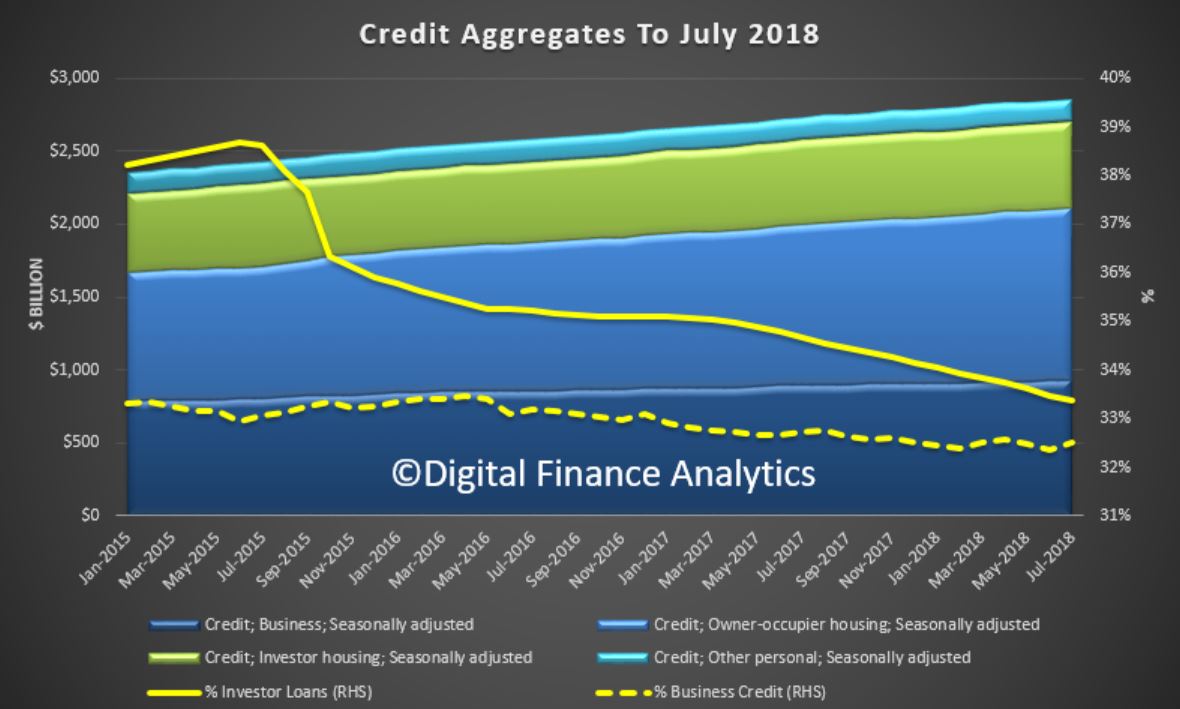

The monthly RBA credit aggregates for July are out today. Total credit for housing rose 0.2% in the month, to $1.77 trillion, with owner occupied credit up 0.5% to $1.18 trillion and investment lending down 0.1% to $593 billion. Investment housing credit fell to 33.4% of the portfolio, and business credit was 32.5%.

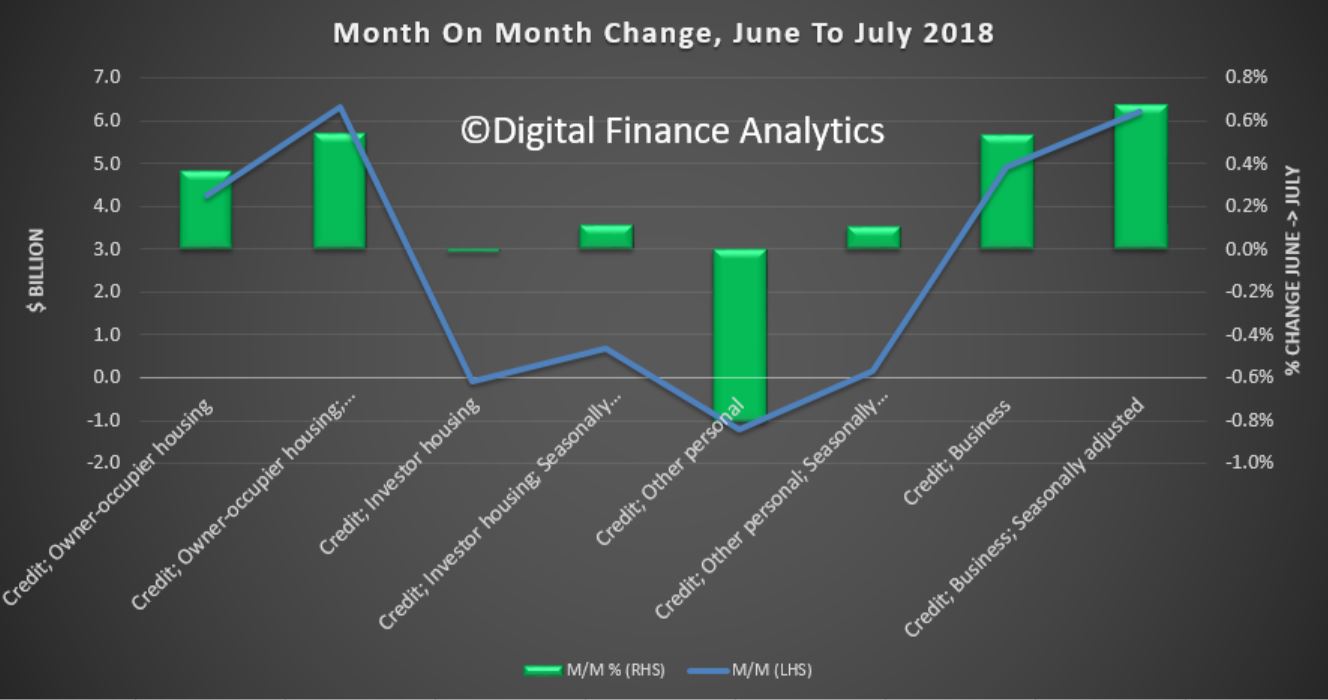

Interestingly the RBA’s seasonally adjusted numbers lifted credit growth from the non-adjusted set, but we are skeptical of these adjustments, given the current abnormal conditions in the market (especially taking into account the APRA data today).

Interestingly the RBA’s seasonally adjusted numbers lifted credit growth from the non-adjusted set, but we are skeptical of these adjustments, given the current abnormal conditions in the market (especially taking into account the APRA data today).

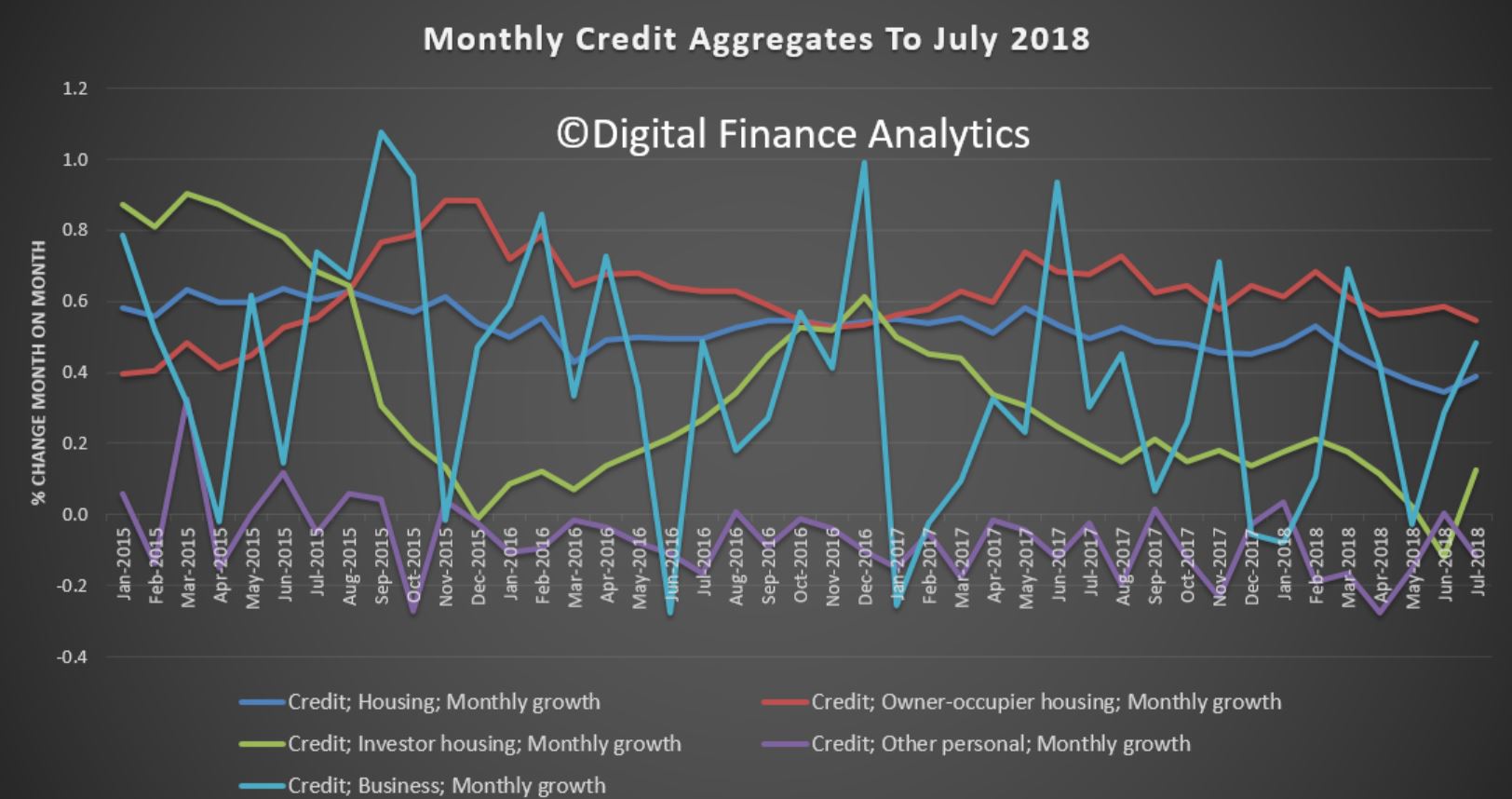

That said, the trends tell the story, with the noisy monthly chart

That said, the trends tell the story, with the noisy monthly chart

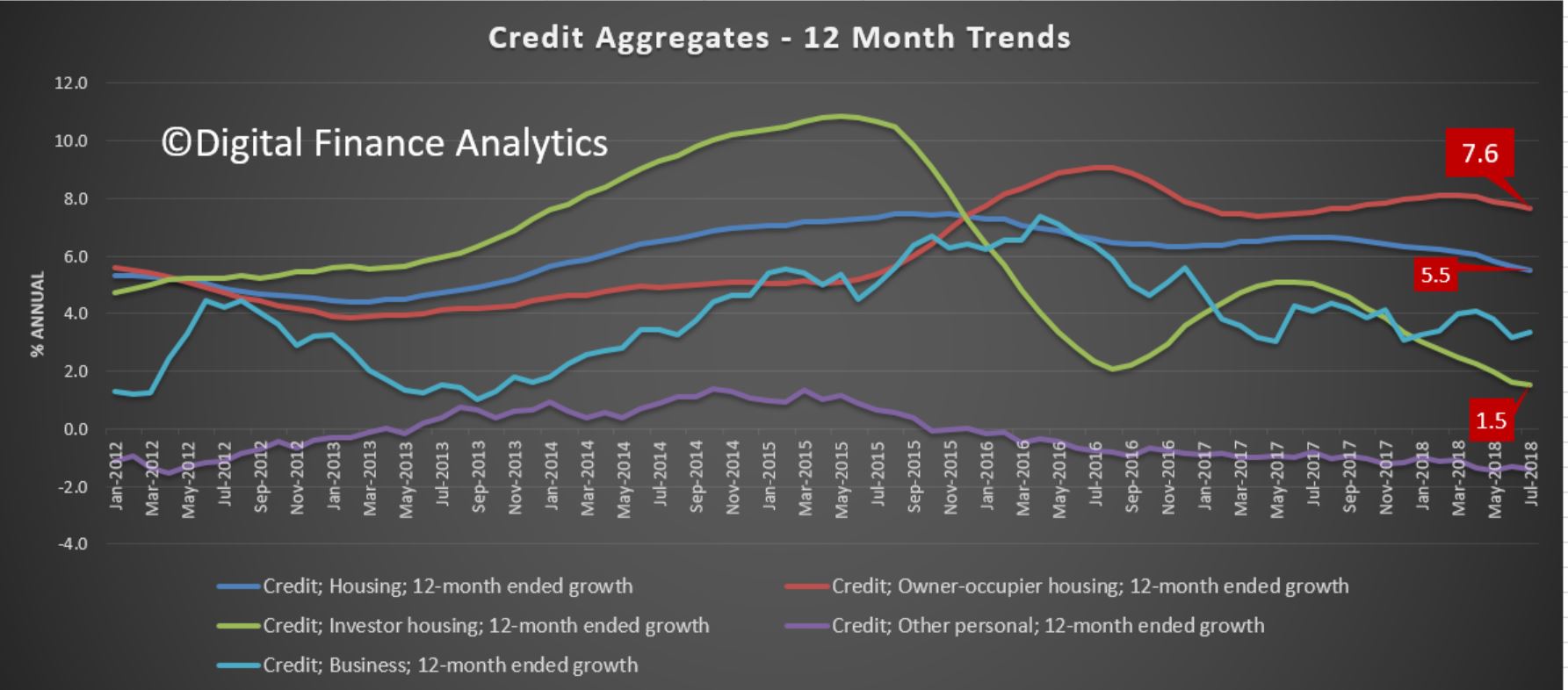

less easy to read than the annual charts. Owner occupied housing is growing at 7.6%, investment housing at 1.5% and overall housing at 5.5%.

We still see some growth in the non-bank sector, and this month the RBA reported NO switching between investment and owner occupied loans.

We still see some growth in the non-bank sector, and this month the RBA reported NO switching between investment and owner occupied loans.

So overall, the credit tightening continues to bite and investors are at the sharp end. No reason to think this will change, as it is driven by more responsible lending practices.