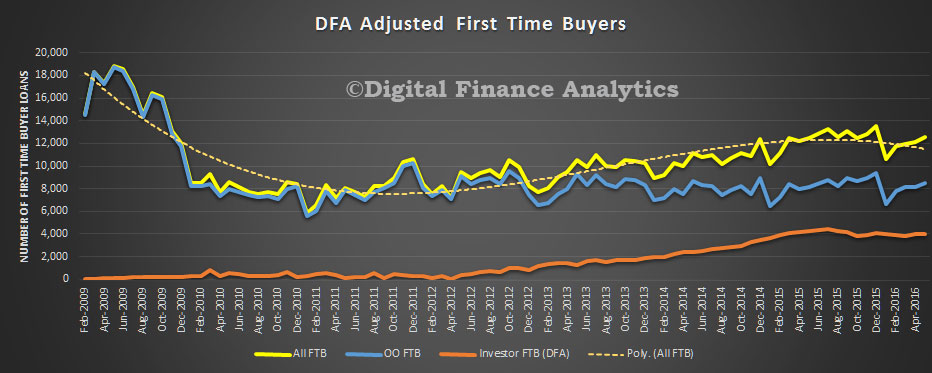

Are you on the property ladder? You might want to look again. That comforting metaphor of an aspirational route to economic security has come to dominate our thinking, but what if it wrongly describes the phenomenon? There has been a steady decrease in the number of first-time house buyers since 1980, with the biggest drop of 47% occurring from 2007 to 2008. It may be that the British housing market now resembles the classic pyramid scheme scam that rewards those at the top and punishes the fools who dive in too late or can’t dive in at all.

I’m certainly not the first to think of the housing market in this way. As journalist Gabby Hinsliff observed:

Rather like pyramid-selling scams, housing markets need a constant stream of fresh-faced hopefuls coming in at the bottom in order to keep delivering big returns at the top.

So is this really true, and if it is, should we continue to tolerate such a mainstream social practice which seems to be so ethically dubious?

A losing game

The classic pyramid scheme is essentially a sales scam. Someone is recruited and pays a fee to join a team ostensibly flogging something – health supplements, perhaps, or even providing no product or service at all. This recruit then gets a cut from the fees paid by the salespeople he or she newly recruits. They then do the same. Very quickly, the scheme reaches saturation point.

Two more generations of suckers? EPA/HANNAH MCKAY

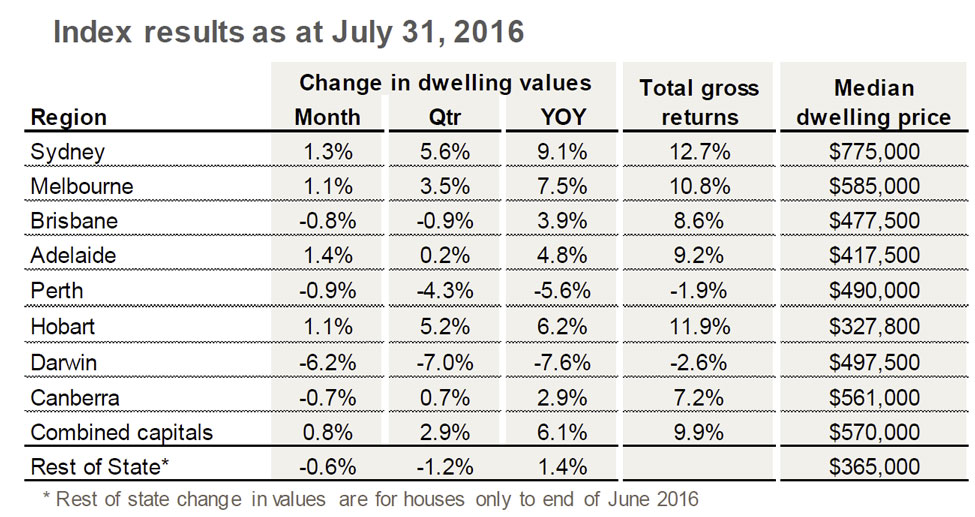

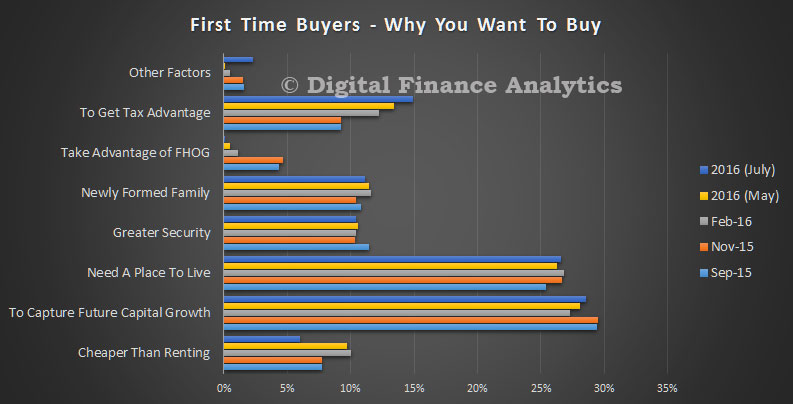

So how does this relate to the housing market? Let us begin with an essential feature of pyramid schemes: most people lose. This involves the membership factor in which new recruits pay a progressively higher fee to get onto the pyramid. In other words, the pyramid is driven by a top-down dynamic. Those at the lowest level try to recoup what they paid to become members by making a profit off those wishing to gain access to the scheme. Chronologically, those who come later have a greater risk of losing.

Under the current economic system, those pensioners sitting on six-bedroom townhouses in chic parts of London, bought for pennies in the post-war period, are our equivalent of pyramid scheme bosses – through no fault of their own, of course.What makes the housing market more restrictive than a classic sales scam is that its sale item is finite in supply. There may be an almost unlimited supply of health supplements in the example above, but with housing there is only so much land available. This makes entry into the scheme more competitive, and by virtue of that, it has the effect of increasing demand.

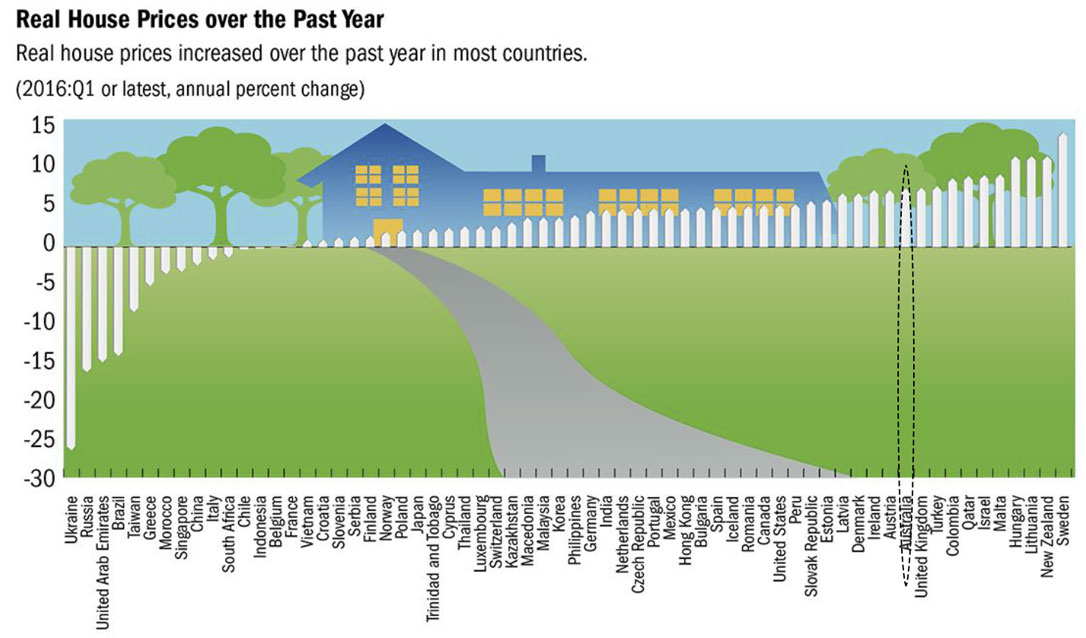

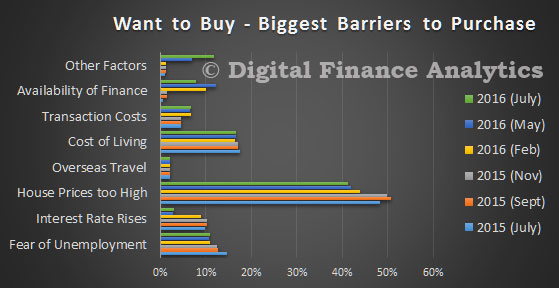

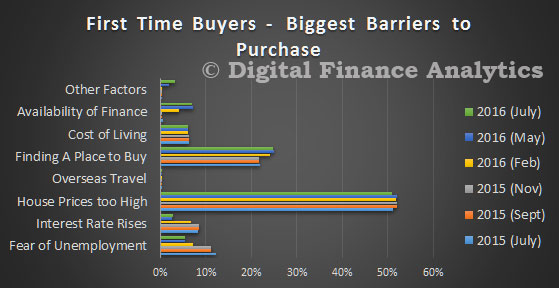

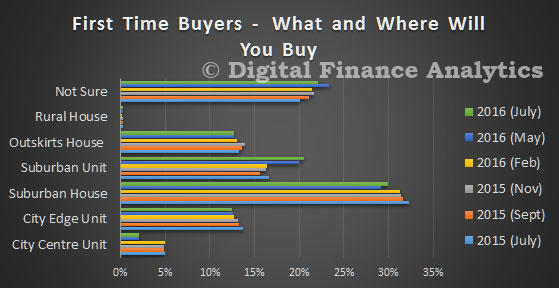

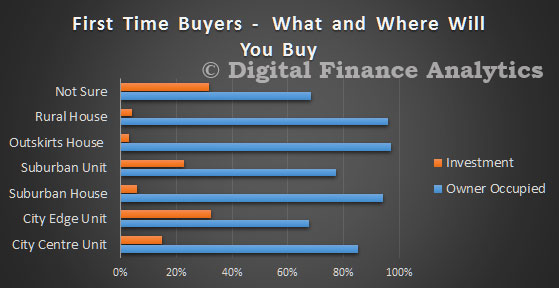

In short, most people lose in the housing market because most people who do not own property can never really afford to do so. Despite government efforts to help, first-time buying has continued to struggle, and the odds of finding an affordable price are stacked against non-owners. They may even find that those most willing to buy property already own some. Indeed, such speculators know that the more they buy up land, the more it will tend to be in higher demand.

Saturation

There is a second essential feature of pyramids: most people lose because there is no one left to pay the higher fee. In effect the market reaches saturation point. In housing, this happens because non-owners, who usually constitute the majority of the population, cannot find the means to make the high fee payments – in other words, a mortgage deposit and monthly payments. And this is where the ethically dubious nature of the scheme emerges.

In classic pyramids, the good or service being sold is not really important. With the housing market, the good in question is essential. One can easily live without health supplements, for example. Yet, show me one person who can live and work without access to land or shelter. In other words, at the sake of making a profit for the few, the majority of people are denied access to land, which is access to the opportunity to flourish.

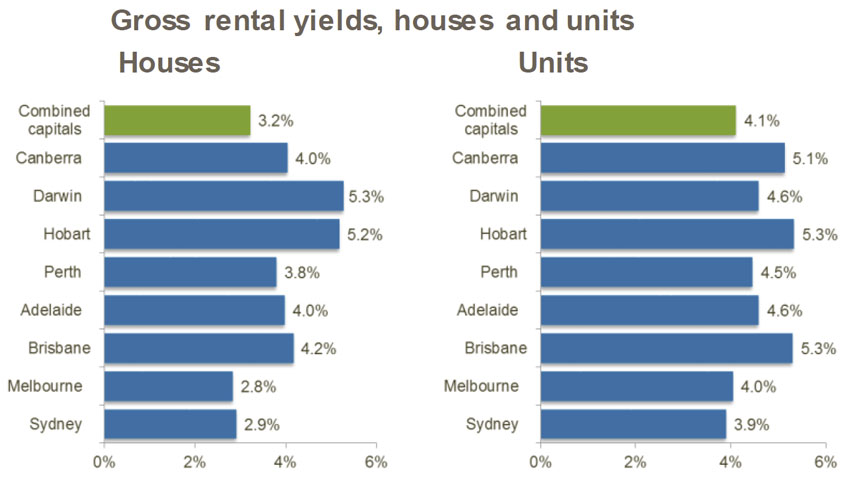

It will have damaging effects more broadly, too. In a build-up of the housing market, the allure of property investment is so high that money is diverted to buying property rather than to production. Without investment in production, non-owners do not see an increase in their wages. If we go back to the pyramid scheme set-up, investment in production is like telling a salesperson to concentrate on selling the vitamin supplements, rather than on recruiting more salespeople into the scheme, which is where the easy money lies.

No knockdown prices here. stockcreations/Shutterstock

Why fund a new business and wonder about whether it is going to succeed when you can buy the land on which either the business relies or on which its employees rely in order to live? If investing in property means diverting money from production and wages, then the economic system is bound to break. In other words, we are all bound up in this giant pyramid scheme whether we like it or not; whether we own property or not; whether we are suckers are not.

The obsession with maintaining the everlasting growth in the housing market places the economy in a stranglehold and engenders something that looks very much like a pre-crash phase. It’s not just the non-owners who lose, but because production itself takes a hit, property owners also lose in terms of property investments which do not make a return.

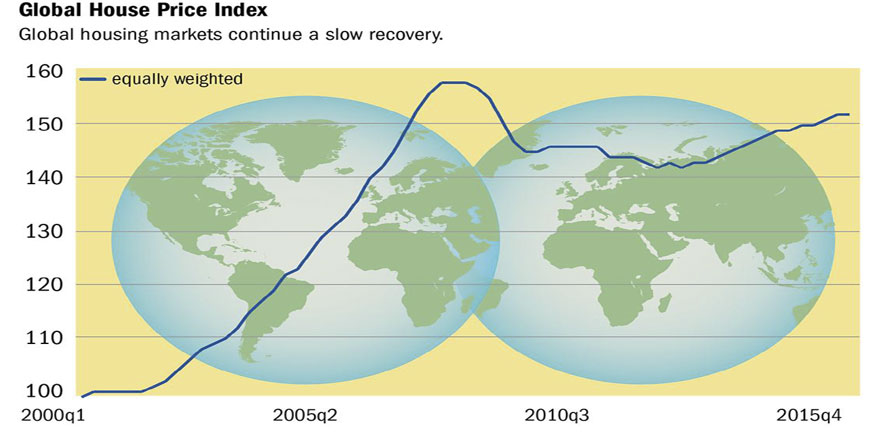

So why hasn’t the housing market caused the economy to break once and for all? Well it certainly came close in 2008, but our economic system seems flexible enough to make adjustments that keep us afloat. However, these adjustments are makeshift reactions to a system’s fundamental problems rather than a remedy. Why not fix the problems? Why not raze the pyramid that is the housing market? To do that would require a philosophical change: an appeal to understanding how land (and thus housing) constitutes a unique kind of primary good that cannot be subject to the same kinds of conventions as capital.

Author: Todd Mei, Lecturer in Philosophy, University of Kent