Over the last decade, the digital transformation of the banking sector has accelerated dramatically, and the pace of change is showing no sign of slowing.

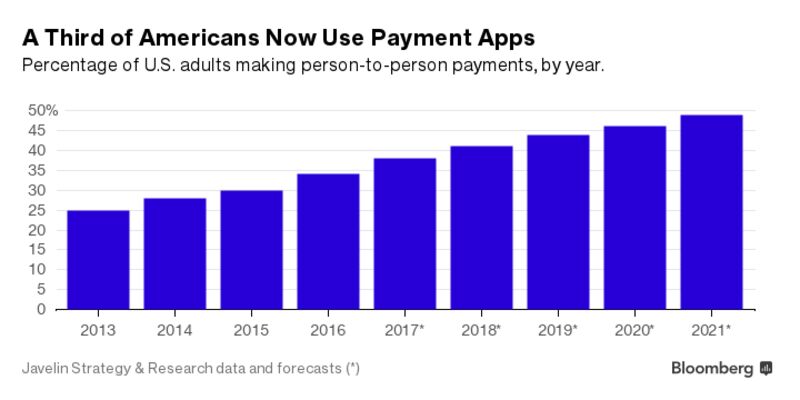

Recent research data shows more than 1.2 billion people are banking on their mobile devices today, a number set to increase to over two billion by 2021.

Competition from agile new arrivals to the market, combined with a need to enhance the customer experience, are compelling credit providers to improve their range of services and reduce the time it takes to make credit decisions.

Gone are the days when a discussion with the local bank manager was the only option.

Dissatisfaction with traditional systems that fail to meet the instantaneous needs of the modern-day customer already has some Australians looking to fintech start-ups and alternative lending sources.

Millennials report convenience anywhere, any time as the primary driver for choosing non-traditional finance providers, according to recent Telstra research.

This highlights that many of today’s consumers live in a world of digital banking and expect to be able to have their banking needs met at any time, in any place and on any device.

There are signs consumer pressure is shifting the massive cogs of Australia’s financial services industry, slowly but surely adjusting to the demands of today’s hyper competitive 24/7 global economy.

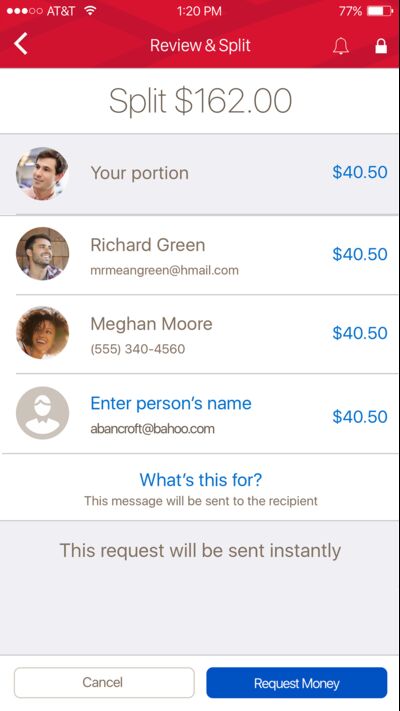

The National Payments Platform (NPP) rollout in late 2017 will provide Australian businesses and consumers with a faster, more flexible and data-rich way to transfer funds within seconds.

In the NPP world, an Australian credit shopper can receive funds from friends, family or peers almost instantly.

Australian credit providers will have the same ability to almost instantly fulfil a customer’s credit wishes, but they will also need the right tools in place to assess customer risk with the same level of immediacy.

In order for credit providers to meet the evolving demands, real-time automated decision-making must become the new norm across the credit industry, enabled by access to a variety of internal and external databases.

What are the databases and insights credit providers need at their fingertips to make well-informed decisions?

In order to accurately, quickly and confidently make a ‘yes’ decision anytime, anywhere, a credit provider needs to first answer these five fundamental questions:

- Is the applicant who he or she purports to be? (ID data)

- Will the applicant likely be fraudulent? (fraud data)

- Is the applicant too risky? (credit data)

- Can the applicant afford to repay the loan? (servicing capacity data)

- If the applicant has a property, is it worth what they say it’s worth? (asset value data)

Historically most credit providers have answered each of these questions separately, using disparate and unconnected systems. For example, the bank will access an existing customer’s profile on their CRM database, but will also look at external data provided by a credit bureau or a shared fraud database.

The result is a lengthy process that delays credit decisions and results in a poor customer experience. In an increasingly saturated market, consumers’ ability to access credit seamlessly will likely be a key differentiator.

A one-stop shop

Emerging technologies promise a faster and more customer-friendly alternative to these clunky systems of old, offering access to a wide range of separate databases on demand and as part of a singular process.

As banks up the ante in their adoption of cloud-based services, a more flexible, collaborative technology ecosystem is emerging.

These technologies enrich a bank’s own customer data with third-party credit data, identity information, fraud insights and property data, and make it all available online and in real time.

With integrated workflow and decisioning processes, banks can fast track applications from existing customers and prompt a request for more data from new customers.

This enables credit providers to deliver a credit decision within seconds, reducing the number of customers who drop-off midway through the application process due to the lengthy questions and delays.

However, it also ensures credit offers are more accurate, based on a holistic approach to a customer’s financial situation. For the bank, this reduces risk, streamlines operations, and enables it to offer efficient and competitive products and services.

A digitised approach also addresses an ongoing concern for credit providers.

In 2009, to meet ASIC’s responsible lending guidelines, the onus was put on lenders to request evidence such as pay slips or financial statements, to support credit applications.

This process significantly delays the processing of applications. However, by applying the same principles in data integration, banks can now automatically access bank statements to fast track their evaluation of the ability of a consumer to service a loan.

Developing an effective data hub with real-time decisioning software future-proofs a bank, enabling an agile response to both future regulatory changes and transformations to the market.

Such a capability results in a more positive experience for customers and delivers much improved efficiencies and business performance for credit providers.