At the heart of the property market there is a paradox – prices are still rising in most centres and auction clearance rates remain elevated, yet mortgage lending momentum is easing. How can this be?

In our latest weekly review we look at lending momentum, property prices and mortgage industry innovation. We are living in turbulent times! Welcome to the Property Imperative Weekly to 15th July 2017.

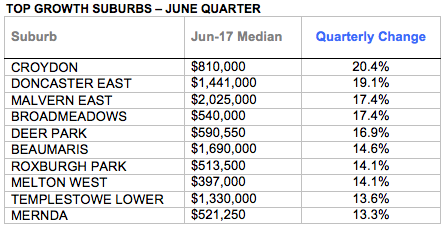

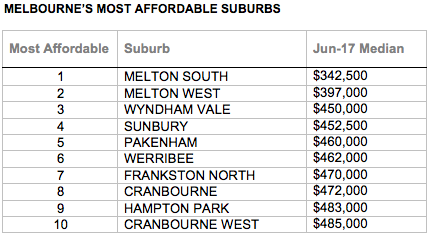

First, don’t believe all the noise about home prices collapsing. Latest data shows continued growth. For example, in Victoria, according to RIEV, the metropolitan Melbourne median house price rose 2.9 per cent in the three months to June 30, to $822,000. The top growth suburbs were spread right across Melbourne, and at both the low and high ends of the market, from Broadmeadows and Roxburgh Park in the north, to Malvern East and Toorak in the south-east. Croydon in the outer east experienced the city’s largest quarterly increase, up more than 20 per cent to a median of $810,000. Toorak was the most expensive suburb though half of the top-growth suburbs are priced below the Melbourne’s median, suggesting buyers continue to seek value further from the city.

Melbourne’s apartment sector performed similarly well in the June quarter, with the metropolitan Melbourne median apartment price increasing 4.3 per cent to $606,500. House prices in regional Victoria rose strongly for the second consecutive quarter, up two per cent in June to a record high $385,000.

Data from CoreLogic also showed that to 9th July, prices in Sydney rose 3.4% in the past month, in Brisbane they rose 0.5% but fell in Adelaide by 1% and Perth 0.8%. In addition, the preliminary auction clearance rates increased to 70.7 per cent this past week, up from 67.3 per cent the previous last week, even though auction volumes fell week-on-week, there were 1,751 properties taken to auction this week, down from 2,001 last week, still higher than this time last year. All but two of the capital cities saw the clearance rate increase week-on-week while Melbourne recorded the highest preliminary clearance rate at 73.9 per cent.

There are a number of clouds on the horizon though. This week the Government released draft legalisation stemming from the 2017-18 Budget when the Treasurer said travel expense deductions relating to residential investment properties would be disallowed and depreciation deductions for plant and equipment used in relation to residential investment properties would be limited.

We released our Household Finance Confidence index to June 2017, and the news was not good. Overall the index dropped below the neutral setting and appears to be trending lower. The current reading is 99.8% compared with 100.6 in May. The fall is being driven by a confluence of issues, none new, but now writ large. Households are seeing the costs of living rising (especially power costs, child care costs and council rates), whilst household income remains depressed and is falling in real terms. Returns on deposits actually fell as well, so mortgage repricing is not being matched by better saving rates. The costs of mortgage repayments rose. The most significant fall in confidence was in the property investor segment, where loan repricing has been more pronounced, whilst rental incomes are hardly growing. They are also concerned about slowing capital appreciation. However, it is still true that property owners have their confidence buttressed relative to property inactive households who are more likely to be renting, and see no rise in their net worth.

The ripple of mortgage rates rises continued with Advantedge an important wholesale funder and distributor of white-label home loans, and part of the National Australia Bank Group, announcing it will increase the interest rate on all new and existing variable rate interest only home loans by 0.35% p.a., effective Tuesday 8 August.

Westpac said it ditching mortgage and equity-release products in a high-level review of its product range and underwriting standards. The latest products to be dumped include equity access low documentation loans, which is a revolving line of credit secured against property; and a range of fixed rate low documentation home loan. Review recommendations are expected to flow onto Bank of Melbourne, St George Bank and BankSA.

Data from the ABS showed that overall lending finance sagged in May. Owner Occupied housing grew, by 0.4%, with a rise in first time buyers, but all other lending flows were lower, whether you look at the trend or seasonally adjusted figures.

Personal credit continues to fall, the flows fell 3.2% of $193 million, with similar rates of decline across both fixed and revolving loans.

Total commercial lending fell 0.8% of $314 million. Within that lending for investment housing fell 1.5% or $194 million, whilst other fixed commercial lending fell 0.5% or $96 million. Revolving commercial credit fell 0.3% or $24 million. If business confidence is really so strong, why no growth in borrowing – something does not add up!

As a result, the total proportion of business lending to total lending stood at 29.9% down from a peak of 30.9% in December 2016. The proportion of investment property lending flows slipped to 18.1% of all lending, and 37.4% of all housing lending.

So whilst the regulatory tightening is crimping demand for investor finance, it is not being replaced with a rise in productive business lending, so commercial finance has fallen. This will put downward pressure on growth, at a time when mortgage interest rates are rising. We cannot see how the future growth expectations from the RBA are going to be met on these figures.

It is clear however, that secured lending for owner occupation rose, as first time buyers pick up the slack, and investor lending remains strongest in the two overheated markets of Sydney and Melbourne. Much of the fall in investment sector lending resides in the other states, who are already experience economic pressure. Data from AFG showed that more new loans are being written by non-major banks, who are helping fill the void left by some of the majors and consumers are benefiting from the fact that a mortgage broker can offer products from those lenders without a branch network.

All this explains why we have home prices moving up, whilst lending is slowing – you need to get granular to understand what’s happening, as discussed in an interesting IMF working paper.

Elsewhere, mortgage brokers commissions were in the spotlight following the ASIC review which found that consumers were not getting great outcomes and that the standard model of upfront and trail commissions creates conflicts of interest. The industry is being given a chance to self-regulate.

A combined industry forum, which involves the ABA, MFAA, FBAA and COBA, first met in June and is scheduled to meet later this month, with the broad objective of responding to ASIC’s review. Participants though hold a range of different views.

CHOICE, said it was “simply not good enough” that ASIC “has left it up to the industry to find a solution”. They suggested that the way mortgage brokers are currently paid “means it’s very unlikely that a customer is going to get a loan that’s best for them” and that the industry therefore needed a “major change”.

In a joint submission to the Treasury, consumer advocacy group CHOICE, along with the Financial Rights Legal Centre, Consumer Action Law Centre and Financial Counselling Australia, called for the removal of upfront and trail commissions, the implementation of fixed fees (via lump sum payments or hourly rates), the removal of bonus commissions, bonus payments and soft dollar payments; and a change in law so brokers have to act in the ‘best interest’ of clients; and a requirement that brokers disclose ownership relationships and the lender behind any white-label loan recommended to a consumer.

However, the peak broker bodies – the MFAA and FBAA have called this submission “ignorant” and “misinformed”, which perhaps is unsurprising, as these bodies are strongly aligned with the current mode of operation. They slammed the recommendations as “detrimental” to consumer interests and claimed mortgage rates would rise if such reforms were implemented.

The Australian Bankers Association announced it wants commissions to be decoupled from loan size but is prepared to negotiate with brokers to find a new model. Their Sedgwick review called for commissions to be completely decoupled from loan size by 2020.

So there will be some changes to mortgage broker commissions, but is not yet clear what the shape of those reforms will be. Whilst consumers say they get good service from brokers, the implicit conflicts in the current model cannot be overlooked.

Finally, this week two interesting Fintechs launched, highlighting that innovation is set to disrupt the mortgage market. Tic:Toc has emerged offering ‘instant home loans’ through a digital real-time loan processing system that connects customers directly to the lender, claiming a 22-minute home loan is available, which includes approval and document generation. This is significantly faster than most traditional lenders.

Separately, peer-to-peer lender Zagga, held a launch party in Sydney recently. The firm is looking to differentiate itself from competitor peer-to-peer players by pitching itself as the ‘secured alternative’. All Zagga’s loans are secured against a property and investors are matched with a specific loan, i.e. it is not a ‘pooled’ structure. While an algorithm is used to match investors with borrowers, depending on each investor’s risk tolerance, each lender undergoes a credit assessment by Zagga’s staff.

So signs of digital disruption now hitting the mortgage industry, in this time of uncertainty.

And that’s the Property Imperative week to 15th July. If you found this useful, do subscribe to get the next edition, or sign up to the Digital Finance Analytics blog to receive all the latest news. Thanks for watching.