A financial crisis in China is no more likely in the coming decade than it was in the past 10 years, and pessimists predicting one have long done so without regard for fundamentals.

So says sinologist Andy Rothman, a San Francisco-based investment strategist at Matthews International Capital Management LLC, which oversees $26.1 billion. Before joining in 2014 he lived in China for two decades, working in the U.S. Foreign Service, including as head of the macroeconomics and domestic policy office of the U.S. embassy in Beijing. He later was a Shanghai-based strategist in CSLA Ltd., an investment banking arm of Credit Agricole SA.

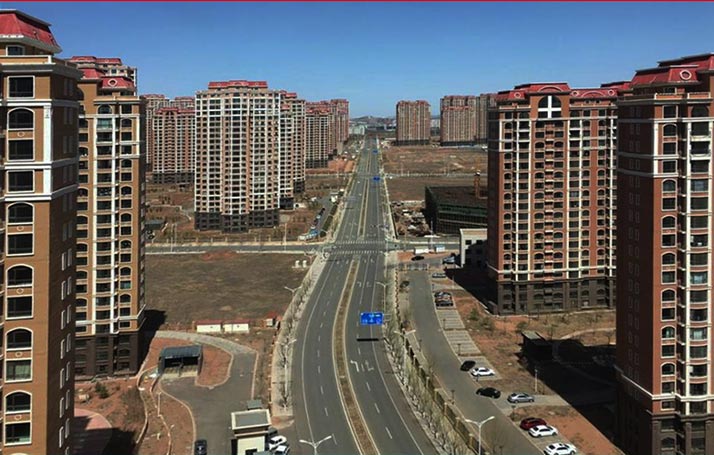

China has no housing bubble and there’s no looming banking crisis, he says. His optimism rests on his view that the housing market is on a solid foundation. Leverage is the most important precondition for a bubble in any asset, and home buyer indebtedness in China is very low because down payment requirements are high, unlike in the U.S., he says.

“This isn’t like speculating in Las Vegas with zero money down,” he says. “China has a lot of problems, but they don’t tend to be the apocalyptic, catastrophic problems that we often read about. They’re more mundane, longer-term problems like how do you develop a rental market.”

While the country’s overall debt situation is serious, it’s still unlikely to lead to a financial crisis or economic hard landing, he says. That’s because potential bad debts are in state entities, which allows the government to manage how or whether they go bad, Rothman says.

He projects new home sales may fall 10 percent next year after rising about 30 percent in 2016 as the government continues to curb prices. While bears may see that as evidence of impending disaster, Rothman says it would still make 2017 China’s second-best year ever for new home sales because the base has grown so big.