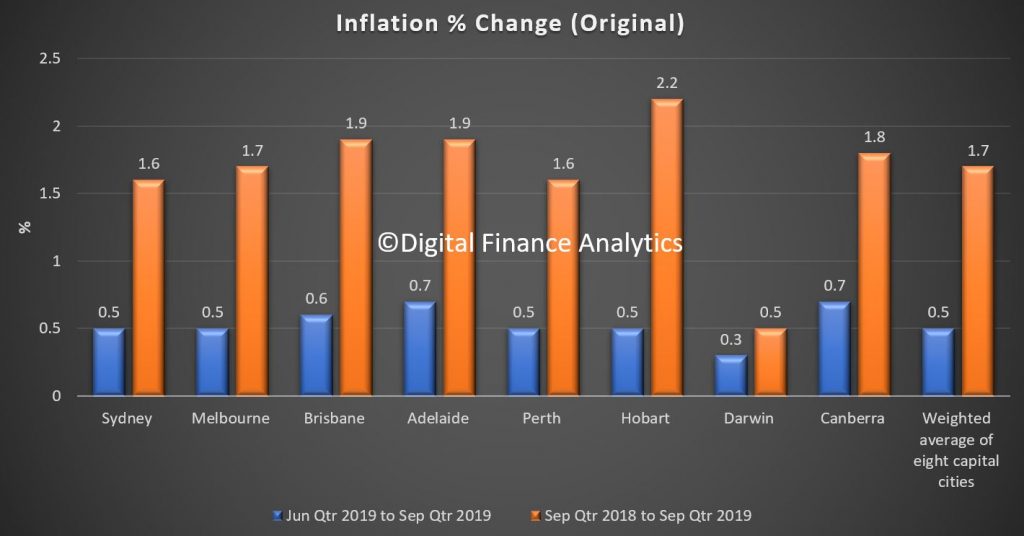

The Consumer Price Index (CPI) rose 0.5 per cent in the September 2019 quarter, according to the latest Australian Bureau of Statistics (ABS) figures. This follows a rise of 0.6 per cent in the June 2019 quarter.

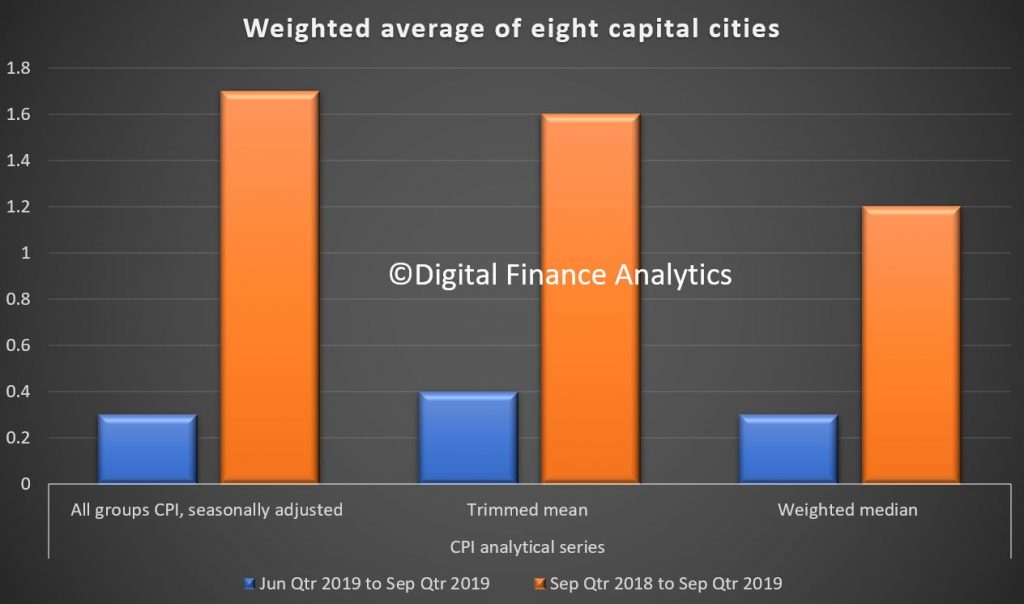

All groups CPI seasonally adjusted rose 0.3%.

The trimmed mean rose 0.4%, following a rise of 0.4% in the June 2019 quarter. Over the twelve months to the September 2019 quarter, the trimmed mean rose 1.6%, following a rise of 1.6% over the twelve months to the June 2019 quarter.

The weighted median rose 0.3%, following a rise of 0.4% in the June 2019 quarter. Over the twelve months, the weighted median rose 1.2%, following a rise of 1.3% over the twelve months to the June 2019 quarter.

This is well below the RBA target.

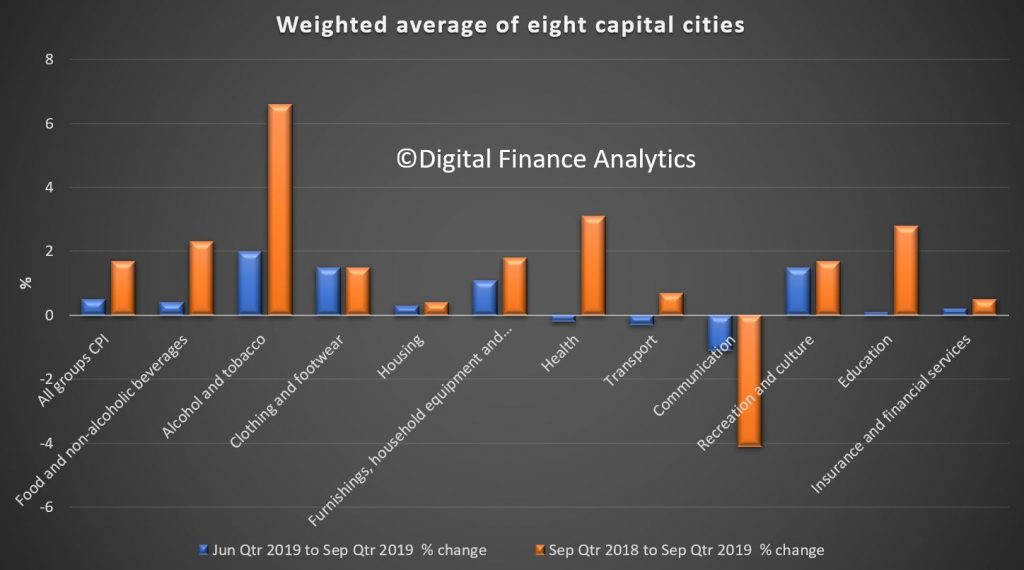

The most significant price rises in the September 2019 quarter were international holiday, travel and accommodation (+6.1 per cent), tobacco (+3.4 per cent), property rates and charges (+2.5 per cent) and child care (+2.5 per cent).

The most significant price falls this quarter were automotive fuel (-2.0 per cent), fruit (-3.1 per cent) and vegetables (-2.5 per cent).

ABS Chief Economist, Bruce Hockman said: “Despite the price falls for fruit and vegetables this quarter, the drought is impacting on the prices for a range of food products. Prices rose this quarter for meat and seafood (+1.7 per cent), dairy and related products (+2.2 per cent) and bread and cereal products (+1.3 per cent).”

The CPI rose 1.7 per cent through the year to the September 2019 quarter. This follows a through the year rise of 1.6 per cent to the June 2019 quarter.

“Annual inflation remains subdued partly due to price rises for housing related expenses remaining low, and in some cases falling in annual terms. Prices for utilities (-0.3 per cent) and new dwelling purchase by owner-occupiers (-0.1 per cent) both fell slightly through the year to the September 2019 quarter, while rents (0.4 per cent) recorded only a small rise,” said Mr Hockman.

Main contributors by city:

Sydney (+0.5%)

- International holiday, travel and accommodation (+6.9%)

- Tobacco (+3.4%)

- Wine (+2.6%).

The rise was partially offset by:

- Automotive fuel (-2.2%)

- New dwelling purchase by owner-occupiers (-0.6%). The fall in new dwelling purchase by owner-occupiers is mainly driven by base price reductions due to weak market conditions.

- Sports participation (-3.5%) due to the introduction of a second $100 Active Kids sports voucher for school aged children in New South Wales.

Melbourne (+0.5%)

- International holiday, travel and accommodation (+5.5%)

- Tobacco (+3.5%)

- Gas and other household fuels (+3.5%) due to the seasonal switch to peak winter gas prices.

The rise was partially offset by:

- Electricity (-4.1%) due to the introduction of the Victorian Default Offer from 1 July 2019.

- Motor vehicles (-2.0%)

- Automotive fuel (-1.8%).

Brisbane (+0.6%)

- International holiday, travel and accommodation (+4.7%)

- Tobacco (+3.2%)

- Electricity (+2.6%) driven by the $50 asset ownership dividend that was applied to consumers’ electricity bills last quarter.

The rise was partially offset by:

- Automotive fuel (-2.6%)

- Fruit (-2.7%).

Adelaide (+0.7%)

- International holiday, travel and accommodation (+6.3%)

- Tobacco (+3.4%)

- Wine (+3.5%).

The rise was partially offset by:

- Domestic holiday, travel and accommodation (-2.4%)

- Insurance (-3.5%) due to the Compulsory Third Party insurance market being opened to competition on 1 July.

- New dwelling purchase by owner-occupiers (-0.7%).

Perth (+0.5%)

- International holiday, travel and accommodation (+6.8%)

- Tobacco (+3.5%)

- Electricity (+1.7%).

The rise was partially offset by:

- Automotive fuel (-2.6%)

- Fruit (-6.5%).

Hobart (+0.5%)

- New dwelling purchase by owner-occupiers (+2.3%) due to a strong housing market.

- International holiday, travel and accommodation (+6.2%)

- Tobacco (+2.6%).

- Hobart is the only capital city to record a rise in automotive fuel this quarter (+0.5%).

The rise was partially offset by:

- Domestic holiday, travel and accommodation (-7.0%)

- Vegetables (-2.5%).

Darwin (+0.3%)

- Domestic holiday, travel and accommodation (+4.4%) due to increased demand during the peak tourist season this quarter.

- Tobacco (+3.1%)

- International holiday travel and accommodation (+4.6%).

The rise was partially offset by:

- Rents (-1.8%); due to continued high vacancy rates

- Other financial services (-3.2%) due to the introduction of the Territory home owner discount (THOD), which offers a discount on stamp duty when purchasing a dwelling for owner-occupier purposes from May 2019.

- Sports participation (-9.0%) due to the biannual $100 sports voucher provided to school aged children in the Northern Territory.

Canberra (+0.7%)

- International holiday, travel and accommodation (+6.5%)

- Property rates and charges (+7.9%) due to reductions in stamp duty for property purchases being replaced by increases in general rates.

- Domestic holiday, travel and accommodation (+3.2%).

The rise was partially offset by:

- Other financial services (-7.6%) due to the introduction of the home buyer concession scheme.

- Games, toys and hobbies (-3.6%)

- Fruits (-3.1%).