The latest edition of our finance and property news digest with a distinctively Australian flavour.

Live event tomorrow:

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Live event tomorrow:

Damien Klassen, Head of Investments at Nucleus Wealth highlights some important issues….

He runs a superannuation fund that only buys liquid assets in separately managed accounts. So, an investor’s return is their return. They can’t rely on tax mingling, unlisted asset revaluations or other accounting tricks that master trusts use. So some may say its sour grapes. But he highlights some surprising facts. Anyone remaining in certain funds bears the brunt of the losses as others chose to leave.

Most superannuation funds, and especially industry funds have significant balances in unlisted assets. Many are telling you that these assets haven’t lost money, or are only down a little despite sharemarkets being down close to 30%. This gives rise to perverse incentives for superannuants:

Rough numbers? I suspect right now that the median superannuation fund will pay you about 7% to leave.

Chant West gave us a quick preview of superannuation fund returns for March:

From Chant West:

“Growth funds, which is where most Australians have their superannuation invested, hold diversified portfolios that are spread across a wide range of growth and defensive asset sectors. This diversification works to cushion the blow during periods of share market weakness. So while Australian and international shares are down at least 27% since the end of January, the median growth fund’s loss has been limited to about 13%.”

Some quick maths.

Chant West’s definition of a growth fund is one that has 60-80% of its assets in growth equities.

Let’s call it 70% exposure to shares, 5% cash and 25% to a composite bond fund.

If shares are down “at least” 27%, cash is unchanged, and a composite bond fund is down about 5%, then the implied return is a loss of -20%.

Chant West says the loss is only 13%.

There is 7% missing.

And that assumes that the 25% is in composite bonds, more likely it is higher risk unlisted assets.

Now, individual funds will have different performance obviously. Our own growth fund is down less than 1% over the same time frame, but we took dramatic and aggressive measures at the end of January that I know others did not.

The superannuation market is $3 trillion. It is the market. If, somehow, almost every superannuation fund worked out the same thing we did and sold equities at the end of January, the market would have fallen in January. They didn’t.

The answer is superannuation funds have unlisted assets that they are not writing down. They are pretending that the prices are mostly unchanged from January.

A few industry funds have written down assets. For example, AustralianSuper has revalued its unlisted infrastructure and property holdings downwards by 7.5%.

Um, have they looked at the rest of the market? The listed property sector is off more than 40%. Airports? Down 30%+. Private Equity? Ha! You are telling me that illiquid shares are worth a few per cent less while listed shares are down 25%+ and illiquid bonds aren’t even trading?

The writedowns help, but are nowhere near the level the assets would sell for today.

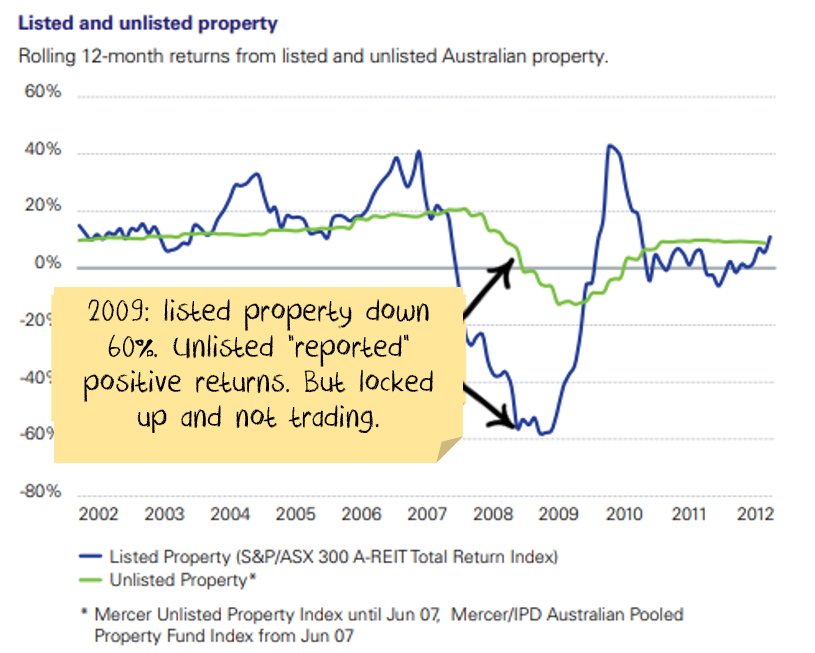

A great example is unlisted property funds during the financial crisis. Unlisted property funds invest in effectively the same assets as listed property funds, the underlying properties are worth the same, the performance differs because of how it is reported:

The problem is that if you own a fund that reports like this, you can be diluted if other investors leave. And any contributions you make now are at inflated prices. To illustrate with an extreme example, let’s say:

The other problem with a typical superannuation fund (but not some of the newer ones that use a separately managed account structure) is your tax is mixed with other investors. Rodney Lay from IIR recently highlighted the issue:

…unit trust investors face another risk – being subject to the taxation implications of the trading activities of other investors. Net redemption requests may require the manager to sell underlying portfolio holdings which, in turn, may crystallise a capital gain… …During the GFC some investors had both (substantial) negative returns plus a tax bill on the fund’s crystallised gains. Good times!!!

So, if you are a loyal soldier sticking with a superannuation fund that continues valuing unlisted assets at last year’s prices then:

But at least your superannuation fund will be able to “report” higher returns.

Workers overwhelmingly pay for increases in compulsory superannuation contributions through lower wages, a new Grattan Institute paper finds.

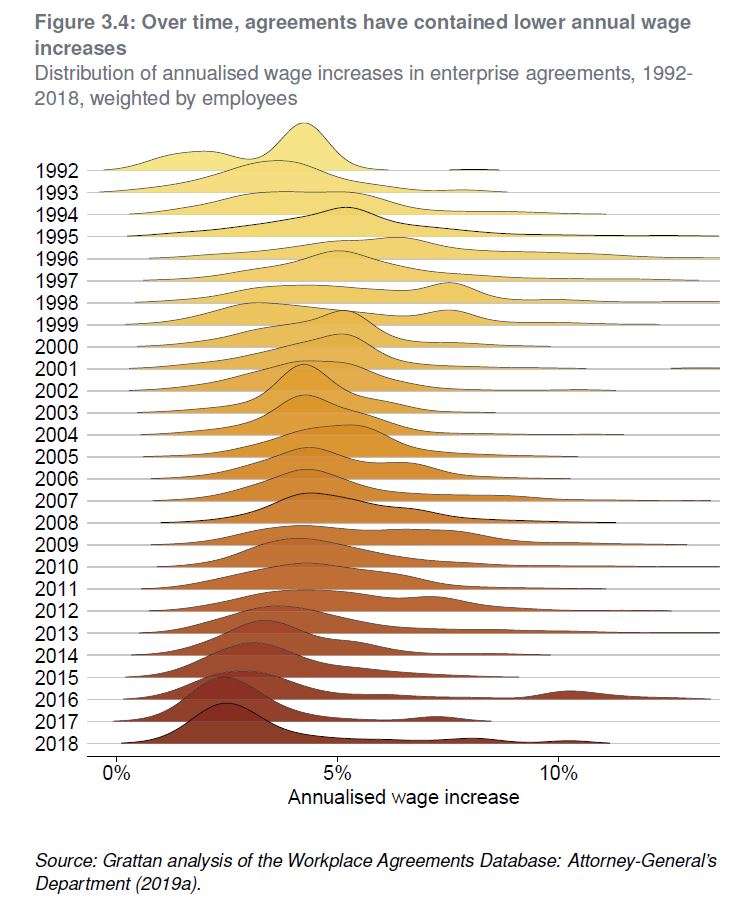

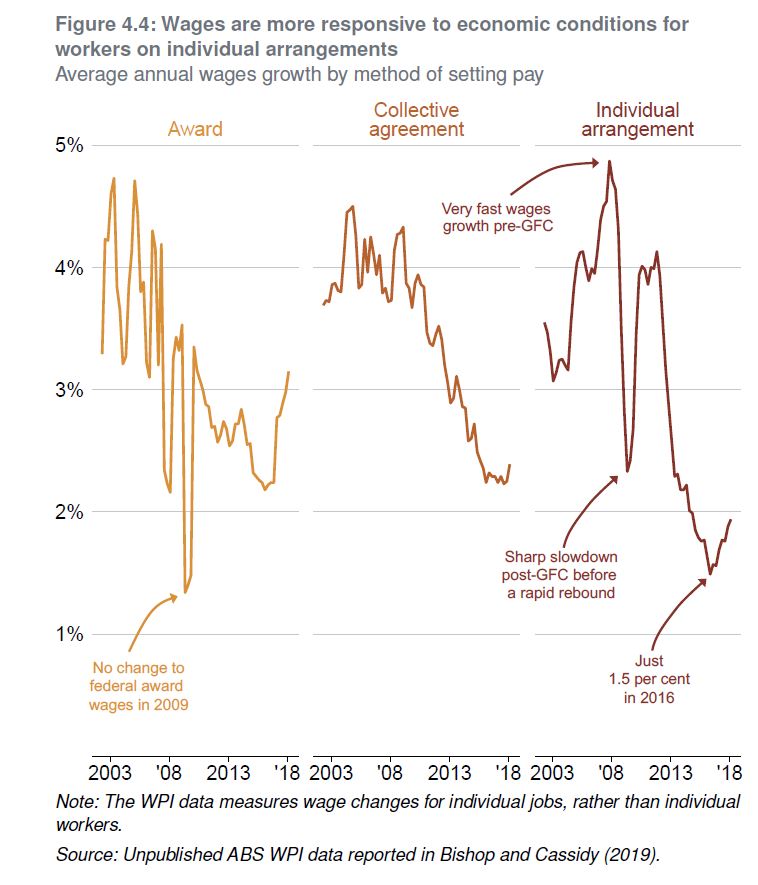

No free lunch: higher super means lower wages uses administrative data on 80,000 federal workplace agreements made between 1991 and 2018 to show that about 80 per cent of the cost of increases in super is passed to workers through lower wage rises within the life of an enterprise agreement, typically 2-to-3 years. And the longer-term impact is likely to be even higher.

‘This trade-off between more superannuation in retirement but lower living standards while working isn’t worth it for most Australians,’ says the lead author, Grattan’s Household Finances Program Director, Brendan Coates.

‘This new empirical analysis reinforces that the planned increase in compulsory super, from 9.5 per cent now to 12 per cent July 2025, should be abandoned. Most Australians are already saving enough for their retirement.’

The paper directly measures the super-wages trade-off for nearly a third of Australian workers – those on federal enterprise agreements. But it shows that other workers are also likely to bear the cost of higher compulsory super in the form of lower wages growth.

Despite the claims of some in the superannuation industry, it is unlikely that future super increases will be different from past increases.

It’s true that wages growth has slowed in recent years, but nominal wages are still growing by more than 2 per cent a year, so employers have plenty of scope to slow the pace of wages growth if compulsory super contributions are increased.

And none of the plausible explanations for lower wages growth – whether slower growth in productivity, technological change, globalisation, an under-performing economy, or weaker bargaining power among workers – helps explain why employers would foot any more of the bill for higher compulsory super this time around.

If employers aren’t willing to offer large pay rises today, it’s hard to imagine why they would pay for higher super. In fact, if workers’ bargaining power has fallen, employers are even less likely to pay for higher compulsory super than in the past.

Grattan’s 2018 report, Money in retirement: more than enough, found that the conventional wisdom that Australians don’t save enough for retirement is wrong.

Now this working paper finds that the conventional wisdom that higher super means lower wages is right.

‘Together, these findings demand a rethink of Australia’s retirement incomes system,’ Mr Coates says.

Quirks in the superannuation system in Australia means that some who save more will get less. This highlights again the limitations of the current arrangements.

https://thenewdaily.com.au/finance/superannuation/2020/01/26/pension-super-income-backwards

We look at a recent report on the future of retirement. There are some big issues on the horizon.

https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-research-institute-publishes-study-urging-rethink–202001.html

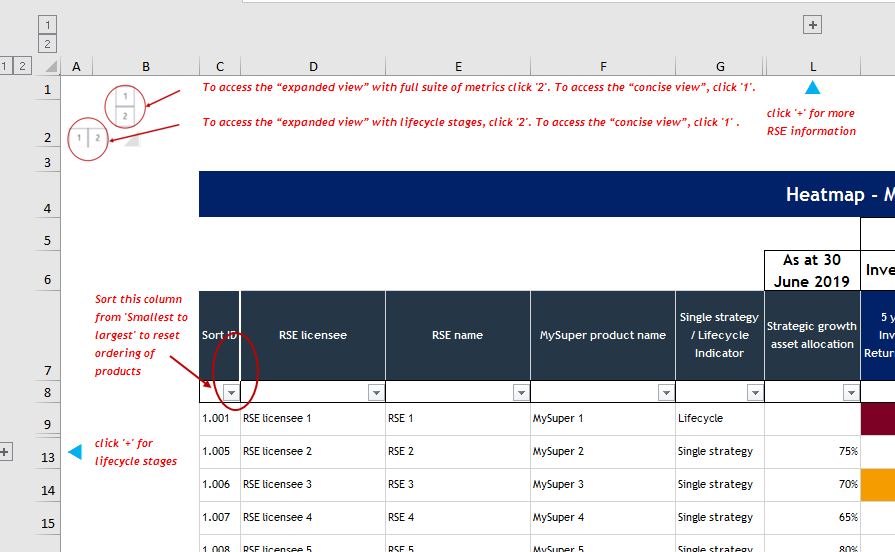

From the excellent James Mitchell, at The Adviser. If the prudential regulator was hoping to provide clarity on MySuper products it has failed miserably.

Call me ignorant, but when APRA announced the launch of its MySuper heatmap, I didn’t envision downloading an Excel spreadsheet and navigating multiple tabs in order to decipher what the hell I was looking at. If this monstrosity is intended to be fit for public consumption then the average Australian better have a financial adviser by their side, if for no other reason than to decode the thing.

Fortunately, the team who put the spreadsheet together included a “user guide” on tab 4 (see below). Crikey!

There is also a colour legend and a glossary of definitions for terms such as “strategic asset allocation” and “net investment return”.

My fear is that the average Australian super member looking to compare funds will struggle to comprehend what APRA’s heatmap actually means. Particularly when you consider what the financial literacy of an average Australian actually looks like.

Back in August, Compare the Market and Deloitte Access Economics released the second edition of The Financial Consciousness Index, which measures the extent to which Aussies are conscious or aware of their ability to affect and change their own financial outcomes, encompassing their willingness to act, and the extent to which they are able to participate in financial matters.

Australians scored 48 per cent on average on the index, which means they are just into the “conscious” band and out of the “it’s a blur” band.

Meanwhile, ASIC’s 2018 Financial Capability initiative noted that two in three Australians don’t understand the investment concept of diversification and only 35 per cent know what their super balance is.

With this in mind, it’s difficult to fathom how APRA’s overly complex Excel spreadsheet is going to translate, let alone be used as a guide, to everyday Australians.

FSC CEO Sally Loane warned against the misuse of the thing and said it should not be used to rank superannuation products.

“It is really important to understand that the heatmaps are a point-in-time analysis, which is a useful tool for APRA in its supervision activities, but it doesn’t tell the whole story when it comes to members’ retirement outcomes,” Ms Loane said.

“Particularly for life cycle products, which adjust investment strategies over a person’s lifetime, the headline numbers in the heatmap don’t reflect the actual experience of a member in that fund, and could be misleading if viewed in isolation.”

The FSC noted that the heatmap may tell you that other funds have had higher returns over five years, but if you’re close to retirement you might be far more concerned with how your fund is managing the risks of a market downturn to safeguard your retirement savings.

Some of the heatmap’s other failings are that it doesn’t tell you how your super has performed over your lifetime, it can’t tell you whether your fund invests in accordance with your ethical and philosophical beliefs, and it doesn’t tell you what additional services they offer to help you manage your savings.

“If you have concerns about whether your super fund is right for you, talk to your fund or speak to a financial adviser,” Ms Loane said.

Ms Loane said that while the FSC hoped APRA would continue to refine its MySuper heatmap methodology, the proposal to extend the exercise to choice products was highly problematic.

“The broad variety of choice products in the market, the complexity and bespoke nature of platforms and wraps where individuals choose their investment strategies, and the lack of direct comparable data, [make] it extremely difficult to translate heatmapping beyond MySuper and we urge APRA to not only be cautious in proceeding with this exercise but to engage deeply with industry,” she said.

In a fresh blow to Westpac, the Federal Court this morning delivered the corporate regulator a win in its appeal against a previous ruling on Westpac’s telephone campaigns. Via Financial Standard.

The full court this morning said ASIC’s appeal will be allowed with costs, while Westpac-related companies’ cross-appeal will be dismissed.

The matter relates to whether or not Westpac’s telephone sales campaigns amounted to advice and if that advice was personal or general in nature.

In 2014 and 2015, Westpac ran telephone and snail-mail campaigns to encourage customers to roll over external superannuation accounts into their existing accounts with Westpac Securities Administration Limited and BT Funds Management.

ASIC was primarily concerned with the telephone calls.

The corporate regulator claimed that the two Westpac companies had breached their FoFA-stipulated best interest duty by advising rollovers to Westpac-related super funds without a proper comparison of options, as required by law.

And so, it initially launched civil penalty proceedings against the two Westpac subsidiaries in December, 2016.

The Federal Court handed down its judgment in January this year, with a mixed outcome. It decided that ASIC had failed to demonstrate that the two Westpac companies had provided personal financial product advice to 15 customers in regards to the consolidation of superannuation accounts.

However, the judge added the Westpac subsidiaries contravened the Corporations Act in 14 of 15 customer phone calls by implying the rollover of super funds into a BT account was recommended. This came about through a “quality monitoring framework” where BT staff were coached in sales technique.

ASIC appealed the January judgment. Westpac also made a counter appeal.

Former Liberal Party leader John Hewson has questioned the management of superannuation funds and called out Australia’s sovereign wealth fund for ignoring climate risks. Via InvestorDaily.

Speaking on a panel at the Crescent Think Tank in Sydney on Thursday (24 October), Mr Hewson noted that most of the $2.9 trillion of superannuation money is invested in stock markets, primarily in the US and Australia.

“You are heavily exposed when those markets are as overvalued as they are. By any measure the US stock market is way overvalued. There is going to be a correction. It’s just a matter of when and how far. Super funds are taking a risk by staying in those markets,” the former Liberal Party leader said.

“Some have rebalanced portfolios and put a bit more into cash, but you don’t earn anything on cash. Fixed-interest gives you a very low return.”

Mr Hewson noted the low interest rate environment globally, highlighting that around 25 per cent of sovereign bonds have negative rates.

“These are uncharted waters for those in the financial sector. Everyone is chasing yield but the only place you get a return is a stock market. The big question is how sustainable is that return? You can see how volatile equities markets are just based on a tweet from Trump. This is a very volatile and dangerous world for superannuation funds to be so exposed,” he said.

Mr Hewson was one of the key figures behind The Climate Institute’s Asset Owners Disclosure Project (AODP), which has since been taken over by ShareAction. Over the years the AODP index and report has repeatedly called out Australia’s sovereign wealth fund, the Future Fund, for lagging behind its international peers on climate change.

Last week Future Fund CEO David Neal stated that Australia’s sovereign wealth fund does not invest for social concerns and will continue to invest in fossil fuels.

“Our job is very clear. Our job is to generate a financial return for the nation,” Mr Neal told a committee in Canberra last week.

Commenting on the Future Fund’s stance, Mr Hewson said: “This is a fund that was buying British American Tobacco flat out when both sides of government were running anti-smoking campaigns.”

“They are not interested in climate risk. The fund is not transparent enough to satisfy a lot of people. They are taking big risks,” he said.

Here’s the boldest idea the government’s inquiry into retirement incomes should consider but might not: no longer exempting all of the value of each retiree’s home from the pension assets test. Via The Conversation.

The test would merely exempt part of the value of retirees’ homes. The change would free-up funds to support other retirees who are struggling because they have to pay rent.

It’s an idea with an impressive lineage.

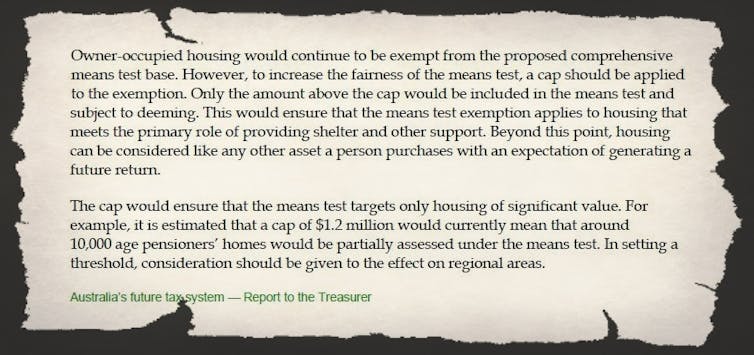

The Henry Tax Review suggested exempting only the first A$1.2 million. The bit above $1.2 million would be regarded as an asset and subject to the test.

The review said it would hit only 10,000 retirees. The $1.2 million figure was in 2009 dollars, meaning that if the change came in today the review would want it to cut in at a higher dollar figure.

The Grattan Institute suggests a lower cut in: $500,000. The first $500,000 of each mortgaged home would remain exempt from the pension assets test, the part above $500,000 would be regarded as an asset. Grattan says it would save the budget $1 to $2 billion a year.

The Australian Chamber of Commerce and Industry agrees, as does the Actuaries Institute.

Who could object?

The Combined Pensioners and Superannuants Association says asset testing the family home would be “massively unfair”, targeting the vulnerable.

But people with high-value mortgage-free homes aren’t normally thought of as vulnerable.

Labor’s treasury spokesman Jim Chalmers says it would push more retirees “off the pension, out of their homes, or both”.

He is right about the former, but wrong to think the retirees who suffered a cut in their pension or lost their pension would be badly off.

The worst off retirees, as recognised by a Senate Committee, are those without homes making do with grossly inadequate rental assistance.

Right now it is possible for a single person owning a $1.3 million mortgage-free home and $260,000 of other assets to get the full age pension.

Assuming that person draws down on those other assets at the rate of 5% per year, he or she can spend $37,000 per year and pay no rent.

A non home owner with $785,000, or half the assets, would be denied the pension.

Like the much-richer homeowner, that person would be able to draw an income of about $37,000 per year, but half it will have to go on rent.

It’s hardly fair.

It encourages retirees with homes to stash more and more of their assets into them in order to get the pension (and pass something valuable on to their children). Retirees with lesser assets miss out and have to rent.

But fairness is in the eye of the beholder.

The problem is that a ceiling on exemption from the assets test that seems fair in one part of Australia might not seem fair in another where home prices and perhaps the cost of living is higher.

In order to make more equal treatment seem fair to all retirees with homes I and fellow actuary Colin Grenfell have worked up an option that would use the median (typical) price for each postcode as the cut off point for exemption from the assets test.

It would happen postcode by postcode, updated every year using Council valuations and as the median prices changed.

Only the owners of homes who values were atypical for the area would be affected, and only that part of the value of their home that was atypical would be included in the assets test.

Its key selling point is that it wouldn’t threaten homeowners with values at and below the average for their area.

The funds freed could increase the overall pension, but would probably be better applied to lifting rent assistance.

It’s important to treat retirees in the same financial circumstances the same, regardless of whether they own a mortgage-free home, and fewer and fewer retirees are owning mortgage-free homes.

It would have the added benefit of reducing the pressure on our parents and grandparents to own houses with bedrooms on the first floor that are never opened, not until they die and their houses are sold.

Anthony Asher, Associate Professor, UNSW

We look at a global study of superannuation (pensions) and see where Australia stands, and also discuss the elephant in the room – poor returns in a low rate environment.

https://www.monash.edu/business/monash-centre-for-financial-studies