The latest edition of our weekly finance and property news digest with a distinctively Australian flavour.

Contents:

0:24 Introduction

0:58 US Markets

3:10 The Feds “Non-QE” QE

5:40 Brexit and UK Markets

6:50 Metro Bank

8:06 ECB

10:20 Australian Segment

10:30 Economic Data

12:30 Cash Transaction Ban

14:20 Property Sales and Prices

16:45 Foreign Buyers

18:45 WA First Time Buyer Incentives

19:40 Bank Profitability

20:30 Interest Only Lending

21:25 Local QE Is Coming

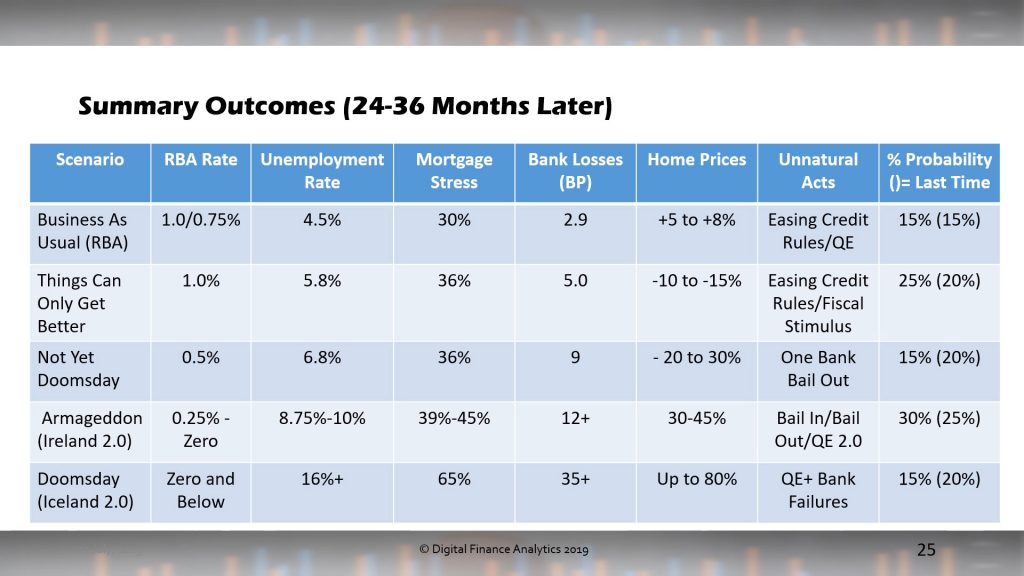

25:30 Local Market Summary