The Productive Commission released their latest report today. We discuss the findings and consider the implications. Many people are not getting the maximum returns from their savings, thanks to poor fund choice, high fees, multiple accounts and insurance premiums.

In addition, APRA and ASIC have been asleep at the wheel, with more of a focus on the institutions compared with the interests of members.

Finally, industry funds often out perform retail funds.

The Productive Commission summary says:

- Australia’s super system needs to adapt to better meet the needs of a modern workforce and a growing pool of retirees. Structural flaws — unintended multiple accounts and entrenched underperformers — are harming millions of members, and regressively so.

- Fixing these twin problems could benefit members to the tune of $3.8 billion each year. Even a 55 year old today could gain $79 000 by retirement. A new job entrant today would have $533 000 more when they retire in 2064.

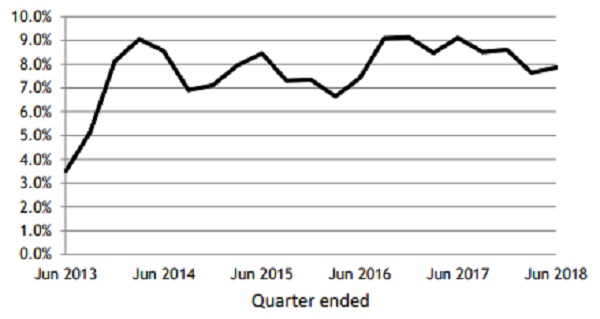

- Our unique assessment of the super system reveals mixed performance.

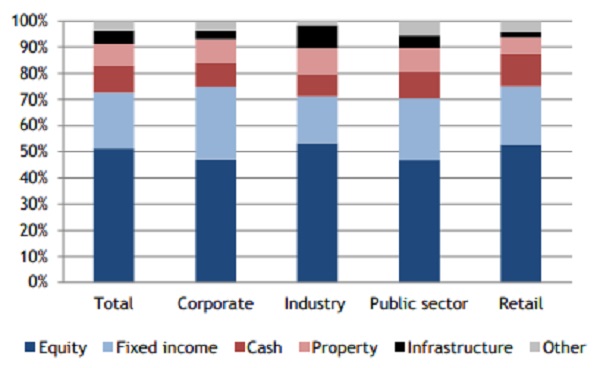

- While some funds consistently achieve high net returns, a significant number of products underperform, even after adjusting for differences in investment strategy. Underperformers span both default and choice, and most (but not all) affected members are in retail funds.

- Evidence abounds of excessive and unwarranted fees in the super system. Reported fees have trended down but a tail of high‑fee products remains entrenched, mostly in retail funds.

- Compelling cost savings from realised scale have not been systematically passed on to members as lower fees or higher returns. Much scale remains elusive with too few mergers.

- A third of accounts (about 10 million) are unintended multiple accounts. These erode members’ balances by $2.6 billion a year in unnecessary fees and insurance.

- The system offers products that meet most members’ needs, but members lack simple and salient information and impartial advice to help them find the best products.

- Not all members get value out of insurance in super. Many see their retirement balances eroded — often by over $50 000 — by duplicate or unsuitable (even ‘zombie’) policies.

- Inadequate competition, governance and regulation have led to these outcomes.

- Rivalry between funds in the default segment is superficial, and there are signs of unhealthy competition in the choice segment (including product proliferation). Many funds lack scale, with 93 APRA‑regulated funds — half the total — having assets under $1 billion.

- The default segment outperforms the system on average, but the way members are allocated to default products has meant many (at least 1.6 million member accounts) have ended up in an underperforming product, eroding nearly half their balance by retirement.

- Regulations (and regulators) focus too much on the interests of funds and not members. Subpar data and disclosure inhibit accountability to members and government.

- Policy initiatives have chipped away at some problems, but architectural change is needed.

- Default should be the system exemplar. Members should only be defaulted once, and move to a new fund only when they choose. Members should also be empowered to choose their own super product from a ‘best in show’ shortlist, set by a competitive and independent process. This will bring benefits above and beyond simply removing underperformers.

- All MySuper and choice products should have to earn the ‘right to remain’ in the system under elevated outcomes tests. Weeding out persistent underperformers will make choosing a product safer for members.

- All trustee boards need to steadfastly appoint skilled board members, better manage unavoidable conflicts of interest, and promote member outcomes without fear or favour.

- Regulators need clearer roles, accountability and powers to confidently monitor trustee conduct and enforce the law when it is transgressed. A strong member voice is also needed.

- Implementation can start now, carefully phased to protect member (not fund) interests.