My latest Friday afternoon chat with Journalist Tarric Brooker, who is @AvidCommentator on Twitter.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

My latest Friday afternoon chat with Journalist Tarric Brooker, who is @AvidCommentator on Twitter.

Go to the Walk The World Universe at https://walktheworld.com.au/

I caught up again with Steve Van Metre to discuss the latest macro outlook, following the recent interventions to try to tame the bond rates by Central Banks, including the RBA, as volatility rose and the talk of inflation has reached fever pitch.

Steven Van Metre, Certified Financial Planner™ Professional, (CA Insurance License #0D45202 & Investment Advisory Representative with Atlas Financial Advisors, Inc., a Registered Investment Advisory firm.) is a financial planner, portfolio manager, and President of Steven Van Metre Financial. He specializes in retirement income strategies and the direct management of client assets.

https://www.youtube.com/channel/UCRIQM-CUkxVazVPv980YZsw/videos

Go to the Walk The World Universe at https://walktheworld.com.au/

I catch up with Damien Klassen from Nucleus Wealth to discuss the latest on the bond rates, inflation and Central Bank intervention.

Go to the Walk The World Universe at https://walktheworld.com.au/ for more on Nucleus Wealth.

Posted on by Damien Klassen

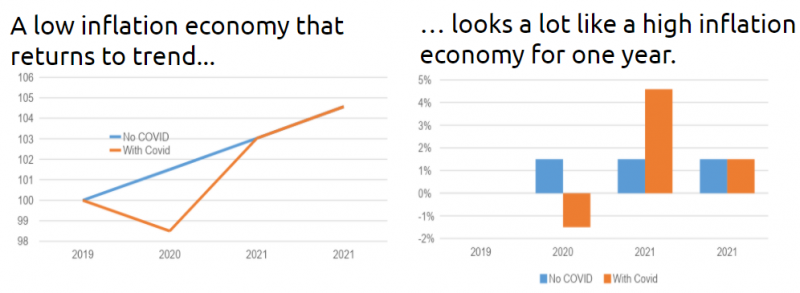

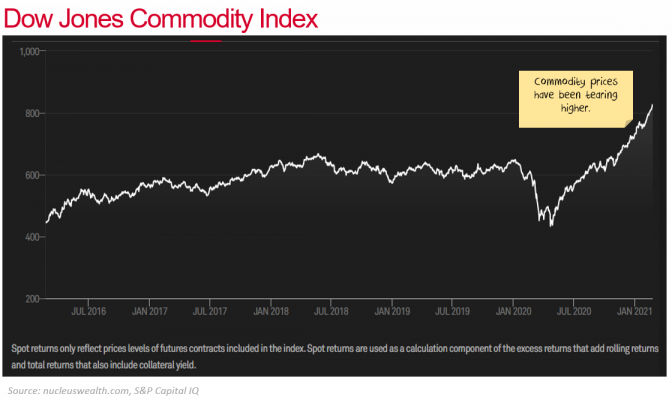

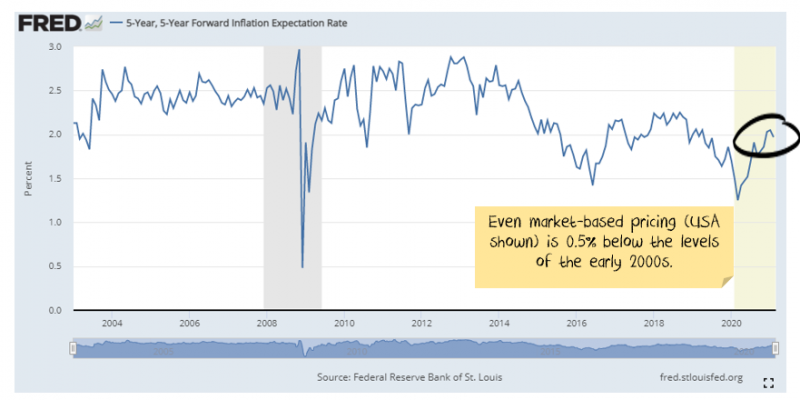

While rising inflation expectations were a minor feature in January, in February markets reflected higher inflation expectations and we expect this to continue in 2021.

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game will be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

In short, policymakers have decided on zombification: limit bankruptcies; increase debt and never raise interest rates again. It doesn’t make for a healthy economy. But it limits short-term pain which appears to be the current goal of most politicians.

This zombification is inflationary in the recovery phase but deflationary soon afterwards as oversupply swamps demand.

We are, therefore, suspicious that beyond 2021/22 we are entering a new inflationary cycle, as some have posited.

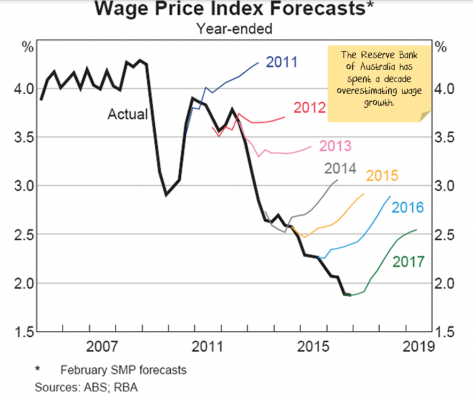

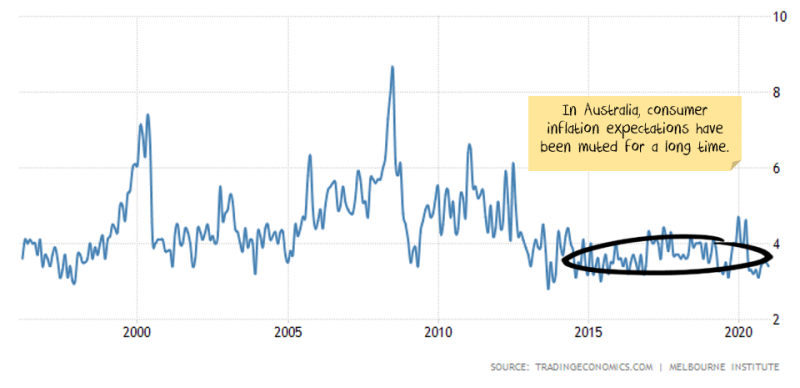

For almost the past 15 years many economists have been forecasting a dramatic return to inflation driven by central bank largesse. The most fearful of these suggest that inflation is an inevitable consequence of quantitative easy and that Weimar Germany / Zimbabwe hyperinflation is not far off. So far they have been wrong.

They are about to have their day in the sun. Or at least something that looks like the start of their day in the sun. Inflation will bounce hard over the next six months, especially in the US on the back of a number of factors:

The Value stock rotation lives and dies on this narrative.

It can continue with inflation and rising market interest rates or end without it, culminating in a return to Growth stocks. We are positioning for a run to Value that lasts for 6-12 months. For it to continue, we will need to see more policy innovation, especially the putative integration of fiscal and monetary policy worldwide.

For the past dozen years inflation has disappointed, continually falling below central bank expectations. This is for a number of reasons, the key ones include:

With this in mind, the important investment factor for 2021 will be managing the inflation scare, followed by its likely disappointment.

There are a number of factors that could extend the duration of the elevated inflation, the chief being government stimulus. We are expecting it to be six months or more before it is time to switch back into the stocks that are resistant to deflationary pressures.

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Go to the Walk The World Universe at https://walktheworld.com.au/

Economist John Adams And Analyst Martin North discuss market manipulation using “Black Wednesday” in the UK as an example, and extending it to other markets, including Silver which is currently under the microscope. Asymmetric opportunity might await those who recognise that we have departed from fair market value.

Go to the Walk The World Universe at https://walktheworld.com.au/

Two important discussions on why the inflation myth may not be true and why stagflation is unlikely.

You might want to revisit my recent show with Steve Van Metre: Inflation, Deflation, Confusion https://youtu.be/4hRdbcsX1es

Go to the Walk The World Universe at https://walktheworld.com.au/

My latest Friday afternoon chat with Tarric Brooker, Journalist. He can be found at @AvidCommentator on Twitter.

See his recent article: https://independentaustralia.net/politics/politics-display/bank-neoliberalism-sets-the-stage-for-the-next-trump,14804

0:00 Start

0:32 Introduction

2:00 Tide Going Out/ Employment Figures

5:50 “Election Keeper”

7:45 Job Keeper Stats

13:00 US Employment

17:00 Will Rates Rise?

20:10 Global Debt Up To $281 Tr

24:20 Migration Taps On?

32:44 The Facebook Affair

36:40 People And Bad News

41:00 UK Poles

43:10 US and Biden

49:00 Polarisation

53:00 Trump Mark 2

54:34 Ending

Go to the Walk The World Universe at https://walktheworld.com.au/

I discuss the key issues which we need to consider to ensure financial advice is effective, with Tim Fuller Head of Advice at Nucleus Wealth.

“Seeking financial advice can be a daunting endeavour. With more than 80% of Australians without financial advice, and 45% of the adult population calculated to be financially illiterate, there is proof that work needs to be done to help more people get help with their personal finances. This article aims at those who had never sought financial advice before and were wondering how to do it, and what to expect from the experience.”

Go to the Walk The World Universe at https://walktheworld.com.au/

Join our live show tonight, and ask a question live via the YouTube Chat.

Join us for a live Q&A as I discuss the latest on the financial markets with Damien Klassen, Head Of Investments at Nucleus Wealth. https://nucleuswealth.com/author/damien-klassen/

I caught up with George Gammon to discuss one of the most important economic and social issues in play, yet one which is not well understood – and which is been driven by the global technocrats.

He is a Real Estate Investor, entrepreneur and self proclaimed macro economics addict. Prior to 2012, George started and operated multiple businesses in the convention and advertising space. He grew his last business to $24 million in annual revenues and over 100 employees.

George is a gifted teacher with a passion for learning and teaching macroeconomics. If he’s not breaking down complicated topics like the repo markets, then you’ll find him interviewing the World’s top experts in their respective fields.

https://www.georgegammon.com/ Also see his YouTube channel.

https://www.youtube.com/channel/UCpvyOqtEc86X8w8_Se0t4-w

Go to the Walk The World Universe at https://walktheworld.com.au/