China’s housing market is likely to continue to cool in response to stronger restrictions on home purchases across many cities and tighter credit conditions, say Fitch Ratings. Housing is the key cyclical sector in the Chinese economy, and will weigh on growth in the second half of the year and into 2018.

There is already evidence that the housing market is slowing. Growth in new residential property sales decelerated to 24.0% yoy (on a trailing 12-month basis) in May 2017, down for the fifth straight month from the 36.2% peak in December 2016. Price gains have also moderated. Secondary home prices in Tier 1 cities rose by 28.7% in 2016, but increased by just 3.6% in the first five months of 2017, and fell for the first time since September 2014 in May.

The downturn has been policy driven, with the authorities stepping in to prevent excessive froth in the market. Tightened rules on home purchases and mortgages are curbing buying by speculators and upgraders. Some first-time buyers might also be postponing purchases in the expectation that prices may fall. Meanwhile, the increased focus of the authorities on controlling leverage and limiting financial risks has led to a significant rise in money-market interest rates since last December, and some banks have recently increased mortgage rates.

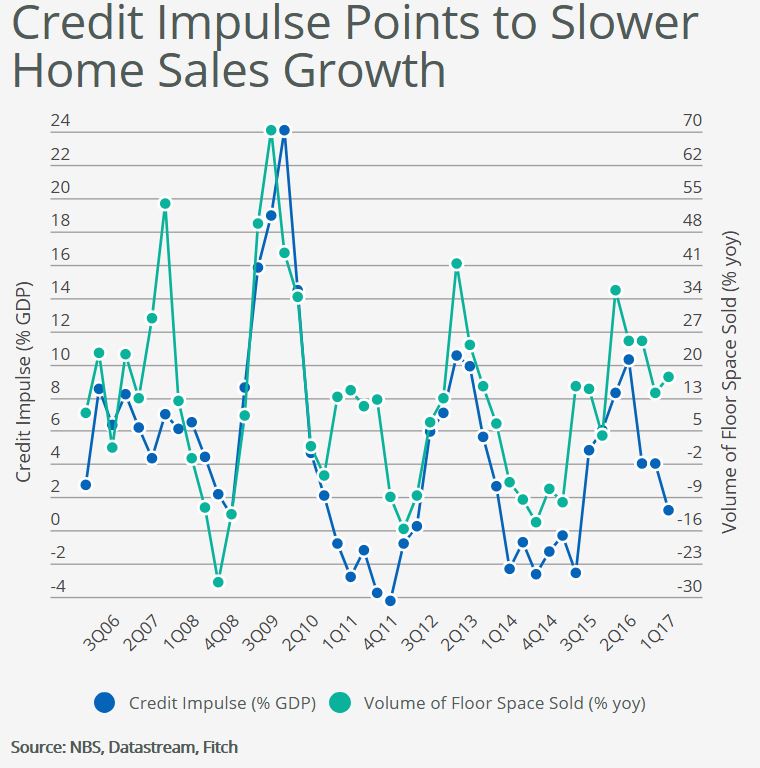

The near-term outlook for China’s housing market is closely linked to the domestic credit cycle. As the chart below shows, housing sales move broadly in line with the “credit impulse” – or the change in the flow of new credit (including local government bonds) as a share of GDP. A weaker credit impulse, along with the tightening of home purchase restrictions, is likely to drag down home sales growth further in 2H17.

That said, the government will want to avoid causing significant volatility in the market. Home sales dropped by 9% yoy in early 2015, following the last tightening of restrictions, which contributed to a strong release of pent-up demand when policies were subsequently relaxed. We expect a more cautious approach this time, which is likely to result in home sales stalling, but not falling, in 2H17.

House prices are likely to decline slightly in 2H17, as demand weakens. We expect prices in Tier 1 cities to hold up better than in lower-tier cities. Prices in Tier 1 cities have risen by almost 90% in the last four years, compared with increases of 10%-25% in lower-tier cities. However, demand in Tier 1 cities remains strong and land supply is tight, which gives the authorities more scope to support the market if the downturn is sharper than expected. In lower-tier cites, demand is weaker and developers’ housing inventories are higher.

A likely weakening in the housing market is one of the main reasons behind our forecast that GDP growth will slow in 2H17. Investment in housing alone accounts for around 10% of GDP, and most estimates place its contribution to GDP much higher once supporting industries are included. There tends to be a six- to eight-month lag from sales to housing investment growth, which means that the economic impact of the housing market slowdown will continue well into 2018, when we expect GDP growth to slip slightly below 6%.