Back in 2007, the ratings agencies were so woefully behind the eight ball in understanding and reporting the credit risks in the U.S. financial system that it was nearly impossible to tell from day to day whether they were really just that incompetent or if they were complicit in the biggest financial fraud in history. Regardless of which you believe is more likely, they seem intent upon not making the same mistake again…at least not in Australia.

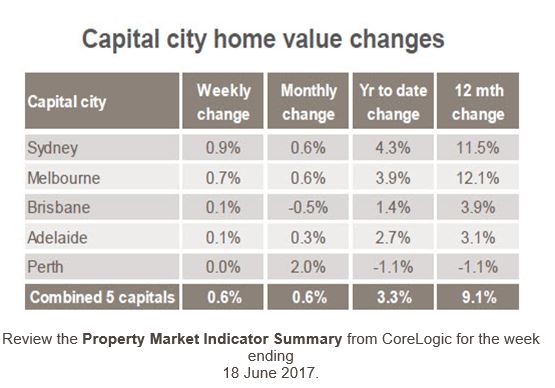

As The Sydney Morning Herald points out today, Moody’s has cut the long-term credit rating of Australia’s four biggest banks after pointing to surging home prices, rising household debt and sluggish wage growth as potential threats to the financial industry down under. Australia & New Zealand Banking Group Ltd., Commonwealth Bank of Australia, National Australia Bank Ltd. and Westpac Banking Corp. were all downgraded to Aa3 from Aa2, Moody’s said in a statement released earlier today. Per The Sydney Morning Herald

“In Moody’s view, elevated risks within the household sector heighten the sensitivity of Australian banks’ credit profiles to an adverse shock, notwithstanding improvements in their capital and liquidity in recent years,” the statement said.

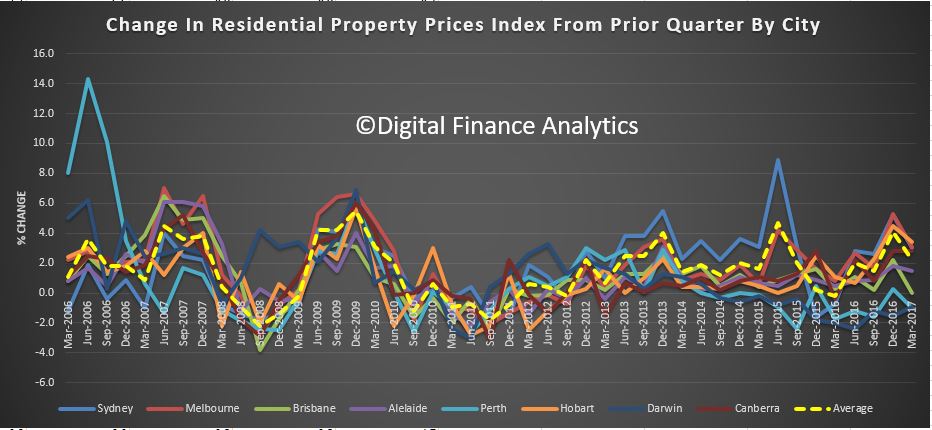

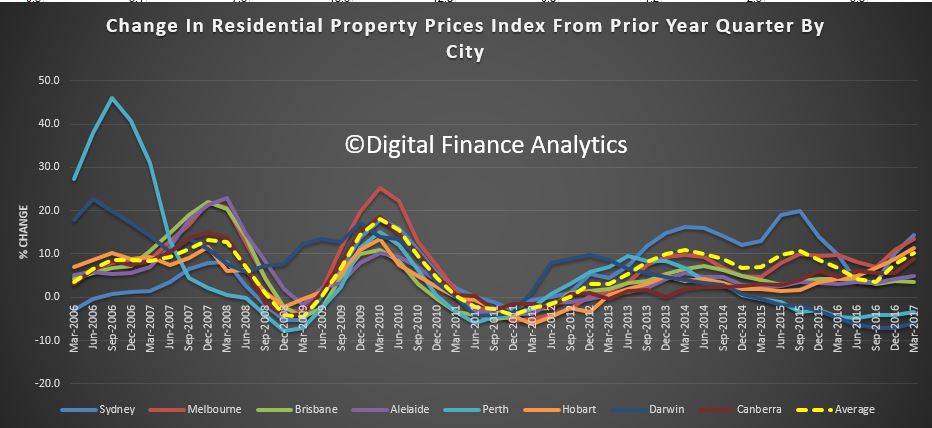

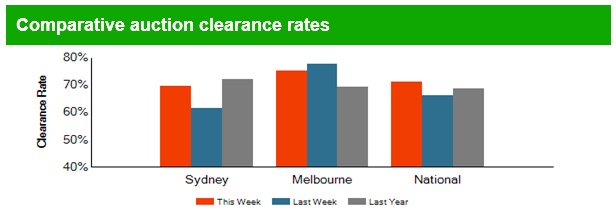

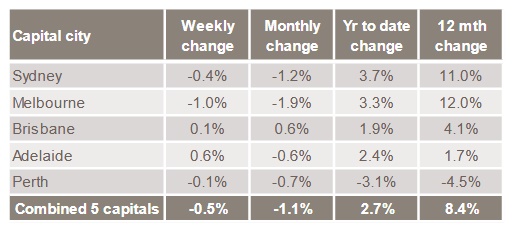

“In Moody’s assessment, risks associated with the housing market have risen sharply in recent years. Latent risks in the housing market have been rising in recent years, because significant house price appreciation in the core housing markets of Sydney and Melbourne has led to very high and rising household indebtedness,” the statement said.

“The rise in household indebtedness comes against the backdrop of low wage growth and structural changes in the labour market, which have led to rising levels of underemployment”.

“Whilst mortgage affordability for most borrowers remains good at current interest rates, the reduction in the savings rate, the rise in household leverage and the rising prevalence of interest-only and investment loans are all indicators of rising risks.”

Of course, as we’ve pointed out multiple times before, the Chinese money laundering operation…sorry, we meant Sydney “housing market”…puts the previous U.S. housing bubble to shame.

Of course, all of the banks that are now being downgraded are the same ones that assured us just a couple of months ago that Australian home prices were not in a “speculative bubble.” Testifying before a parliamentary committee, the chief executives of National Australia Bank, Westpac Banking and Commonwealth Bank of Australia all said that while they were worried about elements of the housing market, prices weren’t over-inflated. Per Bloomberg

“I would draw the distinction between a speculative bubble in prices and prices beyond what fundamentals would justify,”Westpac’s Brian Hartzer told the committee in Canberra Wednesday. A bubble isn’t occurring in Sydney or Melbourne, where house prices have risen the most, he said.

“There are increasing risks, but I still believe the answer is no,” National Australia Bank’s Andrew Thorburn said when asked if houses in Sydney and Melbourne are overpriced.

Commonwealth Bank, the nation’s largest mortgage lender, is “lending at levels we are comfortable with” across Australia, Chief Executive Officer Ian Narev told the committee when he testified Tuesday.

Meanwhile, the ever-important “crane-index” helps to put some perspective around just how ‘bubbly’ the Australia market has become.

Of course, maybe Australia’s bankers are right and bubbly home prices are just the result of strong fundamentals. Although, the last time a prominent banker made a similar prediction in the U.S. he turned out to be just a bit off the mark. Ben Bernanke (July 2005):

“Well, unquestionably, housing prices are up quite a bit; I think it’s important to note that fundamentals are also very strong. We’ve got a growing economy, jobs, incomes. We’ve got very low mortgage rates. We’ve got demographics supporting housing growth. We’ve got restricted supply in some places. So it’s certainly understandable that prices would go up some. I don’t know whether prices are exactly where they should be, but I think it’s fair to say that much of what’s happened is supported by the strength of the economy.”

Oops!