On Sunday, Deutsche Bank AG announced an €8 billion fully underwritten common equity capital raise and some major course corrections to its 2020 strategic plan. These measures, on top of the firm’s progress in de-risking its balance sheet, are positive for DB bondholders. Most importantly, the capital raise gives DB more time and financial leeway to achieve the revised 2020 plan, although sustainable improvement to the bank’s credit strength and ratings will depend on the success of its ongoing reengineering. With plenty for management still to do, capital and liquidity protection and strong strategic execution will continue to drive DB’s creditworthiness this year.

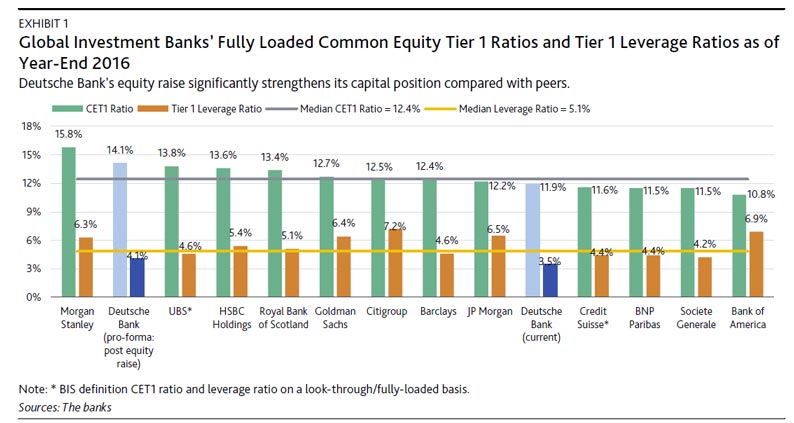

The fully underwritten €8 billion equity capital raise will increase DB’s fully loaded common equity Tier 1 ratio by about 200 basis points to more than 14% pro forma as of year-end 2016, significantly improving its capital position relative to its closest global investment bank peers, especially considering the reduction in tail risk resulting from a settlement with the US Department of Justice announced in late 2016.

The capital raise is a powerful response to the challenges DB faced in 2016, and will allow the bank to pursue business and revenue growth more assertively following losses in 2016 that hindered efforts to strengthen and stabilize profitability and led to some customer and counterparty attrition. The settlement with the Justice Department has helped alleviate concerns, and momentum has picked up in many businesses this year, aided by improved market conditions.

Along with the capital raise, DB announced five key components to the latest recalibration of its strategic plan. They are the following:

- Retain, rather than dispose of, Deutsche Postbank AG and merge it with DB’s domestic operations, thereby eliminating the Postbank ring-fencing, which would make retail liquidity more fungible and increase the potential for cost efficiencies

- An initial public offering of a minority stake in Deutsche Asset Management to provide a new share currency that DB can use for retention and recruitment of investment management talent and for potential expansion

- Reconfigure the existing Global Markets, Corporate Finance and Transaction Banking businesses into a single Corporate and Investment Banking division to generate additional cost savings and pursue a strategy more focused on cross-selling to real economy corporate clients

- Some senior management changes, including the creation of two deputy CEO positions

- Board approval of upcoming Additional Tier 1 coupons and an intention to reinstate the common dividend at a rate of €0.11 per share in May 2017

Management indicated further restructuring costs of approximately €2 billion through 2020 and a plan to establish a legacy portfolio of approximately €46 billion of risk-weighted assets, mostly in the form of legacy rates and credit positions and other non-core assets.

The decision to retain, rather than dispose of, Postbank is a major strategic reversal. If approved by regulators, the plan to integrate Postbank into DB’s existing German private and commercial banking and wealth management businesses may eventually bring bondholder benefits in the form of fungible liquidity across the bank, and a greater contribution of earnings from German retail banking, bringing more balance to the business mix. Streamlining and refocusing these businesses will help DB build leaner, more profitable franchises that more closely match its long-term strategic goal to simplify and de-risk the bank while revitalizing its operating platform and processes.

At this stage, however, we think large cost savings will prove difficult to achieve. In 2016, DB reported an 84% cost-to-income ratio for Postbank and an 83% cost-to-income ratio for the Private, Wealth & Commercial Clients segment, illustrating the formidable execution challenge the bank will face to reach its 65% target. The task is further complicated by the fact that Postbank owns BHW, a savings and loan association whose business model is particularly challenged by the low interest rate environment.