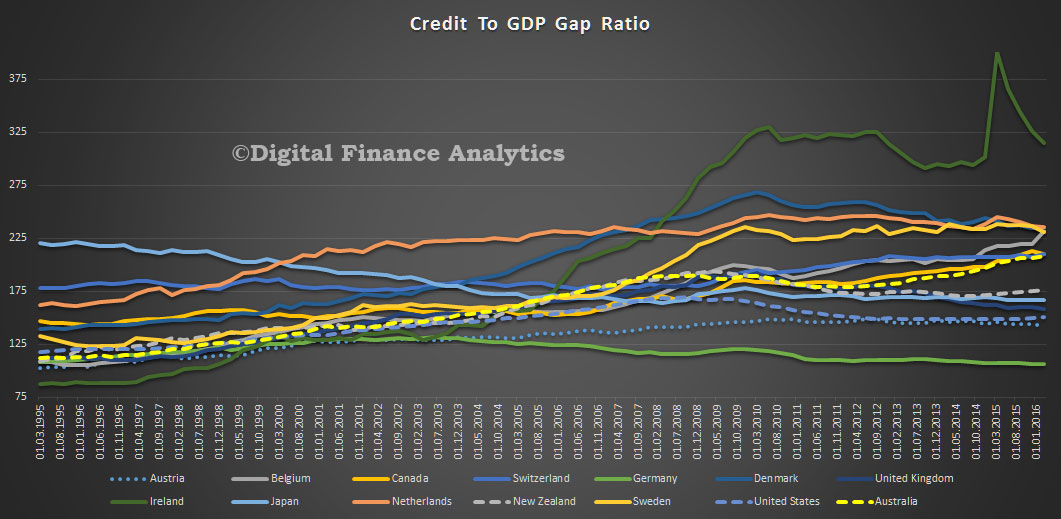

The Bank for International Settlements has released time-series data for the credit-to-GDP gap covering 43 economies starting at the earliest in 1961. The higher the ratio, the greater the risk of a looming financial crisis. Consider these leading indicators.

Ireland has the highest ratio, followed by Denmark, Sweden and Netherlands, but Australia and Canada are rising fast, relative to US, UK and NZ. More evidence of the high debt burden.

Ireland has the highest ratio, followed by Denmark, Sweden and Netherlands, but Australia and Canada are rising fast, relative to US, UK and NZ. More evidence of the high debt burden.

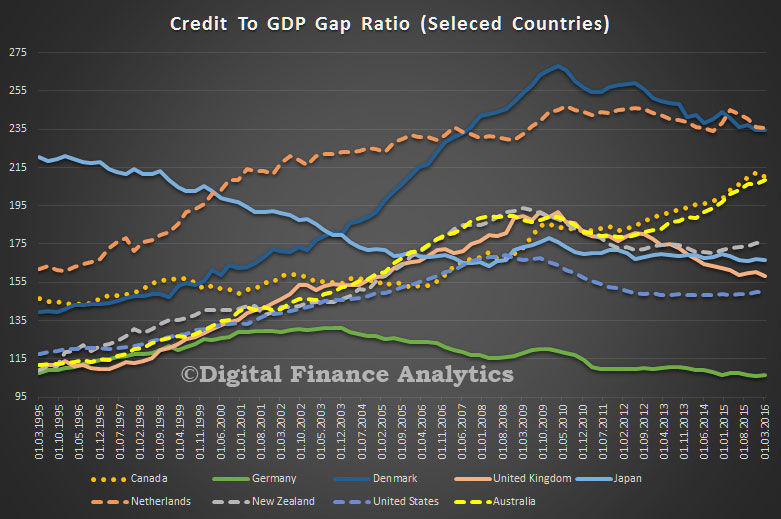

Here is a clearer view of a sub-set of the data.

The credit-to-GDP gap captures the build-up of excessive credit in a reduced-form fashion. It is defined as the difference between the credit-to-GDP ratio and its long-run trend, and it has been found to be a useful early warning indicator of financial crises. This data set covers 43 economies, starting in 1961 for the economies with the longest run of data. As input, we use the data on the credit-to-GDP ratio as published in the BIS database of total credit to the private non-financial sector. The credit series capture total borrowing by the private non-financial sector (ie households and non-financial corporations) from all sources.

Across countries, the credit-to-GDP gaps are derived from a standardised methodology and measure of credit to the private non-financial sector, implying that the BIS series may differ from credit-to-GDP gaps that are considered by national authorities as part of their countercyclical capital buffer decisions. The Basel Committee guidance on the countercyclical capital buffer suggests that the credit-to-GDP gap should be considered as one starting point about discussions of determining countercyclical capital buffer levels.

You can read about the basis of calculation, and assumptions here.