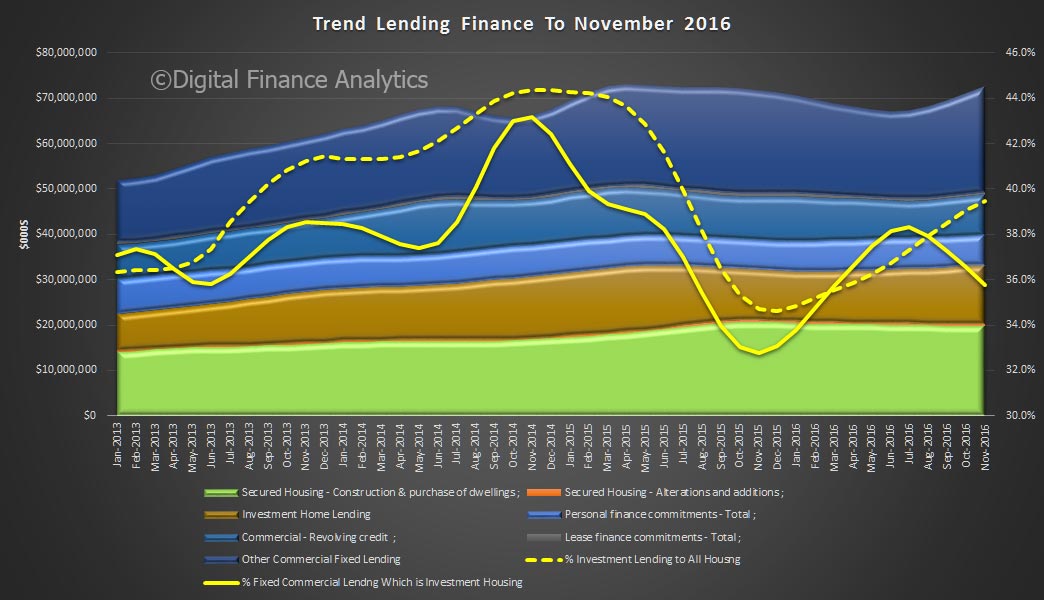

The latest trend finance data from the ABS shows that total lending flows were up in November 2016. Overall $72 billion of credit was written, up 2.3% from the previous month, thanks to momentum in the commercial sector.

Within that, secured lending for residential construction and purchase was $19.8 billion, down slightly from October, whilst finance for alterations and additions rose 0.13%. Personal finance grew just a little, at 0.07%.

Within that, secured lending for residential construction and purchase was $19.8 billion, down slightly from October, whilst finance for alterations and additions rose 0.13%. Personal finance grew just a little, at 0.07%.

Looking at total fixed business lending, this grew $1.4 billion, up 3.74% to $45 billion, comprising a rise of $1.2 billion, or 5.26% to $23.2 billion for commercial lending other than housing investment, and $0.2bn for investment housing, up 1.6%, to $12.9 billion.

Revolving business credit flows grew 2.95% to $8.9 billion, and leasing rose 0.19% to 0.5 billion.

So we see a rise in investment housing lending to 39.5% of all housing lending flows, driven by strong growth in NSW mainly, and a slowing in owner occupied lending. We also see an overall rise in business lending, even after isolating investment lending. We need to see ongoing growth in non-housing related business investment if economic momentum is to be sustained.