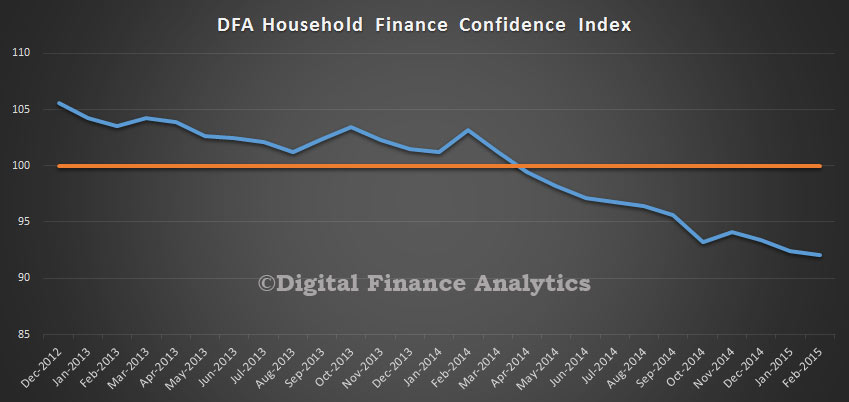

Using data from our household surveys, we have updated our household finance confidence index to end February. We compare the confidence of households now, compared with 12 months ago. The overall index, which is still below a neutral setting, fell slightly again in the month, despite the RBA rate cut of 25 basis points in February. Households are less confident about their financial health than anytime since December 2012. To calculate the index we ask questions which cover a number of different dimensions. We start by asking households how confident they are feeling about their job security, whether their real income has risen or fallen in the past year, their view on their costs of living over the same period, whether they have increased their loans and other outstanding debts including credit cards and whether they are saving more than last year. Finally we ask about their overall change in net worth over the past 12 months – by net worth we mean net assets less outstanding debts.

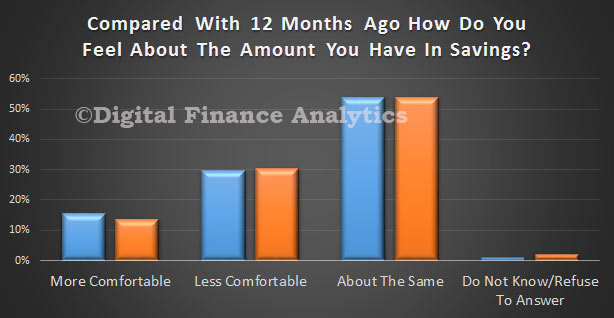

Looking at the composite elements in the index, with regards to savings, those comfortable with what they have saved, fell by 1.7%, reflecting mainly lower deposit rates, especially amongst females. Those less comfortable rose a little (0.6%). Those in part-time work had similar ratings to those households unemployed, in contrast to those full time employed. In these charts, the blue is data 12 months to January, and orange is 12 months to February.

Looking at the composite elements in the index, with regards to savings, those comfortable with what they have saved, fell by 1.7%, reflecting mainly lower deposit rates, especially amongst females. Those less comfortable rose a little (0.6%). Those in part-time work had similar ratings to those households unemployed, in contrast to those full time employed. In these charts, the blue is data 12 months to January, and orange is 12 months to February.

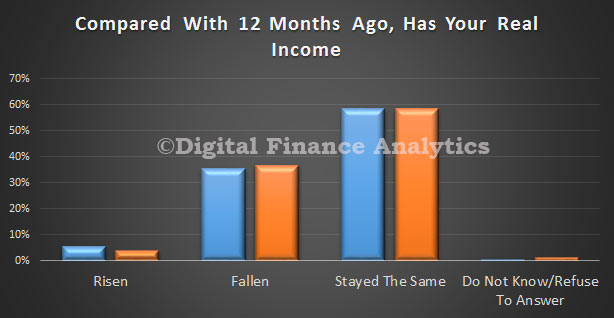

Those households who think their real incomes have grown, fell by 1.8% in the month, whilst those households whose real incomes fell, rose by 1.3%.

Those households who think their real incomes have grown, fell by 1.8% in the month, whilst those households whose real incomes fell, rose by 1.3%.

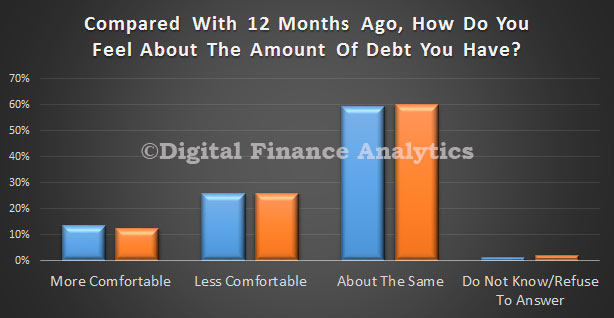

Looking at household debt, households who were comfortable with their level of debt fell by 1.1%, though we found males more comfortable with their debt position than females. A slightly higher proportion were as comfortable as 12 months ago.

Looking at household debt, households who were comfortable with their level of debt fell by 1.1%, though we found males more comfortable with their debt position than females. A slightly higher proportion were as comfortable as 12 months ago.

Those whose costs of living stablised over the last 12 months rose by 0.5% to 59.3%, helped by lower interest rates, petrol and electricity bills.

Those whose costs of living stablised over the last 12 months rose by 0.5% to 59.3%, helped by lower interest rates, petrol and electricity bills.

More than half of the households said their net worth had increased over the past year, up by 1.1% for last month. Less households had seen a fall in net worth (down 1.85%)

More than half of the households said their net worth had increased over the past year, up by 1.1% for last month. Less households had seen a fall in net worth (down 1.85%)

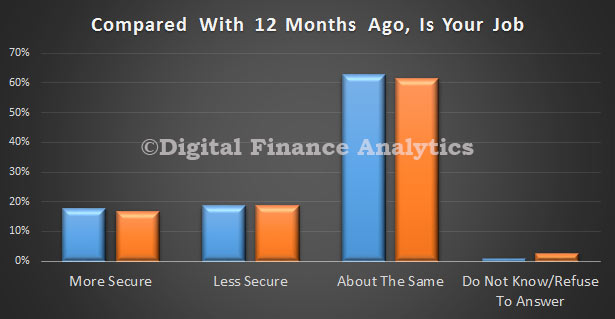

Finally a slightly smaller number of households thought their jobs were as secure as a year ago, (down 1.1% to 61.6%), those who felt their jobs were more secure fell (down 0.9%), whilst those felling less secure rose a little (up 0.3%).

Finally a slightly smaller number of households thought their jobs were as secure as a year ago, (down 1.1% to 61.6%), those who felt their jobs were more secure fell (down 0.9%), whilst those felling less secure rose a little (up 0.3%).

Our take is that household financial confidence is still in the doldrums, despite ultra low interest rates and sky high property prices. Their future spending patterns will remain conservative, and we will not see a sudden change in consumption patterns anytime soon. We will update the index again next month.

Our take is that household financial confidence is still in the doldrums, despite ultra low interest rates and sky high property prices. Their future spending patterns will remain conservative, and we will not see a sudden change in consumption patterns anytime soon. We will update the index again next month.