ASIC has released new research revealing many consumers confuse ‘general’ and ‘personal’ advice exposing them to greater risk of poor financial decisions.

The ASIC report, Financial advice: Mind the gap (REP 614), presents new independent research on consumer awareness and understanding of general and personal financial advice, identifying substantial gaps in consumer comprehension.

“This disturbing gap in understanding whether the advice they are getting is personal or not means many consumers are under the false premise their interests are being prioritised, when no such protection exists,” said ASIC Deputy Chair, Karen Chester.

Millions of Australians will likely seek financial advice at some stage in their lives. When they do, it is critical they understand whether that advice is personal, whether it is tailored to their circumstances and does the adviser have a legal obligation to act in their interest.

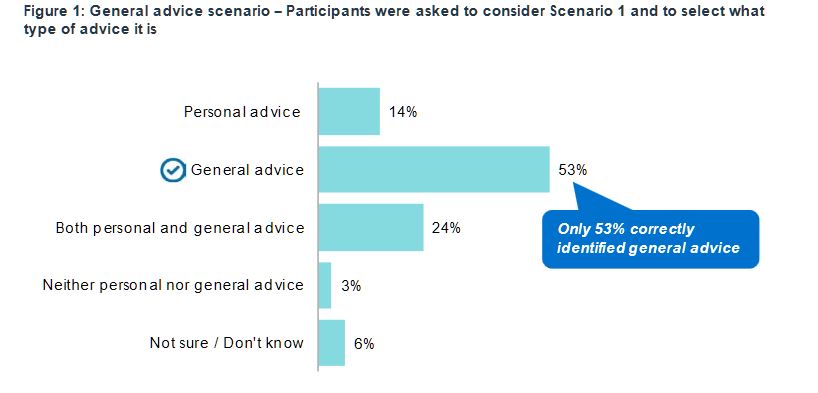

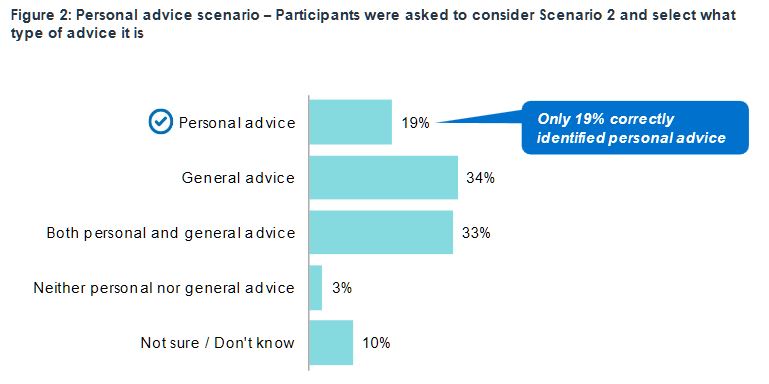

“The survey not only revealed consumers are not familiar with the concepts of general and personal advice, but only 53 per cent of those surveyed correctly identified ‘general’ advice. And even when provided the general advice warning, nearly 40 per cent of those surveyed wrongly believed the adviser had an obligation to take their personal circumstances into account,” Ms Chester said.

The report highlights the importance of consumer awareness and understanding of the distinction between personal and general advice with the Future of Financial Advice (FOFA) protections only applying when personal advice is provided. These include obligations for advisers to act in their client’s best interests, to provide advice that is appropriate to their client’s personal circumstances and to prioritise their client’s interests. These obligations do not apply when general advice is provided.

“The survey also revealed that the responsibilities of financial advisers, when providing general advice, is not well understood. Nearly 40 per cent of those surveyed were unaware that advisers were not required by law to act in their clients’ best interests,” Ms Chester said.

ASIC anticipates the need for financial advice to grow, reflecting an ageing population and many financial products, especially retirement products, becoming more complex. ASIC reports that much of the advice is likely to be general advice, and while appropriate in some circumstances, it is inevitably of limited use.

“ASIC is seeing increased sales of complex financial products under general advice models – so not tailored to personal circumstances – leaving many consumers, especially retirees, exposed to the potential risk of financial loss. And whilst the Financial Services Royal Commission, and the Government’s response, dealt with the most egregious risks of hawking of complex financial products, consumer confusion about what is personal and general advice needs to be addressed,” Ms Chester said.

The report’s findings reinforce those of the Murray Financial System Inquiry and the Productivity Commission reports on the financial and superannuation systems. Those reports made recommendations about the use of the term ‘general advice’, which is likely to lead to false consumer expectations as to the value of and protections afforded advice received.

Ms Chester said, “This consumer research is timely. It comes as the Government is considering policy recommendations on financial advice from the Productivity Commission’s twin reports on Australia’s financial and superannuation systems. And at a time when the financial system itself undergoes much change, following the intense scrutiny of the Financial Services Royal Commission, including considering new financial advice and distribution business models”.

The report includes quantitative and qualitative research commissioned by ASIC and undertaken by independent market research agency, Whereto Research. The research used hypothetical advice scenarios to test consumer recognition of when general and personal advice was being provided, and awareness of adviser responsibilities when being given each type of advice.

Report 614 Financial advice: Mind the gap is the first stage in ASIC’s broader research project into consumer experiences with and perceptions of the financial advice sector. Additional research by ASIC will get underway in 2019 to identify a more appropriate label for general advice and consumer-test the effectiveness of different versions of the general advice warning.