We look at a recent report on the future of retirement. There are some big issues on the horizon.

https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-research-institute-publishes-study-urging-rethink–202001.html

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at a recent report on the future of retirement. There are some big issues on the horizon.

https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-research-institute-publishes-study-urging-rethink–202001.html

From the excellent James Mitchell, at The Adviser. If the prudential regulator was hoping to provide clarity on MySuper products it has failed miserably.

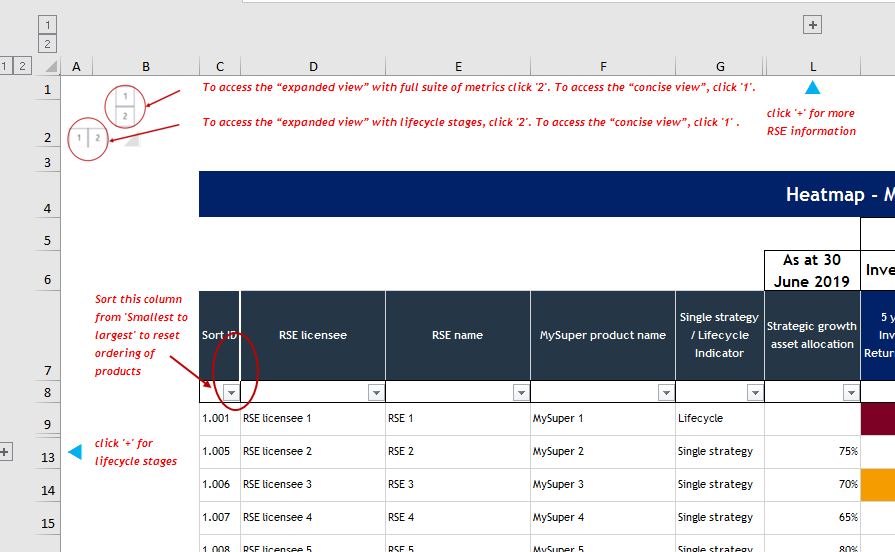

Call me ignorant, but when APRA announced the launch of its MySuper heatmap, I didn’t envision downloading an Excel spreadsheet and navigating multiple tabs in order to decipher what the hell I was looking at. If this monstrosity is intended to be fit for public consumption then the average Australian better have a financial adviser by their side, if for no other reason than to decode the thing.

Fortunately, the team who put the spreadsheet together included a “user guide” on tab 4 (see below). Crikey!

There is also a colour legend and a glossary of definitions for terms such as “strategic asset allocation” and “net investment return”.

My fear is that the average Australian super member looking to compare funds will struggle to comprehend what APRA’s heatmap actually means. Particularly when you consider what the financial literacy of an average Australian actually looks like.

Back in August, Compare the Market and Deloitte Access Economics released the second edition of The Financial Consciousness Index, which measures the extent to which Aussies are conscious or aware of their ability to affect and change their own financial outcomes, encompassing their willingness to act, and the extent to which they are able to participate in financial matters.

Australians scored 48 per cent on average on the index, which means they are just into the “conscious” band and out of the “it’s a blur” band.

Meanwhile, ASIC’s 2018 Financial Capability initiative noted that two in three Australians don’t understand the investment concept of diversification and only 35 per cent know what their super balance is.

With this in mind, it’s difficult to fathom how APRA’s overly complex Excel spreadsheet is going to translate, let alone be used as a guide, to everyday Australians.

FSC CEO Sally Loane warned against the misuse of the thing and said it should not be used to rank superannuation products.

“It is really important to understand that the heatmaps are a point-in-time analysis, which is a useful tool for APRA in its supervision activities, but it doesn’t tell the whole story when it comes to members’ retirement outcomes,” Ms Loane said.

“Particularly for life cycle products, which adjust investment strategies over a person’s lifetime, the headline numbers in the heatmap don’t reflect the actual experience of a member in that fund, and could be misleading if viewed in isolation.”

The FSC noted that the heatmap may tell you that other funds have had higher returns over five years, but if you’re close to retirement you might be far more concerned with how your fund is managing the risks of a market downturn to safeguard your retirement savings.

Some of the heatmap’s other failings are that it doesn’t tell you how your super has performed over your lifetime, it can’t tell you whether your fund invests in accordance with your ethical and philosophical beliefs, and it doesn’t tell you what additional services they offer to help you manage your savings.

“If you have concerns about whether your super fund is right for you, talk to your fund or speak to a financial adviser,” Ms Loane said.

Ms Loane said that while the FSC hoped APRA would continue to refine its MySuper heatmap methodology, the proposal to extend the exercise to choice products was highly problematic.

“The broad variety of choice products in the market, the complexity and bespoke nature of platforms and wraps where individuals choose their investment strategies, and the lack of direct comparable data, [make] it extremely difficult to translate heatmapping beyond MySuper and we urge APRA to not only be cautious in proceeding with this exercise but to engage deeply with industry,” she said.

In a fresh blow to Westpac, the Federal Court this morning delivered the corporate regulator a win in its appeal against a previous ruling on Westpac’s telephone campaigns. Via Financial Standard.

The full court this morning said ASIC’s appeal will be allowed with costs, while Westpac-related companies’ cross-appeal will be dismissed.

The matter relates to whether or not Westpac’s telephone sales campaigns amounted to advice and if that advice was personal or general in nature.

In 2014 and 2015, Westpac ran telephone and snail-mail campaigns to encourage customers to roll over external superannuation accounts into their existing accounts with Westpac Securities Administration Limited and BT Funds Management.

ASIC was primarily concerned with the telephone calls.

The corporate regulator claimed that the two Westpac companies had breached their FoFA-stipulated best interest duty by advising rollovers to Westpac-related super funds without a proper comparison of options, as required by law.

And so, it initially launched civil penalty proceedings against the two Westpac subsidiaries in December, 2016.

The Federal Court handed down its judgment in January this year, with a mixed outcome. It decided that ASIC had failed to demonstrate that the two Westpac companies had provided personal financial product advice to 15 customers in regards to the consolidation of superannuation accounts.

However, the judge added the Westpac subsidiaries contravened the Corporations Act in 14 of 15 customer phone calls by implying the rollover of super funds into a BT account was recommended. This came about through a “quality monitoring framework” where BT staff were coached in sales technique.

ASIC appealed the January judgment. Westpac also made a counter appeal.

Former Liberal Party leader John Hewson has questioned the management of superannuation funds and called out Australia’s sovereign wealth fund for ignoring climate risks. Via InvestorDaily.

Speaking on a panel at the Crescent Think Tank in Sydney on Thursday (24 October), Mr Hewson noted that most of the $2.9 trillion of superannuation money is invested in stock markets, primarily in the US and Australia.

“You are heavily exposed when those markets are as overvalued as they are. By any measure the US stock market is way overvalued. There is going to be a correction. It’s just a matter of when and how far. Super funds are taking a risk by staying in those markets,” the former Liberal Party leader said.

“Some have rebalanced portfolios and put a bit more into cash, but you don’t earn anything on cash. Fixed-interest gives you a very low return.”

Mr Hewson noted the low interest rate environment globally, highlighting that around 25 per cent of sovereign bonds have negative rates.

“These are uncharted waters for those in the financial sector. Everyone is chasing yield but the only place you get a return is a stock market. The big question is how sustainable is that return? You can see how volatile equities markets are just based on a tweet from Trump. This is a very volatile and dangerous world for superannuation funds to be so exposed,” he said.

Mr Hewson was one of the key figures behind The Climate Institute’s Asset Owners Disclosure Project (AODP), which has since been taken over by ShareAction. Over the years the AODP index and report has repeatedly called out Australia’s sovereign wealth fund, the Future Fund, for lagging behind its international peers on climate change.

Last week Future Fund CEO David Neal stated that Australia’s sovereign wealth fund does not invest for social concerns and will continue to invest in fossil fuels.

“Our job is very clear. Our job is to generate a financial return for the nation,” Mr Neal told a committee in Canberra last week.

Commenting on the Future Fund’s stance, Mr Hewson said: “This is a fund that was buying British American Tobacco flat out when both sides of government were running anti-smoking campaigns.”

“They are not interested in climate risk. The fund is not transparent enough to satisfy a lot of people. They are taking big risks,” he said.

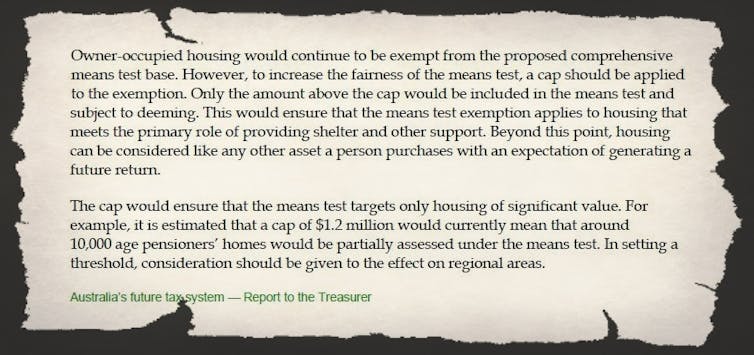

Here’s the boldest idea the government’s inquiry into retirement incomes should consider but might not: no longer exempting all of the value of each retiree’s home from the pension assets test. Via The Conversation.

The test would merely exempt part of the value of retirees’ homes. The change would free-up funds to support other retirees who are struggling because they have to pay rent.

It’s an idea with an impressive lineage.

The Henry Tax Review suggested exempting only the first A$1.2 million. The bit above $1.2 million would be regarded as an asset and subject to the test.

The review said it would hit only 10,000 retirees. The $1.2 million figure was in 2009 dollars, meaning that if the change came in today the review would want it to cut in at a higher dollar figure.

The Grattan Institute suggests a lower cut in: $500,000. The first $500,000 of each mortgaged home would remain exempt from the pension assets test, the part above $500,000 would be regarded as an asset. Grattan says it would save the budget $1 to $2 billion a year.

The Australian Chamber of Commerce and Industry agrees, as does the Actuaries Institute.

Who could object?

The Combined Pensioners and Superannuants Association says asset testing the family home would be “massively unfair”, targeting the vulnerable.

But people with high-value mortgage-free homes aren’t normally thought of as vulnerable.

Labor’s treasury spokesman Jim Chalmers says it would push more retirees “off the pension, out of their homes, or both”.

He is right about the former, but wrong to think the retirees who suffered a cut in their pension or lost their pension would be badly off.

The worst off retirees, as recognised by a Senate Committee, are those without homes making do with grossly inadequate rental assistance.

Right now it is possible for a single person owning a $1.3 million mortgage-free home and $260,000 of other assets to get the full age pension.

Assuming that person draws down on those other assets at the rate of 5% per year, he or she can spend $37,000 per year and pay no rent.

A non home owner with $785,000, or half the assets, would be denied the pension.

Like the much-richer homeowner, that person would be able to draw an income of about $37,000 per year, but half it will have to go on rent.

It’s hardly fair.

It encourages retirees with homes to stash more and more of their assets into them in order to get the pension (and pass something valuable on to their children). Retirees with lesser assets miss out and have to rent.

But fairness is in the eye of the beholder.

The problem is that a ceiling on exemption from the assets test that seems fair in one part of Australia might not seem fair in another where home prices and perhaps the cost of living is higher.

In order to make more equal treatment seem fair to all retirees with homes I and fellow actuary Colin Grenfell have worked up an option that would use the median (typical) price for each postcode as the cut off point for exemption from the assets test.

It would happen postcode by postcode, updated every year using Council valuations and as the median prices changed.

Only the owners of homes who values were atypical for the area would be affected, and only that part of the value of their home that was atypical would be included in the assets test.

Its key selling point is that it wouldn’t threaten homeowners with values at and below the average for their area.

The funds freed could increase the overall pension, but would probably be better applied to lifting rent assistance.

It’s important to treat retirees in the same financial circumstances the same, regardless of whether they own a mortgage-free home, and fewer and fewer retirees are owning mortgage-free homes.

It would have the added benefit of reducing the pressure on our parents and grandparents to own houses with bedrooms on the first floor that are never opened, not until they die and their houses are sold.

Anthony Asher, Associate Professor, UNSW

We look at a global study of superannuation (pensions) and see where Australia stands, and also discuss the elephant in the room – poor returns in a low rate environment.

https://www.monash.edu/business/monash-centre-for-financial-studies

The Federal government has today announced that it will be commissioning an independent review of the retirement income system, via InvestorDaily.

This review was recommended by the Productivity Commission in their report Superannuation: Assessing Efficiency and Competitiveness and comes 27 years after the establishment of compulsory superannuation.

The review will look at the three pillars of the existing retirement income system, being the Age Pension, compulsory superannuation and voluntary savings.

In doing so, the review will cover the current state of the system and how it will perform in the future as Australians live longer and the population ages.

Through its work, the review will establish a fact base of the current retirement income system that will improve understanding of its operation and the outcomes it is delivering for Australians.

The review will be conducted by an independent three person panel.

Mr Michael Callaghan AM PSM, a former Executive Director of the International Monetary Fund and a former senior Treasury official will chair the review, together with fellow panellists Ms Carolyn Kay, who has more than 30 years’ experience in the finance sector across roles both in Australia and overseas, including as a member of the Future Fund Board of Guardians, and Dr Deborah Ralston, who is a Professorial Fellow in Banking and Finance at Monash University, a member of the RBA’s Payments System Board and most recently chair of the Alliance for a Fairer Retirement.

A consultation paper will be released in November 2019 and the final report provided to Government by June 2020.

The Review will establish a fact base of the current retirement income system that will improve understanding of its operation and the outcomes it is delivering for Australians. It aims to identify how the retirement income system supports Australians in retirement, the role of each pillar in supporting Australians through retirement, distributional impacts across the population and over time and the impact of current policy settings on public finances.

FSC CEO Sally Loane said the FSC will work closely with the review to ensure continuing improvements to Australia’s retirement income system, particularly through the superannuation system.

“Superannuation consumers receive significant benefits from competition and choice, and this will be an important focus of the FSC’s approach to the Review,” Ms Loane said.

“However, this review should not delay important reforms that the Government has already committed to that will significantly improve consumer outcomes in superannuation.

“These include the introduction of a ‘default once’ framework to prevent unintended multiple accounts, as recommended by both Commissioner Kenneth Hayne and the recent Productivity Commission review of superannuation, and legislating an obligation for trustees to consider the retirement needs of their members.”

The FSC will also suggest to the review that the government should retain its policy of increasing the Superannuation Guarantee to 12 per cent. The FSC also suggests that superannuation laws should be simplified and red tape in the sector should be removed including barriers to rationalising legacy products.

“The FSC looks forward to advocating strongly for these positions during the Review process over the coming year,” Ms Loane said.

AMP welcomed the review and said a strong retirement system is essential to supporting the wellbeing of Australians now and into the future.

“This is a once-in-a-generation opportunity to improve our current retirement system to make sure it adequately serves everyone’s needs. Now is the time to have the debate on this issue,” an AMP spokesperson said.

With the super industry set to undergo a range of changes in the coming days, the new assistant minister for financial services has hinted that further changes are still to come., via InvestorDaily.

As of 1 July, the government’s Protecting Your Superannuation laws will see automatic life insurance cover be turned off for members whose accounts have been inactive for over 16 months.

Other changes coming include closing inactive super accounts with a balance of less than $6,000, which will be transferred to the ATO before finding its way to members’ active accounts.

Fees will also be capped on low-balance accounts, and exit fees will be removed along with a variety of changes aimed at helping older Australians.

However, Assistant Minister for Superannuation and Financial Services Jane Hume has now suggested that 2021 will see the industry change yet again.

2021 is currently the year that the compulsory superannuation guarantee will rise from 9.5 per cent to 10 per cent and is now potentially the deadline for a system overhaul.

The superannuation guarantee was a hot topic during the election campaign as Labor had vowed to increase the guarantee to 12 per cent by 2025, while other groups called for the planned guarantee raises to be cut.

Chief policy officer for the Association of Superannuation Funds of Australia Glen McRea told Investor Daily that the overwhelming majority of Australians support the increase of the guarantee.

“Recent polling for ASFA by CoreData indicates that an overwhelming majority of Australians support the current compulsory superannuation system and want to see the Superannuation Guarantee (SG) increased to 12 per cent of wages. It found around 80 per cent of respondents across a range of demographics either support or strongly support the increase,” he said.

Ms Hume’s plans for super do not touch upon the guarantee, rather the senator has told the industry that 2021 is the deadline to have the overhaul in order.

“If a system is compulsory and it quarantines nearly $1 in every $10 that you earn for up to 40 years, it is imperative that the government make that system as efficient as possible,” she told the Sydney Morning Herald.

Ms Hume plans to reintroduce super legislation that would make all insurance opt-in for those aged under 25 as well as implementing further recommendations of the Productivity Commission’s review.

The $2.8 trillion super industry is something Australia should be proud of, said Ms Hume, but there were inefficiencies that needed to be ironed out.

Options on the table included the default best-in-show list that has been criticised by the industry and spring cleaning of underperforming funds.

Mr McRea said the ASFA supported the initiatives by the government to improve outcomes and would continue to do so where appropriate.

“ASFA supports recent initiatives to increase efficiency and improve outcomes for members – including significant investment in technology, reducing rollover and transaction processing times, and continuing to reduce the incidence of multiple accounts,” he said.

The best-in-show was a suggestion from the Productivity Commission which doubled down on its call for a top 10 list earlier this year.

“This new approach will support member engagement by ‘nudging’ members towards good products without forcing them to pick one. Members will retain the option to choose from the wider set of MySuper and choice products (or establish their own SMSF), and elevated ‘outcomes tests’ will help to weed out persistently underperforming products from the system,” the report read.

However, Dr Martin Fahy from the ASFA at the time said he was disappointed in the suggested as it risked creating an oligopoly in default superannuation.

The suggestion was also not supported by Labor with then shadow treasurer Chris Bowen expressing concerns that the list may have unintended consequences.

APRA says it has issued directions and additional licence conditions to AMP Superannuation Limited and N.M. Superannuation Proprietary Limited (collectively AMP Super).

APRA has imposed the directions and additional licence conditions to address a range of concerns regarding AMP Super’s compliance with the Superannuation Industry (Supervision) Act 1993 (SIS Act). The action arises from issues identified during APRA’s ongoing prudential supervision of AMP Super, along with matters that emerged during the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

The new directions and conditions are designed to deliver enhanced member outcomes by requiring AMP Super to make significant changes to its business practices. Areas identified for improvement include conflicts of interest management, governance and risk management practices, breach remediation processes, addressing poor risk culture and strengthening accountability mechanisms. The directions also require AMP Super to renew and strengthen its board.

Additionally, APRA requires AMP Super to engage an external expert to report on remediation and compliance with the new directions and conditions.

This is the second time APRA has used the broader directions power that was granted in April following the passage of the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No 1) Bill 2019. It also demonstrates APRA’s commitment to embedding the “constructively tough” enforcement appetite outlined in April’s new Enforcement Approach

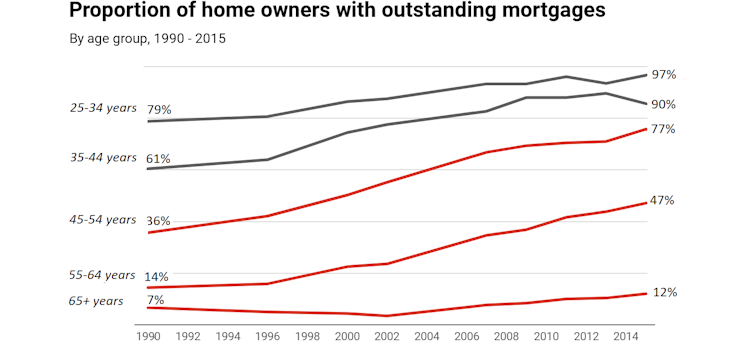

The number of mature age Australians carrying mortgage debt into retirement is soaring.

And on average each mature age Australian with a mortgage debt owes much more relative to their income than 25 years ago.

Microdata from the Bureau of Statistics survey of income and housing shows an increase in the proportion of homeowners owing money on mortgages across every home-owning age group between 1990 and 2015. The sharpest increase is among homeowners approaching retirement.

For home owners aged 55 to 64 years, the proportion owing money on mortgages has tripled from 14% to 47%.

Among home owners aged 45 to 54 years, it has doubled.

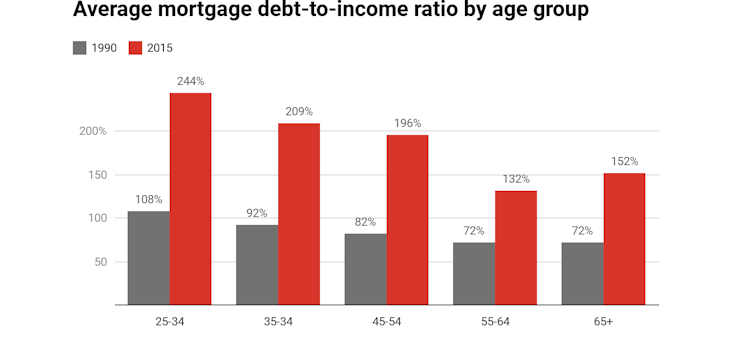

Meanwhile, the average mortgage debt-to-income ratio among those with mortgages has pretty much doubled across every home-owning age group.

In the 45-54 age group the mortgage debt-to-income ratio has blown out from 82% to 169%.

For those aged 55-64 it has blown out from 72% to 132%.

The soaring rates of mortgage indebtedness among older Australians have been driven by three distinct factors.

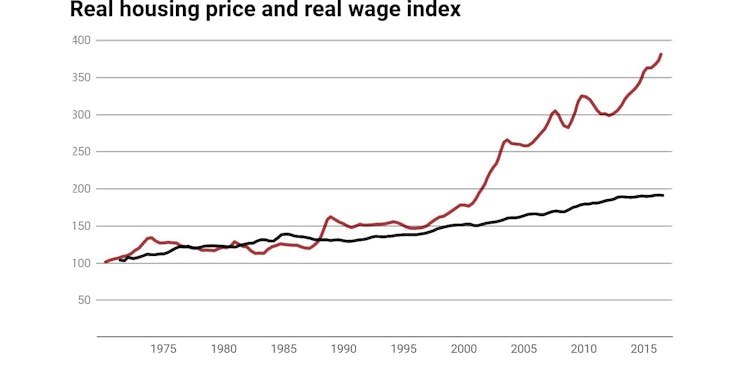

First, property prices have surged ahead of incomes.

Since 1970 the national dwelling price to income ratio has doubled.

Despite weaker property prices, the ratio remains historically high. This means households have to borrow more to buy a home. It also delays the transition into home ownership, potentially shortening the the remaining working life available to repay the loan.

Second, today’s home owners frequently use flexible mortgage products to draw down on their housing equity as needed for other purposes. During the first decade of this century, one in five home owners aged 45-64 years increased their mortgage debt even though they did not move house.

Third, older home owners appear to be taking on bigger mortgages or delaying paying them off in the knowledge that they can work longer than their parents did, or draw down their superannuation account balances.

For mortgage holders aged 55-64 years, there is evidence to suggest that larger debts prolong working lives.

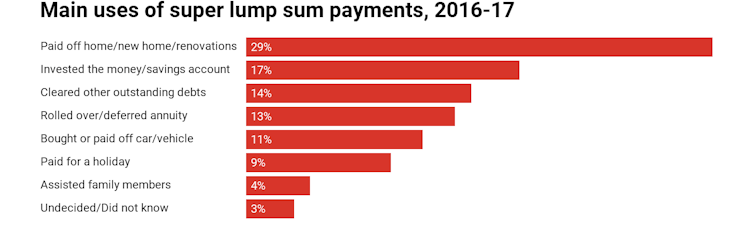

In 2017 around 29% of lump sum superannuation withdrawals were used to pay down mortgages or purchase new homes or pay for home improvements, up from 25% four years earlier.

In the Netherlands, where a mandatory occupational pension scheme along the lines of Australia’s super scheme has been in place for much longer, over one-half of home owners aged 65 and over are still paying off mortgages.

Internationally, studies have found that indebtedness adds to psychological distress. The impacts on wellbeing are more profound for older debtors, without the ability to recover from financial shocks.

Debt-free home ownership in old age used to be known as the fourth pillar of the retirement incomes system because of its role in reducing poverty in old age. It allowed the Australian government to set the age pension at relatively low levels.

Growing indebtedness will increase after-housing-cost poverty among older Australians and create pressure to boost the age pension.

Mortgage debt burdens late in working life will also expose home owners to unwelcome risks, as health or employment shocks can ruin plans to pay off their mortgages.

During the first decade of this century, around half a million Australians aged 50 years and over lost their homes.

Those losing home ownership are often forced to rely on rental housing assistance. Moreover, as older tenants they are unlikely to ever leave housing assistance. This will put pressure on the government to boost spending on housing assistance, which is likely to further boost demand for housing assistance.

Super and government housing assistance could become the safety nets that allow retirees to escape their mortgages.

It wasn’t the intended purpose of superannuation, and wasn’t the intended purpose of housing assistance. It is a development that ought to be front and centre of the inquiry into the retirement incomes system announced by Treasurer Josh Frydenberg.

It is a change we’ll have to come to grips with.

Authors: Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University; Gavin Wood, Emeritus Professor of Housing and Housing Studies, RMIT University