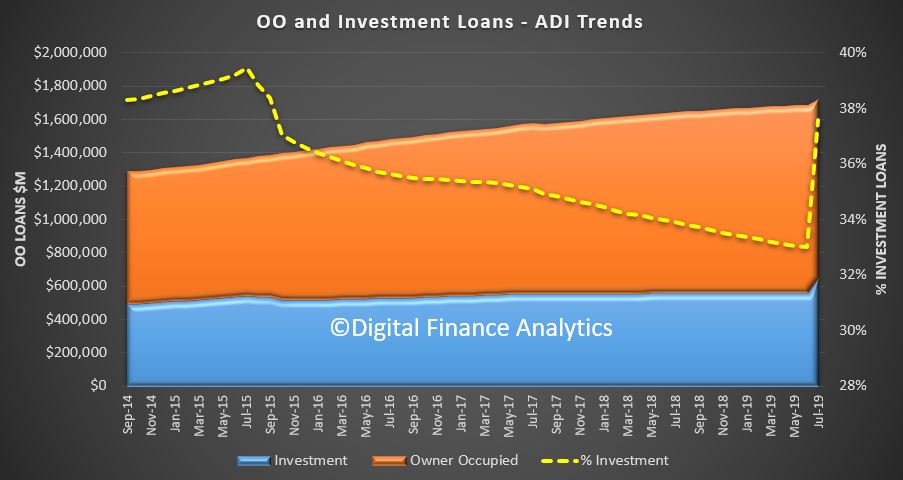

APRA released their monthly statistics to end July 2019. They are rubbish, in terms of trend tracking because thanks to a revised method of data capturing the value of investment lending rose considerably, offset by a fall in owner occupied loans.

The RBA said that there were reclassifications of loans between owner occupied and investment, plus off shore and onshore borrowers.

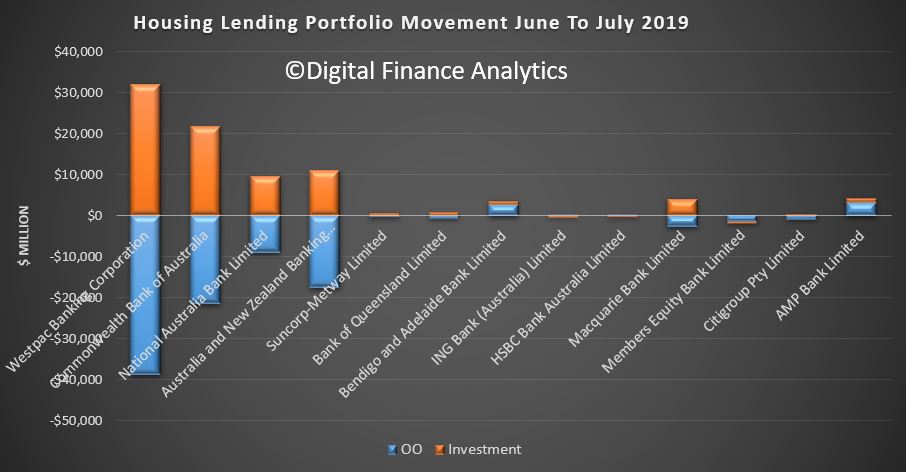

The changes from last month are therefore considerable. Westpac made the largest switch with $40 billion dropping from the owner occupied side of the house.

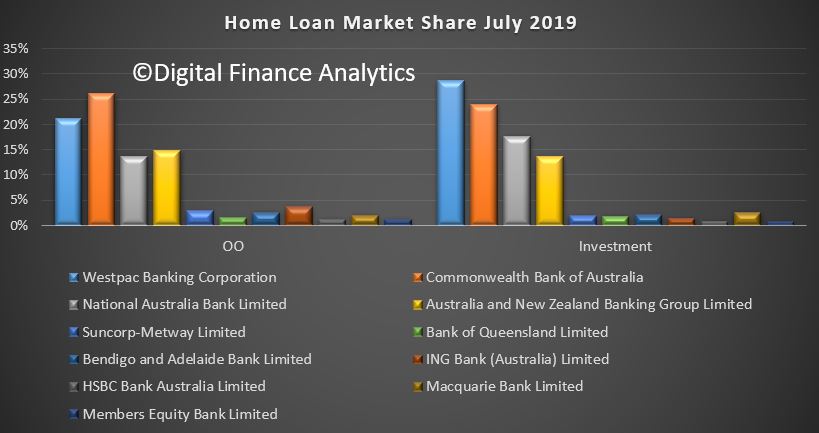

The overall portfolio mix by lender changed less.

But the proportion of investment loans jumped to 37.6%, compared with 33% the previous month. This means that banks ARE EVEN MORE EXPOSED to investment lending than had been previously reported!

Given the size of the changes, it is impossible to tell what is happening within individual lenders (which is convenient?). So we will have to start from this point as a series break.

For the record, the value of owner occupied loans fell 5% from $1.13 trillion to $1.10 trillion, while investment loans rose by 16% from $557.3 billion to $647.4 billion.

Total lending rose from $1.68 trillion to $1.72 trillion, up more than 2%. But this is meaningless.

Frankly this is a joke, and I feel it is designed to hide, not inform. The investment debt bomb just got bigger!