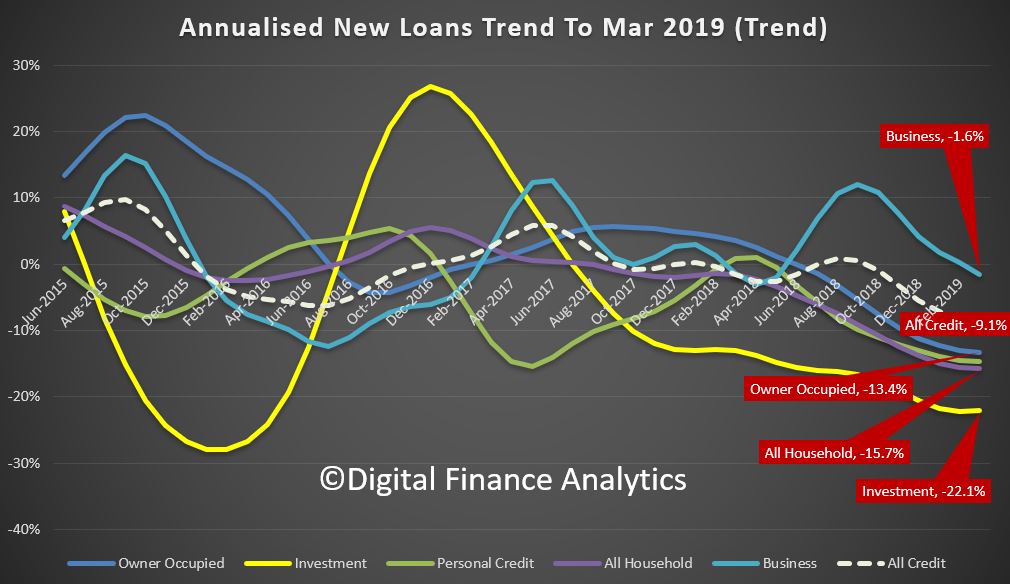

The value of new lending commitments to households fell 3.7 per cent in March 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) figures on new lending to households and businesses.

The fall in lending to households in March follows a 2.2 per cent rise in February 2019.

ABS Chief Economist, Bruce Hockman said: “All components of new lending to households were weaker in March, more than offsetting a bounce in lending activity seen in February.”

“There were large falls in the value of lending for owner occupier dwellings in seasonally adjusted terms in both New South Wales (-5.7 per cent) and Queensland (-5.3 per cent) in March, after rises in both states the previous month” he said.Nationally, lending for investment dwellings also contracted further in March, with the series down 25.9 per cent (seasonally adjusted) compared to March 2018. The level of new lending for investment dwellings is at its lowest level since March 2011.

While nationally there was a fall in the number of loans to owner occupier first home buyers (-0.5 per cent) in March, in a similar pattern to recent months this fall was again much less than the drop in the number of loans to owner occupier non-first home buyers (-3.3 per cent).

After rises in January and February, lending to households for personal finance excluding refinancing fell 11.2 per cent in March, seasonally adjusted.

In trend terms, the value of new lending commitments to businesses fell 2.0 per cent in March. All components of business lending remained subdued.

More detailed analysis to follow. Home prices will fall further.