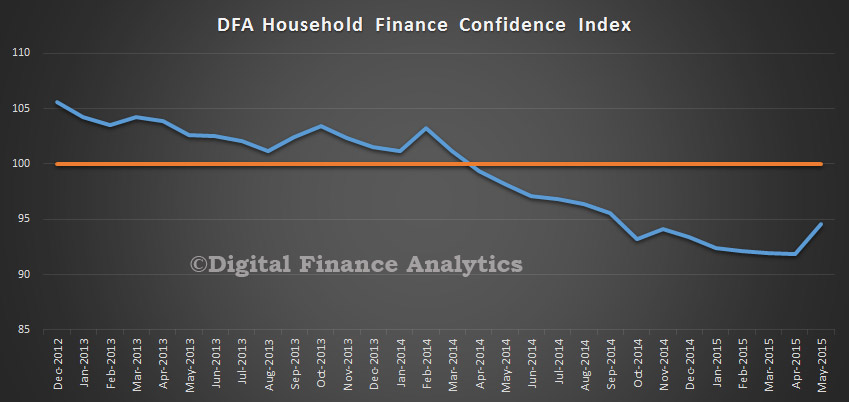

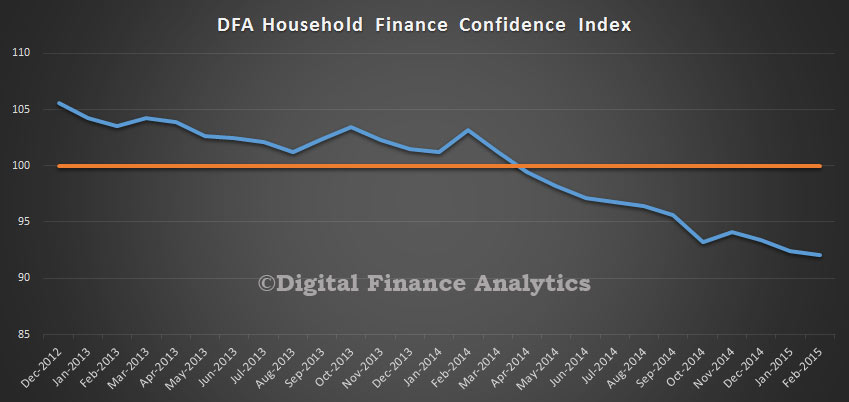

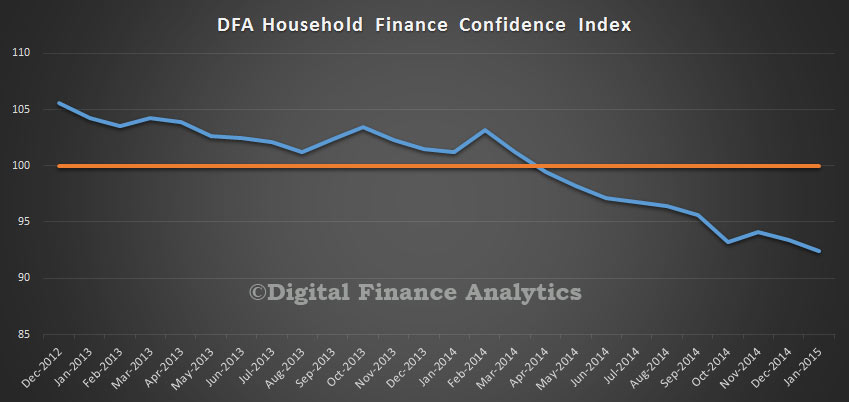

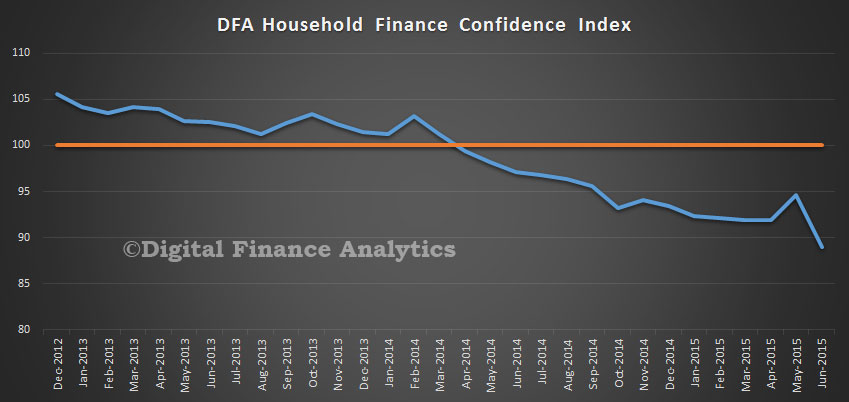

The latest edition of the DFA Household Finance Confidence Index was released today. The latest data to end June shows there was a fall over the last month, the score moved from 94.6 to 89.0, the lowest score since the index started in 2012. A number of factors pressed in on households, including the international financial situation, flat or falling real incomes, concerns about local job security, and concerns about security.

The results are derived from our household surveys, averaged across Australia. We have 26,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health.

The results are derived from our household surveys, averaged across Australia. We have 26,000 households in our sample at any one time. We include detailed questions covering various aspects of a household’s financial footprint. The index measures how households are feeling about their financial health.

To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

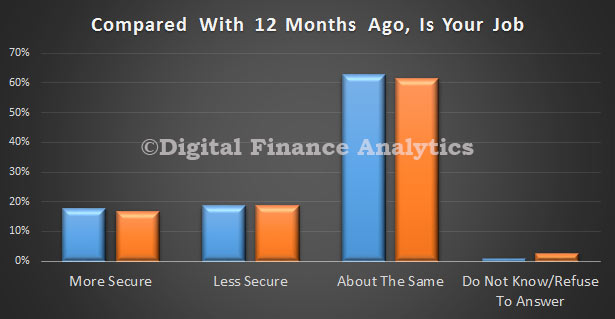

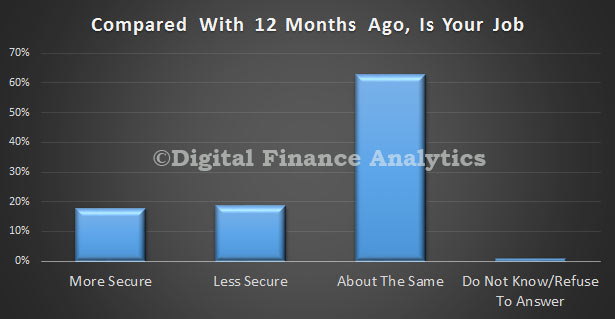

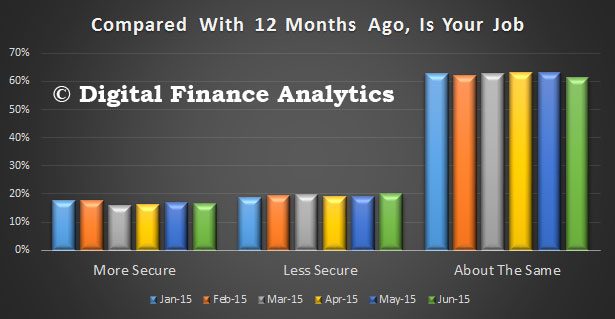

Looking at the drivers of the index, this month, overall job security fell, with those feeling more secure than a year ago at 16.4%, down 0.5%, whilst those who feeling less secure rose by 0.82% to 19.8%. Local employment conditions are still worrying many, overlaid by the international situations in Europe and China.

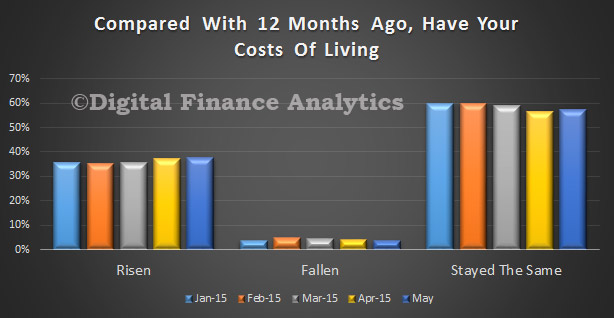

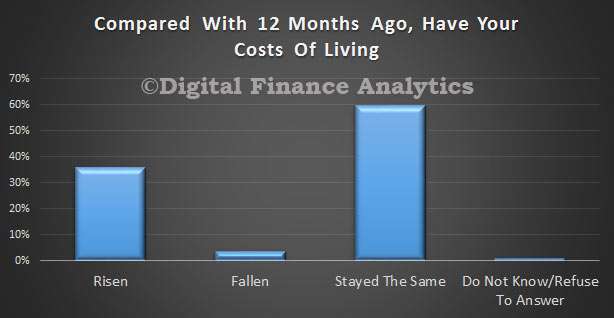

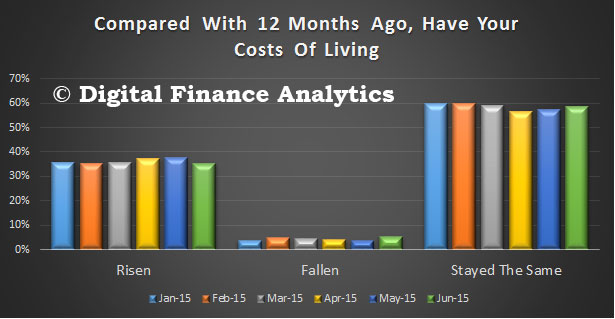

Looking at costs of living, those who said their costs of living rose in the past year was at 35.3%, down by 2.3%, whilst 58% said costs were similar, up 1.19%. Many commented on the costs of child care, which appears to be a major household budget issue.

Looking at costs of living, those who said their costs of living rose in the past year was at 35.3%, down by 2.3%, whilst 58% said costs were similar, up 1.19%. Many commented on the costs of child care, which appears to be a major household budget issue.

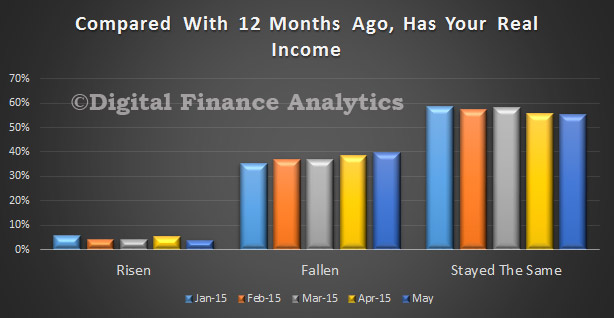

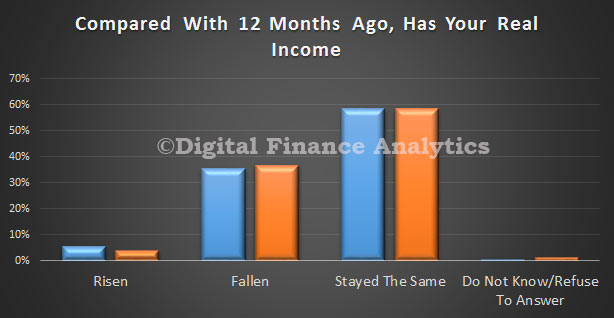

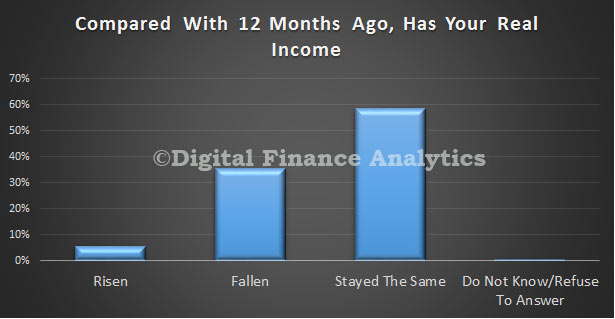

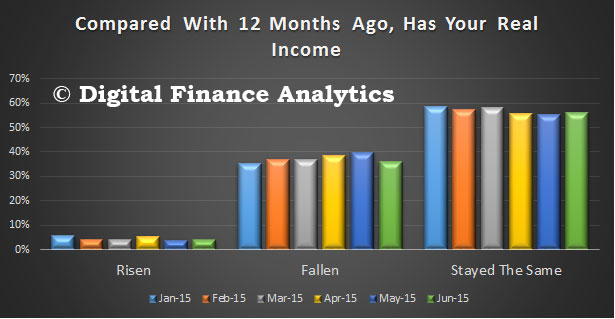

About 5% said their incomes had risen in real terms in the last year, whilst 36% said their incomes had fallen, which is up slightly from last month. Many have not been able to benefit from a cost of living pay rise, and overtime opportunities are limited.

About 5% said their incomes had risen in real terms in the last year, whilst 36% said their incomes had fallen, which is up slightly from last month. Many have not been able to benefit from a cost of living pay rise, and overtime opportunities are limited.

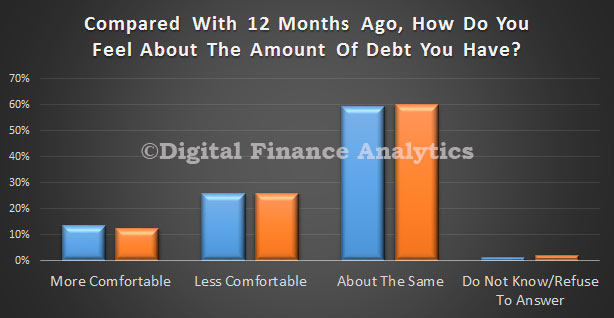

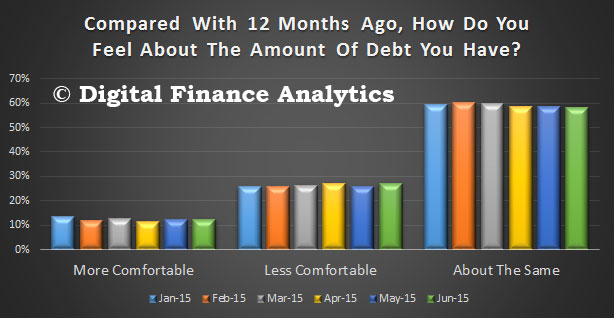

Lower interest rates have impacted households attitudes to debt. About 12.4% of households were more comfortable, thanks to these lower rates, although the proportion who felt uncomfortable with their level of debts rose 1.2% to 27%. Those with a more recent and large mortgage were the most uncomfortable. Around 58% of households were as comfortable as 12 months ago. We noted that younger households with mortgages were the most concerned, whilst older households with lower debt levels were more confident.

Lower interest rates have impacted households attitudes to debt. About 12.4% of households were more comfortable, thanks to these lower rates, although the proportion who felt uncomfortable with their level of debts rose 1.2% to 27%. Those with a more recent and large mortgage were the most uncomfortable. Around 58% of households were as comfortable as 12 months ago. We noted that younger households with mortgages were the most concerned, whilst older households with lower debt levels were more confident.

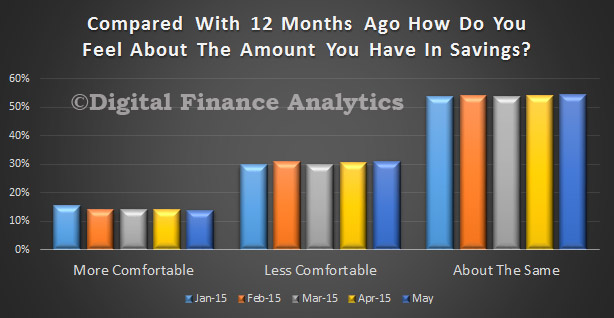

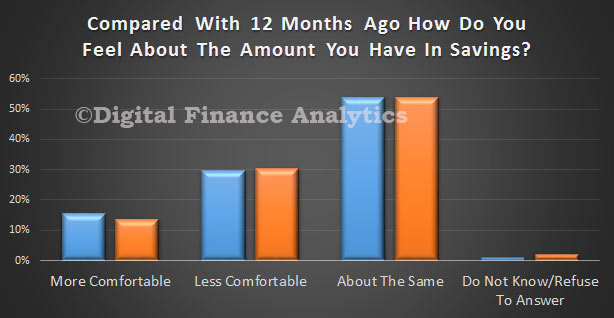

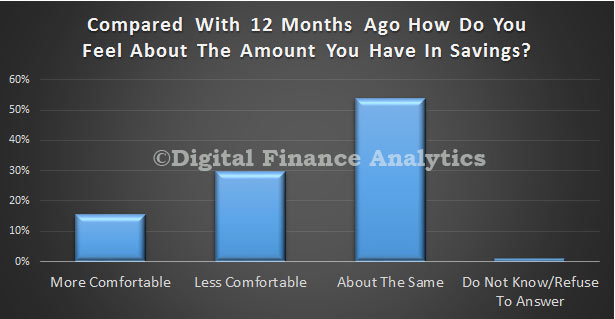

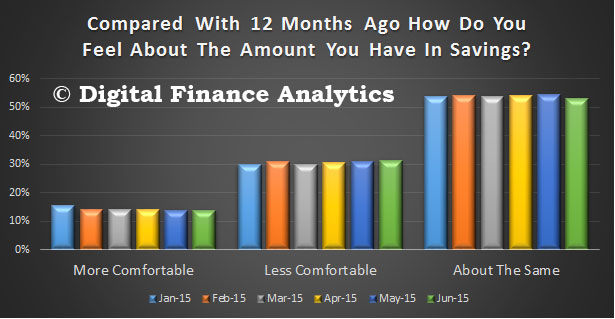

Turning to savings, 13.8% of households were more comfortable with their level of savings compared with twelve months ago, whilst 31% were less comfortable, up 0.4%. The main reason for the discomfort can be traced to the lower returns on savings. Many are finding that their income is being squeezed. This is especially true among older household groups, especially those with higher health related expenses.

Turning to savings, 13.8% of households were more comfortable with their level of savings compared with twelve months ago, whilst 31% were less comfortable, up 0.4%. The main reason for the discomfort can be traced to the lower returns on savings. Many are finding that their income is being squeezed. This is especially true among older household groups, especially those with higher health related expenses.

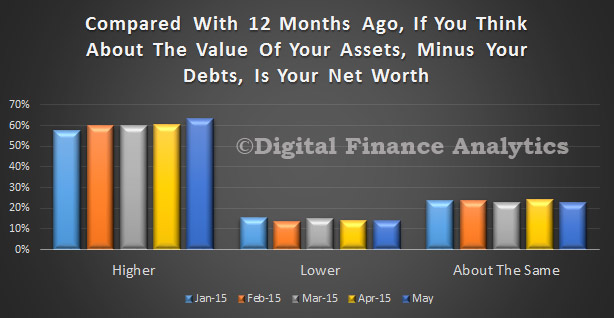

Finally, looking at overall net worth, 60% of households think their worth is higher than 12 months ago, though this fell by 3% in the month, thanks to recent stock market falls. In some states, property prices are also down, but not in Sydney and Melbourne. Those in rented accommodation or in financial stress saw their worth fall, (15%) whilst about 23% saw no change, up 0.6%. Households in rented accommodation or in receipt of Centrelink support were generally less comfortable.

Finally, looking at overall net worth, 60% of households think their worth is higher than 12 months ago, though this fell by 3% in the month, thanks to recent stock market falls. In some states, property prices are also down, but not in Sydney and Melbourne. Those in rented accommodation or in financial stress saw their worth fall, (15%) whilst about 23% saw no change, up 0.6%. Households in rented accommodation or in receipt of Centrelink support were generally less comfortable.

So overall, we see the continuing trend of lower income, higher costs, those households with property and shares enjoying offsetting net worth growth, but others not participating to the same extent. The budget has had little longer term impact, and the RBA rate cut has also not changed the overall trajectory of the index. Households are wary, and will remain cautious in the months ahead.

So overall, we see the continuing trend of lower income, higher costs, those households with property and shares enjoying offsetting net worth growth, but others not participating to the same extent. The budget has had little longer term impact, and the RBA rate cut has also not changed the overall trajectory of the index. Households are wary, and will remain cautious in the months ahead.

Note that this data is averaged across the states, though we note some significant differences between WA (overall confidence lower) and NSW (overall confidence higher), thanks mainly to differential movements in house prices and employment prospects. We do not published the detailed segment and state based analysis in this post. This detail is available to our paying clients!