Ask respected property analyst Martin North what form the coming downturn in the housing market might take and “orderly” is not the description he uses.

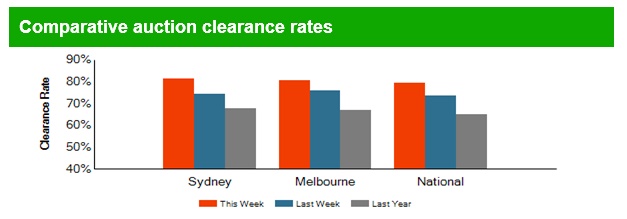

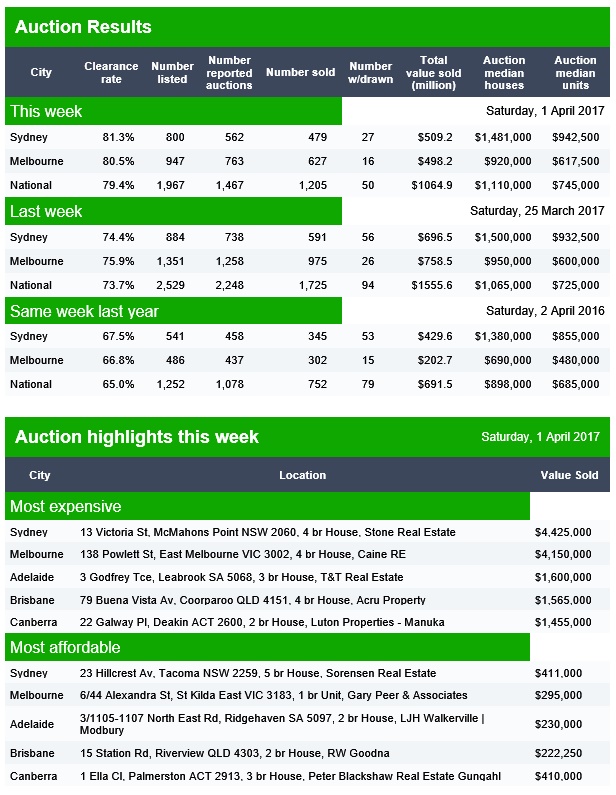

Instead North anticipates a much more significant downturn in the investor-driven, debt-laden markets like Sydney and Melbourne.

“Orderly” is how S&P Global Ratings director Sharad Jain described the likely unwinding of the overheated housing market, where annualised house price growth is running close to 20 per cent in Sydney and Melbourne.

“It could unwind in an orderly manner as we are seeing in parts of Western Australia and Queensland,” Mr Jain said at the Australian Financial Review Banking and Wealth Summit this week.

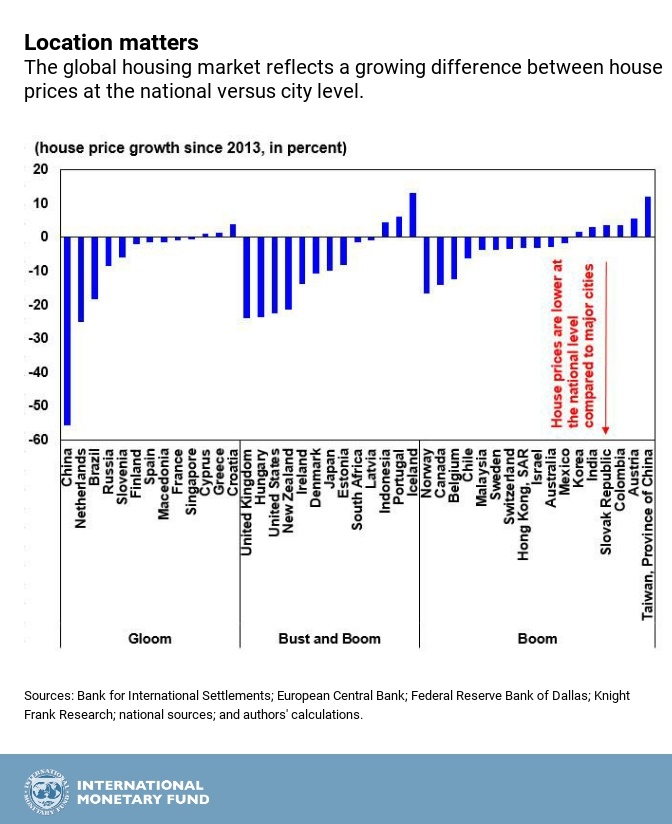

But according to Mr North, whose says his view on the housing market has turned increasingly gloomier, Australia could be at the very early stages of where the US housing market was in 2008 before it crashed.

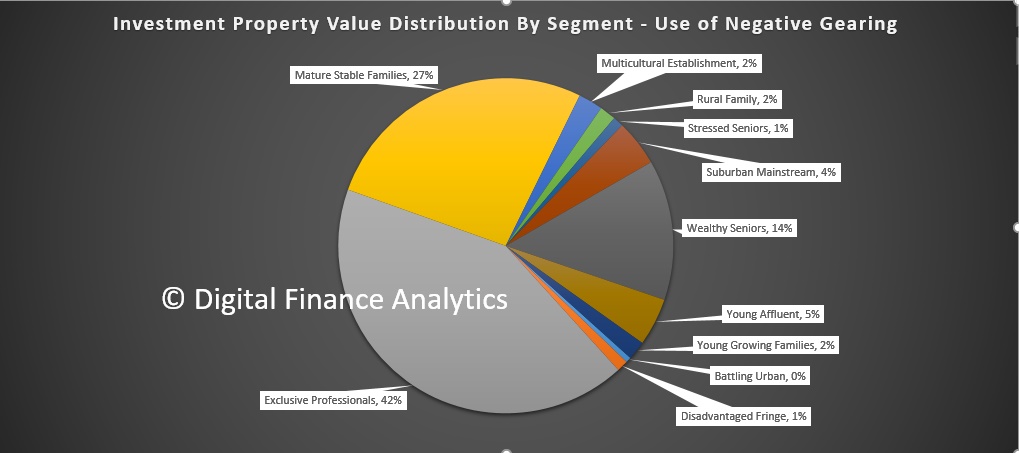

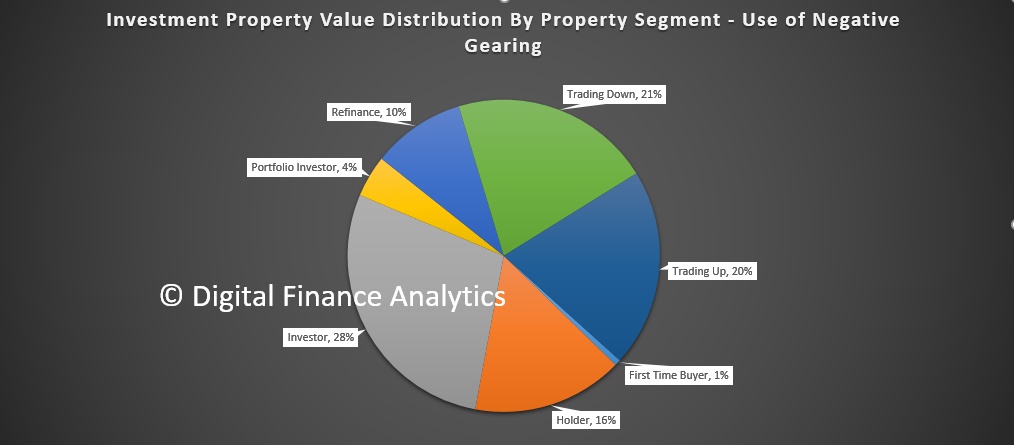

“Regulators have come to the party three or four years too late. They should have tackled negative gearing, not cut rates as much and focused on mortgage underwriting standards. Had they done so we would be in a position to manage the situation,” said Mr North, who runs research house Digital Finance Analytics.

“I have a nasty feeling we are passed the point of being able to manage this. There are not enough levers available to regulators to pull it back in line. I can’t see anything other than a significant correction. It’s not a question of if, but when.”

But SQM Research managing director Louis Christopher, the country’s most accurate forecaster of house price growth, said it was “too early to call what type of correction we will have”.

“The last downturn in Sydney was in 2004, where the market did correct a little bit that year and then stayed flat for an extended period of time.

“On balance you would say the odds favour a similar type of downturn, where the market corrects by 4-5 per cent and thereafter does not do anything for a long time.

“Perth’s correction has been kind of orderly. Not in its rental market where rents are down 20 per cent, but orderly for prices,” he said.

According to Mr Christopher, continued strong population growth in Sydney and Melbourne will continue to drive underlying demand for housing and should act as a buffer against any major correction.

But, he cautioned, the longer house prices continued to rise, the less likely any unwinding will be orderly. “If prices rise another 20 per cent, that increases the risk of a sharper correction,” he said.

CoreLogic figures going back to 2000 show that most housing booms have been followed by shorter periods of correction and then followed by elongated periods of little or no growth.

Even in Perth, where house prices have been correcting since late 2014 and have hardly moved in the past four years, they are still up more than 200 per cent since 2000.

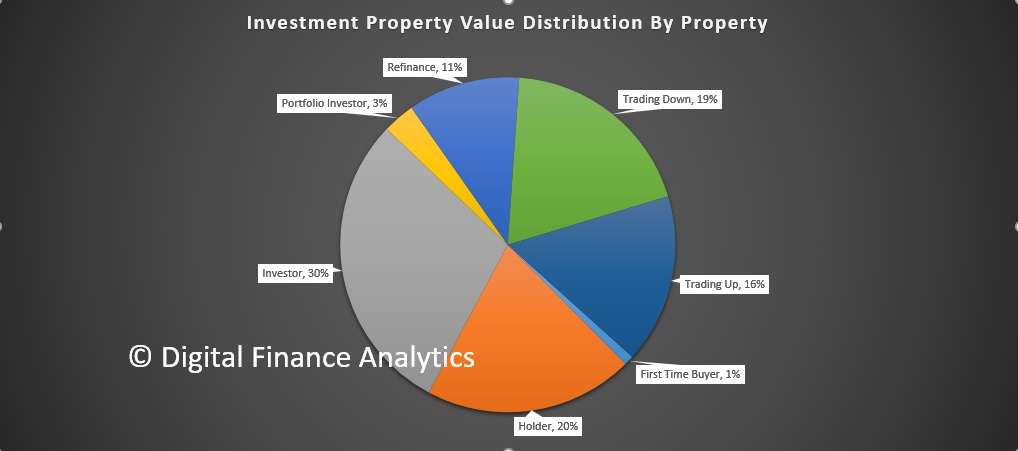

Corelogic’s head of research, Cameron Kusher, said the “great unknown” in how the current house price cycle will play out is what investors will do when the growth is no longer there.

“If investors stay, the correction should not be too bad. But if they go away like they did in Adelaide, Brisbane and Perth and dump property for other asset classes, it could be much worse.”

Were that situation to play out, Mr Kusher said the Brisbane and Melbourne unit markets – where investors have dominated – could be the worst affected.

Based on the latest NAB Residential Property Survey of 250 property professionals, most investors appear to have no intention to quit the market.

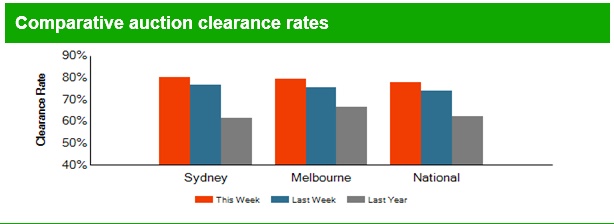

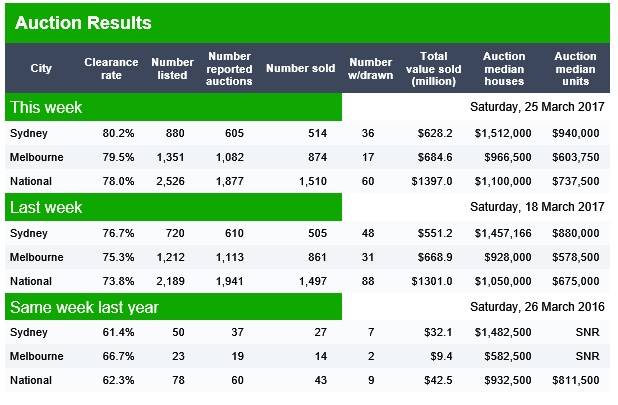

The latest quarterly survey shows a surprise rise in housing market confidence despite mortgage rates going up and APRA turning the screws on lending to investors.

NAB chief economist Alan Oster believes an orderly unwinding of the current boom is the most likely outcome, pointing to the bank’s own forecasts of a slowdown later this year with annualised house price growth halving to about 7 per cent and then dropping to 4 per cent in 2018.

With the demand still strong and interest rates to remain low, Mr Oster said unemployment was the critical factor.

“We don’t see an unorderly correction unless unemployment hits 8.5 per cent and that would take a major global shock most likely coming out of the US or China,” Mr Oster said.

Having witnessed numerous housing cycles in his 30 years in real estate, John McGrath says he does not subscribe to the “housing bubble theory”.

Mr McGrath believes that if there is a correction it is likely to be modest with the recent tightening of lending acting as a “natural economic firebreak” to any collapse in prices.

“Historically if and when there is a correction the market gives back about half of the prior years growth which would suggest that when prices stop rising we are likely to see either a stabilisation at that point or perhaps a 5 per cent correction.

“Sydney and Melbourne are now major international cities and an ideal alternate address for those living or doing business in Asia. Compared to values in other great cities of the world, many overseas buyers and expats still see our two biggest cities as good value globally and a very safe place to invest,” he says.

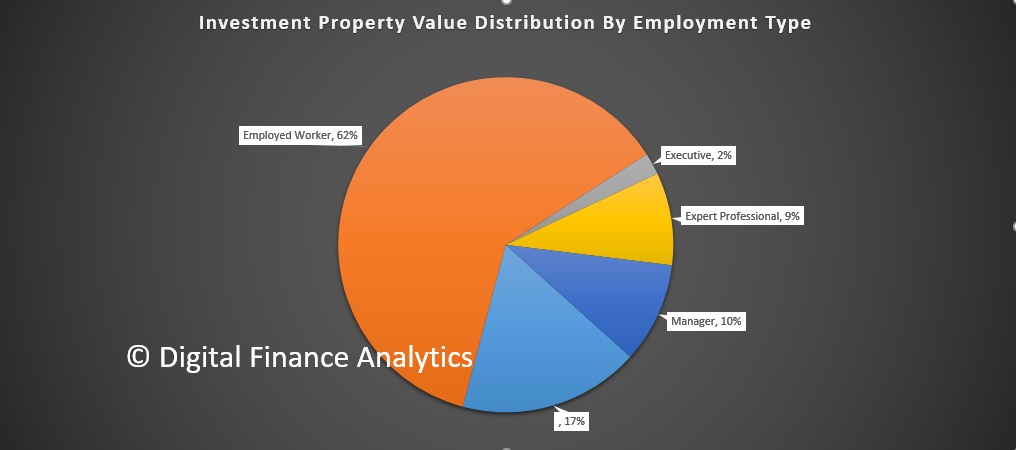

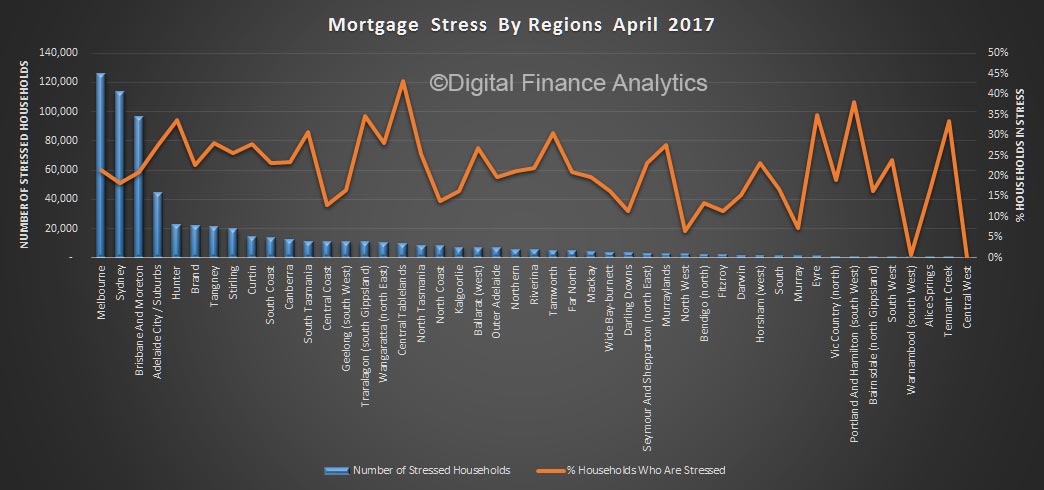

But, Mr North sees things differently: “We have about 22 per cent of households in mortgage stress, which will continue to rise. There’s flat employment growth and no wages growth. I can’t see how you can hold all those elements together.”

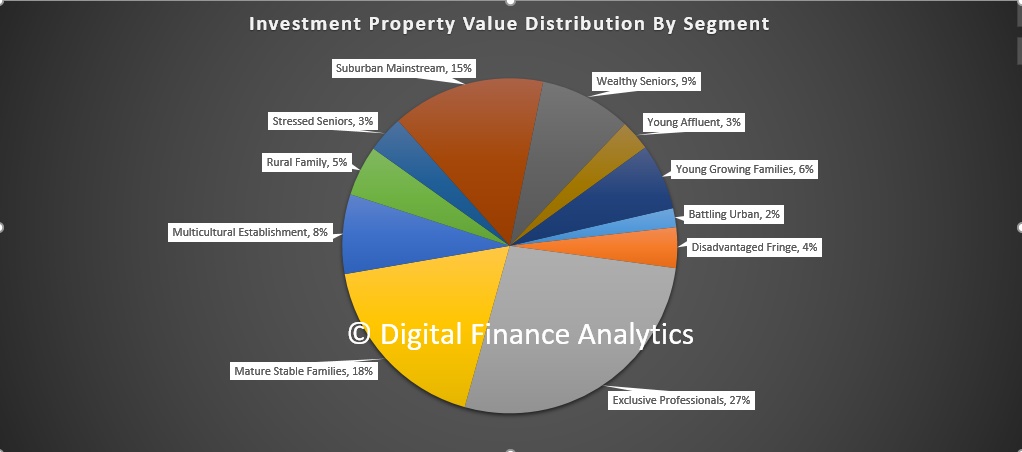

And he believes the wealthier end of town could be most at risk: “My data shows the highest levels of immediate problems are not in the suburban fringe, but in the affluent suburbs, where people are really geared up with multiple properties.”