien Boey at Credit Suisse said this week that by the start of 2020, Sydney house prices could have dropped by 15-20% from their 2017 peak. The market is heavily oversupplied, even before we consider the risk of higher insolvency activity and foreclosure sales. He argues that demand is the problem – not credit supply. We could ease lending standards from here, and still not cause housing demand to bounce back. Investors cannot sustain capital growth by themselves. They need a “greater fool” to on sell their houses too. But foreign demand is weak, and first home buyers are priced out of the market. Specifically, Chinese demand for property is weak, as evidenced by low levels of outward direct investment, and the failure of the AUD to rise in response to CNH weakness. Promised relaxation of capital controls has not eventuated, and CNY devaluation pressure has had a negative impact on credit conditions, as well as the ability of Chinese residents to export capital abroad. Finally, dwelling completions are still rising in response to high levels of building approvals from more than a year ago – the building lead time has lengthened significantly. As for the RBA, any rate cuts from here are unlikely to be passed on in full to end borrowers, given counterparty credit risk concerns in the interbank market.

UBS Global Housing Bubble Index came out and showed that Sydney had slipped from 4th to 11th in a year. They noted that Prices peaked last summer and have slid moderately as tighter lending conditions reduced affordability. Particularly since the land tax surcharge more than doubled and a vacancy fee was introduced, the high end of the market has suffered most. The vacancy rate on the rental market has also climbed. Nevertheless, inflation-adjusted prices are still 50% higher than five years ago, while rents and incomes have grown at only single-digit rates.

Corelogic reported further prices falls this week in Sydney, down 0.57%, Melbourne down 0.79%, Adelaide, down 0.15%, Perth down 0.73%, while Brisbane rose a little up 0.06%. Melbourne looks to be the weakest centre currently, and we continue to expect to see further falls.

CoreLogic says that last week 2,404 homes went to auction across the combined capital cities, returning a final auction clearance rate of 52.4 per cent, slightly higher than the 51.8 per cent the previous week which was the lowest seen since Dec-12. Over the same week last year, 2,782 homes went to auction and a clearance rate of 66.2 per cent was recorded.

Melbourne’s final clearance rate was recorded at 53.8 per cent across 1,161 auctions last week, compared to 54.1 per cent across a lower 988 auctions over the previous week. This time last year a higher 1,361 homes were taken to auction across the city and a much stronger clearance rate was recorded (70.6 per cent).

Sydney’s final auction clearance rate came in at 51.1 per cent across 851 auctions last week, up from 48.6 per cent across 669 auctions over the previous week. Over the same week last year, 1,033 Sydney homes went to auction returning a final clearance rate of 65.9 per cent.

Across the smaller auction markets, clearance rates improved across Adelaide and Tasmania, while Brisbane, Canberra and Perth saw clearance rates fall week-on-week.

Of the non-capital city auction markets, the Geelong region was the best performing in terms of clearance rate (61.1 per cent), followed by the Hunter region where 58.8 per cent of homes sold.

The combined capital cities are expecting 65 per cent fewer homes taken to market this week, with half the nation host to an upcoming public holiday, combined with both the NRL and AFL grand finals being held over the weekend, it looks to be a quiet week for the auction markets.

There are 846 capital city auctions currently being tracked by CoreLogic this week, down from the 2,404 held last week and lower than the 969 auctions held over the same week last year.

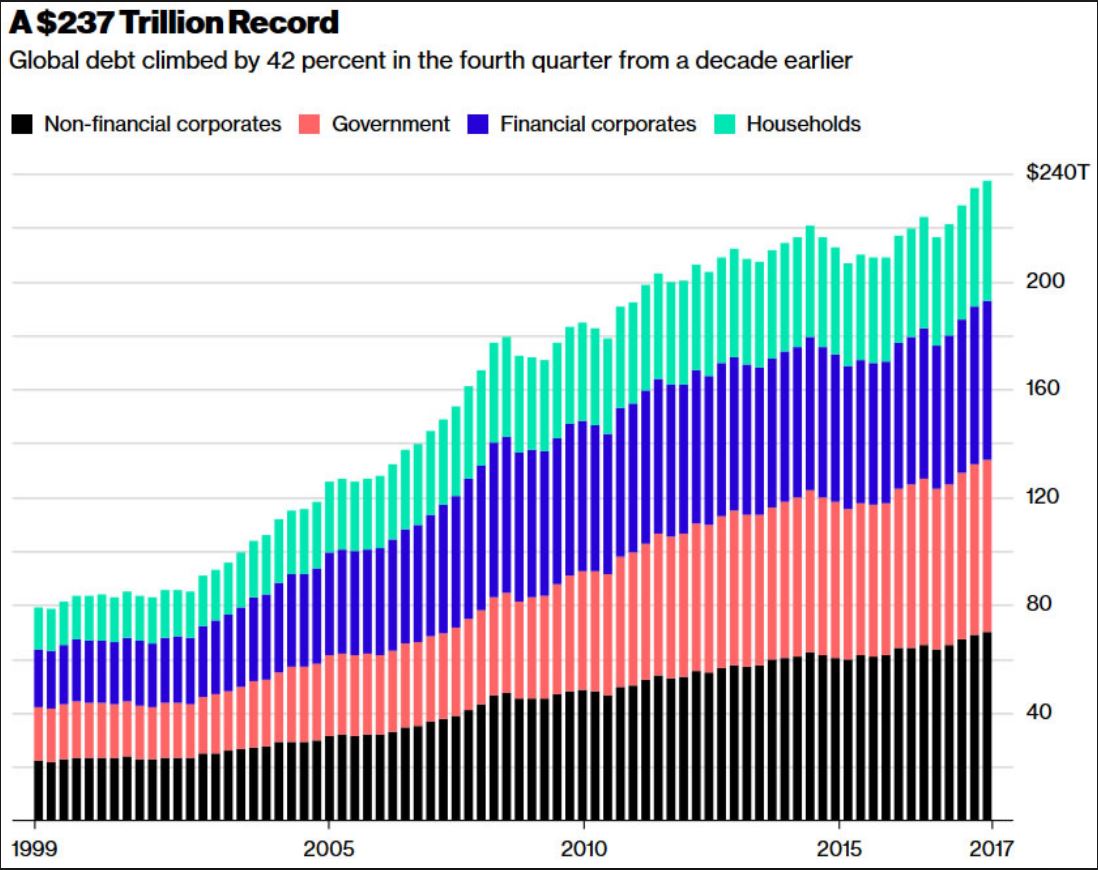

Finally, the latest RBA and APRA lending statistics, plus the June quarter household ratios, shows that credit growth is still too strong, with the 12-month growth by category shows that owner occupied lending is still growing at 7.5% annualised, while investment home loans have fallen to 1.5% on an annual basis. Overall housing lending is growing at 5.4% (compared with APRA growth of 4.5% over the same period, so the non-banks are clearly taking up some of the slack). Still above wages and inflation. Household debt continues to rise.

The non-bank sector (derived from subtracting the ADI credit from the RBA data) shows a significant rise up 5% last month in terms of owner occupied loans. APRA needs to look at the non-banks. And quickly. This was confirmed looking at the rising household debt to income ratios, where in short the debt to income is up again to 190.5, the ratio of interest payments to income is up, meaning that households are paying more of their income to service their debts, and the ratio of debt to home values are falling. All three are warnings. The policy settings are not right. You can watch our show “What Does The Latest Data Tell Us? But for now it is worth highlighting that despite all the grizzles from the property spruikers, mortgage lending is STILL growing…. and faster than inflation. We have not tamed the debt beast so far, despite failing home prices. No justification to ease lending standards – none.

So to a quick look at the markets. The ASX 200 Financial Sector Index was up 1.20% on Friday to close at 6,127 – in a relief rally that the Royal Commission report was not worse (and the prospect of less regulation was mooted). We think this will reverse as the full implications of the report are digested, but of course the market profits from volatility. CBA, the biggest owner occupied mortgage lender was up 1.9% to close at 71.41, despite some analysts now suggesting a fair price closer to 65.00. Both are a long way from the 81.00 it reached in January. It will not return there anytime soon.

Westpac rose 1.16% to close at 27.93, still well off its November 2017 highs of 33.50, National Australia Bank rose 1.76% to 27.81 and ANZ closed at 28.10 up 1.4%. AMP, who has already been hit hard by the Royal Commission rose 1.59% to 3.19, still way down on its March highs before the revelations came out. Macquarie Group fell 1.34% and ended at 126.04. Suncorp ended at 14.46, up 0.84% and Bendigo Adelaide Bank rose 1.22% to 10.75. The Aussie ended up a little to 72.22, 0.19% higher on Friday, but with still more falls expected ahead, we think it could test 71.00 quite soon.

In the US markets, the Dow Jones Industrial ended at 26,458, up 0.07%, but off its recent highs, the NASDAQ ended up 0.05% to 8,046, while the S&P 500 was flat at 2,913. The Volatility index was lower, at 12.12, down 2.34%. The bulls are, in the short term at least, firmly in control.

Gold was up 0.74% to 1,196, but still in lower regions than last year, reacting to the strength of the US Dollar. Oil was higher again, up 1.41% to 73.53. In fact, until sizable supply is offered up by OPEC some are suggesting we could see prices above the $100 per barrel market, but $100 seems an overreach on the current charts.

On the currencies, the Yuan USD was up 0.31% to 14.56, as China continues to manage the rate lower. Of course the trade wars are in full play.

President Trump has announced a 10% tariff on $200 billion in Chinese imports. That tariff is currently 10%, but at the end of 2018, that’s expected to rise to 25%. This is the third round of tariffs, and it’s the largest round of tariffs. Back in July, we had $34 billion worth of Chinese goods tariffed. Then, in August, we had a follow-on of $16 billion in tariffs. So, this is really a huge jump up of $200 billion. This is affecting all kinds of goods. The U.S. brings in a little over $500 billion worth of goods from China. The $250 billion so far this year is roughly half, but Trump has said that if China were to take retaliatory action on these tariffs, which they have, in fact, then he’s going to put in place another $267 billion worth of imports. For all intents and purposes, that would put a tariff in place on 100% of U.S.-China trade.

China also announced some tariffs on $60 billion worth of goods that also went into effect on September 24th. This is in addition to, China had also had previously announced tariffs of $50 billion. The total U.S.-China trade is about $130 billion dollars of imports of United States goods into China. This second round of Chinese tariffs is going to now cover $110 billion dollars of the $130 billion of U.S.-China trade — again, almost 100% of the entire trading relationship.

So, this is pretty significant in that almost all the cards have been played here. If all the threats and allegations with regard to tariffs are followed through upon, all of U.S.-China trade is set to be under some kind of tariff barrier in 2018. This will be a big deal.

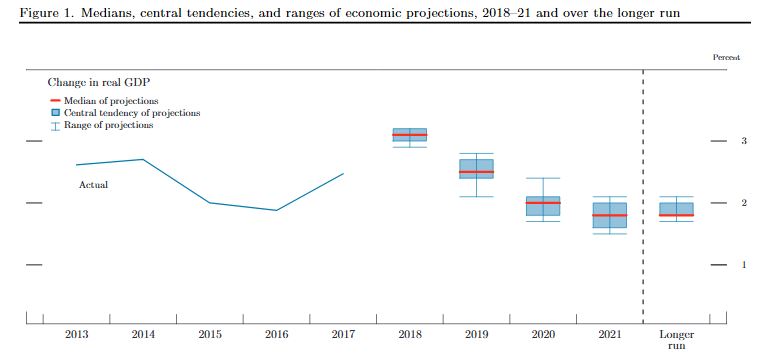

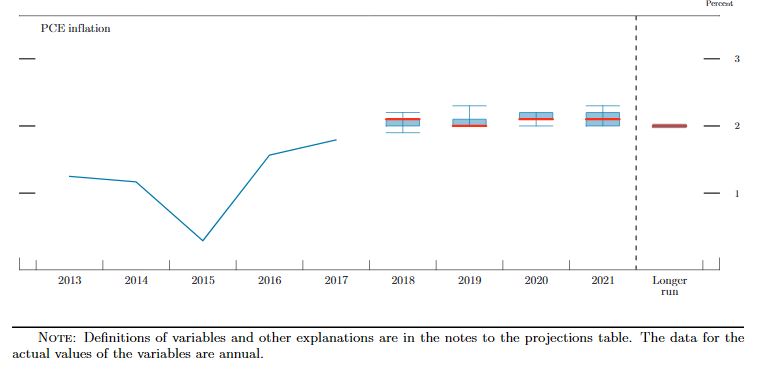

The 10 Year Bond rate was up 0.29% to 3.065 after the Fed rate hike this week. The Fed moved as expected, and continues to highlight more upward movements in the months ahead – in fact their language is arguably more bullish now. The target range for the federal funds rate is now 2 to 2-1/4 percent. In their projection release, they see GDP sliding from 2019…. while inflation is expected to rise. The 3-month rate was up 0.35% on Friday to 2.207., still signalling a recession risk down the track. We discussed the impact of the US Rated move in our show “The FED Lifts, More Ahead And What Are The Consequences?”

We think the US corporate bond market is the key here, and we discussed this in our video Is A [US] Corporate Meltdown On The Cards?

Finally, turning to Crypto, Bitcoin ended down 1.43% to 6,617. Little signs of new directions here in the short term.

So in summary a week dominated by the Royal Commission locally, against a back cloth of higher international interest rates, and risks. We are, as they say, set for interesting times ahead.