The results from the just updated Digital Finance Analytics Household Surveys shows that after a few wobbly months, demand for property has strengthened. The latest results supplement those found in the Property Imperative Report, which is still available on request. According to the results, lower interest rates, the removal of the negative gearing “risk”, no budget changes, and lower returns from alternative investments all lead to the same conclusion – buy property. We also note that property price rise expectations have risen for some. Over the next few days we will discuss our segment specific findings – looking especially at investors and first time buyers. Today, however we summarise the main trends.

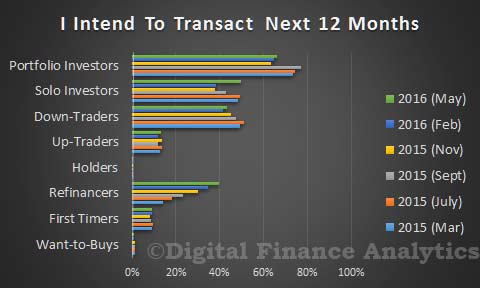

In response to the question, are you expecting to transact in the next 12 months, we see a larger proportion of investors and refinancers expect to be active. Solo investors showed the largest movement compared with the February 2016 data.

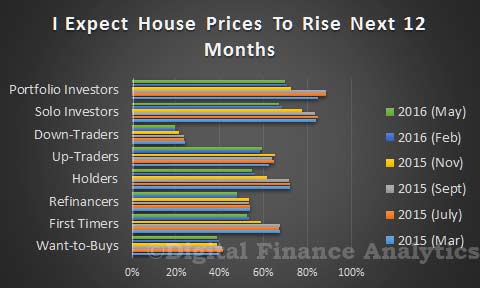

More than half of households expect property prices to continue to rise in the next 12 months. Uptraders increased their expectations, compared with February, others were a little less bullish. But a fair degree of optimism reigns.

More than half of households expect property prices to continue to rise in the next 12 months. Uptraders increased their expectations, compared with February, others were a little less bullish. But a fair degree of optimism reigns.

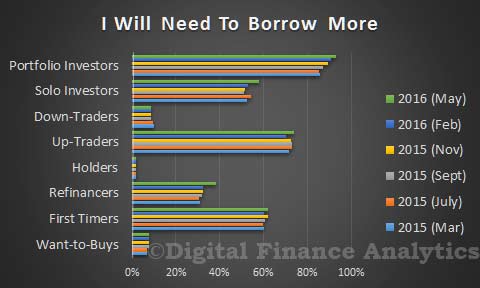

Looking at borrowing requirements, we see that demand for more credit remains strong – the 7% growth rate in credit will likely continue. Demand is strongest among investors, but we also see a spike in the refinance sector. This is driven by finance availability, lower and discounted rates and capital extraction.

Looking at borrowing requirements, we see that demand for more credit remains strong – the 7% growth rate in credit will likely continue. Demand is strongest among investors, but we also see a spike in the refinance sector. This is driven by finance availability, lower and discounted rates and capital extraction.

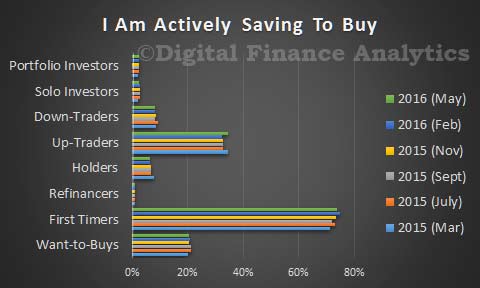

First time buyers are saving the hardest, but uptraders also saving.

First time buyers are saving the hardest, but uptraders also saving.

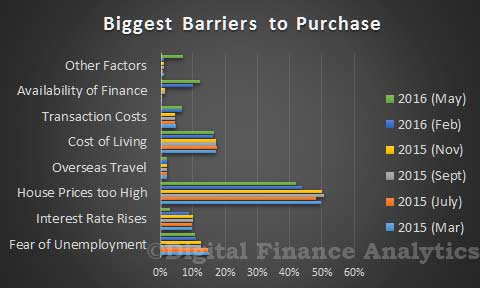

Looking at the barriers to purchase, we see that the availability of finance is now impacting more than 12% of households wishing to transact. This reflects tighter underwriting criteria now in play. Fear of unemployment has fallen as a factor, whilst the expectation of future rate rises has diminished significantly. High prices are still a significant factor.

Looking at the barriers to purchase, we see that the availability of finance is now impacting more than 12% of households wishing to transact. This reflects tighter underwriting criteria now in play. Fear of unemployment has fallen as a factor, whilst the expectation of future rate rises has diminished significantly. High prices are still a significant factor.

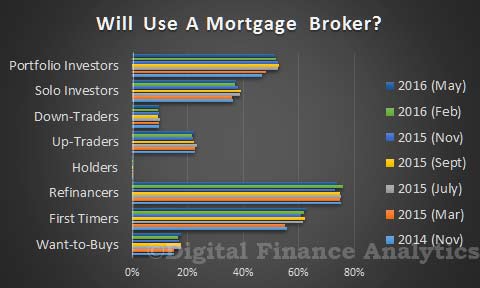

Finally in this overview, we see that the propensity to use a mortgage brokers remains strong among investors, refinancers and first time buyers.

Finally in this overview, we see that the propensity to use a mortgage brokers remains strong among investors, refinancers and first time buyers.

Next time we will look in more detail at our segment specific analysis. You can read about our segmentation methodology here.

Next time we will look in more detail at our segment specific analysis. You can read about our segmentation methodology here.

2 thoughts on “Demand For Property Roars Back To Life”