The Australian bond market is likely to feel the effects of US President Donald Trump’s protectionist trade stance both directly and indirectly, writes Nikko Asset Management’s James Alexander.

The emergence of China is clearly of great importance to the economic fortunes of Australia, and as a result it may be tempting to downplay, or even overlook, President Trump’s agenda and its impact on Australia.

While our largest import and export partner is now China, Australia will still be impacted by US trade policy both directly and, perhaps more importantly, indirectly.

The difficulty for investors, however, is the general uncertainty around future US trade policy, and the impact the Trump administration will have on financial markets.

Uncertainty around trade

While most of President Trump’s comments so far have been directed at China and Mexico, we do know that he is not a fan of trade deals negotiated by others.

Trade deals he has criticised in which Australia has been involved include the Trans-Pacific Partnership (TPP), from which the US has just withdrawn, and the North American Free Trade Agreement (NAFTA).

The essential message here is that these are bad deals for the US, as opposed to future Trump-negotiated deals, which will of course be good for the US.

It is likely to be some time before we can reasonably assess the impact of changes to US trade policy with Australia directly, given their larger trade relationships are most certainly ahead of us in the queue.

This brings us to the indirect but significant impact of the US’ future trade relations with our biggest trading partner, China.

A tit-for-tat trade war is likely to be harmful to both the US and China, with Australia most certainly suffering some collateral damage.

It is too early to tell how this relationship will unfold but the early signs are not great, with President Trump taking every opportunity to criticise China.

These two economic heavyweights have plenty of tools to ‘penalise’ each other on trade, which could potentially hurt Australian trade in the process.

Rising bond yields

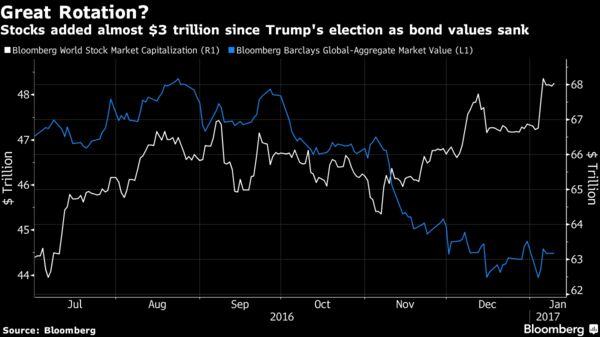

The other broad area where the impact of a Trump presidency is likely to be felt is in financial markets – more specifically, bond yields and foreign exchange rates.

Australia’s bond yields have historically been strongly correlated with US Treasury yields and this is likely to continue.

If the Trump agenda of lower taxes, increased infrastructure spending and more protectionist trade policy prove to be inflationary as we expect, US interest rates and bond yields are likely to be headed higher.

Australian bond yields will surely follow, as Commonwealth bond yields must remain globally competitive to ensure international investors continue to support our borrowing needs.

Another widely discussed by-product of Trump’s agenda is a stronger US dollar.

While the Australian dollar has fallen by around 2.5 per cent against the American currency, it has actually risen slightly on a trade-weighted basis since the presidential election in November.

This divergence, should it continue, will be one to watch carefully.

While a weaker Australian dollar would indeed help to counter any negative impact from higher bond yields, weakness that is mainly isolated to the US dollar is not nearly as helpful as weakness on a trade-weighted basis.

James Alexander is the co-head of global fixed income and head of Australian fixed income at Nikko Asset Management.