The Foreign Investment and Review Board (FIRB) published their annual report for 2017-2018.

In 2017-18, there were declines in approvals by both number and proposed investment value for both residential and non-residential sectors.

For the first time since 2012–13, the United States surpassed China as the largest source country for approved proposed investment due to an increase in United States approvals and a decline in Chinese approvals. The United States recorded an increase in approved investment from $26.5 billion in 2016-17 to $36.5 billion in 2017-18, with significant increases in real estate and the manufacturing, electricity and gas sector.

China was the second largest source country following a decrease in approved proposed investment to $23.7 billion in 2017–18 from $38.9 billion in 2016–17. This reduction was due to falls in the value of approvals across all sectors. Over the last five years, Chinese proposed investment peaked at $47.3 billion in 2015–16 and also reached $46.6 billion in 2014–15. While proposed investment will not necessarily translate to actual investment and such datasets are not comparable, International Monetary Fund and Australian Bureau of Statistics data to the end of 2017 indicate that Australia has been impacted to a lesser degree by the decrease in Chinese outward investment compared to similar economies.

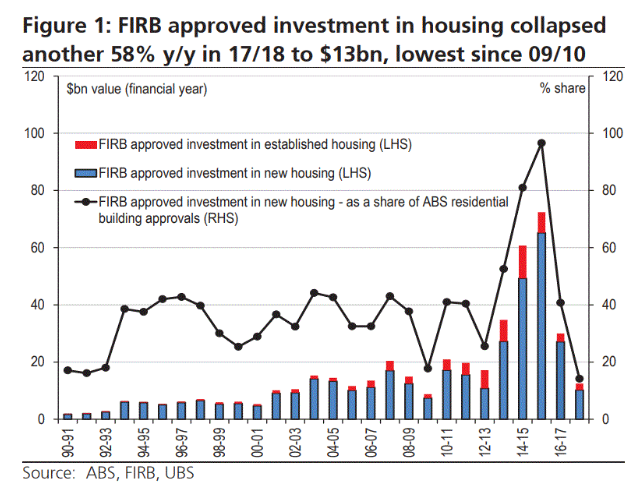

By number of approvals, 91 per cent were for proposed investment in residential real estate worth $12.5 billion by value. This was a drop of $17.5 billion from 2016–17 reflecting a slowing in foreign demand for residential real estate.

In residential real estate, there was a decline in New South Wales’ share of approvals, which was offset by increases in Victoria and Western Australia’s shares. The decrease in residential real estate approvals by value was driven by a drop in new dwelling related approvals. Like other similar economies we have seen a decline in proposed investment from China as Chinese authorities have tightened capital controls.

The main driver of the drop by value was a decline in new dwelling related approvals, in particular, in developers seeking exemption certificates that provide pre-approval for foreign persons to purchase new dwellings in developments. However, approvals in the same category were significantly elevated in 2014-15 and 2015-16 at three to four times the average of the immediate years prior.

Consistent with the overarching principle of Australia’s Foreign Investment Policy that proposed investment in residential real estate should increase Australia’s housing stock, 84 per cent of approvals by number were for categories, such as new dwellings and vacant land for development, that contribute to increasing Australia’s housing stock.

While Chinese demand for residential real estate has fallen, China still accounts for a majority of residential real estate approvals.

With major reforms having been made to foreign investment regimes overseas, such as in the United States and the United Kingdom, the Australian Government has enhanced its cooperation with counterpart agencies overseas, particularly in relation to national security developments. The comparatively well-developed nature of the Australian foreign investment review mechanism has been the subject of close scrutiny by other like-minded countries as part of their consideration of addressing national security and other issues relevant to their foreign investment regimes.