“An unexpected tight squeeze on credit for home buyers is accelerating the slowdown in building activity,” said Mr Tim Reardon, HIA Principal Economist.

HIA released its quarterly economic and industry outlook report today. The State and National Outlook Reports include updated forecasts for new home building and renovations activity for Australia and each of the eight states and territories.

“The credit squeeze that has been impeding investors for the past 18 months has expanded and is now restricting building activity across the market,” added Mr Reardon.

“APRA’s restrictions were designed to curb high risk lending practices but we are now seeing ordinary home buyers experience delays and constraints in accessing finance.

“This disruption in the lending environment is impacting on the amount of residential building work entering the pipeline. The effect on actual building activity will become more evident in the first half of 2019.

“The credit squeeze is weighing on a market that had already started to cool from a significant and sustained boom.

“If these disruptions to the home lending environment prove to be long lasting then we could see building activity retreat from the recent highs more rapidly than we currently expect.

“The decline in housing finance data shows that something in the lending environment has changed. Lending to owner-occupiers building or purchasing new homes fell by 3.6 per cent in September and is down by 16.5 per cent over the year.

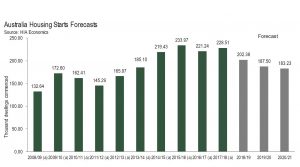

“The year 2017/18 saw over 120,000 detached house starts. This is one of the strongest results on record. We expect new home starts to decline by 11.4 per cent this year and then by a further 7.4 per cent next year in 2019.

“With the prospect for the release of the Hayne Royal Commission’s findings to trigger further upheaval in the banking system, we need the banks maintain stable lending practices for fear of a destabilising influence on the housing market,” concluded Mr Reardon.