The stock market is at record highs and people with FICO scores as low as 500 are once again happily obtaining mortgages. Not only that, but these mortgages are once again being securitized and are in demand by yield chasers.

All of the elements that are necessary for the 2008 subprime crisis to repeat itself are starting to fall back into place. Aside from the fact that we have inflated bubbles across basically all asset classes for the most part, not the least of which is evident in the stock market, the Financial Times reported today that not only are subprime mortgage backed securities becoming prominent again, but that the chase for yield was what fueling demand:

Issuance of securities backed by riskier US mortgages roughly doubled in the first quarter from a year earlier, as investors lapped up assets blamed for bringing the global financial system to the brink of collapse a decade ago. Home loans to people with scratches and dents in their credit histories dwindled to almost nothing in the aftermath of the crisis, as litigation-weary lenders retreated to patch up their balance sheets.

But over the past couple of years a group of specialist firms has begun to bring the loans back, navigating a dense web of new rules drawn up to protect borrowers and investors in the $9.3tn US home-loan market. Last year saw issuance of $4.1bn of securities backed by loans that would have been called “subprime” before the last financial crisis, according to figures from Inside Mortgage Finance, with the pace picking up in the latter half of the year. The momentum has continued into 2018, with deals worth $1.3bn in the first quarter — twice the $666m issued in the same period a year earlier.

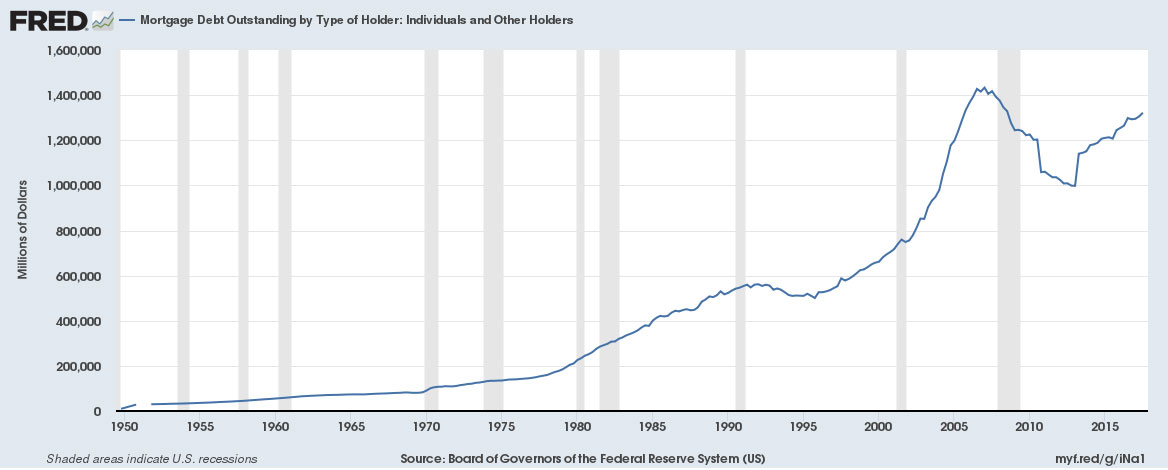

Our central banks have done such a great job of getting us out of our last crisis that the recovery has prompted a mortgage originators and real estate investors to basically do the same exact thing that they were doing 2006 to 2007. After all, mortgage levels are already almost back to 2008 levels.

If that wasn’t disturbing enough, the hedge fund partner that FT quotes in the article says that the subprime market has “a lot of room to grow“ as if it were some type of new emerging market generating productivity, and not just a carbon copy repeat of exactly what happen nearly 10 years ago.

If that wasn’t disturbing enough, the hedge fund partner that FT quotes in the article says that the subprime market has “a lot of room to grow“ as if it were some type of new emerging market generating productivity, and not just a carbon copy repeat of exactly what happen nearly 10 years ago.

“The market is . . . starting from such a small base that it has a lot of room to grow,” said Jamshed Engineer, a partner at Axonic Capital, a New York hedge fund with more than $2bn in assets under management.

“[Investors] are definitely chasing yields. Whenever these deals come out, for the most part, they are oversubscribed.”

The Financial Times article tries to couch the fact that all hell could be breaking loose yet again at some point soon by citing Dodd Frank reforms that we reported in March are already past the Senate. The key provisions of the rollback are:

- Relaxes a host of reporting requirements for small – medium banks, and to a smaller extent, large banks

- Eliminates a reporting requirement introduced by Dodd-Frank designed to avoid discriminatory lending

- Relaxes stress testing requirements intended to show how banks would survive another financial crisis

- Raises the threshold for banks which are not subject to enhanced liquidity requirements, stress tests, and enhanced risk management, from $50 billion to $250 billion – exempting several institutions which could pose systemic risks down the road.

- Allows megabanks such as Citi to count municipal bonds as “highly liquid assets” that could be used towards the “liquidity coverage ratio,” – assets which can be quickly liquidated during a crisis.

- Calls for a report on the risks and benefits of algorithmic trading within 18 months

Despite the fact that the FT states that 500 FICO scores are getting approved for mortgages, S&P, one of the willfully ignorant and blind rating agencies that missed the subprime crisis thinks that everything is going to be fine:

“The risk is contained, in our view,” said Mr Saha.

For the way that our Federal Reserve has addressed the problems of 2007 or 2008, these are the end results that they deserve, but the American people ultimately do not.