From AAP.

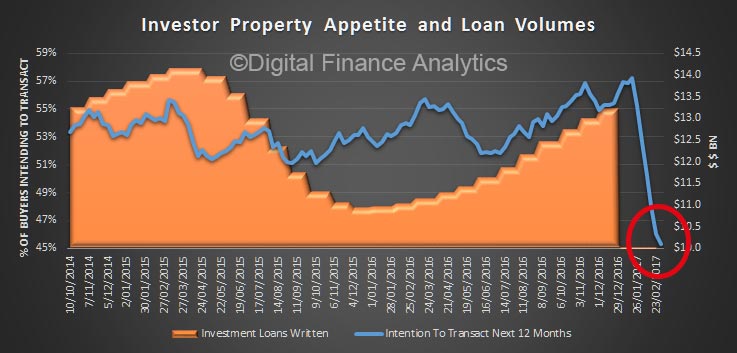

Soaring household debt and housing prices could make it “dangerous” to cut interest rates, the head of the Reserve Bank of Australia says.

Dr Philip Lowe has told a Federal parliamentary economics committee that a deeper cut to the official cash rate could deliver a short-term boost to jobs and inflation but also push already-high property prices and household debt levels to worrying levels.

“Is it really in the national interest to create a little bit more employment growth in the short-run at the expense of creating vulnerabilities which could be quite dangerous in the long term,” Dr Lowe said at the hearing in Sydney on Friday.

“Is it really in the national interest to create a little bit more employment growth in the short-run at the expense of creating vulnerabilities which could be quite dangerous in the long term,” Dr Lowe said at the hearing in Sydney on Friday.

He said another rate cut could help drive down the unemployment rate, which could be lower than its current 5.7 per cent, and boost underlying inflation, which could be higher than 1.55 per cent.

RBA figures show the household debt-to-income ratio is already at 187 per cent, while total household debt is equal to about 123 per cent of the country’s gross domestic product.

“I accept that different people will come to different points on judging that trade-off; at the moment we’re in a reasonable place because the unemployment rate is broadly steady and household debt and house price growth at the aggregate level are fast enough,” Dr Lowe said.

“I feel if they were even faster at the moment we would be moving into the area where the vulnerabilities are increasing, perhaps to unacceptable levels.”

Lower housing prices and household debt levels would only marginally strengthen the case for another rate cut, he said.

The central bank chief said monetary policy alone could no longer drive growth and it was up to the Parliament to use fiscal policy — through changes to tax and spending — to support the economy.

“Monetary policy at the margin can help you, but were talking very much at the margin,” he said.

The best way the Government could reduce pressure on property prices and boost growth would be investing in urban transport infrastructure, he said.

He said with a growing population, crowded cities, poor land supply and the difficulties people encounter moving around, investment in urban transport infrastructure would be “a first order gain”.

“It increases demand, takes the pressure off ultra-low interest rates, increases the productive capacity of the economy because people can move around, it takes the pressure off housing prices,” Dr Lowe.

“It’s probably the best housing affordability policy.”