According to a report in the Financial Times, Deutsche Bank is going to overhaul its trading operations and create “bad bank” which will house or sell assets valued at up to €50B (risk adjusted). This would lead to the closure or reduction in its U.S. equity and trading businesses.

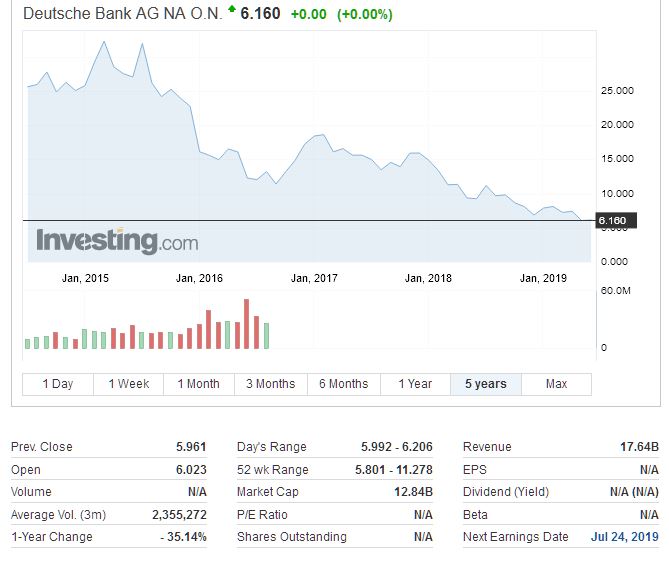

While this will likely de-risk the business, it will also reduce profitability (as the US trading division contributed higher returns, and the remaining bank will rely more on deposits for funding. This helps to explain the falls in its share price.