We are getting to the rub now with the RBA releasing its Credit Aggregate data to end September 2019. This is loan stock data, reflecting the net effect of new loans coming on, old loans repaid, refinancing, and any reclassification which occurred in the month.

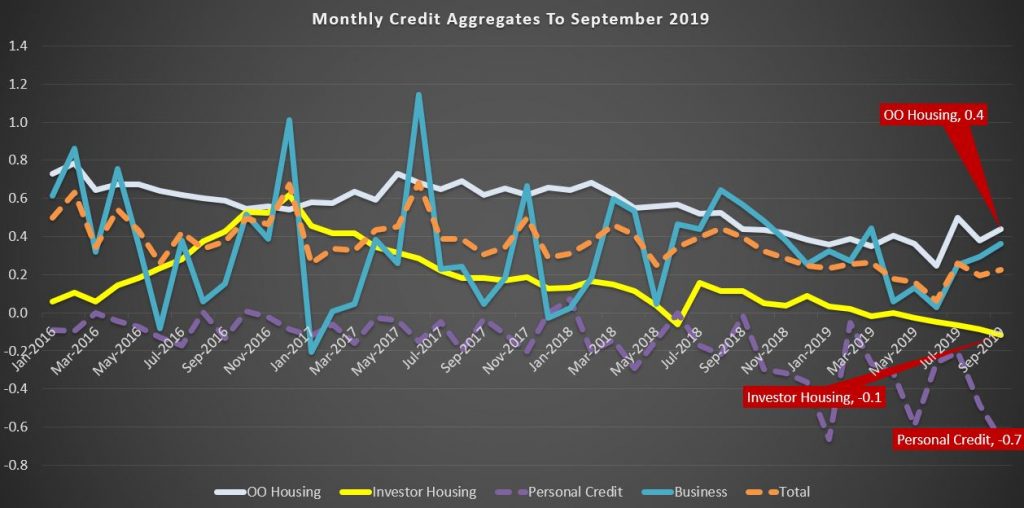

Over the month of September, total credit grew by 0.2%, with housing also at 0.2%, business at 0.4% and personal credit down another 0.7%. Owner occupied lending was a little firmer, but investment lending faded again.

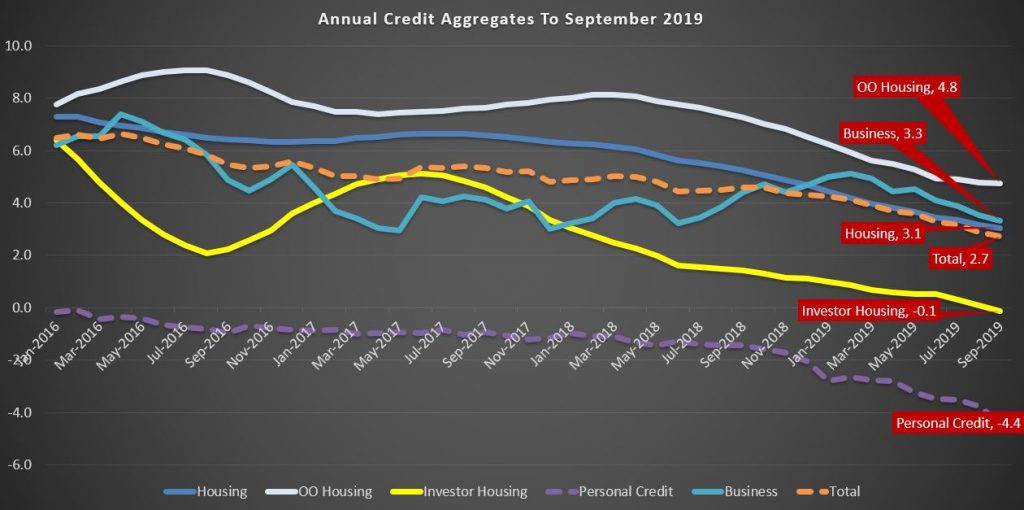

For the year ending, total credit grew by 2.7%, the lowest since June 2011, Housing at 3.1%, the lowest at least since 1977, and business at 3.3%. Personal credit fell 4.4% over the year.

Given the strong link between home prices and housing credit, this suggests home prices will continue weaker ahead. And this, after all the recent adjustments to lending standards and rates.

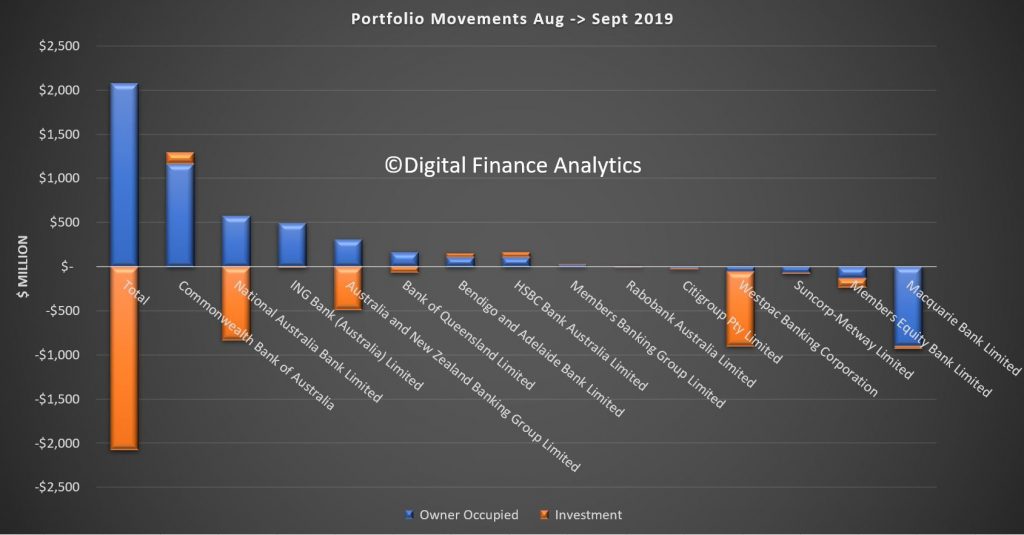

The APRA data also shows some swings between lenders during the month (or reclassification, we cannot tell). NAB, ANZ and Westpac all dropped their investment loan balances, while Macquarie dropped their owner occupied loans.